Your Does insurance go down when car is paid off images are available. Does insurance go down when car is paid off are a topic that is being searched for and liked by netizens today. You can Get the Does insurance go down when car is paid off files here. Find and Download all free photos and vectors.

If you’re looking for does insurance go down when car is paid off images information connected with to the does insurance go down when car is paid off interest, you have come to the right site. Our website frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

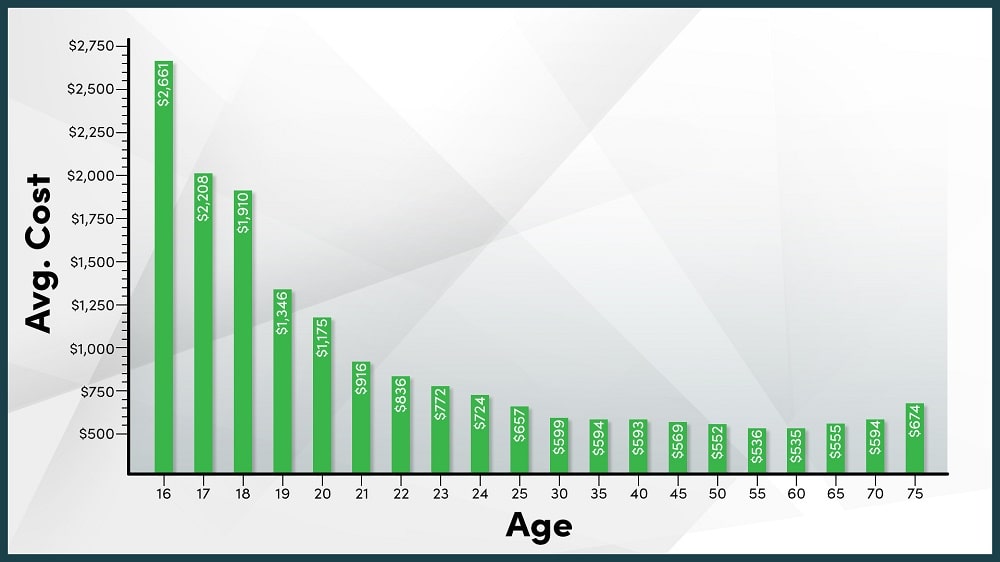

Does Insurance Go Down When Car Is Paid Off. Car insurance companies use statistical data, among other factors, when determining your car insurance rates. Once you have paid off your car loan, your insurance premiums are likely to drop, in some cases dramatically. By contrast, drivers pay an average of $7,179 at 18 and $4,453 at 21 — which demonstrates that car insurance does go down as you age. Paying off your car may affect your insurance coverage requirements.

Does Insurance Go Down When Car Is Paid Off noclutter.cloud From noclutter.cloud

Does Insurance Go Down When Car Is Paid Off noclutter.cloud From noclutter.cloud

These changes include late payments, coverage changes, and policy cancellation. No, your insurance premium does not go down when you pay off your car. Paying off your car is a huge accomplishment. Insured drivers always have the option to add full coverage to their paid off car if they. Full coverage car insurance is only necessary when a car is not paid off yet and the lender requires full coverage, as there isn’t a legal requirement to carry full coverage anywhere in the united states. But it is not automatic.

The presence of a car loan, no matter how much you owe, doesn’t mean you’ll automatically pay a higher insurance rate, as listing a financial company as a payee on your policy won’t affect your rate.

So, you’ll want to maintain physical protection (your collision and comprehensive coverage ) to protect it — these coverages are recommended as long your vehicle retains a worth of at least $4,000. No, you do not need full coverage on a paid off car. Car loans are broken down into monthly payments, which can help you improve your credit score on a monthly basis. You don’t need to wait until you have the title in your hand to make the call. Car insurance rates may go down for a number of reasons. They�ll also decrease your rates as you gain more years of driving experience.

Source: everydaybuzz.co

Source: everydaybuzz.co

So if you make any changes to your car insurance policy, your auto loan provider, as a payee, will be the first to know. Car insurance rates typically go down every year if you�re a safe driver. Paying off your car might coincide with rate reductions related to age. Auto owners with comprehensive insurance are covered when an accident occurs. Totaled vehicles are paid off when you owe less than the car is.

Source: noclutter.cloud

Source: noclutter.cloud

Insured drivers always have the option to add full coverage to their paid off car if they. Insured drivers always have the option to add full coverage to their paid off car if they. In most cases, this is true. You may find that your auto insurance rates go down as you get older or have teen drivers on board. Notify your car insurance company when you’ve paid off your loan so you can remove the lien holder from your policy.

Source: bumper.com

Source: bumper.com

Totaled vehicles are paid off when you owe less than the car is. However, insurance companies will reduce your rates as you get into your 20s and 30s. The presence of a car loan, no matter how much you owe, doesn’t mean you’ll automatically pay a higher insurance rate, as listing a financial company as a payee on your policy won’t affect your rate. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required. Car insurance companies use statistical data, among other factors, when determining your car insurance rates.

Source: revisi.net

Source: revisi.net

Car insurance rates don’t automatically go down when you pay off your car, but you can still save money on your car insurance by making some changes now that you no longer have a payment due. The common myth that your insurance rate drops at 25 just isn�t true. Paying off your car might coincide with rate reductions related to age. This means that if you maintain comprehensive and collision (full coverage) and your vehicle were to be totaled in an accident,. These changes include late payments, coverage changes, and policy cancellation.

Source: ericakunzler.blogspot.com

Source: ericakunzler.blogspot.com

In most cases, this is true. Full coverage car insurance is only necessary when a car is not paid off yet and the lender requires full coverage, as there isn’t a legal requirement to carry full coverage anywhere in the united states. Auto owners with comprehensive insurance are covered when an accident occurs. No, your insurance premium does not go down when you pay off your car. You don’t need to wait until you have the title in your hand to make the call.

Source: expatride.com

Source: expatride.com

The cost of car insurance can also rise and fall over time due to. Yes, let your car insurance company know: The common myth that your insurance rate drops at 25 just isn�t true. Insurance rates are not calculated on whether or not you owe money on your car in the first place, and paying off your vehicle does not change the cost to repair or. The lienholder’s requirements, your age, driving experience insurance deductible, car value, and insurance premiums limits all determine your premiums.

Source: victorypubg.co.uk

Source: victorypubg.co.uk

These changes include late payments, coverage changes, and policy cancellation. Insurance rates are not calculated on whether or not you owe money on your car in the first place, and paying off your vehicle does not change the cost to repair or. This step is important because if your financed vehicle were totaled in a wreck, the insurance payment would go to the lender. In the event you want to buy a newer vehicle and start this loan/purchasing process over again, the sale of your original car could be used to make a down payment. By contrast, drivers pay an average of $7,179 at 18 and $4,453 at 21 — which demonstrates that car insurance does go down as you age.

Source: thebalance.com

Source: thebalance.com

Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation. However, paying off your car does not directly affect your auto insurance rate. Your car insurance premiums won’t just go down because you paid off your car loan, but it’s possible. Auto owners with comprehensive insurance are covered when an accident occurs. Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation.

Source: compareukquotes.com

Source: compareukquotes.com

Most people think their car insurance automatically decreases as soon as the car is paid off. At the very least, you will have more control over how much your insurance costs after you pay off your loan. Car insurance does go down at 25. However, insurance companies will reduce your rates as you get into your 20s and 30s. Most people think their car insurance automatically decreases as soon as the car is paid off.

Source: thebalance.com

Source: thebalance.com

Besides, paying off your car lien amount may make your car insurance go down. The cost of car insurance can also rise and fall over time due to. Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation. This means that if you maintain comprehensive and collision (full coverage) and your vehicle were to be totaled in an accident,. Once you have paid off your car loan, your insurance premiums are likely to drop, in some cases dramatically.

Source: daily.semerusatu.com

Source: daily.semerusatu.com

There are other factors to consider. But if your monthly payments are not paid, the unpaid balances can have a negative impact on your credit score. But it is not automatic. Owning a car outright is an outstanding achievement. However, insurance companies will reduce your rates as you get into your 20s and 30s.

Source: revisi.net

Source: revisi.net

Car insurance rates may go down for a number of reasons. Car insurance companies use statistical data, among other factors, when determining your car insurance rates. Besides, paying off your car lien amount may make your car insurance go down. Car insurance does go down at 25. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required.

Source: mabeyinsurance.com

Source: mabeyinsurance.com

If they do not put down a large down payment, the vehicle can quickly become worth less than what they owe because vehicles depreciate—or lose value—as soon as they are driven off the dealership lot. These changes include late payments, coverage changes, and policy cancellation. The presence of a car loan, no matter how much you owe, doesn’t mean you’ll automatically pay a higher insurance rate, as listing a financial company as a payee on your policy won’t affect your rate. Paying off your car might coincide with rate reductions related to age. However, insurance companies will reduce your rates as you get into your 20s and 30s.

Source: revisi.net

Source: revisi.net

Once you have paid off your car loan, your insurance premiums are likely to drop, in some cases dramatically. But it is not automatic. However, insurance companies will reduce your rates as you get into your 20s and 30s. Car insurance rates may go down for a number of reasons. Some factors that help your rates go down are within your control, while other factors are set by the insurance company.

Source: thebalance.com

Source: thebalance.com

You may be shocked to discover that the. The common myth that your insurance rate drops at 25 just isn�t true. Totaled vehicles are paid off when you owe less than the car is. However, insurance companies will reduce your rates as you get into your 20s and 30s. However, it’s probably still a good time to review your insurance coverage, especially if you think you can lower your coverage details,.

Source: noclutter.cloud

Source: noclutter.cloud

Some factors that help your rates go down are within your control, while other factors are set by the insurance company. They�ll also decrease your rates as you gain more years of driving experience. Your car insurance premiums won’t just go down because you paid off your car loan, but it’s possible. In the event you want to buy a newer vehicle and start this loan/purchasing process over again, the sale of your original car could be used to make a down payment. These changes include late payments, coverage changes, and policy cancellation.

Source: thebalance.com

Source: thebalance.com

In certain situations, the auto insurance rate reduction drops quite dramatically after the vehicle is paid off. This step is important because if your financed vehicle were totaled in a wreck, the insurance payment would go to the lender. However, paying off your car does not directly affect your auto insurance rate. Most people think their car insurance automatically decreases as soon as the car is paid off. At the very least, you will have more control over how much your insurance costs after you pay off your loan.

Source: clovered.com

Source: clovered.com

Insured drivers always have the option to add full coverage to their paid off car if they. Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation. Teenage and new drivers usually have higher premiums because they�re more likely to get into a car accident or receive a traffic violation. Notify your car insurance company when you’ve paid off your loan so you can remove the lien holder from your policy. Paying off your car might coincide with rate reductions related to age.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does insurance go down when car is paid off by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.