Your Does being married lower car insurance images are available. Does being married lower car insurance are a topic that is being searched for and liked by netizens today. You can Get the Does being married lower car insurance files here. Download all free vectors.

If you’re looking for does being married lower car insurance pictures information related to the does being married lower car insurance keyword, you have visit the ideal site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

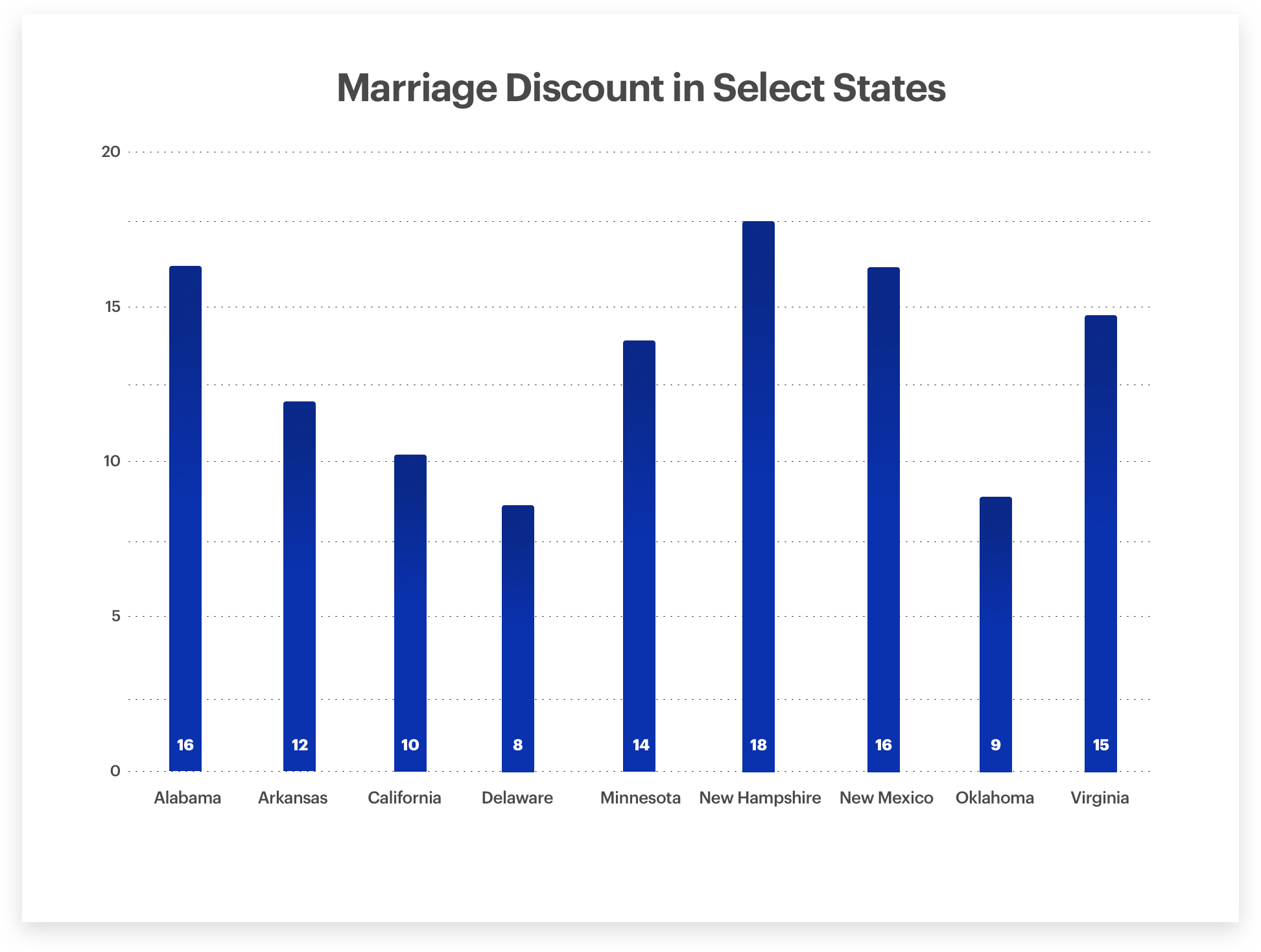

Does Being Married Lower Car Insurance. Most auto insurance carriers offer a discount to married drivers. 52 rows getting married can help lower your car insurance rates if both have good driving records, a married couple will almost always pay less than each did separately unless one has a bad driving history call us toll free: You thought that after getting married everything would be picture perfect, and it may be, except for your finances. Other ways to lower your car insurance premiums now that you�re married

Top 8 Insurance Considerations for NH Newlyweds From hpminsurance.com

Both homeowners and auto insurers may offer lower rates to married couples because statistics show they behave more cautiously and file fewer claims. What may come as a surprise, though, is that where you live also has a significant effect on your insurance premium. As you probably know, insurance companies base their rates on many factors, including your age, driving record, marital status and the type of car you own. Some big life changes, like buying a home and getting married can reduce car insurance costs. Most married couples save money when they combine their coverage into one policy and get a single auto insurance rate.but occasionally separate car insurance for married couples makes more sense. Having one claim can impact your car insurance policy for at.

If you haven’t got round to popping the question yet and lowering your car insurance isn’t a good enough reason to propose, then don’t fear.

So, if you just ask, they may add a discount to your premium simply for being married. Compare the costs of both a combined policy and separate policies from a few insurers to determine. Shop around and compare auto insurance quotes any time you have a. Your personal relationship status does have an impact on what you pay for car insurance. As you probably know, insurance companies base their rates on many factors, including your age, driving record, marital status and the type of car you own. Although your insurance agent probably didn�t send you an official wedding gift, you might feel inspired to write her a thank you note after seeing the savings on your next bill.

Source: express.co.uk

Source: express.co.uk

Insurance is cheaper when you’re married because married couples are less likely to file a claim. Insurance is cheaper when you’re married because married couples are less likely to file a claim. So, if you�re married, that should bring your a reduction in rates or discount, even if having a baby does not. However, the difference is less as you age, so a 30. Some big life changes, like buying a home and getting married can reduce car insurance costs.

Source: cover.com

Source: cover.com

Shop around and compare auto insurance quotes any time you have a. Shop around and compare auto insurance quotes any time you have a. Combining policies for each driver’s car into one policy brings savings of up to 25% in most cases. For auto insurance, the impact is greatest for very young people. Some companies view married people as being safer drivers in general.

Source: youtube.com

Source: youtube.com

There are two other factors significantly affecting. For auto insurance, the impact is greatest for very young people. If you both live at the same address, some insurers will treat you as if you were married and revise your premium accordingly. So, if you just ask, they may add a discount to your premium simply for being married. Shop around and compare auto insurance quotes any time you have a.

Source: generalinsurance.com

Source: generalinsurance.com

Car insurance providers typically lower rates for people with good driving records. Your personal relationship status does have an impact on what you pay for car insurance. According to the study, marital status is almost as significant in car insurance pricing as age and gender. It may feel highly unfair or even biased that married people can get much lower rates for car insurance, but from the insurer�s point of view it makes perfect sense. Everything is on the rise with your newest addition, your partner.

Source: statefarm.com

Source: statefarm.com

There are two other factors significantly affecting. Insurance companies always have profits and risks in mind, and they set rates based on real data. As you probably know, insurance companies base their rates on many factors, including your age, driving record, marital status and the type of car you own. According to the study, marital status is almost as significant in car insurance pricing as age and gender. 52 rows getting married can help lower your car insurance rates if both have good driving records, a married couple will almost always pay less than each did separately unless one has a bad driving history call us toll free:

Source: swfederalinsurance.com

Source: swfederalinsurance.com

Car insurance providers typically lower rates for people with good driving records. Although your insurance agent probably didn�t send you an official wedding gift, you might feel inspired to write her a thank you note after seeing the savings on your next bill. Insurance is cheaper when you’re married because married couples are less likely to file a claim. There are two other factors significantly affecting. Your personal relationship status does have an impact on what you pay for car insurance.

Source: measuringthemoat.com

Source: measuringthemoat.com

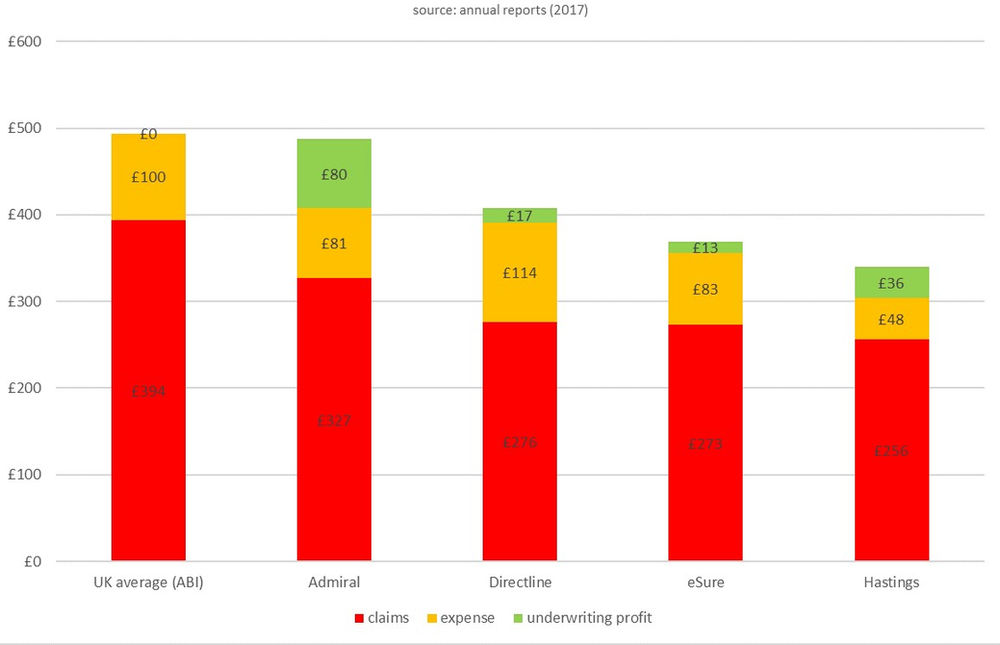

Both homeowners and auto insurers may offer lower rates to married couples because statistics show they behave more cautiously and file fewer claims. Insurance companies always have profits and risks in mind, and they set rates based on real data. Car insurance premiums can increase for various reasons, but there are many things you can do to offset the increases. Nothing is ever simply black and white and the same is certainly. According to the study, marital status is almost as significant in car insurance pricing as age and gender.

Source: pinterest.com

Source: pinterest.com

You thought that after getting married everything would be picture perfect, and it may be, except for your finances. Insurance is cheaper when you’re married because married couples are less likely to file a claim. Other ways to lower your car insurance premiums now that you�re married As you probably know, insurance companies base their rates on many factors, including your age, driving record, marital status and the type of car you own. But all hope is not lost, because there is one expense that may actually go down because you got married, your auto insurance premium.

Source: carinsurancelrates.com

Source: carinsurancelrates.com

Your personal relationship status does have an impact on what you pay for car insurance. So, if you just ask, they may add a discount to your premium simply for being married. As a result, married people pay lower premiums than their single counterparts for the same coverage, all other things being equal. Most married couples save money when they combine their coverage into one policy and get a single auto insurance rate.but occasionally separate car insurance for married couples makes more sense. Both homeowners and auto insurers may offer lower rates to married couples because statistics show they behave more cautiously and file fewer claims.

Source: valuepenguin.com

Source: valuepenguin.com

Some big life changes, like buying a home and getting married can reduce car insurance costs. Both homeowners and auto insurers may offer lower rates to married couples because statistics show they behave more cautiously and file fewer claims. Even men under 25, who generally get stuck with the highest auto insurance premiums, receive a discount for. Having one claim can impact your car insurance policy for at. Although your insurance agent probably didn�t send you an official wedding gift, you might feel inspired to write her a thank you note after seeing the savings on your next bill.

Source: medibankinternational.com.au

Source: medibankinternational.com.au

So, if you just ask, they may add a discount to your premium simply for being married. Your age, driving history, credit score, address, occupation, and usage of the car can all affect the cost of your car insurance. It may feel highly unfair or even biased that married people can get much lower rates for car insurance, but from the insurer�s point of view it makes perfect sense. Insurance is cheaper when you’re married because married couples are less likely to file a claim. Insurers typically consider married people to pose less risk, so premiums go down — provided both drivers are considered low risk to insure.

Source: infographicszone.com

Source: infographicszone.com

Even men under 25, who generally get stuck with the highest auto insurance premiums, receive a discount for. Insurance companies always have profits and risks in mind, and they set rates based on real data. Even men under 25, who generally get stuck with the highest auto insurance premiums, receive a discount for. Combining policies for each driver’s car into one policy brings savings of up to 25% in most cases. On average, a married driver pays $96 less per year for car insurance than does a single, widowed or divorced driver.

Source: compareukquotes.com

Source: compareukquotes.com

You may see your car insurance go down with age—particularly between ages 18 and 25—if your insurance company offers age discounts. Car insurance providers typically lower rates for people with good driving records. As you probably know, insurance companies base their rates on many factors, including your age, driving record, marital status and the type of car you own. Even men under 25, who generally get stuck with the highest auto insurance premiums, receive a discount for. Insurance is cheaper when you’re married because married couples are less likely to file a claim.

Source: comparethemarket.com

Source: comparethemarket.com

Your place of residence influences your likelihood. Your place of residence influences your likelihood. There are two other factors significantly affecting. What may come as a surprise, though, is that where you live also has a significant effect on your insurance premium. Insurers typically consider married people to pose less risk, so premiums go down — provided both drivers are considered low risk to insure.

Source: fanactionsmexico.blogspot.com

Some big life changes, like buying a home and getting married can reduce car insurance costs. So, if you just ask, they may add a discount to your premium simply for being married. Car insurance premiums can increase for various reasons, but there are many things you can do to offset the increases. So, if you�re married, that should bring your a reduction in rates or discount, even if having a baby does not. Some companies view married people as being safer drivers in general.

Source: crixeo.com

Source: crixeo.com

So, if you�re married, that should bring your a reduction in rates or discount, even if having a baby does not. Most auto insurance carriers offer a discount to married drivers. Car insurance premiums can increase for various reasons, but there are many things you can do to offset the increases. But all hope is not lost, because there is one expense that may actually go down because you got married, your auto insurance premium. As a result, married people pay lower premiums than their single counterparts for the same coverage, all other things being equal.

Source: everquote.com

Source: everquote.com

Insurers typically consider married people to pose less risk, so premiums go down — provided both drivers are considered low risk to insure. Your age, driving history, credit score, address, occupation, and usage of the car can all affect the cost of your car insurance. If you haven’t got round to popping the question yet and lowering your car insurance isn’t a good enough reason to propose, then don’t fear. However, the difference is less as you age, so a 30. According to the study, marital status is almost as significant in car insurance pricing as age and gender.

Source: tour-oxygene.com

Source: tour-oxygene.com

You thought that after getting married everything would be picture perfect, and it may be, except for your finances. On average, a married driver pays $96 less per year for car insurance than does a single, widowed or divorced driver. You may see your car insurance go down with age—particularly between ages 18 and 25—if your insurance company offers age discounts. Although your insurance agent probably didn�t send you an official wedding gift, you might feel inspired to write her a thank you note after seeing the savings on your next bill. According to the insurance information institute, car insurance companies may offer lowered premiums for married drivers who are combining their policies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does being married lower car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.