Your Does a life insurance policy pay for accidental overdose images are ready in this website. Does a life insurance policy pay for accidental overdose are a topic that is being searched for and liked by netizens today. You can Find and Download the Does a life insurance policy pay for accidental overdose files here. Get all free vectors.

If you’re searching for does a life insurance policy pay for accidental overdose images information linked to the does a life insurance policy pay for accidental overdose topic, you have pay a visit to the ideal blog. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly search and find more informative video articles and images that match your interests.

Does A Life Insurance Policy Pay For Accidental Overdose. We specialize in the analysis and appeal of denied life insurance claims and accidental death claims related to fentanyl overdoses. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning, accidental drug overdose, or another tragedy. Most life insurance policies contain a “ 2 year contestability period ” which allows the insurance company to investigate any death within the first 2 years of coverage, to ensure the insured person did not lie or misrepresent him/herself on the original application. If death occurs during the contestable part of the policy (the first two years), the life insurance company will review the application, underwriting, and medical records to make sure that a drug problem was not hidden at the time the deceased person applied for life insurance.

Denied Accidental Death Claims Kuzmich Law From kuzmichlaw.com

Denied Accidental Death Claims Kuzmich Law From kuzmichlaw.com

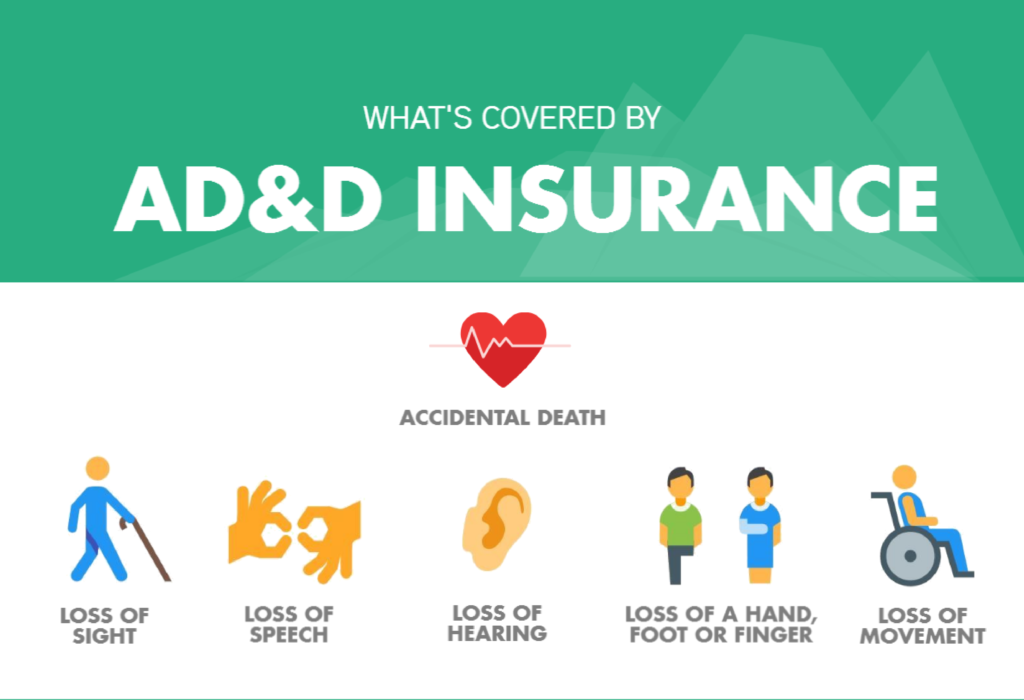

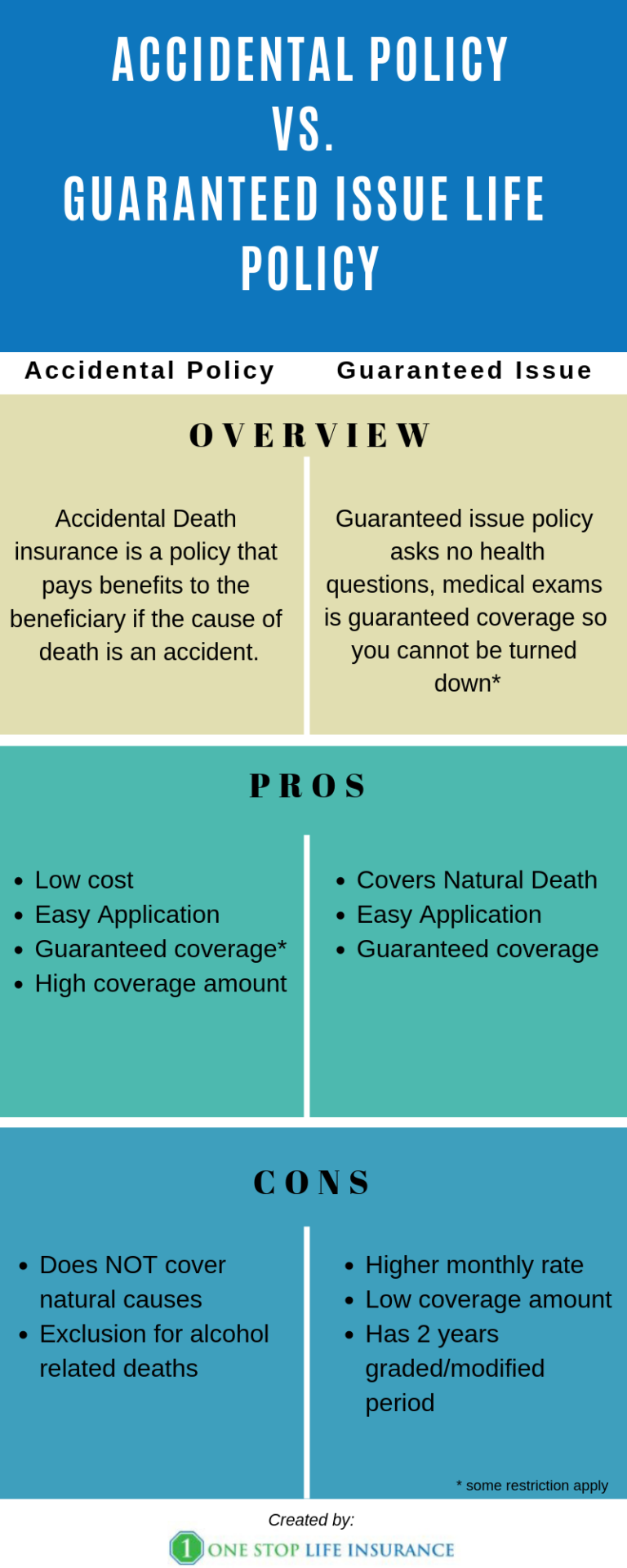

It’s quite common for a death certificate to list a cause of death as accidental when someone dies of a drug overdose. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning, accidental drug overdose, or another tragedy. “exclusions” are the typical reasons life insurance won’t pay out. It has the same logic as the suicide clause, where payouts can be affected. How drug overdose can void a life insurance policy. Tatiana kadetskaya january 18, 2021 both life insurance and accidental death insurance can cover accidental drug overdose in some scenarios.

If it’s within the first two years, you must be able to prove that the drug overdose was accidental (which is easier if the drug was prescribed).

Most life insurance policies contain a “ 2 year contestability period ” which allows the insurance company to investigate any death within the first 2 years of coverage, to ensure the insured person did not lie or misrepresent him/herself on the original application. When you do that, you have. 2) if the drug overdose was suicide after two years, the policy will pay. Does life insurance cover accidental drug overdose? Will life insurance pay for drug overdose? If the overdose was not accidental, then a suicide clause may apply.

Source: escolaclasse10dorf2.blogspot.com

Source: escolaclasse10dorf2.blogspot.com

While life insurance covers most causes of death, accidental death coverage pays only for accidents. Whether the drug was a prescribed medication, how it was administered, and the details of the overdose are all considerations, along with the question of whether the overdose was intentional or accidental. Tatiana kadetskaya january 18, 2021 both life insurance and accidental death insurance can cover accidental drug overdose in some scenarios. Why did the drug overdose happen? If it’s within the first two years, you must be able to prove that the drug overdose was accidental (which is easier if the drug was prescribed).

Source: lifeant.com

Source: lifeant.com

Why did the drug overdose happen? 3) if the drug overdose was due to a drug habit picked up after getting the policy, the policy will pay. “exclusions” are the typical reasons life insurance won’t pay out. If the overdose was not accidental, then a suicide clause may apply. Be sure to disclose information about any issues you�ve had with drug addiction, mental health, and dangerous or illegal activity.

Source: kuzmichlaw.com

Source: kuzmichlaw.com

Accidental death clauses are not common in individual life insurance plans. If someone dies from a drug overdose, are the proceeds from a life insurance policy canceled? The overdose must be from a prescribed medication and not an illegal substance. If the application was filled out honestly: It is not uncommon for insurers to fight life insurance claims involving drug overdoses.

Source: trustage.com

Source: trustage.com

Life insurance will pay for accidental overdose. Contact us by phone or email to discuss your claim. While life insurance covers most causes of death, accidental death coverage pays only for accidents. It has the same logic as the suicide clause, where payouts can be affected. 1) if the drug overdose was accidental, the policy will pay, even within the first two years.

Source: insurist.com

Source: insurist.com

- if the drug overdose was suicide after two years, the policy will pay. Most group life insurance policies indicate an accidental death clause. Logic would dictate that in such a case an accidental death policy will pay a benefit. If the overdose was not accidental, then a suicide clause may apply. Most life insurance policies contain a “ 2 year contestability period ” which allows the insurance company to investigate any death within the first 2 years of coverage, to ensure the insured person did not lie or misrepresent him/herself on the original application.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

How drug overdose can void a life insurance policy. Will a life insurance company deny a claim for a drug overdose? If the insured dies 2+ years after policy purchase, then yes, the life insurance company will certainly pay out the death benefit. When analyzed correctly, death claims from fentanyl overdose should be paid. If death occurs during the contestable part of the policy (the first two years), the life insurance company will review the application, underwriting, and medical records to make sure that a drug problem was not hidden at the time the deceased person applied for life insurance.

Source: insurist.com

Source: insurist.com

Insurers will not, in most cases, cover current illicit drug users. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning,. So, in most cases, the policy will pay out if the policyholder dies from an overdose on a prescription drug or any other accidental overdose situation. If the drug overdose was not intentional then there is a chance that the insurance company will pay out the death benefit. As long as the insured had a prescription we can get the claim paid.

Source: esosojazosazules.blogspot.com

Source: esosojazosazules.blogspot.com

Accidental overdose is covered by most providers if the policy has been in place for more than two years. So, in most cases, the policy will pay out if the policyholder dies from an overdose on a prescription drug or any other accidental overdose situation. Will a life insurance company deny a claim for a drug overdose? Will life insurance pay for drug overdose? Can you still buy life insurance if you�ve used drugs?

Source: cotzenlaw.com

Source: cotzenlaw.com

Does life insurance pay for drug overdose? Can you still buy life insurance if you�ve used drugs? It is not uncommon for insurers to fight life insurance claims involving drug overdoses. If it’s within the first two years, you must be able to prove that the drug overdose was accidental (which is easier if the drug was prescribed). Will a life insurance company deny a claim for a drug overdose?

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Can you still buy life insurance if you�ve used drugs? “exclusions” are the typical reasons life insurance won’t pay out. If the overdose was not accidental, then a suicide clause may apply. Will a life insurance company deny a claim for a drug overdose? There is no simple yes or no answer to your question.

Source: getsure.org

Source: getsure.org

Accidental death clauses are not common in individual life insurance plans. For example, if someone overdoses on oxycontin that was prescribed by a doctor, the death may be ruled accidental and the life insurance company would likely pay the death benefit. There is no simple yes or no answer to your question. Tatiana kadetskaya january 18, 2021 both life insurance and accidental death insurance can cover accidental drug overdose in some scenarios. It has the same logic as the suicide clause, where payouts can be affected.

Source: youtube.com

Source: youtube.com

Accidental death life insurance covers accidental deaths. There is no simple yes or no answer to your question. Does life insurance pay for accidental drug overdose? This gets complicated in certain scenarios, such as a drug overdose. If the insured committed suicide by drug overdose after the contestability period, whether or not the policy will pay out will depend upon the exclusions in that policy and whether the facts point to accidental death rather than suicide.

Source: policyadvice.net

Source: policyadvice.net

The answer is in the negative and the insurance company is not liable to pay for accidental drug overdose. It depends on the circumstances and the insurance provider. The overdose must be from a prescribed medication and not an illegal substance. The answer depends on several things including how the drug overdose happened and the type of life insurance coverage. 2) if the drug overdose was suicide after two years, the policy will pay.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

Insurers will not, in most cases, cover current illicit drug users. However, if the insured was not honest at the time of issuing the policy than the insurance company has the right to deny the death benefit. In short, there is no definitive answer. It’s quite common for a death certificate to list a cause of death as accidental when someone dies of a drug overdose. The answer is in the negative and the insurance company is not liable to pay for accidental drug overdose.

Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

Why did the drug overdose happen? Most group life insurance policies indicate an accidental death clause. The answer depends on several things including how the drug overdose happened and the type of life insurance coverage. Yes, it is possible to get life insurance if you’ve abused drugs in the past but have since stopped. When analyzed correctly, death claims from fentanyl overdose should be paid.

Source: postoast.com

Source: postoast.com

If the overdose was not accidental, then a suicide clause may apply. This means that the policy will be canceled in the event of an accident, in this case, an overdose. When analyzed correctly, death claims from fentanyl overdose should be paid. If the insured committed suicide by drug overdose after the contestability period, whether or not the policy will pay out will depend upon the exclusions in that policy and whether the facts point to accidental death rather than suicide. The overdose must be from a prescribed medication and not an illegal substance.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

- if the drug overdose was accidental, the policy will pay, even within the first two years. “exclusions” are the typical reasons life insurance won’t pay out. Can you still buy life insurance if you�ve used drugs? We specialize in the analysis and appeal of denied life insurance claims and accidental death claims related to fentanyl overdoses. Will life insurance pay for drug overdose?

Source: bestlifequote.com

Source: bestlifequote.com

However, in many cases, insurers do pay death benefits in the event of accidental and even intentional drug overdoses. Tatiana kadetskaya january 18, 2021 both life insurance and accidental death insurance can cover accidental drug overdose in some scenarios. If it’s within the first two years, you must be able to prove that the drug overdose was accidental (which is easier if the drug was prescribed). Insurers don’t want to pay claims. Does life insurance cover accidental drug overdose?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does a life insurance policy pay for accidental overdose by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.