Your Does bmi affect health insurance images are available. Does bmi affect health insurance are a topic that is being searched for and liked by netizens today. You can Get the Does bmi affect health insurance files here. Find and Download all royalty-free images.

If you’re looking for does bmi affect health insurance images information connected with to the does bmi affect health insurance topic, you have visit the right blog. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Does Bmi Affect Health Insurance. It affects the term insurance premium rates. Medical and personal benefits can range from things such as reducing blood pressure, reduced risk of developing type 2 diabetes, having more energy, better sleep, and improvement in mobility. Heart disease, sleep apnea, and diabetes are all definite possibilities, and life insurance underwriters will look closely at your health history and medical records to determine how risky you are to insure. Bmi offers coverage options for all your personal and business insurance needs.

From healthpopuli.com

From healthpopuli.com

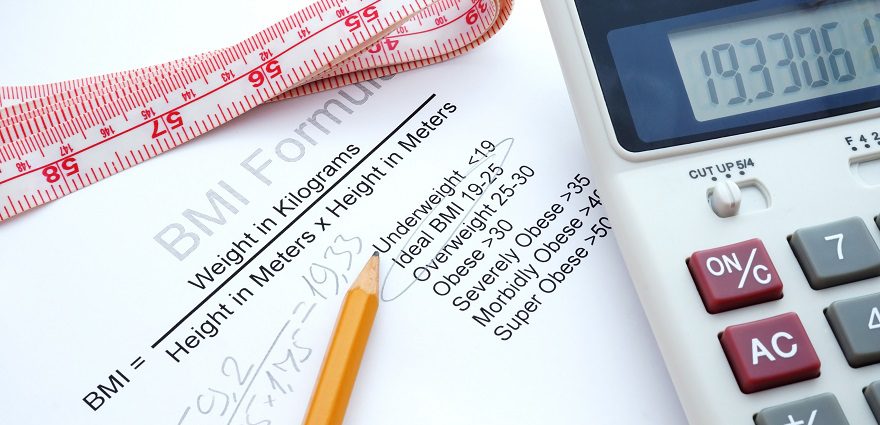

While important, bmi is just 1 of these factors. Your age is a significant factor. Therefore, bmi isn’t an absolute indicator of your health. How does bmi affect your life insurance rates? A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; The other is your physique.

Can an overweight individual be denied coverage?

Bmi offers coverage options for all your personal and business insurance needs. Body mass index (bmi) does impact the premium for life insurance. How does bmi affect your life insurance rates? If it’s extremely low, you may be ineligible for life insurance with some insurers. Because the equation uses only your mass and height, it’s not telling you a whole lot about a person’s function, the type of weight they have on them (e.g. In some cases, health insurance for obese people costs 25 to 50 percent more than coverage for people with a bmi below 30.

Source: nufertility.com

Source: nufertility.com

Since bmi signifies the health status of the individual’s body, it affects the rate of life insurance premiums. Therefore, bmi isn’t an absolute indicator of your health. Your age is a significant factor. How does bmi affect your insurance premiums? Medical and personal benefits can range from things such as reducing blood pressure, reduced risk of developing type 2 diabetes, having more energy, better sleep, and improvement in mobility.

Source: aigdirect.com

Source: aigdirect.com

According to studies, a bit heavier seniors are likely to be healthier and live longer than their slimmer counterparts. Your bmi signifies healthy you are. In some cases, health insurance for obese (2). Body mass index (bmi) is a simple, quick way to try and determine someone’s metabolic health. Since bmi signifies the health status of the individual’s body, it affects the rate of life insurance premiums.

Source: ihealthfacts.ie

Source: ihealthfacts.ie

Healthcare providers record your bmi on every chart for population health metrics, insurance, and billing information. Your bmi signifies healthy you are. How does bmi affect your health insurance premium? A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; That is, a person can have a high bmi but still have a very low fat mass and vice versa.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

Bmi affects your life insurance rates. Your age is a significant factor. Besides being a screening tool, is bmi used for anything else? And when one�s weight is within the normal weight range, bmi will not affect ones� rating for medically underwritten life insurance, either. Bmi offers coverage options for all your personal and business insurance needs.

Source: cbo.gov

Source: cbo.gov

A bmi above 30.0 is medically classified as obese, and suggests a real possibility that your build will affect your health. Your bmi signifies healthy you are. A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; A bmi score of between 20 and 25 is considered to be a healthy one. How does bmi affect your insurance premiums?

Source: ripplusa.com

Source: ripplusa.com

Yes, having a low bmi could affect you when applying for life insurance. A bmi score of between 20 and 25 is considered to be a healthy one. Since people considered obese tend to have higher risk factors for serious conditions and shorter life expectancies, it follows that their life insurance rates are different from those for people in a normal health range and with fewer risk factors. If your bmi is 17 or under, it’s likely you’ll be asked for additional medical information during underwriting. How does bmi affect your insurance premiums?

Source: publichealth.org

Source: publichealth.org

A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; Since bmi signifies the health status of the individual’s body, it affects the rate of life insurance premiums. According to studies, a bit heavier seniors are likely to be healthier and live longer than their slimmer counterparts. It is when someone is overweight that the bmi is looked at in medically underwritten life insurance, to determine whether to give a better or worse rating than one might get based on weight alone.

Source: healthpopuli.com

Source: healthpopuli.com

It is when someone is overweight that the bmi is looked at in medically underwritten life insurance, to determine whether to give a better or worse rating than one might get based on weight alone. Muscle versus fat), not to. Bmi as a determinant of body fat mass. For most carriers, the bmi comes into play for the obesity category and underweight category. (1) generally, people with a body mass index (bmi) of 30 or higher can expect to pay more each month for health insurance.

Source: pulmonologyadvisor.com

Source: pulmonologyadvisor.com

That’s why unless your bmi falls at either extreme, you probably don’t have to worry about your premiums being affected significantly. Can an overweight individual be denied coverage? Bmi as a determinant of body fat mass. Presence of health insurance has effect on body weight. It is when someone is overweight that the bmi is looked at in medically underwritten life insurance, to determine whether to give a better or worse rating than one might get based on weight alone.

Source: onlymyhealth.com

Source: onlymyhealth.com

While bmi instinctively talks about the height and weight of a person, it fails to account the other conditions that affect the health of a person. And when one�s weight is within the normal weight range, bmi will not affect ones� rating for medically underwritten life insurance, either. Body mass index (bmi) does impact the premium for life insurance. Medical and personal benefits can range from things such as reducing blood pressure, reduced risk of developing type 2 diabetes, having more energy, better sleep, and improvement in mobility. How does bmi affect your health insurance premium?

Source: woman.thenest.com

Source: woman.thenest.com

According to studies, a bit heavier seniors are likely to be healthier and live longer than their slimmer counterparts. For most carriers, the bmi comes into play for the obesity category and underweight category. How does bmi affect your life insurance rates? Healthcare providers record your bmi on every chart for population health metrics, insurance, and billing information. Your bmi will affect your life insurance rates, and possible acceptance by the insurer.

Source: miwaylife.co.za

Source: miwaylife.co.za

That’s why unless your bmi falls at either extreme, you probably don’t have to worry about your premiums being affected significantly. Generally, people with a body mass index (bmi) of 30 or higher can expect to pay more each month for health insurance. Since people considered obese tend to have higher risk factors for serious conditions and shorter life expectancies, it follows that their life insurance rates are different from those for people in a normal health range and with fewer risk factors. A bmi above 30.0 is medically classified as obese, and suggests a real possibility that your build will affect your health. Since bmi signifies the health status of the individual’s body, it affects the rate of life insurance premiums.

Source: invitra.com

Source: invitra.com

A bmi above 30.0 is medically classified as obese, and suggests a real possibility that your build will affect your health. Healthcare providers record your bmi on every chart for population health metrics, insurance, and billing information. This extra consumption may go about as a trigger that starts the cycle of thoughtfulness. If it’s extremely low, you may be ineligible for life insurance with some insurers. Concurrently, the medical treatment, along with the cost of medication required for such conditions is high.

Source: medindia.net

Source: medindia.net

A particular problem with bmi as an index of obesity is that it does not differentiate between body lean mass and body fat mass; How will the life insurance companies view your bmi data. The other is your physique. Since people considered obese tend to have higher risk factors for serious conditions and shorter life expectancies, it follows that their life insurance rates are different from those for people in a normal health range and with fewer risk factors. How does bmi affect your insurance premiums?

Source: hungerandhealth.feedingamerica.org

Source: hungerandhealth.feedingamerica.org

Then by dividing overall bmi into detailed group, i study further on if health insurance affects overweight and obesity. How does bmi affect life insurance? Your age is a significant factor. How will the life insurance companies view your bmi data. It uses two variables, your mass and height.

Source: lybrate.com

Source: lybrate.com

If your bmi is 17 or under, it’s likely you’ll be asked for additional medical information during underwriting. Muscle versus fat), not to. Because the equation uses only your mass and height, it’s not telling you a whole lot about a person’s function, the type of weight they have on them (e.g. How does bmi affect your life insurance rates? (1) generally, people with a body mass index (bmi) of 30 or higher can expect to pay more each month for health insurance.

Source: sproutt.com

Source: sproutt.com

Bmi affects your life insurance rates. The bmi of a person can be correlated to obesity and is also a measurement of the general health of. It affects the term insurance premium rates. Bmi can affect your life expectancy, which in turn affects your life insurance rate. Under the affordable care act, group health plans can adopt wellness program that base people�s premiums on.

Source: yourbariatricsurgeryguide.com

Source: yourbariatricsurgeryguide.com

Your bmi affects your life insurance rates. Medical and personal benefits can range from things such as reducing blood pressure, reduced risk of developing type 2 diabetes, having more energy, better sleep, and improvement in mobility. Since people considered obese tend to have higher risk factors for serious conditions and shorter life expectancies, it follows that their life insurance rates are different from those for people in a normal health range and with fewer risk factors. Your age is a significant factor. If your bmi is 17 or under, it’s likely you’ll be asked for additional medical information during underwriting.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does bmi affect health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.