Your Does car insurance impact credit images are ready in this website. Does car insurance impact credit are a topic that is being searched for and liked by netizens today. You can Find and Download the Does car insurance impact credit files here. Find and Download all free photos.

If you’re looking for does car insurance impact credit images information linked to the does car insurance impact credit interest, you have visit the ideal site. Our site frequently gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

Does Car Insurance Impact Credit. Typically, you can cancel a policy and have no further obligation to the provider unless you are behind in premium payments. Even though insurance companies check your credit during the. Some states—including california, hawaii, massachusetts and michigan—strictly limit or entirely prohibit insurance companies� use of credit information in determining auto insurance rates. But if you pay with a credit card, things like your card’s balance or late payments could be reported to the credit bureaus.

How Does Your Credit Score Affect Car Insurance Rate? From nextinsurance.co.ke

How Does Your Credit Score Affect Car Insurance Rate? From nextinsurance.co.ke

Typically, you can cancel a policy and have no further obligation to the provider unless you are behind in premium payments. Most insurance companies perform a soft pull on your credit, providing an incomplete credit history but not impacting your score much. “other factors considered include driving. While your car insurance policy will never impact your credit score, the opposite may be true. What else do auto insurers look at to determine rates? After all, credit inquiries can.

The act of cancelling a policy has no bearing on your credit, according to the murray group insurance services.

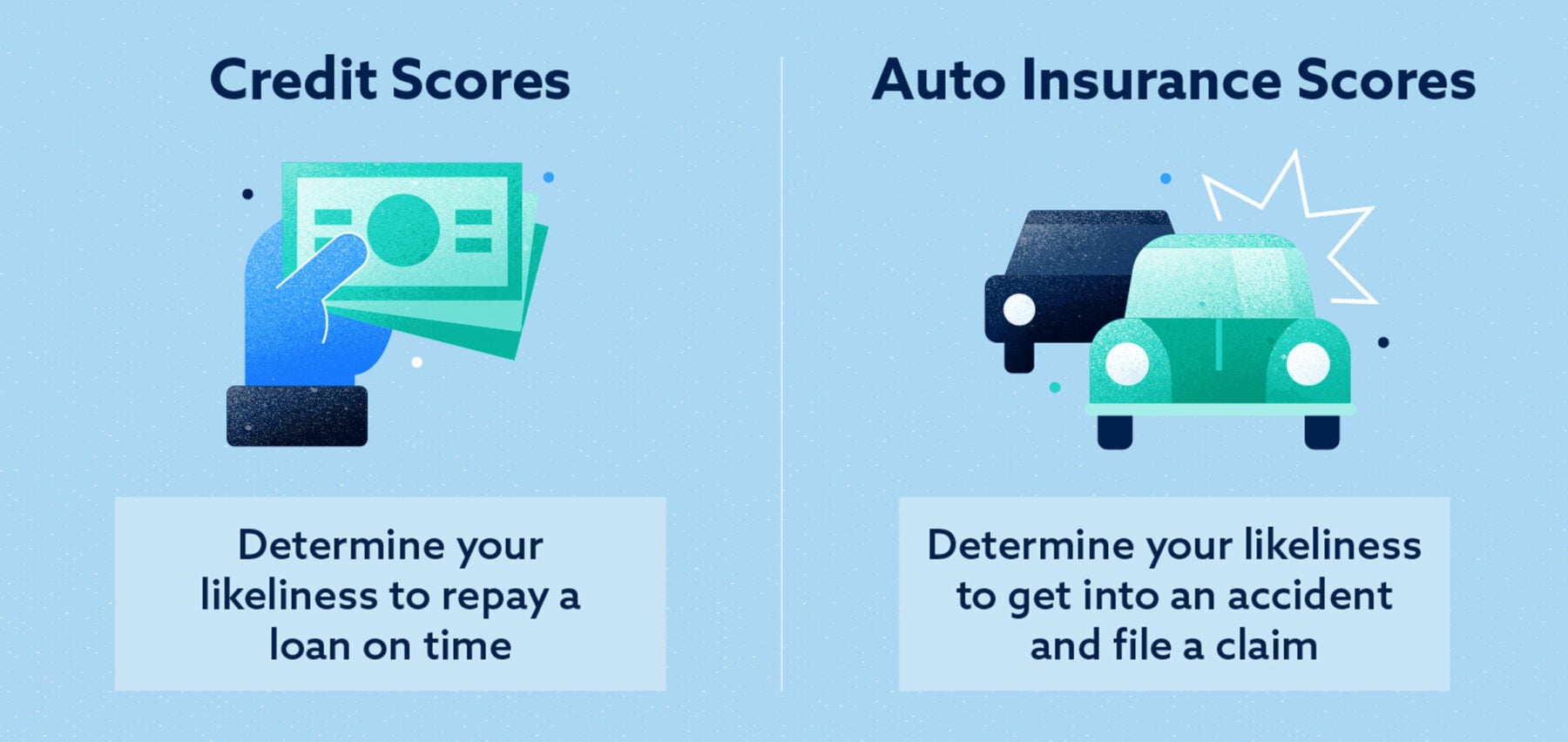

Your credit report influences more than just your borrowing power. This won’t affect your credit score and can only be seen by you. What is an insurance credit score? Learn why credit scores affect car insurance rates and how this impacts you as a consumer. Temporary car insurance policies usually last between 1 day and 1 month. You pay for the cover up front, so they don�t have any impact on your credit score.

Source: insurancepanda.com

Source: insurancepanda.com

Temporary car insurance policies (and being a named driver) won�t affect your credit score. Insurance companies can also review the insurance risk scores of current customers in. That said, your credit score can have an effect on your car insurance rate. You pay for the cover up front, so they don�t have any impact on your credit score. Making payments for car insurance won’t affect your credit score.

Source: pinterest.com

Source: pinterest.com

If you have bad credit, you�re likely paying a much higher car insurance premium than you would if you had excellent credit. This won’t affect your credit score and can only be seen by you. This is because by paying monthly, you are entering into a form of credit agreement with your insurer; The act of cancelling a policy has no bearing on your credit, according to the murray group insurance services. Your credit rating also influences the amount you pay for car insurance.

Source: nextinsurance.co.ke

Source: nextinsurance.co.ke

Your credit report influences more than just your borrowing power. This won’t affect your credit score and can only be seen by you. When you compare quotes, insurance providers will do a ‘ soft search ’ simply to check that the details you’ve given them are accurate. Does car insurance check your credit score? You pay for the cover up front, so they don�t have any impact on your credit score.

Source: pinterest.com

Source: pinterest.com

Your credit can remain unaffected by obtaining an auto insurance quote. According to various studies, people with lower credit scores tend to cost their insurance companies more money. If car insurers pull your credit report during the application process, does that actually affect your credit? As you can see from the findings on how credit score affects car insurance, having good credit can result in vastly cheaper rates, regardless of the level of car insurance you choose to buy.the difference between good credit and poor credit based on minimum coverage is most significant; The act of cancelling a policy has no bearing on your credit, according to the murray group insurance services.

Source: segurosenhouston.com

Source: segurosenhouston.com

It�s a question you might have wondered about before — especially if you have a. Does car insurance check your credit score? Can you get declined for car insurance? It�s a question you might have wondered about before — especially if you have a. Typically, you can cancel a policy and have no further obligation to the provider unless you are behind in premium payments.

![]() Source: coverhound.com

Source: coverhound.com

It�s a question you might have wondered about before — especially if you have a. But if you pay with a credit card, things like your card’s balance or late payments could be reported to the credit bureaus. Not surprisingly, insurance companies tend to charge higher rates to people with lower credit scores. Insurance quotes do not affect credit scores. Studies have shown that this score has an adverse effect on predicting losses in insurance.

Source: pinterest.com

Source: pinterest.com

And most major insurers do accept credit cards as. Even though insurance companies check your credit during the. Does car insurance check your credit score? Not surprisingly, insurance companies tend to charge higher rates to people with lower credit scores. This is because by paying monthly, you are entering into a form of credit agreement with your insurer;

Source: youtube.com

Source: youtube.com

Does car insurance check your credit score? If car insurers pull your credit report during the application process, does that actually affect your credit? Typically, you can cancel a policy and have no further obligation to the provider unless you are behind in premium payments. You pay for the cover up front, so they don�t have any impact on your credit score. A monthly payment scheme like this is effectively a loan.

Source: pinterest.com

Source: pinterest.com

There are almost 92% of insurance companies that take credit into consideration when determining premiums. Learn what an auto declarations page is and how to read one. Insurance quotes do not affect credit scores. Drivers with poor credit may pay as much as 42% more for car insurance than drivers with stronger credit. Does car insurance check your credit score?

Source: pinterest.com

Source: pinterest.com

It�s a question you might have wondered about before — especially if you have a. A car insurance policy is a contract between you and the provider. And most major insurers do accept credit cards as. Credit�s impact on car insurance. After all, credit inquiries can.

Source: lexingtonlaw.com

Source: lexingtonlaw.com

Some states—including california, hawaii, massachusetts and michigan—strictly limit or entirely prohibit insurance companies� use of credit information in determining auto insurance rates. If you have bad credit, you�re likely paying a much higher car insurance premium than you would if you had excellent credit. However, if you pay your car insurance monthly, it can influence your credit score. The act of cancelling a policy has no bearing on your credit, according to the murray group insurance services. In these states, your credit score won�t affect your insurance rates no matter how good or bad it is.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Temporary car insurance policies (and being a named driver) won�t affect your credit score. Drivers with poor credit may pay as much as 42% more for car insurance than drivers with stronger credit. In certain states, the answer is yes, so it�s important to maintain a good credit score in order to. It�s a question you might have wondered about before — especially if you have a. Learn why credit scores affect car insurance rates and how this impacts you as a consumer.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

A driver with poor credit will pay almost. However, if you pay your car insurance monthly, it can influence your credit score. Learn what an auto declarations page is and how to read one. Do car insurance quotes affect credit scores? It�s a question you might have wondered about before — especially if you have a.

Source: completechoiceinsurance.com

Source: completechoiceinsurance.com

The act of cancelling a policy has no bearing on your credit, according to the murray group insurance services. As you can see from the findings on how credit score affects car insurance, having good credit can result in vastly cheaper rates, regardless of the level of car insurance you choose to buy.the difference between good credit and poor credit based on minimum coverage is most significant; Insurance prices for cars are influenced in part by credit. Paying car insurance with a credit card. Named drivers don�t get credit checked, either.

Source: lexingtonlaw.com

Source: lexingtonlaw.com

“yes, most car insurance companies use credit scores as one of many factors affecting car insurance premiums,” affirms adrian mak, ceo of advisorsmith. So unless you live in california, massachusetts or hawaii, your credit score will be factored in. What else do auto insurers look at to determine rates? But if you pay with a credit card, things like your card’s balance or late payments could be reported to the credit bureaus. It�s a question you might have wondered about before — especially if you have a.

Source: 2passdd.com

Source: 2passdd.com

Insurance prices for cars are influenced in part by credit. When you compare quotes, insurance providers will do a ‘ soft search ’ simply to check that the details you’ve given them are accurate. Your credit rating also influences the amount you pay for car insurance. If you have bad credit, you�re likely paying a much higher car insurance premium than you would if you had excellent credit. Temporary car insurance policies usually last between 1 day and 1 month.

Source: bestofweb.info

Source: bestofweb.info

Can you get declined for car insurance? If you have bad credit, you�re likely paying a much higher car insurance premium than you would if you had excellent credit. Does credit score affect car insurance rates? When you compare quotes, insurance providers will do a ‘ soft search ’ simply to check that the details you’ve given them are accurate. You pay for the cover up front, so they don�t have any impact on your credit score.

Source: netclipart.com

Source: netclipart.com

Temporary car insurance policies usually last between 1 day and 1 month. Insurance prices for cars are influenced in part by credit. Not surprisingly, insurance companies tend to charge higher rates to people with lower credit scores. But if you pay with a credit card, things like your card’s balance or late payments could be reported to the credit bureaus. So unless you live in california, massachusetts or hawaii, your credit score will be factored in.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does car insurance impact credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.