Your Does full coverage insurance cover engine failure images are ready. Does full coverage insurance cover engine failure are a topic that is being searched for and liked by netizens now. You can Get the Does full coverage insurance cover engine failure files here. Download all free photos.

If you’re searching for does full coverage insurance cover engine failure images information linked to the does full coverage insurance cover engine failure topic, you have visit the ideal blog. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

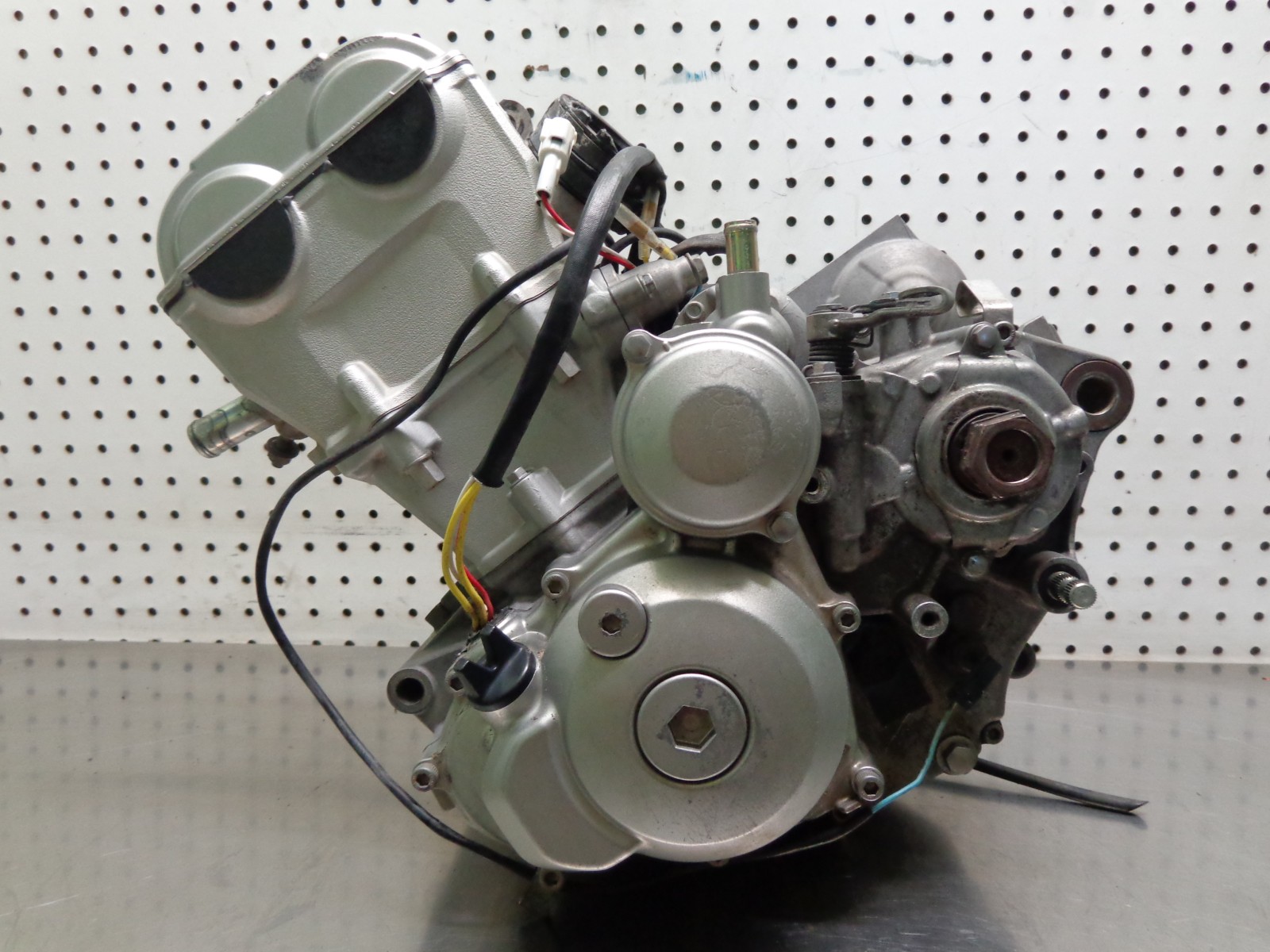

Does Full Coverage Insurance Cover Engine Failure. Some people use the term full coverage to refer to a policy with comprehensive and collision coverage, plus any other coverages your state requires. The simple answer is no, gap insurance doesn�t cover engine failure. If, however, you experience a sudden loss and you have the right coverage, you may be able to file a claim. What does car insurance cover?

Cheap Full Coverage Car Insurance From everquote.com

Cheap Full Coverage Car Insurance From everquote.com

The simple answer is no, gap insurance doesn�t cover engine failure. Mechanical problems or a blown engine are not covered by these policies. Savvy, which defines full coverage car insurance as comprehensive, collision, and. What does full coverage cover in this case? Additional coverages help you personalize your car insurance policy. An extended warranty can often cover mechanical repairs, including repairs to your engine, for up to 100,000 miles, protecting you in the event of an engine failure.

It provides coverage for the cost of repairing or replacing your car’s engine or/and its parts under your car insurance policy on payment of an additional premium cost.

First, let’s make one thing clear: If you’ve failed to maintain your system and it breaks down, that is something you’ll have to pay for yourself. Savvy, which defines full coverage car insurance as comprehensive, collision, and. Think damage from severe weather, theft, vandalism, fire or hitting an animal. While a full coverage option technically doesn�t exist, you will have the opportunity to select comprehensive insurance. It is a legal requirement to have a minimal level of insurance before driving a car in india.

Source: instaspoolperformance.bigcartel.com

Source: instaspoolperformance.bigcartel.com

If, however, you experience a sudden loss and you have the right coverage, you may be able to file a claim. The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. What does car insurance cover? Mechanical breakdown insurance coverage is in excess of coverage provided by your manufacturer�s warranty. You may want rental reimbursement to help with rental.

Source: pinterest.com

Source: pinterest.com

While a full coverage option technically doesn�t exist, you will have the opportunity to select comprehensive insurance. A $500 deductible applied to all collision. In the case of a mechanical problem or blown engine, the exception applies. Damage due to street racing 2. No auto insurance policy covers every known peril or potential problem your car could have.

Source: aviationweek.com

Source: aviationweek.com

Savvy, which defines full coverage car insurance as comprehensive, collision, and. The simple answer is no, gap insurance doesn�t cover engine failure. It provides coverage for the cost of repairing or replacing your car’s engine or/and its parts under your car insurance policy on payment of an additional premium cost. This is the only insurance to cover a bad engine, and it can take care of some mechanical issues as well, including fluid blocks and transmissions. There�s no such thing as full coverage car insurance as no insurance policy can account for everything that could happen to your car.

Source: outboardcovers.com

Source: outboardcovers.com

An insurance claim for a bad engine would only be covered by certain types of policies such as mechanical breakdown insurance. Car insurance or motor insurance is mandatory by law. While a full coverage option technically doesn�t exist, you will have the opportunity to select comprehensive insurance. An insurance claim for a bad engine would only be covered by certain types of policies such as mechanical breakdown insurance. After you pay your deductible, your comprehensive coverage can.

Source: everquote.com

Source: everquote.com

Mechanical problems or a blown engine are not covered by these policies. Savvy, which defines full coverage car insurance as comprehensive, collision, and. There�s no such thing as full coverage car insurance as no insurance policy can account for everything that could happen to your car. It is a legal requirement to have a minimal level of insurance before driving a car in india. Additional coverages help you personalize your car insurance policy.

Source: everquote.com

Source: everquote.com

First, let’s make one thing clear: Think damage from severe weather, theft, vandalism, fire or hitting an animal. There�s no such thing as full coverage car insurance as no insurance policy can account for everything that could happen to your car. Comprehensive is coverage for damage to your vehicle. This type of coverage helps pay for incidents that are often out of your control.

Source: onallcylinders.com

Source: onallcylinders.com

What does car insurance cover? What does car insurance cover? The simple answer is no, gap insurance doesn�t cover engine failure. Full car insurance coverage means different things to different people. It can also help with losses resulting from flood, hail, and when you hit an animal.

Full car insurance coverage means different things to different people. Does full coverage car insurance cover a blown engine? What does car insurance cover? While a full coverage option technically doesn�t exist, you will have the opportunity to select comprehensive insurance. It usually gets classified under consequential damage, or a damage that is not directly a result of an unfortunate incident.

Source: keyworx.org

Source: keyworx.org

Whether it�s routine maintenance, a mechanical failure or a blown engine, car insurance will most likely not cover the costs of repairing or replacing your vehicle. No auto insurance policy covers every known peril or potential problem your car could have. Your car insurance may cover electrical problems if they were caused by a covered peril. Some coverages (such as auto liability) are required by state law. It covers your vehicle in the event of a theft or vandalism.

Source: ebay.com

Source: ebay.com

Think damage from severe weather, theft, vandalism, fire or hitting an animal. Mechanical breakdown insurance covers major components for sudden, unexpected mechanical failures for the full length of your coverage term. In most cases, full coverage insurance will not cover: The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. In the case of a mechanical problem or blown engine, the exception applies.

It is a legal requirement to have a minimal level of insurance before driving a car in india. Your car insurance may cover electrical problems if they were caused by a covered peril. It is a legal requirement to have a minimal level of insurance before driving a car in india. Read the policy amendment for the complete terms and conditions of this coverage. An extended warranty can often cover mechanical repairs, including repairs to your engine, for up to 100,000 miles, protecting you in the event of an engine failure.

Source: benzworld.org

Source: benzworld.org

Car insurance does not typically cover engine damage. Read the policy amendment for the complete terms and conditions of this coverage. Damage due to street racing 2. The national association of insurance commissioners says that maintenance, such as an oil change, is typically not included in car insurance coverage. Mechanical breakdown insurance, or mbi, is a car insurance policy that covers the cost of repairs to certain vehicle parts after they break down as.

Source: ebay.com

Source: ebay.com

There are four common types of insurance coverage that pay for repair of your car, and unfortunately none of them pay for mechanical problems. There are four common types of insurance coverage that pay for repair of your car, and unfortunately none of them pay for mechanical problems. The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. Think damage from severe weather, theft, vandalism, fire or hitting an animal. Others (such as rental reimbursement) may be optional.

Source: keyworx.org

Source: keyworx.org

In the case of a mechanical problem or blown engine, the exception applies. It usually gets classified under consequential damage, or a damage that is not directly a result of an unfortunate incident. A $500 deductible applied to all collision. What does car insurance cover? This type of coverage helps pay for incidents that are often out of your control.

Source: ford-trucks.com

Source: ford-trucks.com

Some people use the term full coverage to refer to a policy with comprehensive and collision coverage, plus any other coverages your state requires. No, insurance does not cover a car�s transmission, unless you have mechanical breakdown insurance coverage. We’ll get into the details below, including what gap insurance does. Full car insurance coverage means different things to different people. It covers your vehicle in the event of a theft or vandalism.

Source: everquote.com

Source: everquote.com

This ‘add on’ cover, covers all the major components of not only your engine in case of an accident, but your gearbox too! This ‘add on’ cover, covers all the major components of not only your engine in case of an accident, but your gearbox too! What does full coverage cover in this case? Your car insurance may cover electrical problems if they were caused by a covered peril. But, there�s really no such thing as full coverage for your car.

![5 Important Car Insurance Coverages Explained [Infographic] 5 Important Car Insurance Coverages Explained [Infographic]](http://southernstatesinsurance.com/wp-content/uploads/2016/11/5-Important-Car-Insurance-Coverages-Explained-Infographic.jpg) Source: southernstatesinsurance.com

Source: southernstatesinsurance.com

There may be other forms of optional coverage offered by your auto insurance provider for handling an issue like this, as every company is different. This type of coverage helps pay for incidents that are often out of your control. Even mechanical breakdown insurance only covers sudden malfunctions, though, not normal. Does full coverage insurance cover engine issues? If, however, you experience a sudden loss and you have the right coverage, you may be able to file a claim.

Source: outboardcovers.com

Source: outboardcovers.com

There�s no such thing as full coverage car insurance as no insurance policy can account for everything that could happen to your car. An insurance claim for a bad engine would only be covered by certain types of policies such as mechanical breakdown insurance. Whether it�s routine maintenance, a mechanical failure or a blown engine, car insurance will most likely not cover the costs of repairing or replacing your vehicle. In most cases, car insurance — even full coverage — won�t cover your car�s repair if it�s just due to mechanical breakdown or wear and tear. Even if you have full coverage on your car insurance, engine failure is not usually covered.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does full coverage insurance cover engine failure by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.