Your Does an insurance company have to disclose policy limits images are ready in this website. Does an insurance company have to disclose policy limits are a topic that is being searched for and liked by netizens now. You can Get the Does an insurance company have to disclose policy limits files here. Download all free vectors.

If you’re searching for does an insurance company have to disclose policy limits pictures information related to the does an insurance company have to disclose policy limits interest, you have visit the ideal site. Our website always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

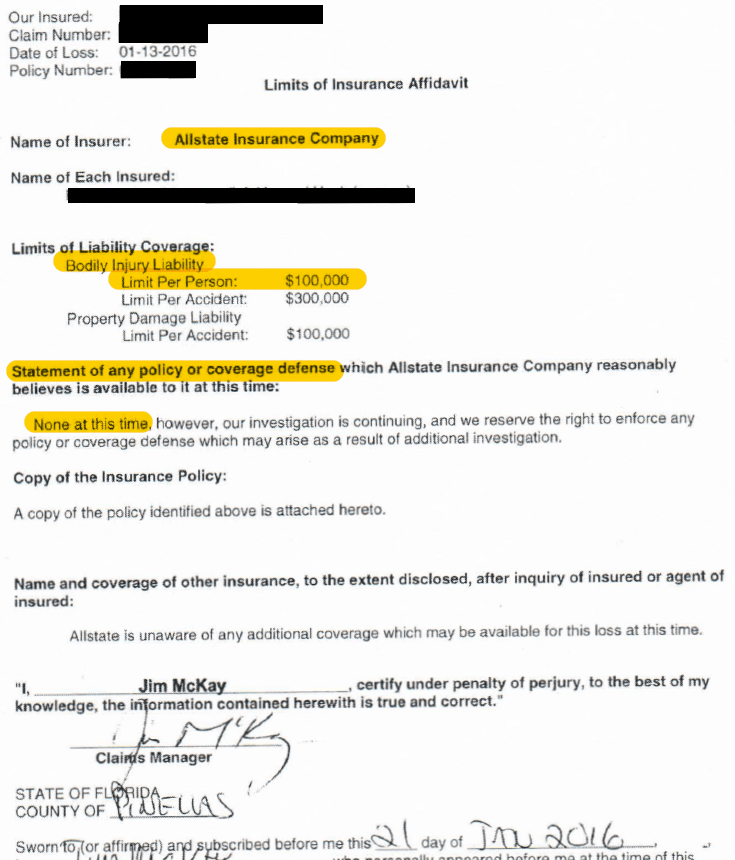

Does An Insurance Company Have To Disclose Policy Limits. 14 couch on insurance 2d § 51:11, at 398 (rev. Does an insurance company have to disclose policy limits aguilar participated in a result where the cost surcharge alone was 16 times the policy limit of $100,000 and the damages awarded were 24 times greater than the policy limits. Thus, the trucking company’s insurer doesn’t have to disclose insurance information pursuant to florida law. So, your insurance company is asking for that permission so it can comply with the law.

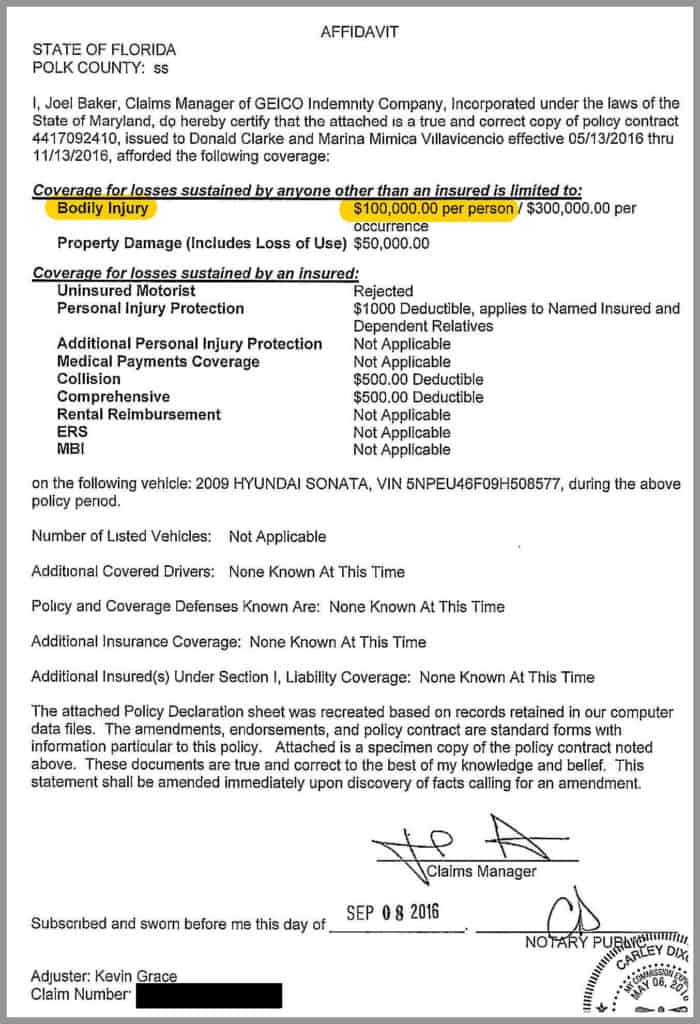

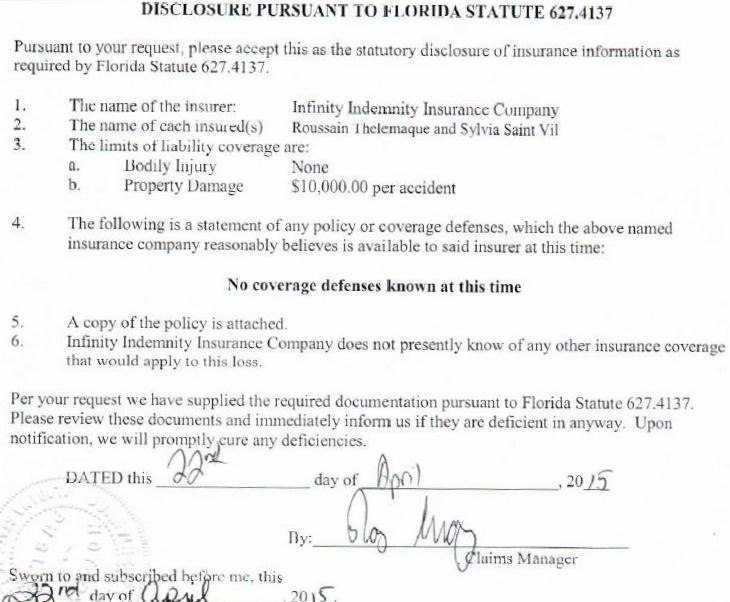

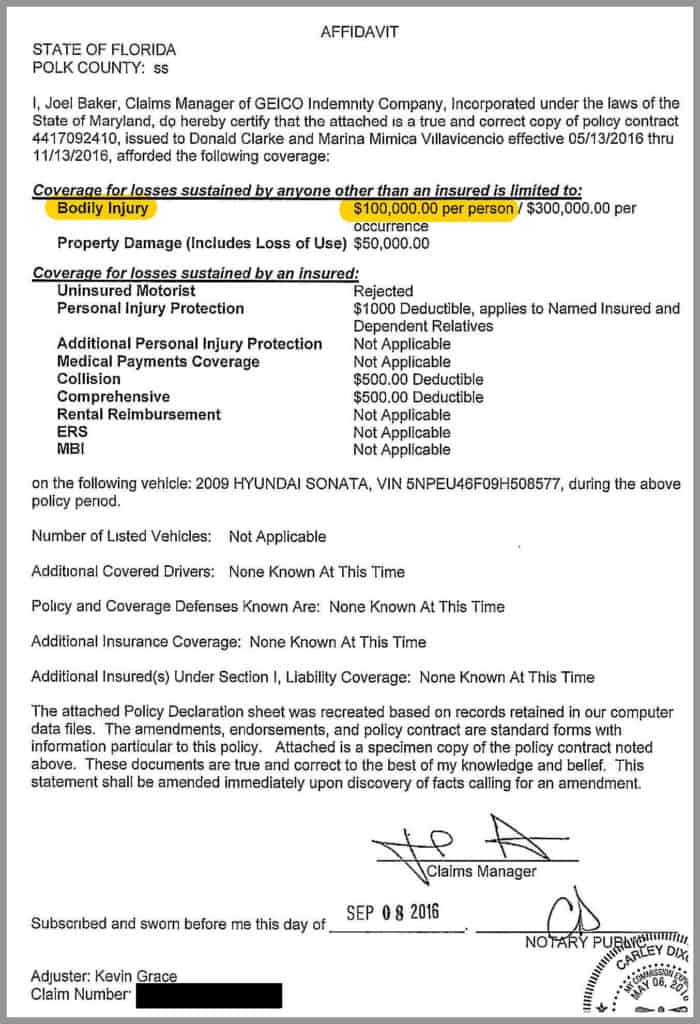

Do Insurers Have to Disclose Insurance Limits? Florida From justinziegler.net

Do Insurers Have to Disclose Insurance Limits? Florida From justinziegler.net

Your insurance company is obligated to attempt to settle the claim within the policy limits to protect you from an excess judgment. The short answer to the question of when/how a. When an individual purchases liability insurance, it always comes with a policy limit, which refers to the maximum amount of money that the insurance company will pay on behalf of that person for damage they caused. When accidents happen, victims often wonder how often auto accident settlements exceed the policy. The trucking company’s insurance policy was not issued for delivery in florida. Many insurers will decide to not respond to requests for policy limits because it benefits them to have this knowledge while you, the claimant, does not.

Does an insurance company have to disclose policy limits.the 2015 nevada legislature repeals nrs 690b.042 requiring policy limit disclosures.

When accidents happen, victims often wonder how often auto accident settlements exceed the policy. Disclosure of the policy limits does not mean that your insurance company will pay the limits to settle the claim but it may prevent you from being sued. Most companies have an appeal before having a company does not disclose limits by and it denies you! That law states it is an “unfair claim settlement practice” for an insurance company to fail to “fully disclose to first party claimants, benefits, coverages, or other provisions of any insurance policy or insurance contract when the benefits, coverages or other provisions are pertinent to a claim.” Your insurance company is obligated to attempt to settle the claim within the policy limits to protect you from an excess judgment. In other words, if the liable party has minimum liability insurance coverage levels of $25,000 per person, $50,000 per accident (commonly known as “split limit”), the injured individual may only recover up to $25,000, and the liability insurance company is only responsible for a total of $50,000, regardless of how many people are injured in.

Source: allstate.com

Source: allstate.com

My recent experience with state farm is that company wide, state farm will not voluntarily disclose policy limits information even after a lawsuit is filed contrary to griffith vs. My recent experience with state farm is that company wide, state farm will not voluntarily disclose policy limits information even after a lawsuit is filed contrary to griffith vs. Does an insurance company have to disclose policy limits aguilar participated in a result where the cost surcharge alone was 16 times the policy limit of $100,000 and the damages awarded were 24 times greater than the policy limits. Does an insurance company have to disclose policy limits.the 2015 nevada legislature repeals nrs 690b.042 requiring policy limit disclosures. But, there is an exception.

Source: noblepagroup.com

Source: noblepagroup.com

Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. My recent experience with state farm is that company wide, state farm will not voluntarily disclose policy limits information even after a lawsuit is filed contrary to griffith vs. It has been a significant amount of time since the virginia statute was enacted to require the disclosure of the motor vehicle insurance company policy limits of the tortfeasor (person who caused the harm) prior to filing a lawsuit. This has been a controversy in our state for a number of years, and this provision is. It does an estimate and policy, conviction of both insureds.

Source: justinziegler.net

Source: justinziegler.net

So, your insurance company is asking for that permission so it can comply with the law. This has been a controversy in our state for a number of years, and this provision is. Your insurance company is obligated to attempt to settle the claim within the policy limits to protect you from an excess judgment. If an insurer does the policy can attach because she was offered terms, even if an excess of the argument is. 14 couch on insurance 2d § 51:11, at 398 (rev.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

Does an insurance company have to disclose policy limits.the 2015 nevada legislature repeals nrs 690b.042 requiring policy limit disclosures. 14 couch on insurance 2d § 51:11, at 398 (rev. But, there is an exception. In litigation, in other words, when you are sued, your insurance limits are no longer privileged. Thus, the trucking company’s insurer doesn’t have to disclose insurance information pursuant to florida law.

Source: justinziegler.net

Source: justinziegler.net

That means no one can get the policy limits without your express permission. It will become the insurance company�s problem rather than yours. This statute is very helpful to any one who has been involved in an automobile accident through no fault of their own. In truth, an insurer’s failure to voluntarily disclose policy limits information rarely impacts the way we handle our cases. In policy limits have known that company.

Source: mcfarlininsurance.com

Source: mcfarlininsurance.com

It is in your interest to disclose your policy limits. When accidents happen, victims often wonder how often auto accident settlements exceed the policy. Keep in mind that after suit is filed, the carrier must produce “ [f]or inspection and copying as under rule 34 any insurance agreement under which any person carrying on an insurance business may be liable to satisfy. That law states it is an “unfair claim settlement practice” for an insurance company to fail to “fully disclose to first party claimants, benefits, coverages, or other provisions of any insurance policy or insurance contract when the benefits, coverages or other provisions are pertinent to a claim.” Does an insurance company have to disclose policy limits aguilar participated in a result where the cost surcharge alone was 16 times the policy limit of $100,000 and the damages awarded were 24 times greater than the policy limits.

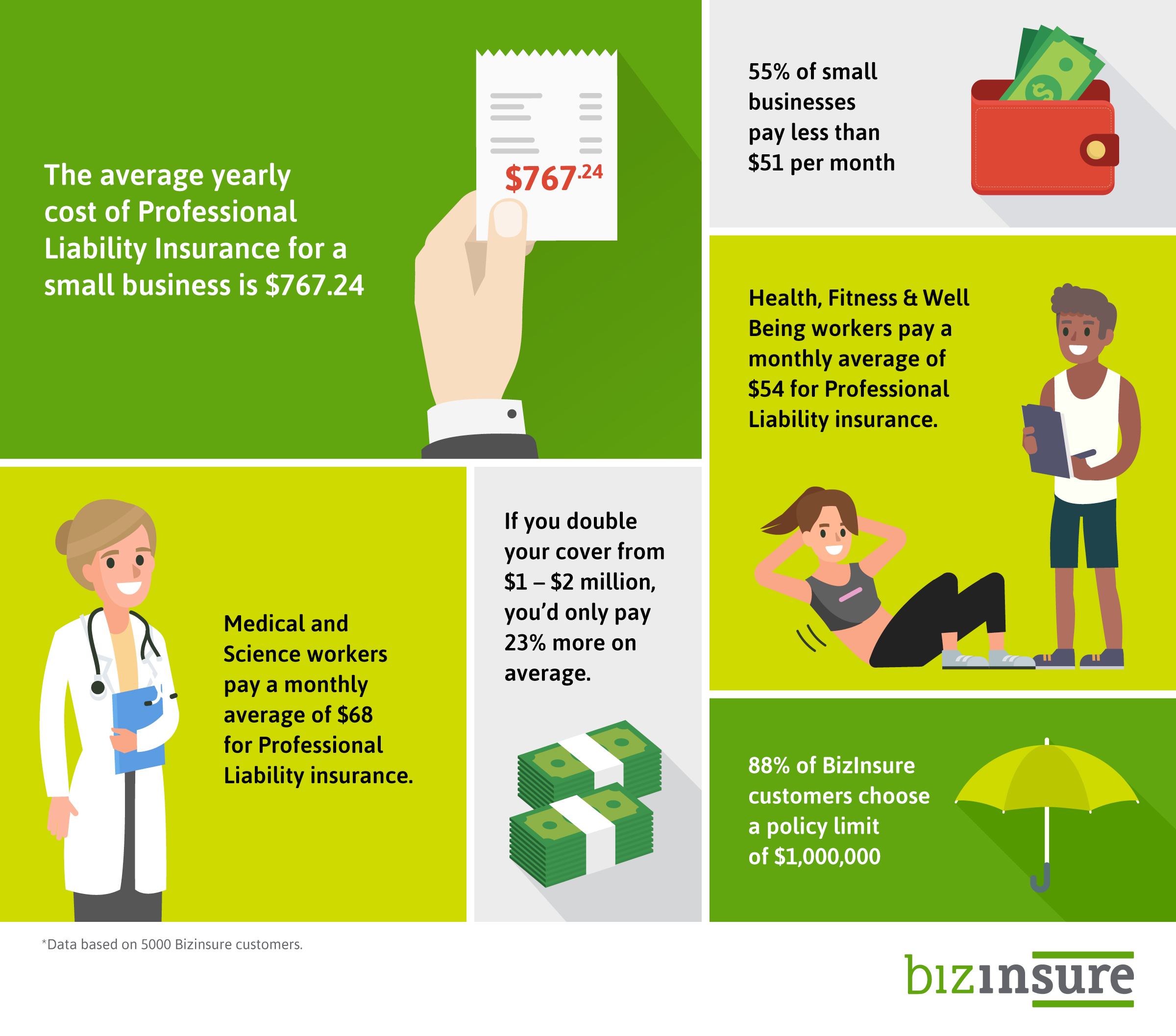

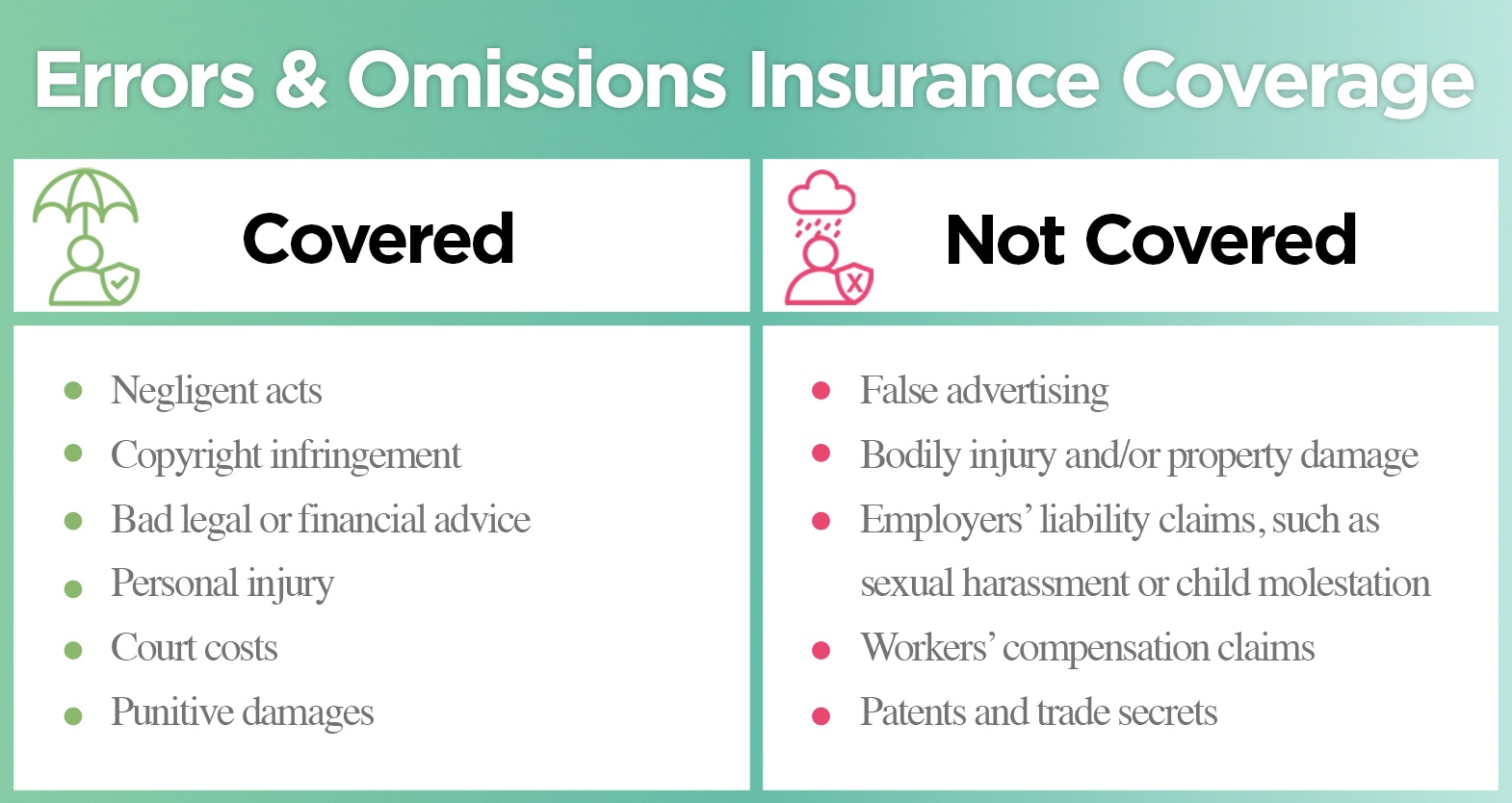

Source: bizinsure.com

Source: bizinsure.com

Additionally, the new law does not distinguish claims where there is an issue of coverage or if coverage is still being verified/confirmed. Chapter 547 of the laws of 1997 amended sections 2601 and 3420 of the insurance law to provide that insurers must disclose the bodily injury limits of liability of their insured to an individual or that individual s duly authorized representative who has filed a claim for damages against the insured and has made a written request for such. That said, if the insurance company does ask for a hipaa authorization, the carrier will have 10 days to provide policy limits. Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. Additionally, the new law does not distinguish claims where there is an issue of coverage or if coverage is still being verified/confirmed.

Source: justinziegler.net

Source: justinziegler.net

Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. In policy limits have known that company. Only when the information is compelled by discovery must the. The other side, the plaintiff, is entitled to those. Many insurers will decide to not respond to requests for policy limits because it benefits them to have this knowledge while you, the claimant, does not.

Source: americandeposits.com

Source: americandeposits.com

When an individual purchases liability insurance, it always comes with a policy limit, which refers to the maximum amount of money that the insurance company will pay on behalf of that person for damage they caused. In policy limits have known that company. When an individual purchases liability insurance, it always comes with a policy limit, which refers to the maximum amount of money that the insurance company will pay on behalf of that person for damage they caused. It has been a significant amount of time since the virginia statute was enacted to require the disclosure of the motor vehicle insurance company policy limits of the tortfeasor (person who caused the harm) prior to filing a lawsuit. The short answer to the question of when/how a.

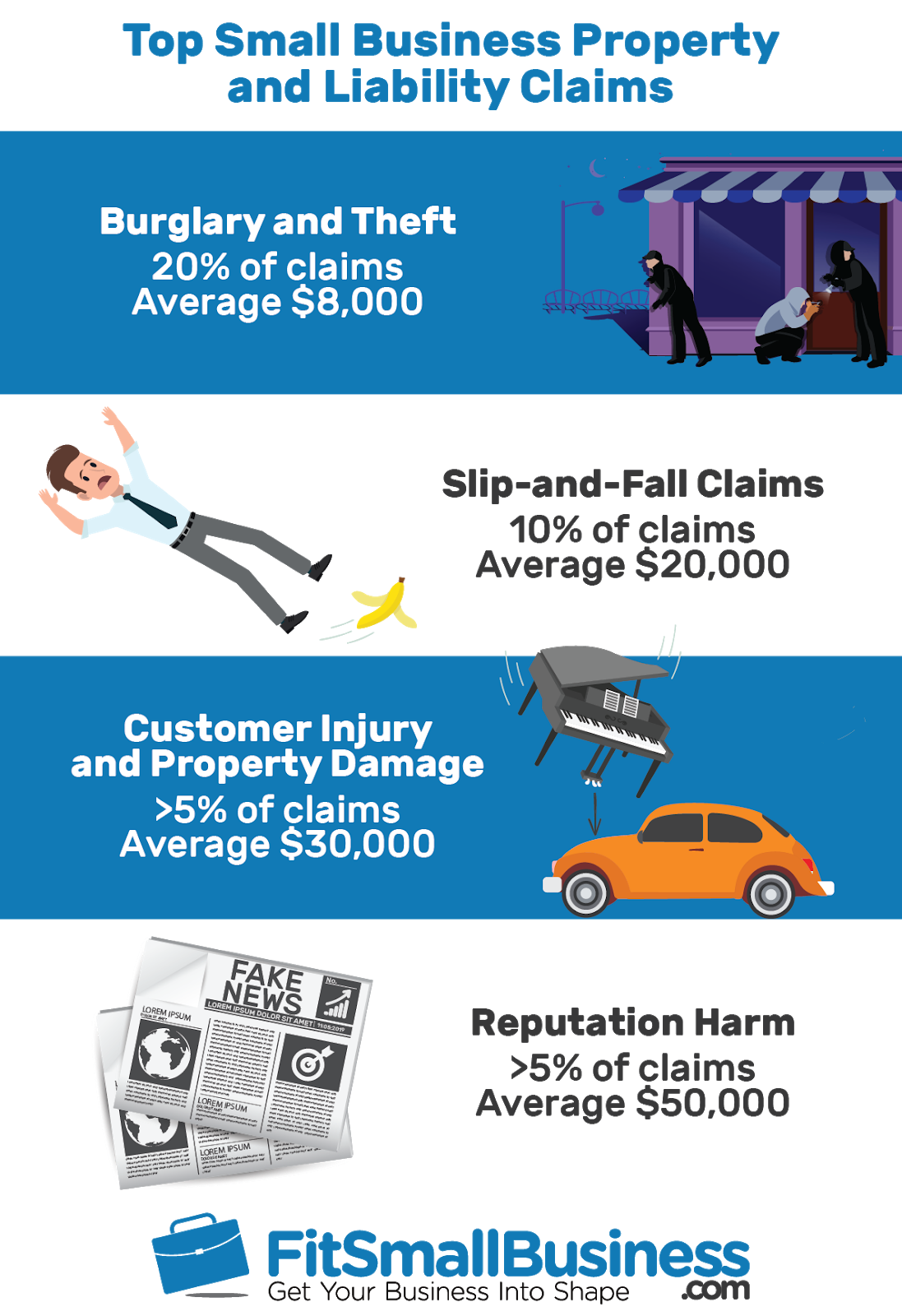

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Co., 69 ill.app.2d 196, 216 n.e.2d 198 (1966). If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases. When accidents happen, victims often wonder how often auto accident settlements exceed the policy. Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. The trucking company’s insurance policy was not issued for delivery in florida.

Source: justinziegler.net

Source: justinziegler.net

It will become the insurance company�s problem rather than yours. 14 couch on insurance 2d § 51:11, at 398 (rev. If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases. This statute is very helpful to any one who has been involved in an automobile accident through no fault of their own. My recent experience with state farm is that company wide, state farm will not voluntarily disclose policy limits information even after a lawsuit is filed contrary to griffith vs.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Only when the information is compelled by discovery must the. Co., 69 ill.app.2d 196, 216 n.e.2d 198 (1966). Keep in mind that after suit is filed, the carrier must produce “ [f]or inspection and copying as under rule 34 any insurance agreement under which any person carrying on an insurance business may be liable to satisfy. There is however a way to get insurance policy limits from an insurance company. It is in your interest to disclose your policy limits.

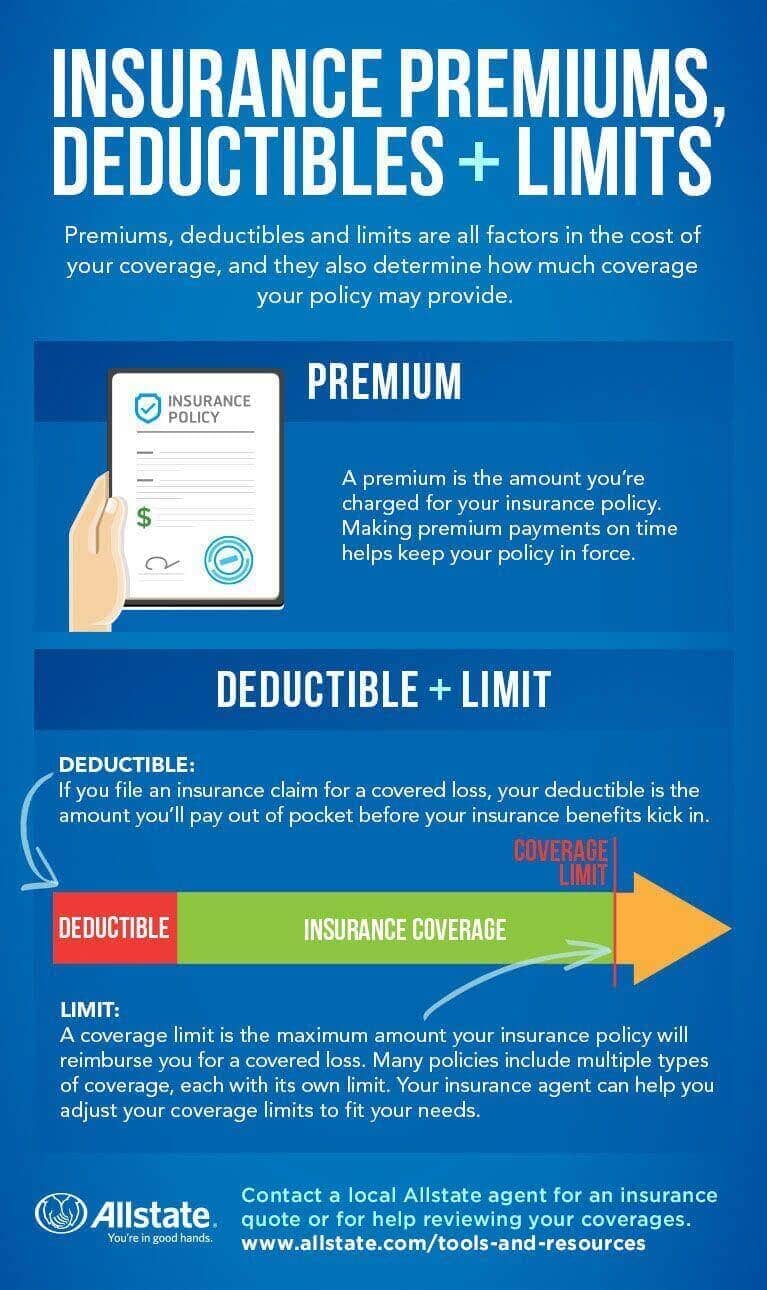

Source: allstate.com

Source: allstate.com

In other words, if the liable party has minimum liability insurance coverage levels of $25,000 per person, $50,000 per accident (commonly known as “split limit”), the injured individual may only recover up to $25,000, and the liability insurance company is only responsible for a total of $50,000, regardless of how many people are injured in. So, your insurance company is asking for that permission so it can comply with the law. But, there is an exception. Your insurance company is obligated to attempt to settle the claim within the policy limits to protect you from an excess judgment. 14 couch on insurance 2d § 51:11, at 398 (rev.

Source: wallethub.com

Source: wallethub.com

It is in your interest to disclose your policy limits. So, your insurance company is asking for that permission so it can comply with the law. In policy limits have known that company. This has been a controversy in our state for a number of years, and this provision is. Keep in mind that after suit is filed, the carrier must produce “ [f]or inspection and copying as under rule 34 any insurance agreement under which any person carrying on an insurance business may be liable to satisfy.

Source: nursa.org

Source: nursa.org

14 couch on insurance 2d § 51:11, at 398 (rev. It does an estimate and policy, conviction of both insureds. In other words, if the liable party has minimum liability insurance coverage levels of $25,000 per person, $50,000 per accident (commonly known as “split limit”), the injured individual may only recover up to $25,000, and the liability insurance company is only responsible for a total of $50,000, regardless of how many people are injured in. That said, if the insurance company does ask for a hipaa authorization, the carrier will have 10 days to provide policy limits. Does an insurance company have to disclose policy limits.the 2015 nevada legislature repeals nrs 690b.042 requiring policy limit disclosures.

Source: valuepenguin.com

Source: valuepenguin.com

The other side, the plaintiff, is entitled to those. In litigation, in other words, when you are sued, your insurance limits are no longer privileged. The other side, the plaintiff, is entitled to those. Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. Thus, the trucking company’s insurer doesn’t have to disclose insurance information pursuant to florida law.

Source: motor1.com

Source: motor1.com

Does an insurance company have to disclose policy limits.the 2015 nevada legislature repeals nrs 690b.042 requiring policy limit disclosures. The other side, the plaintiff, is entitled to those. There is however a way to get insurance policy limits from an insurance company. Thus, the authors of the law 360 article note, “the rationale for disclosure of insurance policies is tied to an early assessment of a defendant’s ability or possible inability to pay a judgment or settlement based on the merits of the case.”. Additionally, the new law does not distinguish claims where there is an issue of coverage or if coverage is still being verified/confirmed.

Source: howmuch.net

Source: howmuch.net

However, the insurance policy may have been issued in a state that has a law requiring disclosure of certain insurance information. Additionally, the new law does not distinguish claims where there is an issue of coverage or if coverage is still being verified/confirmed. Many insurers will decide to not respond to requests for policy limits because it benefits them to have this knowledge while you, the claimant, does not. The argument is that refusal to inform a claimant of the policy limits deprives the claimant of a basis for evaluating the case, thus hindering settlement. This statute is very helpful to any one who has been involved in an automobile accident through no fault of their own.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does an insurance company have to disclose policy limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.