Your Does home insurance cover tenant damage images are available in this site. Does home insurance cover tenant damage are a topic that is being searched for and liked by netizens now. You can Find and Download the Does home insurance cover tenant damage files here. Find and Download all royalty-free photos.

If you’re looking for does home insurance cover tenant damage images information connected with to the does home insurance cover tenant damage keyword, you have pay a visit to the right site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Does Home Insurance Cover Tenant Damage. You file a claim on your landlord insurance policy. For instance, if your home�s floors are damaged in a fire, your home insurance may pay for new flooring, up to your policy�s limits and minus your deductible. Homeowners insurance for rental property, sometimes called landlord insurance, is meant to help you protect your home from common risks, which can sometimes be the people who are sharing your home with you. Does landlord insurance cover tenant damage to your rental property?

Does Landlord Insurance Cover Tenant Damage? Get Insured From lifeinvestmentinsurance.com

Does Landlord Insurance Cover Tenant Damage? Get Insured From lifeinvestmentinsurance.com

Landlord insurance typically includes dwelling coverage, which helps protect against sudden and accidental damage to your rental property. This is why you need landlord insurance to pay for all repairs. It’s worth noting that your landlord’s insurance will not extend to your tenant’s personal belongings. You file a claim on your landlord insurance policy. Homeowners insurance covers the actual building you live in (and associated structures like garages), while renters insurance does not. A natural disaster, such as hail, fire, rain, hail, or wind storm.

Does renters insurance’s liability coverage help with water damage?

This type of insurance often includes dwelling coverage, which is beneficial as it provides protection against accidental or sudden damage to rental properties. Renters insurance offers financial protection for people who rent their homes. Renters insurance covers personal liability coverage and offers financial protection against unexpected property damage. Does your homeowners insurance cover the damages? The short answer is yes. However, this insurance must not be confused with the tenant’s content insurance — the latter exclusively covers the contents inside the property.

Source: insurefloridians.com

Source: insurefloridians.com

Yes, renters insurance typically covers any damage to your personal possessions resulting from a ceiling leak. Their renters liability coverage will pay for the damages. Common floor damage scenarios spills Standard renters� insurance does not, however, cover all natural disasters. Renters insurance covers personal liability coverage and offers financial protection against unexpected property damage.

Source: servprohydeparkcentralaustin.com

Source: servprohydeparkcentralaustin.com

But like most insurance policies, there is small print to be aware of. When a tenant causes damage to our property, you may feel you need to file a claim for your losses,. If a tenant accidentally starts a kitchen fire that damages your rental property, for example, landlord insurance may help pay for repairs as well as cover the cost of lost rental. Their renters liability coverage will pay for the damages. The short answer is yes.

Source: clearsurance.com

Source: clearsurance.com

Yes, renters insurance typically covers any damage to your personal possessions resulting from a ceiling leak. However, you can — indirectly. If a tenant accidentally starts a kitchen fire that damages your rental property, for example, landlord insurance may help pay for repairs as well as cover the cost of lost rental. A landlord home and contents insurance policy covers loss due to natural disasters, storm, and fire. Dwelling coverage, on your condo or homeowners policy, may pay to repair or replace your floors and carpet if they�re damaged by a covered peril.

Source: thedamagechoices.blogspot.com

Source: thedamagechoices.blogspot.com

If your tenant damages your rental property, your landlord insurance may cover the loss, but it depends on the type of damage and your coverages. Typically home insurance does not cover tenant damage, but there is an insurance that’s right for you. Landlord insurance typically includes dwelling coverage, which helps protect against sudden and accidental damage to your rental property. It’s your responsibility as a landlord to fix all damage to the home because the tenant won’t be able to do this. If your tenant damages your rental property, your landlord insurance may cover the loss, but it depends on the type of damage and your coverages.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Homeowners insurance covers the actual building you live in (and associated structures like garages), while renters insurance does not. When a tenant causes damage to our property, you may feel you need to file a claim for your losses,. Tenant liability insurance protects you if you’ve damaged property, or an accident occurs in your home and someone is injured. It may also provide liability coverage for accidents that happen on. But like most insurance policies, there is small print to be aware of.

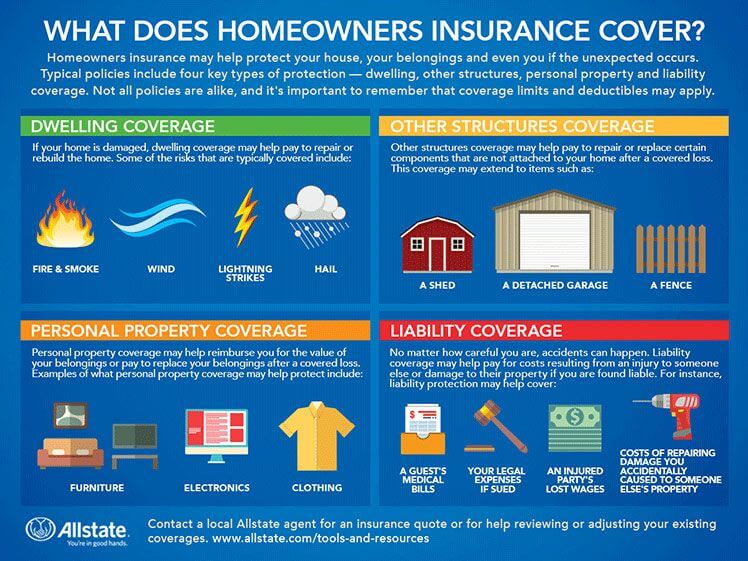

Source: allstate.com

Source: allstate.com

The way the claim would work is this: Yes, renters insurance typically covers any damage to your personal possessions resulting from a ceiling leak. Does landlord insurance cover tenant damage to your rental property? It’s your responsibility as a landlord to fix all damage to the home because the tenant won’t be able to do this. Generally, there are three kinds of tenant damage:

Source: lifeinvestmentinsurance.com

Source: lifeinvestmentinsurance.com

The way the claim would work is this: Does landlord insurance cover tenant damage to your rental property? Does landlord insurance cover tenant damage? Additionally, you may protect yourself against any loss arising due to damage to your property caused by your tenants or their guests. It may also provide liability coverage for accidents that happen on.

Source: patch.com

Source: patch.com

Dwelling coverage, on your condo or homeowners policy, may pay to repair or replace your floors and carpet if they�re damaged by a covered peril. Normal wear and tear, intentional, and accidental. For instance, if your home�s floors are damaged in a fire, your home insurance may pay for new flooring, up to your policy�s limits and minus your deductible. Generally, there are three kinds of tenant damage: Their renters liability coverage will pay for the damages.

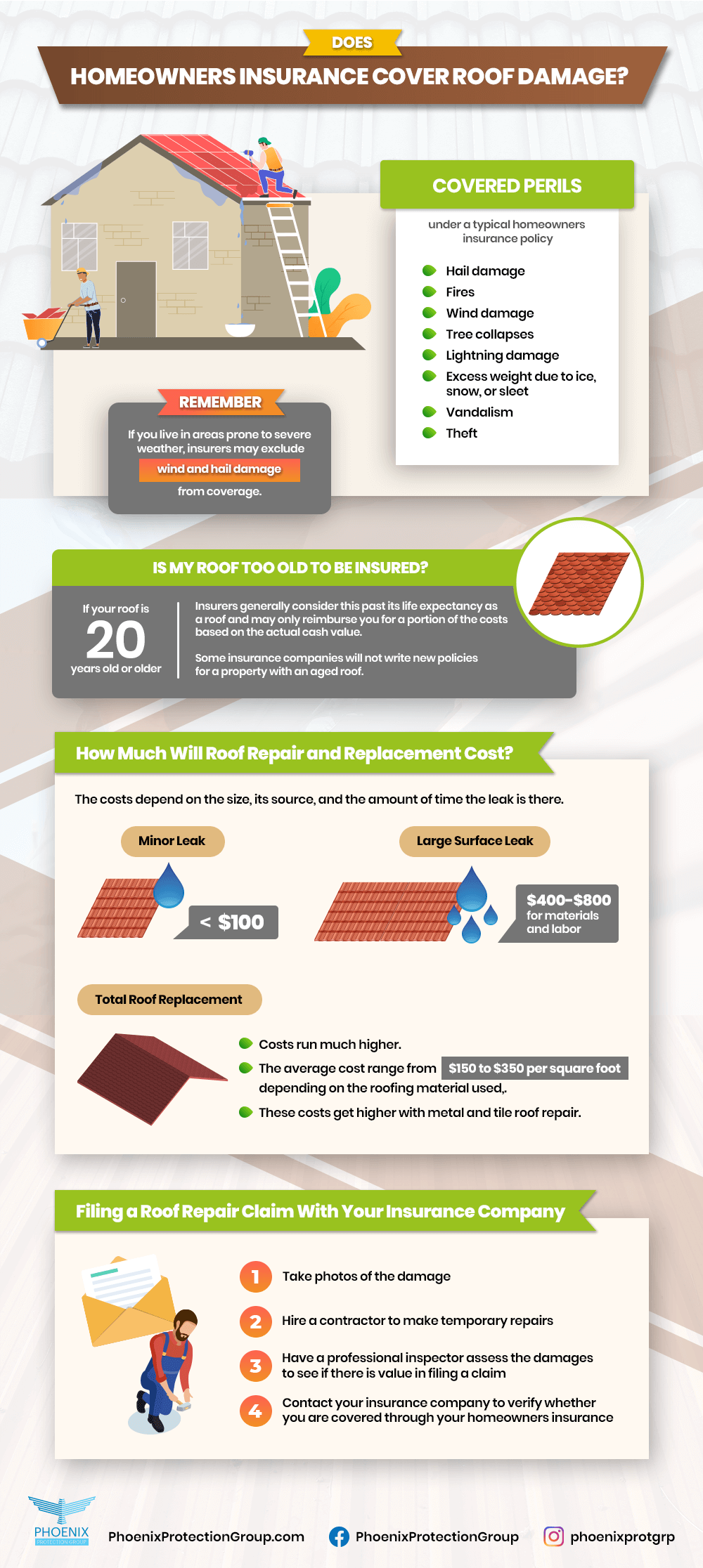

Source: phoenixprotectiongroup.com

Source: phoenixprotectiongroup.com

Generally, there are three kinds of tenant damage: Since renters don’t own the unit they live in, renters insurance doesn’t cover any damage to the structural property of the rental unit the policyholder is living in. Does homeowners insurance cover tenant vandalism? Additionally, you may protect yourself against any loss arising due to damage to your property caused by your tenants or their guests. Landlord insurance does cover tenant damage.

Source: merchantfamilyagency.com

Source: merchantfamilyagency.com

The short answer is yes. However, you can — indirectly. Landlord insurance typically includes dwelling coverage, which helps protect against sudden and accidental damage to your rental property. If your policy includes water damage, there may also be coverage for water discharge, like when the tenant’s child sends their stuffed fish for a. What you’re looking for is landlord insurance, which protects against accidental or sudden damage to your adu.

Source: keyrenteraustin.com

Source: keyrenteraustin.com

If a tenant accidentally damages your property, your landlord insurance policy may help. Accidental damage done by tenants is covered by most property policies. Does your homeowners insurance cover the damages? A natural disaster, such as hail, fire, rain, hail, or wind storm. If a tenant accidentally damages your property, your landlord insurance policy may help.

Source: svmfireandwater.com

Source: svmfireandwater.com

A natural disaster, such as hail, fire, rain, hail, or wind storm. It’s your responsibility as a landlord to fix all damage to the home because the tenant won’t be able to do this. It may also provide liability coverage for accidents that happen on. Your landlord insurance policy may cover tenant damage to your property. Renters insurance covers personal liability coverage and offers financial protection against unexpected property damage.

Source: lincolnbrokerage.com

Source: lincolnbrokerage.com

Dwelling coverage, on your condo or homeowners policy, may pay to repair or replace your floors and carpet if they�re damaged by a covered peril. Does landlord insurance cover damage caused by tenants? It’s your responsibility as a landlord to fix all damage to the home because the tenant won’t be able to do this. Property damage is usually covered by your landlord’s homeowner’s insurance policy. Yes, renters insurance typically covers any damage to your personal possessions resulting from a ceiling leak.

Source: servicemasternw.com

Source: servicemasternw.com

Generally, it also covers fixtures like stovetops, light fittings, window coverings, carpets, and ovens. Their renters liability coverage will pay for the damages. The insurance legally covers the damages caused during their stay. But when a tenant is found to have caused damage to the property intentionally or on accident, they’re usually the ones that end up being responsible for paying for repairs and replacements. The short answer is yes.

Source: damagecontrol-911.com

Source: damagecontrol-911.com

Landlord insurance does cover tenant damage. Landlord insurance typically includes dwelling coverage, which helps protect against sudden and accidental damage to your rental property. Typically home insurance does not cover tenant damage, but there is an insurance that’s right for you. Your house is flooded and it’s due to the irresponsibility of the tenant you were renting to. Generally, it also covers fixtures like stovetops, light fittings, window coverings, carpets, and ovens.

Source: luxurypropertycare.com

Source: luxurypropertycare.com

Since renters don’t own the unit they live in, renters insurance doesn’t cover any damage to the structural property of the rental unit the policyholder is living in. Landlord insurance typically includes dwelling coverage, which helps protect against sudden and accidental damage to your rental property. Property damage is usually covered by your landlord’s homeowner’s insurance policy. Landlord insurance does cover tenant damage. If a tenant accidentally damages your property, your landlord insurance policy may help.

Source: clovered.com

Source: clovered.com

Does landlord insurance cover tenant damage? Renters insurance covers personal liability coverage and offers financial protection against unexpected property damage. You file a claim on your landlord insurance policy. It may also provide liability coverage for accidents that happen on. Typically home insurance does not cover tenant damage, but there is an insurance that’s right for you.

Source: pinterest.com

Source: pinterest.com

Typical exceptions include earthquakes and floods (in which case you will need to purchase additional. The insurance legally covers the damages caused during their stay. However, you can — indirectly. With renters insurance , the landlord will be expected to have coverage on the building while your insurance will cover your personal property. Typically home insurance does not cover tenant damage, but there is an insurance that’s right for you.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does home insurance cover tenant damage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.