Your Does car insurance go on your credit report images are ready. Does car insurance go on your credit report are a topic that is being searched for and liked by netizens now. You can Get the Does car insurance go on your credit report files here. Get all royalty-free photos and vectors.

If you’re searching for does car insurance go on your credit report pictures information linked to the does car insurance go on your credit report interest, you have pay a visit to the right blog. Our website frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

Does Car Insurance Go On Your Credit Report. Credit inquiries and identity theft The fair credit reporting act (fcra) gives you the right to obtain your credit report for free. Most car insurance companies will pull your credit report and use your credit score and credit history as just one factor when setting premiums. It’s the law, everywhere but new hampshire.

Do You Need SR22 Car Insurance? From thebalance.com

Do You Need SR22 Car Insurance? From thebalance.com

The correlation between credit and life insurance. Auto insurance companies can use your credit score to calculate your auto insurance quotes in most states. If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau. If you notice inaccurate information, you have the right to contest it and correct your credit history. Where allowed by law, insurance companies can use your credit report to calculate your insurance score when you apply for insurance. Car dealers, lenders, and auto manufacturers aren’t required to report payments to the three major credit bureaus, but most report payments every month to equifax, experian, and transunion.

Insurance companies don’t report to the credit bureaus, so you don’t get any benefit from paying car insurance when it comes to your credit.

We also know that our credit scores dictate what types of credit cards and loans we can get. As we�ve discussed in the past, your credit history affects. Where allowed by law, insurance companies can use your credit report to calculate your insurance score when you apply for insurance. Insurance companies don’t report to the credit bureaus, so you don’t get any benefit from paying car insurance when it comes to your credit. Does your credit score impact your car insurance rate? The fair credit reporting act (fcra) gives you the right to obtain your credit report for free.

Source: thebalance.com

Source: thebalance.com

Most other carriers use it as a rating factor. This can affect your ability to get a credit card or loan, and the derogatory mark will remain on your. Everyone knows you need auto insurance to drive. If you owe money on your car insurance and your insurer passes the debt to a collection agency, it will likely impact your credit score. The fair credit reporting act (fcra) gives you the right to obtain your credit report for free.

Source: money.com

Source: money.com

Your insurance provider is giving you a year�s worth of car insurance and allowing you to pay it off month by month. The correlation between credit and life insurance. Does your credit score impact your car insurance rate? If you notice inaccurate information, you have the right to contest it and correct your credit history. Auto owners with comprehensive insurance are covered when an accident occurs.

Source: thebalance.com

Source: thebalance.com

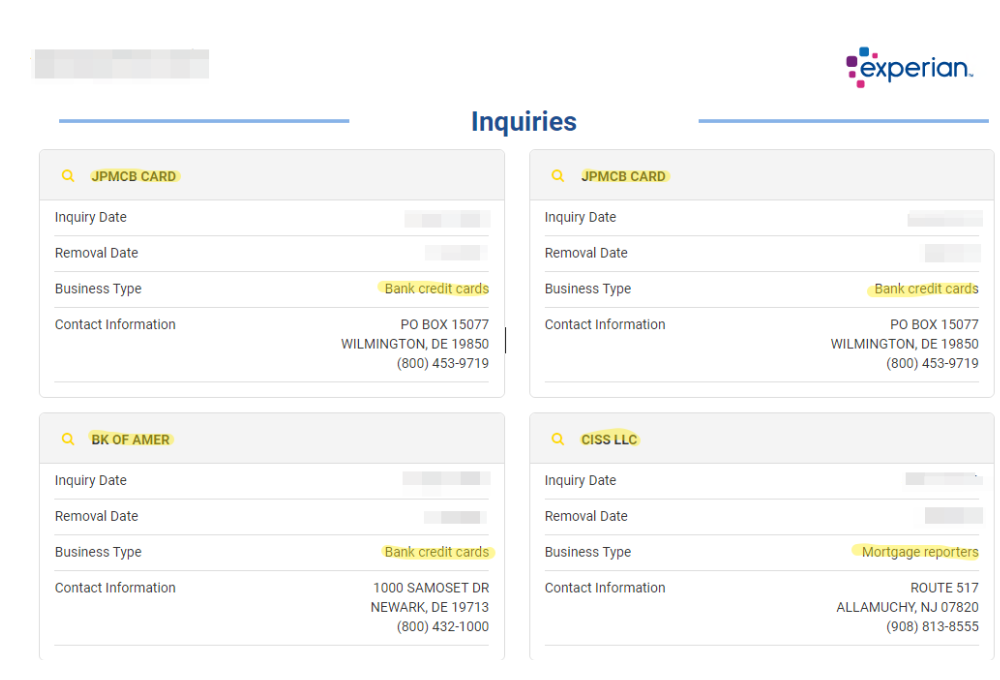

It’s the law, everywhere but new hampshire. This credit inquiry will appear on your credit report but does not usually harm. Here we�ll explain and show how much an an improvement or deterioration in your credit score can impact the quotes you get and how that can differ across the major car insurance companies. The people who look at your insurance score can be: Your credit score can drop:

Source: pinterest.com

Source: pinterest.com

Totaled vehicles are paid off when you owe less than the car is. An insurance score is a score calculated from information on your credit report. The people who look at your insurance score can be: In the states where insurance companies don’t use credit information, the price of car insurance is based mainly on how people actually drive and. Here we�ll explain and show how much an an improvement or deterioration in your credit score can impact the quotes you get and how that can differ across the major car insurance companies.

Source: thebalance.com

Source: thebalance.com

Each insurer has its own method for evaluating this credit information. In the states where insurance companies don’t use credit information, the price of car insurance is based mainly on how people actually drive and. The people who look at your insurance score can be: Totaled vehicles are paid off when you owe less than the car is. We also know that our credit scores dictate what types of credit cards and loans we can get.

Source: hubinsurancehunter.ca

Source: hubinsurancehunter.ca

Where allowed by law, insurance companies can use your credit report to calculate your insurance score when you apply for insurance. The fair credit reporting act (fcra) gives you the right to obtain your credit report for free. Each insurer has its own method for evaluating this credit information. Your auto insurance, rent and utility accounts do not routinely appear on your credit report. The insurer will then pull your credit reports from one or more credit bureaus and calculate your insurance risk score based upon this data.

Source: theintroduce.com

Source: theintroduce.com

The insurer will then pull your credit reports from one or more credit bureaus and calculate your insurance risk score based upon this data. The fair credit reporting act. The insurer will then pull your credit reports from one or more credit bureaus and calculate your insurance risk score based upon this data. When an insurance company checks your credit, a record of the credit check will be added to your credit file. Insurance inquiries do not hurt your credit score.

Source: thebalance.com

Source: thebalance.com

You�ll see this credit inquiry if you review a copy of your credit report, but because it�s a soft inquiry, it won�t impact your credit scores. They will check your credit every time you apply for say, life insurance, and they may check it again every time your policy is up for renewal. The people who look at your insurance score can be: The correlation between credit and life insurance. Where allowed by law, insurance companies can use your credit report to calculate your insurance score when you apply for insurance.

Source: thebalance.com

Source: thebalance.com

Pay with credit cards this doesn�t mean that your credit score cannot benefit from your monthly auto insurance payment. This can affect your ability to get a credit card or loan, and the derogatory mark will remain on your. In the states where insurance companies don’t use credit information, the price of car insurance is based mainly on how people actually drive and. If you notice inaccurate information, you have the right to contest it and correct your credit history. Credit inquiries and identity theft

Source: scoredcredit.com

Source: scoredcredit.com

We also know that our credit scores dictate what types of credit cards and loans we can get. Auto owners with comprehensive insurance are covered when an accident occurs. If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau. Does car insurance go on your credit report? Each insurer has its own method for evaluating this credit information.

Source: kiplinger.com

Source: kiplinger.com

Not all car insurance companies will use a credit scores as part of the rating process. However, paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. Auto owners with comprehensive insurance are covered when an accident occurs. The people who look at your insurance score can be: The fair credit reporting act (fcra) gives you the right to obtain your credit report for free.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

One way to work around not having your auto insurance reported to your account is to charge it to a credit account. However, paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. One way to work around not having your auto insurance reported to your account is to charge it to a credit account. When an insurance company checks your credit, a record of the credit check will be added to your credit file. Your credit score can drop:

Source: thebalance.com

Source: thebalance.com

Here we�ll explain and show how much an an improvement or deterioration in your credit score can impact the quotes you get and how that can differ across the major car insurance companies. Most other carriers use it as a rating factor. If you pay for your car insurance in one lump sum, your credit score won�t be affected at all. Credit inquiries and identity theft Auto insurance companies can use your credit score to calculate your auto insurance quotes in most states.

Source: peerloansonline.com

Source: peerloansonline.com

Not all car insurance companies will use a credit scores as part of the rating process. Remember that your actual credit score isn’t going to impact your life insurance. Insurance inquiries do not hurt your credit score. It�s a question you might have wondered about before — especially if you have a. It�s only one piece of the puzzle, however, as insurance companies are generally prohibited from making a.

Source: ictsd.org

Source: ictsd.org

If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau. When you apply for auto insurance, the insurer will ask you for permission to check your credit score under the fair credit reporting act’s regulations. Get a copy of your credit report. But if you pay monthly, it usually will. Here we�ll explain and show how much an an improvement or deterioration in your credit score can impact the quotes you get and how that can differ across the major car insurance companies.

Source: imoney.ph

Source: imoney.ph

Insurance companies aren�t permitted to make any adjustments to your score. It’s the law, everywhere but new hampshire. This credit inquiry will appear on your credit report but does not usually harm. Here we�ll explain and show how much an an improvement or deterioration in your credit score can impact the quotes you get and how that can differ across the major car insurance companies. In some states, direct general does not use credit for rating.

Source: pinterest.com

Source: pinterest.com

However, paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. Remember that your actual credit score isn’t going to impact your life insurance. However, paying your insurance on time does help you avoid late fees and get into good habits that could later translate to helping you build credit. Everyone knows you need auto insurance to drive. The fair credit reporting act.

Source: thebalance.com

Source: thebalance.com

Most other carriers use it as a rating factor. It�s only one piece of the puzzle, however, as insurance companies are generally prohibited from making a. If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau. If you owe money on your car insurance and your insurer passes the debt to a collection agency, it will likely impact your credit score. Auto insurance companies can use your credit score to calculate your auto insurance quotes in most states.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does car insurance go on your credit report by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.