Your Does each resident need renters insurance images are ready in this website. Does each resident need renters insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Does each resident need renters insurance files here. Find and Download all free photos and vectors.

If you’re looking for does each resident need renters insurance images information linked to the does each resident need renters insurance topic, you have pay a visit to the right site. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

Does Each Resident Need Renters Insurance. Does everyone in an apartment need renters insurance? If a husband & wife, then it is not needed on each person. Each roommate should have their own renters insurance policy. If you are referring to a room mate situation, then it would be wise for each person to have renter�s insurance.

35 percent of U.S. residents rent their home. Many From pinterest.com

35 percent of U.S. residents rent their home. Many From pinterest.com

A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. Everyone living in the rented home should have a renters insurance policy unless you are married or there are dependent children involved. By purchasing your own insurance, you ensure that you are protected. You can share a policy with your roommate if both your state and insurance company allow it. That means your children, husband, wife, partner, parents, etc. Does each tenant need renter’s insurance?

Each resident doesn’t need their own renters insurance policy.

While each roommate may not need their own renters insurance one policy won’t cover both of your belongings unless you’re both on the policy. And although your senior community may cover many of your daily needs, most senior living communities do not insure small possessions against loss because of natural disasters and similar circumstances. Roommates at a college or university might need renters insurance. Living with a roommate can be both a blessing and a curse, but i hope you’re getting excited about the move! Furthermore, tenants who earn 50 percent or less of the median area income, as well as tenants of publicly subsidized housing, cannot be required to buy renters insurance. Ask you agent or broker about your specific situation.

Source: futuremploi-appui.com

Source: futuremploi-appui.com

A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. Insurance is based on an insurable interest. Does each roommate need renters insurance? The insurance will pay you the cost of the stuff you lost. Typically, a tenant insurance policy covers only the policyholder’s belongings.

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

The new roommate can get her own renters insurance policy, which would provide her with the full protection of the policy limits even if there was a loss that involved more than one of you. How does telling tenants renters insurance is required benefit me as a landlord? Each resident doesn’t need their own renters insurance policy. For tenants and renters, only their possessions can be protected by this insurance. Generally speaking, each resident doesn�t need renters insurance, but each resident must be named on a renters insurance policy to be covered.

Source: npa1.org

Source: npa1.org

Roommates at a college or university might need renters insurance. You are not legally required to have renters insurance, but your landlord can require it as part of your lease agreement. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. Renters insurance is relatively affordable and provides protection against possible financial losses. Typically, a tenant insurance policy covers only the policyholder’s belongings.

Source: revisi.net

Source: revisi.net

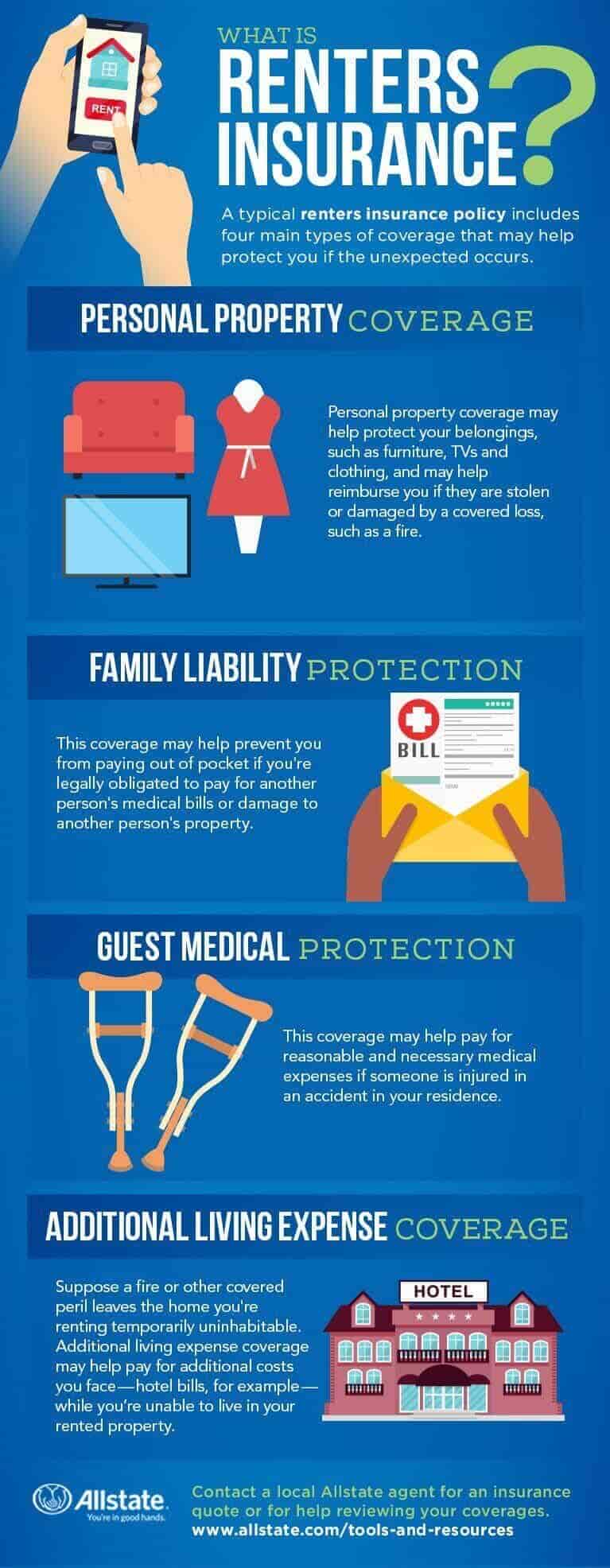

A typical renters insurance policy includes three types of coverage that help protect you, your belongings and your living arrangements after a covered loss. How much will it cost? Generally speaking, each resident doesn�t need renters insurance, but each resident must be named on a renters insurance policy to be covered. A basic condo insurance policy provides coverage for your belongings, which include cash, jewelry, furniture, and appliances. And although your senior community may cover many of your daily needs, most senior living communities do not insure small possessions against loss because of natural disasters and similar circumstances.

Source: allstate.com

Source: allstate.com

There are few exceptions to this, which are very narrowly tailored to specific circumstances. How does telling tenants renters insurance is required benefit me as a landlord? In other words, if you have $15,000 of personal property coverage on your renters insurance and you share the policy with your roommate, you still only have $15,000 of coverage between you. The downside of roommates sharing renters insurance is that the coverage limits don’t change just because someone is endorsed onto the policy. How much will it cost?

Source: clovered.com

Source: clovered.com

Cooking fires are the most common example, but smoke damage, water damage from an overflowing bathtub, and other causes of loss due to tenant negligence would also be covered. The downside of roommates sharing renters insurance is that the coverage limits don’t change just because someone is endorsed onto the policy. Tenants should have renters insurance to insure the contents inside their apartment as well provide insurance should they cause the structure to be damaged by fire, flood or smoke. Generally speaking, each resident doesn�t need renters insurance, but each resident must be named on a renters insurance policy to be covered. Insurance is based on an insurable interest.

Source: everquote.com

Source: everquote.com

However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. Renters insurance isn’t mandated by law, but some landlords require tenants to have a policy before signing the lease. Tenants should have renters insurance to insure the contents inside their apartment as well provide insurance should they cause the structure to be damaged by fire, flood or smoke. You can purchase insurance jointly, however, but don’t assume you’re automatically covered by your housemate’s policy because you probably aren’t unless specified. Each resident doesn’t need their own renters insurance policy.

Source: imsguenstony.blogspot.com

Source: imsguenstony.blogspot.com

A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. Since you’re going to live with your friends, if everyone wants to be covered, each roommate will need their own renters insurance policy. And although your senior community may cover many of your daily needs, most senior living communities do not insure small possessions against loss because of natural disasters and similar circumstances. A typical renters insurance policy includes three types of coverage that help protect you, your belongings and your living arrangements after a covered loss. For those getting insurance, you can each choose a policy that works best for you, and no one has to settle for.

Source: moneylend.net

Source: moneylend.net

By purchasing your own insurance, you ensure that you are protected. How much will it cost? Does each roommate need renters insurance? How does telling tenants renters insurance is required benefit me as a landlord? Renters insurance is relatively affordable and provides protection against possible financial losses.

Source: torontorentals.com

Source: torontorentals.com

But the short answer to a complicated question is this: Everyone living in the rented home should have a renters insurance policy unless you are married or there are dependent children involved. How does telling tenants renters insurance is required benefit me as a landlord? Talk to your independent insurance agent to determine whether sharing a policy is the right decision for you. Roommates at a college or university might need renters insurance.

Source: dubaikhalifas.com

Source: dubaikhalifas.com

Talk to your independent insurance agent to determine whether sharing a policy is the right decision for you. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. Talk to your independent insurance agent to determine whether sharing a policy is the right decision for you. Each resident doesn’t need their own renters insurance policy. Read on to learn how each type of coverage works.

Source: pangeare.com

Source: pangeare.com

Insurance is based on an insurable interest. How does telling tenants renters insurance is required benefit me as a landlord? Furthermore, tenants who earn 50 percent or less of the median area income, as well as tenants of publicly subsidized housing, cannot be required to buy renters insurance. Insurance is based on an insurable interest. By purchasing your own insurance, you ensure that you are protected.

Source: revisi.net

Source: revisi.net

We break down how it all works in easy terms below. By purchasing your own insurance, you ensure that you are protected. Every roommate needs to be listed on renters insurance, and getting a policy for each roommate is the best practice. There are few exceptions to this, which are very narrowly tailored to specific circumstances. Everyone who owns anything needs renters insurance.

Source: tspeck.com

Source: tspeck.com

Does each tenant need renter’s insurance? If your roommate decides to get a renters insurance policy, only their personal property has coverage. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. A basic condo insurance policy provides coverage for your belongings, which include cash, jewelry, furniture, and appliances. Furthermore, tenants who earn 50 percent or less of the median area income, as well as tenants of publicly subsidized housing, cannot be required to buy renters insurance.

Source: pinterest.com

Source: pinterest.com

Everyone who owns anything needs renters insurance. Each resident doesn’t need their own renters insurance policy. If your roommate decides to get a renters insurance policy, only their personal property has coverage. Roommates at a college or university might need renters insurance. While each roommate may not need their own renters insurance one policy won’t cover both of your belongings unless you’re both on the policy.

Source: tspeck.com

Source: tspeck.com

There are few exceptions to this, which are very narrowly tailored to specific circumstances. A basic condo insurance policy provides coverage for your belongings, which include cash, jewelry, furniture, and appliances. Since you’re going to live with your friends, if everyone wants to be covered, each roommate will need their own renters insurance policy. Every roommate needs to be listed on renters insurance, and getting a policy for each roommate is the best practice. A typical renters insurance policy includes three types of coverage that help protect you, your belongings and your living arrangements after a covered loss.

Source: mabeyinsurance.com

Source: mabeyinsurance.com

Does each tenant need renter’s insurance? That means your children, husband, wife, partner, parents, etc. A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment. How does telling tenants renters insurance is required benefit me as a landlord? For those getting insurance, you can each choose a policy that works best for you, and no one has to settle for.

Roommates living in a dormitory owned by the university are probably covered by a parent or guardian�s homeowners policy and don�t need renters insurance. Every roommate needs to be listed on renters insurance, and getting a policy for each roommate is the best practice. Since you’re going to live with your friends, if everyone wants to be covered, each roommate will need their own renters insurance policy. Everyone who owns anything needs renters insurance. How does telling tenants renters insurance is required benefit me as a landlord?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does each resident need renters insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.