Your Does home insurance legal cover car images are available. Does home insurance legal cover car are a topic that is being searched for and liked by netizens now. You can Get the Does home insurance legal cover car files here. Download all royalty-free photos and vectors.

If you’re searching for does home insurance legal cover car pictures information linked to the does home insurance legal cover car topic, you have come to the ideal site. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Does Home Insurance Legal Cover Car. You also get access to a 24/7 legal helpline, for assistance with legal matters covered under the legal expenses policy. Family legal protection covers you for up to £100,000 worth of legal costs per claim for several issues, including property and employment disputes, as well as personal injury claims. Issues such as property or employment disputes, personal injury and personal identity theft are all covered, as long as the event happens after your policy has started. Car insurance legal cover car insurance legal expenses insurance covers events arising from the use or ownership of an insured vehicle.

What Is Car Insurance Liability? Visual.ly From visual.ly

What Is Car Insurance Liability? Visual.ly From visual.ly

Any dispute involving the government or your local council; It also might offer some coverage for identity theft or fraud. Policies bought ‘before the event’ protect policyholders in case legal action has to be fought or defended in the future. Legal expenses cover can protect you from the cost of legal action. Some policies may include it at no extra cost. For example if someone sues you or you need to go to court to get money back from an uninsured driver.

You also get access to a 24/7 legal helpline, for assistance with legal matters covered under the legal expenses policy.

Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. This may include taking action against a third party for negligence, or defending accusations made against you by a third party. How much does legal cover cost? Some policies may include it at no extra cost. Typically, the amount of legal cover offered is between £50,000 and £100,000. 7 find out what your home insurance offers before you make a choice on your legal insurance plan options.

Source: coinlaundryinsurance.com

Source: coinlaundryinsurance.com

If it�s more likely than not your case will be successful, home legal expenses cover will provide up to £100,000 for legal expenses to protect you against the costs of being sued or having to make a claim against someone else. Legal expenses cover is included with home insurance select silver or gold. Driving under the influence of alcohol or drugs is illegal, obviously. Typically, the amount of legal cover offered is between £50,000 and £100,000. Policies bought ‘before the event’ protect policyholders in case legal action has to be fought or defended in the future.

Source: spaceagefcu.org

Source: spaceagefcu.org

There is a waiting period before certain areas of cover can be activated. What’s covered by home insurance legal expenses? However, if you drive drunk and cause a car accident, your car insurance policy will pay for damages you cause — up to the liability limits of your policy. Where you choose your own solicitor • you must not agree to any legal expenses without arc’s prior agreement Driving under the influence of alcohol or drugs is illegal, obviously.

Source: instabima.com

Source: instabima.com

Although it’s possible to buy standalone legal expenses insurance, most policies are added to home or car insurance as an optional extra. Legal fees cover could include: These are known as uninsured losses. Support for employment disputes, medical negligence claims and consumer issues. However, if you drive drunk and cause a car accident, your car insurance policy will pay for damages you cause — up to the liability limits of your policy.

Source: edgarsnyder.com

Source: edgarsnyder.com

Cover for cars, vans, motorbikes, motorhomes and anything towed. Some policies may include it at no extra cost. The legal expenses insurance geared to you get a quotation legal assistance to recover your uninsured losses and help you stay on the road after an accident that was not your fault. In that case, it most likely only covers legal matters related to whatever the main policy covers. While homeowners insurance won’t cover damage to the auto itself, many policies will provide.

Source: woodrow28ernie.wordpress.com

Source: woodrow28ernie.wordpress.com

Most home insurance providers offer lei as an optional extra costing, on average, £30. Essentially, motor legal protection helps cover the cost of your fees if you need to take legal action against another driver or road user. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. Our legal expenses insurance policy also helps to cover legal costs if you’re facing prosecution for a motoring offence which you want to contest, as well as helping to cover legal costs for any disputes you may have after buying or selling a car, or concerns you may have with the garage about poor servicing or repair work. Issues such as property or employment disputes, personal injury and personal identity theft are all covered, as long as the event happens after your policy has started.

Source: thebalance.com

Source: thebalance.com

Legal cover provides financial protection against legal fees and losses following an accident that was not your fault. This policy does not cover legal expenses incurred in appealing any final decision of a civil court or against a conviction in a criminal court. This is where the distinction between your home and auto insurance policies can become a little blurry. It also might offer some coverage for identity theft or fraud. Legal expenses cover is included with home insurance select silver or gold.

Source: dreamstime.com

Source: dreamstime.com

Driving under the influence of alcohol or drugs is illegal, obviously. This is where the distinction between your home and auto insurance policies can become a little blurry. Legal expenses insurance won’t cover you in a few notable cases, including: Car insurance legal cover car insurance legal expenses insurance covers events arising from the use or ownership of an insured vehicle. It also might offer some coverage for identity theft or fraud.

Source: visual.ly

Source: visual.ly

7 find out what your home insurance offers before you make a choice on your legal insurance plan options. And for any disputes that are vehicle related you’re generally expected to rely on the legal expenses cover that’s usually offered with car insurance. This is where the distinction between your home and auto insurance policies can become a little blurry. There is a waiting period before certain areas of cover can be activated. Driving under the influence of alcohol or drugs is illegal, obviously.

Source: readyforquote.com

Source: readyforquote.com

This means your insurance would pay for damages to the light pole you damage or cover the medical bills of someone you injure. If it�s more likely than not your case will be successful, home legal expenses cover will provide up to £100,000 for legal expenses to protect you against the costs of being sued or having to make a claim against someone else. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. In that case, it most likely only covers legal matters related to whatever the main policy covers. Car insurance legal cover car insurance legal expenses insurance covers events arising from the use or ownership of an insured vehicle.

Source: varsitydrivingacademy.com

Source: varsitydrivingacademy.com

Essentially, motor legal protection helps cover the cost of your fees if you need to take legal action against another driver or road user. For example if someone sues you or you need to go to court to get money back from an uninsured driver. It also provides a legal helpline available 24 hours a day, 365 days a year for advice on any personal legal matter that affects you or your family. Our legal expenses insurance policy also helps to cover legal costs if you’re facing prosecution for a motoring offence which you want to contest, as well as helping to cover legal costs for any disputes you may have after buying or selling a car, or concerns you may have with the garage about poor servicing or repair work. Certain actions of the policyholder which occur away from the insured property may also be covered.

Source: carinsuranceguidebook.com

Source: carinsuranceguidebook.com

In that case, it most likely only covers legal matters related to whatever the main policy covers. You�ll usually be covered for up to £100,000. Get up to £50,000 per claim to cover legal fees. 7 find out what your home insurance offers before you make a choice on your legal insurance plan options. Typically, the amount of legal cover offered is between £50,000 and £100,000.

Source: newquoteslife.blogspot.com

Source: newquoteslife.blogspot.com

However, it’s important to note that legal cover only applies to the costs associated with making and defending claims. In that case, it most likely only covers legal matters related to whatever the main policy covers. This policy does not cover legal expenses incurred in appealing any final decision of a civil court or against a conviction in a criminal court. Legal expenses cover can protect you from the cost of legal action. It gives you access to a 24/7 legal advice helpline.

Source: carsoid.com

Source: carsoid.com

You also get access to a 24/7 legal helpline, for assistance with legal matters covered under the legal expenses policy. Legal cover provides financial protection against legal fees and losses following an accident that was not your fault. Boundary disputes and other problems with neighbours; Essentially, motor legal protection helps cover the cost of your fees if you need to take legal action against another driver or road user. Driving under the influence of alcohol or drugs is illegal, obviously.

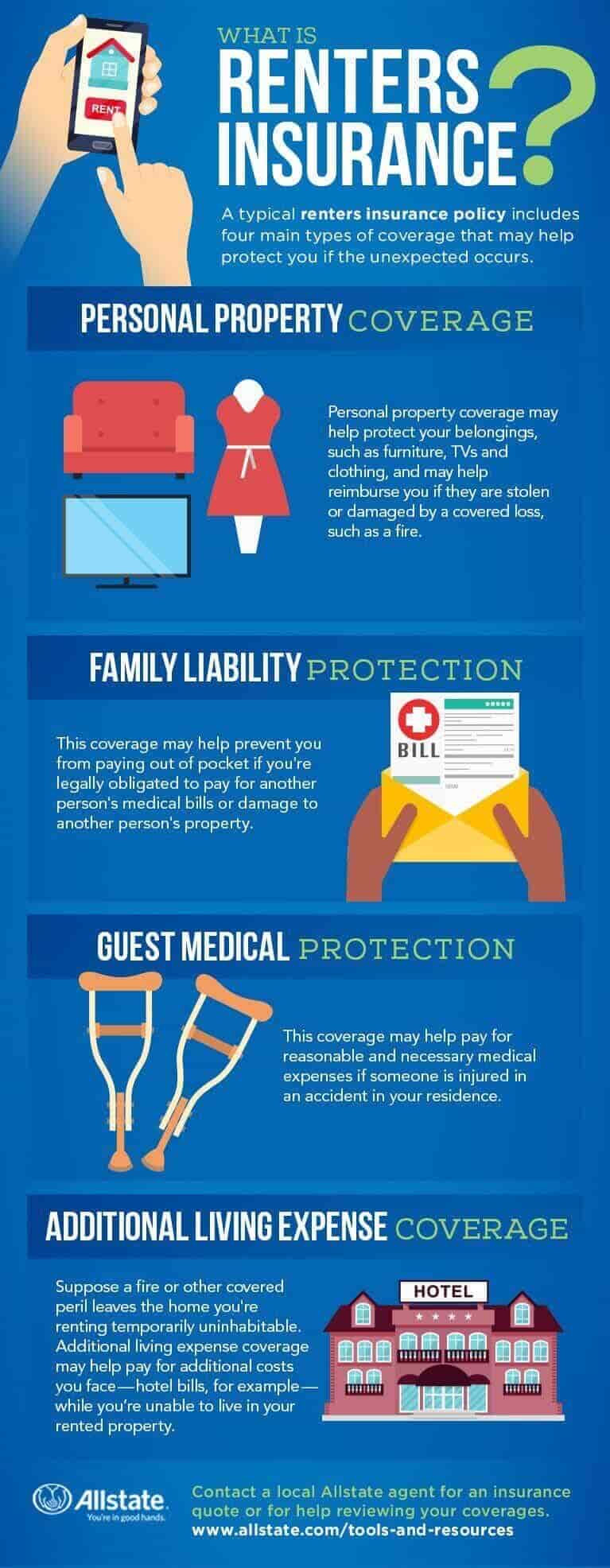

Source: allstate.com

Source: allstate.com

And for any disputes that are vehicle related you’re generally expected to rely on the legal expenses cover that’s usually offered with car insurance. Get up to £50,000 per claim to cover legal fees. Liability coverage homeowner�s insurance policies cover legal liability in the event that anyone suffers an injury while on the insured property. What’s covered by home insurance legal expenses? Any dispute that began before you took out insurance;

Source: baumgartnerlawyers.com

Source: baumgartnerlawyers.com

Policies bought ‘before the event’ protect policyholders in case legal action has to be fought or defended in the future. What’s covered by home insurance legal expenses? Legal cover can allow you to claim for any loss of income, as well as any other expenses that result from the accident, like the excess on your own car insurance policy that you were forced to claim on. In that case, it most likely only covers legal matters related to whatever the main policy covers. Your car insurance policy should cover claims for damage to your vehicle, but you might need to take legal action if you face other costs.

Source: allstate.com

Source: allstate.com

This policy does not cover legal expenses incurred in appealing any final decision of a civil court or against a conviction in a criminal court. It’s designed to give you the right support to protect and negotiate your legal rights. You�ll usually be covered for up to £100,000. Certain actions of the policyholder which occur away from the insured property may also be covered. If it�s more likely than not your case will be successful, home legal expenses cover will provide up to £100,000 for legal expenses to protect you against the costs of being sued or having to make a claim against someone else.

Source: bestpricefs.co.uk

Source: bestpricefs.co.uk

Although it’s possible to buy standalone legal expenses insurance, most policies are added to home or car insurance as an optional extra. It’s possible that you already have legal expenses insurance as part of your home insurance policy or your bank account, or if you’re a named driver on someone else’s car insurance. The legal expenses insurance geared to you get a quotation legal assistance to recover your uninsured losses and help you stay on the road after an accident that was not your fault. Expert legal support when you need it most. What’s covered by home insurance legal expenses?

Source: pinterest.com

Source: pinterest.com

But these are only a few of the legal matters you might face. Policies bought ‘before the event’ protect policyholders in case legal action has to be fought or defended in the future. Expert legal support when you need it most. If you decide to buy legal expenses cover, just make sure you don’t have it already. Where you choose your own solicitor • you must not agree to any legal expenses without arc’s prior agreement

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does home insurance legal cover car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.