Your Does life insurance cover accidental death images are ready. Does life insurance cover accidental death are a topic that is being searched for and liked by netizens now. You can Get the Does life insurance cover accidental death files here. Get all free vectors.

If you’re searching for does life insurance cover accidental death pictures information related to the does life insurance cover accidental death keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Does Life Insurance Cover Accidental Death. You sometimes have the option to put an accidental death rider on a basic life insurance policy. Accidental death insurance only covers accidental deaths, which means that it doesn’t cover you if you die of natural causes. However, policies vary by provider, so it’s important to note (3). However, policies vary by provider, so it’s important to note what your insurance provider considers a covered death before applying, as there may be some.

What Does Accidental Death and Dismemberment Insurance From garnerltd.com

What Does Accidental Death and Dismemberment Insurance From garnerltd.com

One of the most common questions i get from people about life insurance is what is considered accidental death for insurance purposes?. The life insurance laws in each state will define “accidental death” differently as well. In addition, life insurance will pay out to your beneficiaries after your death. You could have stage 3 cancer and get accidental life insurance. Life insurance and accidental death insurance difference cause of death covered. If you die from an accidental drug overdose, motor vehicle accident, poisoning, drowning or another tragedy, your beneficiaries will receive the death benefit.

After the accident is fatal or otherwise, the insurer pays the sum assured depending upon the.

Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue. The life insurance laws in each state will define “accidental death” differently as well. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. When it comes to the funeral, let’s assume no one pays for your funeral. Unfortunately, alcohol or drug use are among the most common reasons life insurance claims are denied.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

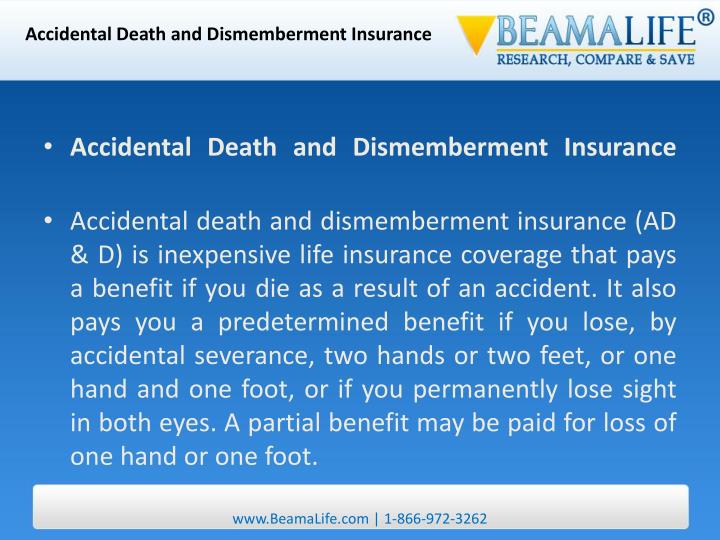

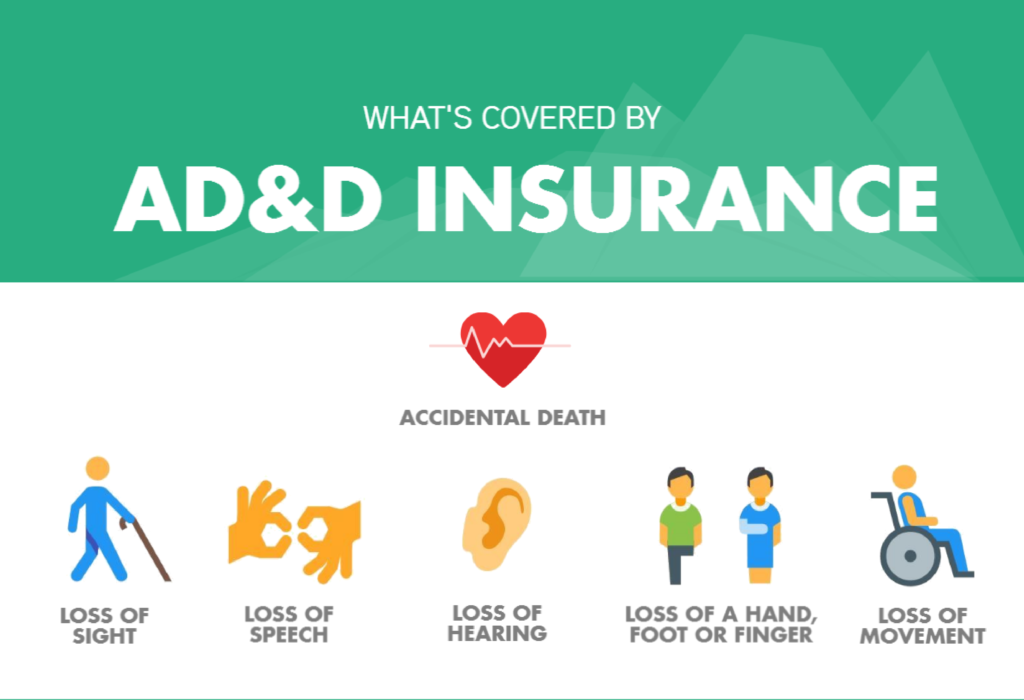

Accidental death and dismemberment coverage pays only if a death is accidental, or you suffer a severe injury. In some cases, yes, accidental death is covered in a life insurance policy. If you opt for the accidental death benefit rider while buying term insurance, it will provide an additional sum of money to your family if your death happens due to an accident. Unfortunately, alcohol or drug use are among the most common reasons life insurance claims are denied. Accidental death and dismemberment insurance, or ad&d, is designed to cover accidents.

Source: postoast.com

Source: postoast.com

In some cases, yes, accidental death is covered in a life insurance policy. However, policies vary by provider, so it’s important to note what your insurance provider considers a covered death before applying, as there may be some. Since this coverage provides limited form of life insurance (which covers only accident insurance) the monthly premiums are less. In some cases, yes, accidental death is covered in a life insurance policy. If you were to have an accidental death while owning a life insurance policy depending on your plan you would be protected because this coverage is built into your policy.

Source: h2o-just-add-water-margo.blogspot.com

Source: h2o-just-add-water-margo.blogspot.com

As you mostly know that the primary purpose of life insurance is to protect the beneficiary/s after your death/accidental death. Life insurance pays out the death benefit to your beneficiaries for most causes of death. Term life insurance policies that cover accidental death can provide insurance coverage for. If you’re wondering if your life insurance policy can include accidental death, the answer is yes. Many life insurance policies contain a suicide clause or provision.

Source: policyadvice.net

Source: policyadvice.net

In some cases, yes, accidental death is covered in a life insurance policy. Accidental death insurance only covers accidental deaths, which means that it doesn’t cover you if you die of natural causes. Term life pays out whether a death is due to an accident, illness or natural causes. You sometimes have the option to put an accidental death rider on a basic life insurance policy. As you mostly know that the primary purpose of life insurance is to protect the beneficiary/s after your death/accidental death.

Source: cpp.ca

Source: cpp.ca

Accidental death life insurance covers accidental deaths. One of the most common questions i get from people about life insurance is what is considered accidental death for insurance purposes?. In some cases, yes, accidental death is covered in a life insurance policy. If you were to have an accidental death while owning a life insurance policy depending on your plan you would be protected because this coverage is built into your policy. Accidental death life insurance covers accidental deaths.

Source: fr.slideserve.com

Source: fr.slideserve.com

Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning, accidental. Accidental death and dismemberment insurance, or ad&d, is designed to cover accidents. However, policies vary by provider, so it’s important to note what your insurance provider considers a covered death before applying, as there may be some. Companies will typically not pay a death benefit if the policyholder commits suicide. Yes, basic life insurance does cover accidental death, as well as death due to natural causes (i.e.

Source: abramsinc.com

Source: abramsinc.com

Life insurance plans provide financial benefit covering all causes of death excluding suicide (which may be covered after waiting period). Life insurance and accidental death insurance difference cause of death covered. Whether it is mortgage balance or funeral expenses, a suitable life insurance policy will help your beneficiary/s get away with such hardships. Unfortunately, alcohol or drug use are among the most common reasons life insurance claims are denied. Accidental death insurance is a form of life insurance that will cover death from an unexpected accident.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident. One of the most common questions i get from people about life insurance is what is considered accidental death for insurance purposes?. In some cases, yes, accidental death is covered in a life insurance policy. However, policies vary by provider, so it’s important to note what your insurance provider considers a covered death before applying, as there may be some. In turn, many people are concerned whether life insurance will pay out, if that’s their cause of death.

Source: insurancenewsdesk.com

Source: insurancenewsdesk.com

Have a brand new policy It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. Life insurance is more comprehensive in nature than accidental death and dismemberment insurance. However, policies vary by provider, so it’s important to note what your insurance provider considers a covered death before applying, as there may be some. Accidental death life insurance covers your loved ones in case you die of an accident.

Source: garnerltd.com

Source: garnerltd.com

Accidental death insurance is a form of life insurance that will cover death from an unexpected accident. When it comes to the funeral, let’s assume no one pays for your funeral. Accidental death and dismemberment insurance, or ad&d, is designed to cover accidents. In some cases, yes, accidental death is covered in a life insurance policy. Accidental death and disability are by default covered in the term insurance policy.

Source: askadamskutner.com

Source: askadamskutner.com

You sometimes have the option to put an accidental death rider on a basic life insurance policy. Life insurance and accidental death insurance difference cause of death covered. If you die from an accidental drug overdose, motor vehicle accident, poisoning, drowning or another tragedy, your beneficiaries will receive the death benefit. Accidental death life insurance covers your loved ones in case you die of an accident. If you’re wondering if your life insurance policy can include accidental death, the answer is yes.

Source: neamb.com

Source: neamb.com

By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident. Accidental death insurance only covers accidental deaths, which means that it doesn’t cover you if you die of natural causes. Whether the insured died from an accidental overdose of prescribed drugs or an overdose of illegal drugs may also matter. For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. Accidental death life insurance covers your loved ones in case you die of an accident.

![Does Life Insurance Cover Natural Death [Get The TRUTH!] Does Life Insurance Cover Natural Death [Get The TRUTH!]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/10/Infografic27-2-LI-Plans-No-Pay-Natural-Death.png) Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

However, policies vary by provider, so it’s important to note (3). For example, if you take out an accidental death policy and you pass away as a result of an illness, a pay out won’t be made. However, policies vary by provider, so it’s important to note (3). Your loved ones won’t receive a pay out if you pass away due to any other cause. By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident.

Source: smartinsurance.co.uk

If you’re wondering if your life insurance policy can include accidental death, the answer is yes. You sometimes have the option to put an accidental death rider on a basic life insurance policy. When it comes to the funeral, let’s assume no one pays for your funeral. Life insurance is more comprehensive in nature than accidental death and dismemberment insurance. If you opt for the accidental death benefit rider while buying term insurance, it will provide an additional sum of money to your family if your death happens due to an accident.

Source: slideserve.com

Source: slideserve.com

Life insurance plans provide financial benefit covering all causes of death excluding suicide (which may be covered after waiting period). You could have stage 3 cancer and get accidental life insurance. Yes, basic life insurance does cover accidental death, as well as death due to natural causes (i.e. Since this coverage provides limited form of life insurance (which covers only accident insurance) the monthly premiums are less. One of the most common questions i get from people about life insurance is what is considered accidental death for insurance purposes?.

Source: unionplus.org

Source: unionplus.org

One of the most common questions i get from people about life insurance is what is considered accidental death for insurance purposes?. Accidental death insurance is a form of life insurance that will cover death from an unexpected accident. Have a brand new policy If you’re wondering if your life insurance policy can include accidental death, the answer is yes. You sometimes have the option to put an accidental death rider on a basic life insurance policy.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Accidental death and dismemberment insurance, or ad&d, is designed to cover accidents. Many life insurance policies contain a suicide clause or provision. Your loved ones won’t receive a pay out if you pass away due to any other cause. Illness, suicide after two years, most accidents, and death by natural causes are all covered by life insurance. Term life insurance policies that cover accidental death can provide insurance coverage for.

Source: gabar.memberbenefits.com

Source: gabar.memberbenefits.com

Accidental death and disability are by default covered in the term insurance policy. Life insurance and accidental death insurance difference cause of death covered. Accidental death insurance only covers accidental deaths, which means that it doesn’t cover you if you die of natural causes. Accidental death life insurance covers accidental deaths. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning, accidental.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does life insurance cover accidental death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.