Your Does homeowners insurance cover accidental death images are available in this site. Does homeowners insurance cover accidental death are a topic that is being searched for and liked by netizens today. You can Download the Does homeowners insurance cover accidental death files here. Download all royalty-free photos and vectors.

If you’re looking for does homeowners insurance cover accidental death images information related to the does homeowners insurance cover accidental death keyword, you have visit the ideal site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Does Homeowners Insurance Cover Accidental Death. Ad&d is usually an additional benefit or rider paid above what your life insurance policy would already pay. As long as the period covered by the suicide clause has elapsed. August 9, 2019 by homeowners insurance cover. 4.7 · 1,800 reviews · $15.00 to $300.00 · in stock (3).

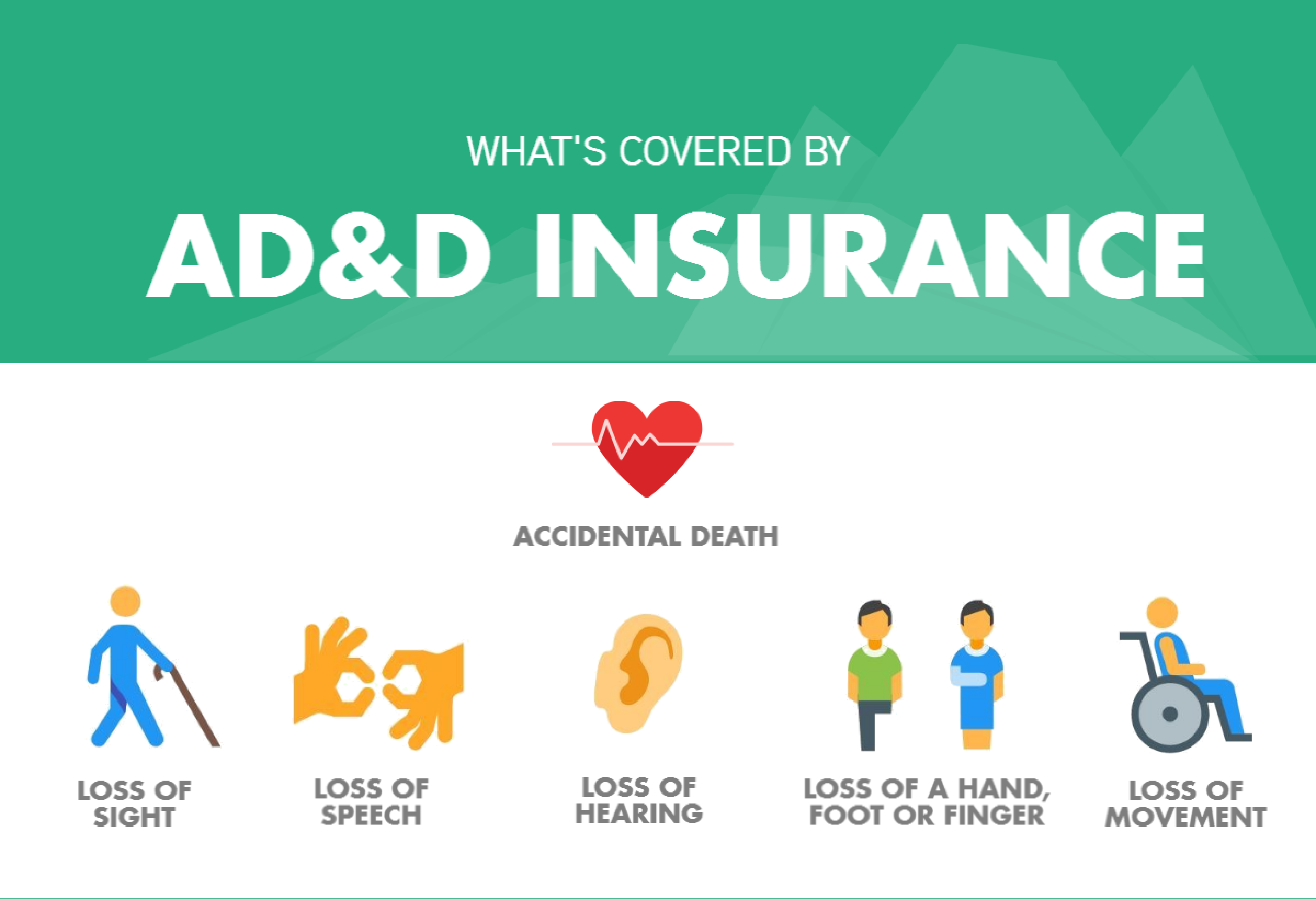

What Does Accidental Death and Dismemberment Insurance From garnerltd.com

What Does Accidental Death and Dismemberment Insurance From garnerltd.com

Homeowner’s insurance covers personal injury claims by providing accident liability coverage for the property owner. Homeowner’s insurance covers personal injury claims if there is verbiage in the policy that covers bodily injury. 4.7 · 1,800 reviews · $15.00 to $300.00 · in stock (3). There are two instances when this is the case. Medical payments coverage on homeowners insurance is a specific type of coverage that pays for the medical bills of guests or other people that you invite on. An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue.

Homeowner�s insurance protects the homeowner from sudden losses relating to the structure itself.

Accidental death insurance, in the unfortunate case the robber has a heart attack and dies when he encounters my watch dog. The type of insurance that you would need to cover an accidental death would be life insurance or an accidental death policy. As long as the period covered by the suicide clause has elapsed. Loss of limb or finger. Think about, for example, what would happen if someone were to take an. Homeowners insurance policies come with many options.

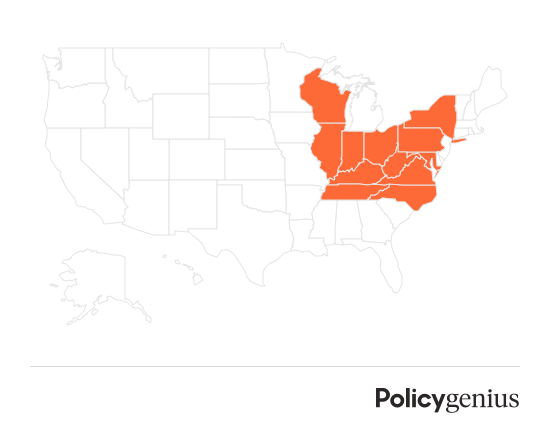

Source: usafact.org

Source: usafact.org

If a homeowner dies before the mortgage is paid off, this could put the home in jeopardy. Homeowner’s insurance covers personal injury claims by providing accident liability coverage for the property owner. Homeowners insurance policies come with many options. The type of insurance that you would need to cover an accidental death would be life insurance or an accidental death policy. Does accidental death insurance cover accidental deaths while traveling?

Source: smartinsurance.co.uk

Benefits are paid to the policyholders designated beneficiaries. Accidental drug overdose, motor vehicle accident, poisoning, drowning, or any other tragedy. Under california’s concurrent causation doctrine, where an accident is caused by both covered and noncovered events, coverage usually exists. However, if you live in a wildfire zone, you’ll need to purchase specific coverage to protect your property from damages. As its name suggests, these events must qualify as accidental per the insurer’s definition of the term, and can include death or serious injury from events such.

Source: pioneer.com.ph

Source: pioneer.com.ph

The insurance company must pay your accidental death and dismemberment claim when it has all the records necessary to prove that the death was an accident. Homeowner’s insurance covers personal injury claims if there is verbiage in the policy that covers bodily injury. By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident. Homeowner’s insurance covers personal injury claims by providing accident liability coverage for the property owner. Homeowner�s insurance does not cover accidental death.

Source: garnerltd.com

Source: garnerltd.com

If a guest is injured on your property, homeowner’s insurance will cover $1,000 of medical expenses per person per incident. Homeowner’s insurance covers personal injury claims if there is verbiage in the policy that covers bodily injury. Think about, for example, what would happen if someone were to take an. There can be age restrictions that can limit you from being able to apply, as some. Terrorist insurance, in case some psycho decides to crash a plane into your house.

Source: aandlfinancial.com

Source: aandlfinancial.com

Earthquake insurance, even though we have no earthquakes here. Does my homeowners policy cover accidental death off my property? It will not provide any coverage per persons living in the home. There can be age restrictions that can limit you from being able to apply, as some. Accidental death insurance, (also known as accidental life insurance) will only pay out money to your family if your death is caused by accident.

Source: gabar.memberbenefits.com

Source: gabar.memberbenefits.com

An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue. Better known as accidental death and dismemberment insurance or simply as accidental death insurance, ad&d insurance provides coverage for a relatively limited set of covered events. Often the homeowner is also the primary breadwinner, and that income is. Life insurance covers the death of the homeowner. When someone passes away, it can be upsetting and uncomfortable to figure out the finances of the estate and to navigate the rules of the insurance world.

Source: usagencies.com

Source: usagencies.com

Ad&d is usually an additional benefit or rider paid above what your life insurance policy would already pay. Since add policies pay only for accidental death, the insurance company will require all documents or records surrounding the death. While no one expects to be held liable after an accident at their home, liability coverage may help prevent you from paying out of pocket should the unexpected occur. Homeowner’s insurance covers personal injury claims by providing accident liability coverage for the property owner. As its name suggests, these events must qualify as accidental per the insurer’s definition of the term, and can include death or serious injury from events such.

Source: dkblawyers.com

Source: dkblawyers.com

Loss of limb or finger. Death in an accident, like a car crash or airplane crash. Under california’s concurrent causation doctrine, where an accident is caused by both covered and noncovered events, coverage usually exists. If the property owner has legal liability for an accident, the insurance company may step in and pay the claim. Unfortunately, homeowners insurance policies don�t cover mortgages.

Source: onewayfinserv.com

Source: onewayfinserv.com

An accidental death plan will not have any type of underwriting attached to it and will always be guaranteed issue. At other times, a policy. It will not provide any coverage per persons living in the home. Think about, for example, what would happen if someone were to take an. One of the most common questions about homeowners insurance is whether it covers your home and your assets from fire damage.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

The insurance company must pay your accidental death and dismemberment claim when it has all the records necessary to prove that the death was an accident. The insurance company needs to conduct an investigation. Unfortunately, homeowners insurance policies don�t cover mortgages. Another difficult area is if an automobile was involved in an accidental death and coverage is claimed under a homeowners insurance policy. Homeowner’s insurance covers personal injury claims if there is verbiage in the policy that covers bodily injury.

Source: alankitinsurance.com

Source: alankitinsurance.com

Often the homeowner is also the primary breadwinner, and that income is. While no one expects to be held liable after an accident at their home, liability coverage may help prevent you from paying out of pocket should the unexpected occur. Your homeowner�s insurance does not cover accidents that happen in your car. Personal liability coverage is a typical component of a homeowners insurance policy. Accidental death insurance, in the unfortunate case the robber has a heart attack and dies when he encounters my watch dog.

Source: visitorsinsurancereviews.com

Source: visitorsinsurancereviews.com

By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident. Earthquake insurance, even though we have no earthquakes here. Homeowners insurance policies come with many options. What does accidental death and dismemberment insurance cover? As long as the period covered by the suicide clause has elapsed.

Source: aa.co.nz

Source: aa.co.nz

Loss of limb or finger. Often the homeowner is also the primary breadwinner, and that income is. Personal liability coverage is a typical component of a homeowners insurance policy. The type of insurance that you would need to cover an accidental death would be life insurance or an accidental death policy. Accidental drug overdose, motor vehicle accident, poisoning, drowning, or any other tragedy.

Source: policybazaar.com

Source: policybazaar.com

The insurance company needs to conduct an investigation. Under california’s concurrent causation doctrine, where an accident is caused by both covered and noncovered events, coverage usually exists. At other times, a policy. When someone passes away, it can be upsetting and uncomfortable to figure out the finances of the estate and to navigate the rules of the insurance world. Accidental death insurance, in the unfortunate case the robber has a heart attack and dies when he encounters my watch dog.

Source: brashearsinsurance.com

Source: brashearsinsurance.com

The type of insurance that you would need to cover an accidental death would be life insurance or an accidental death policy. Terrorist insurance, in case some psycho decides to crash a plane into your house. What does accidental death and dismemberment insurance cover? If the property owner has legal liability for an accident, the insurance company may step in and pay the claim. By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident.

Source: providentins.com

Source: providentins.com

Loss of limb or finger. Life insurance is more comprehensive in nature than accidental death and dismemberment insurance. The insurance company must pay your accidental death and dismemberment claim when it has all the records necessary to prove that the death was an accident. Earthquake insurance, even though we have no earthquakes here. Accidental death insurance can help with benefits that range from $37,500 to $200,000 in the event of a covered accident.

Source: slideshare.net

Source: slideshare.net

By contrast, accidental death and dismemberment insurance, due to the inclusion of the dismemberment aspect, can provide benefits to replace lost income after an accident. It will not provide any coverage per persons living in the home. That is where your automobile insurance comes in. The insurance company needs to conduct an investigation. Homeowners insurance policies come with many options.

Source: quickinsuranceservice.com

Source: quickinsuranceservice.com

Unfortunately, homeowners insurance policies don�t cover mortgages. Purchasing life insurance or mortgage. Does homeowners insurance cover the death of the owner? One of the most common questions about homeowners insurance is whether it covers your home and your assets from fire damage. Homeowners insurance policies come with many options.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does homeowners insurance cover accidental death by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.