Your Does a defective vehicle ticket affect insurance images are ready in this website. Does a defective vehicle ticket affect insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Does a defective vehicle ticket affect insurance files here. Get all royalty-free vectors.

If you’re searching for does a defective vehicle ticket affect insurance images information linked to the does a defective vehicle ticket affect insurance keyword, you have pay a visit to the right blog. Our site always gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Does A Defective Vehicle Ticket Affect Insurance. However, it is important to note that a seatbelt ticket is a conditional ticket. Less cost reduction over time. When parking tickets affect insurance rates. If you are caught driving a car that is not registered, you will actually face a citation for operating an unregistered vehicle.

How A Driving Ticket Affects Your Auto Insurance Premium From pinterest.com

How A Driving Ticket Affects Your Auto Insurance Premium From pinterest.com

However, it is important to note that a seatbelt ticket is a conditional ticket. How does a speeding ticket affect your car insurance? In some states, a seatbelt ticket is considered a minor traffic violation, which means that an insurer can’t penalize you for it. As a result, your insurance company may not notice a speeding. When your policy renews, your provider will check your record to find out if you have any convictions that may impact your costs. This ticket does count as a traffic offence and can result in.

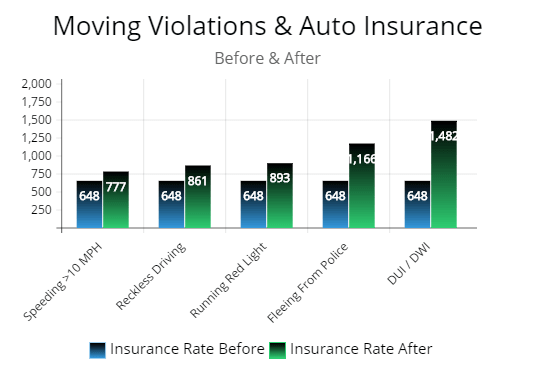

Speeding tickets and reckless driving tickets have points, which often negatively impact insurance rates a lot.

Our analysis found that car insurance typically goes up about 25% after a speeding ticket. You should expect insurance rates to go up,. In some cases, you can have a traffic ticket erased from your record so it won�t affect your auto insurance rates. However, it is important to note that a seatbelt ticket is a conditional ticket. A speeding ticket can affect your car insurance rate both in the short and long term. If you are caught driving with an expired licence plate, there is a $65 fine, not including surcharges and fees.

Source: abraminterstate.com

Source: abraminterstate.com

Parking tickets do not typically affect your auto insurance rates directly. This ticket does count as a traffic offence and can result in. Besides potentially raising your car insurance rates, a speeding ticket may affect your car insurance in other ways: 1) a single traffic ticket can raise car insurance costs as much as 82%. However, those little yellow tickets do affect your ability to renew your licence plate.

Source: lawandpolicyblog.com

Source: lawandpolicyblog.com

Most insurance companies look at your driving record only when your insurance policy is renewed or when you buy a new policy. Speeding tickets and reckless driving tickets have points, which often negatively impact insurance rates a lot. If your insurance policy specifically forbids you to loan out your car, then you could get in trouble if someone else gets a speeding ticket in your car. The following is a list of some of the most common types of minor, major, and serious/criminal convictions that will likely affect your car insurance rate. As a result, your insurance company may not notice a speeding.

Source: elephant.com

Source: elephant.com

Traffic violations not only take a financial toll in the form of fines, but they can also increase your car insurance premiums—up to a whopping 82% in some cases, according to a study by insurance comparison website the zebra. A speeding ticket can affect your car insurance rate both in the short and long term. The following is a list of some of the most common types of minor, major, and serious/criminal convictions that will likely affect your car insurance rate. Getting multiple traffic violations may cause you to miss out on cost reductions on your insurance. In general, the iii explains, more experienced drivers are likely to pay less for auto insurance.

Source: pinterest.com

Source: pinterest.com

A speeding ticket can affect your car insurance rate both in the short and long term. Failing to share the road; Driving with an insecure load; If your insurance policy specifically forbids you to loan out your car, then you could get in trouble if someone else gets a speeding ticket in your car. South carolina is different in that it lists driving an unsafe vehicle, unsafe equipment and defective parts cited on a vehicle under equipment violations and not as moving violations.

Source: americanpremierblog.com

Source: americanpremierblog.com

The latter having no points, but a. Parking tickets are the exception and have no impact. On average, a driver convicted of speeding will pay $2,043 a year for full coverage insurance — $413. When your policy renews, your provider will check your record to find out if you have any convictions that may impact your costs. South carolina is different in that it lists driving an unsafe vehicle, unsafe equipment and defective parts cited on a vehicle under equipment violations and not as moving violations.

Source: autoinsuresavings.org

Source: autoinsuresavings.org

This ticket does count as a traffic offence and can result in. (1) it is unlawful for any person to drive or move or for the owner to cause or knowingly permit to be driven or moved on any highway any vehicle or combination of vehicles which is in such unsafe condition as to endanger any person, or which does not contain those parts or is not at all times equipped with such lamps and other equipment in proper condition. Severity and number of convictions determine how much your insurance goes up. If the person you loaned your car to caused damage while speeding, then that could make things even more complicated. In some states, a seatbelt ticket is considered a minor traffic violation, which means that an insurer can’t penalize you for it.

Source: francesapres.blogspot.com

Source: francesapres.blogspot.com

However, it is important to note that a seatbelt ticket is a conditional ticket. When parking tickets affect insurance rates. Most insurance companies look at your driving record only when your insurance policy is renewed or when you buy a new policy. The following is a list of some of the most common types of minor, major, and serious/criminal convictions that will likely affect your car insurance rate. Will my first speeding ticket affect insurance?

![]() Source: jovenes-betel-getxo.blogspot.com

Source: jovenes-betel-getxo.blogspot.com

Speeding tickets and reckless driving tickets have points, which often negatively impact insurance rates a lot. In some states, a seatbelt ticket is considered a minor traffic violation, which means that an insurer can’t penalize you for it. As for the proof of the insurance i plan to bring proof that the vehicle was insured and i�m assuming that will get thrown out, any information or tips on that also would be awesome yes. You’re getting pulled over and are about to receive a speeding ticket. They could potentially even lead to your insurance company dropping your coverage altogether.

Source: autoinsurancematchup.com

Source: autoinsurancematchup.com

The following is a list of some of the most common types of minor, major, and serious/criminal convictions that will likely affect your car insurance rate. If your insurance policy specifically forbids you to loan out your car, then you could get in trouble if someone else gets a speeding ticket in your car. In some states, a seatbelt ticket is considered a minor traffic violation, which means that an insurer can’t penalize you for it. Most insurance companies look at your driving record only when your insurance policy is renewed or when you buy a new policy. Parking tickets do not typically affect your auto insurance rates directly.

Source: veloxinsurance.com

Source: veloxinsurance.com

However, those little yellow tickets do affect your ability to renew your licence plate. Will my first speeding ticket affect insurance? Does an expired registration ticket affect insurance? Almost all driving convictions will impact rates. Speeding tickets and reckless driving tickets have points, which often negatively impact insurance rates a lot.

Source: pinterest.com

Source: pinterest.com

The latter having no points, but a. A speeding ticket can affect your car insurance rate both in the short and long term. 1) a single traffic ticket can raise car insurance costs as much as 82%. If you are caught driving a car that is not registered, you will actually face a citation for operating an unregistered vehicle. However, those little yellow tickets do affect your ability to renew your licence plate.

Source: moneyunder30.com

Source: moneyunder30.com

However, it is important to note that a seatbelt ticket is a conditional ticket. They could potentially even lead to your insurance company dropping your coverage altogether. Besides potentially raising your car insurance rates, a speeding ticket may affect your car insurance in other ways: How does a speeding ticket affect your car insurance? Getting multiple traffic violations may cause you to miss out on cost reductions on your insurance.

Source: pinterest.com

Source: pinterest.com

If you are caught driving a car that is not registered, you will actually face a citation for operating an unregistered vehicle. Besides potentially raising your car insurance rates, a speeding ticket may affect your car insurance in other ways: It�s often a good idea to call your auto insurance provider to ask how a ticket will affect your rates before making any decision regarding your ticket. Getting multiple traffic violations may cause you to miss out on cost reductions on your insurance. On average, a driver convicted of speeding will pay $2,043 a year for full coverage insurance — $413.

Source: pinterest.com

Source: pinterest.com

Parking tickets are the only tickets that don�t affect your car insurance rates. Severity and number of convictions determine how much your insurance goes up. Does an expired registration ticket affect insurance? Besides potentially raising your car insurance rates, a speeding ticket may affect your car insurance in other ways: Failing to share the road;

Source: visual.ly

Source: visual.ly

South carolina is different in that it lists driving an unsafe vehicle, unsafe equipment and defective parts cited on a vehicle under equipment violations and not as moving violations. Traffic violations not only take a financial toll in the form of fines, but they can also increase your car insurance premiums—up to a whopping 82% in some cases, according to a study by insurance comparison website the zebra. South carolina is different in that it lists driving an unsafe vehicle, unsafe equipment and defective parts cited on a vehicle under equipment violations and not as moving violations. When your policy renews, your provider will check your record to find out if you have any convictions that may impact your costs. Nonmoving violations typically don�t affect a motorist�s insurance premiums.

Source: pinterest.com

Source: pinterest.com

- a single traffic ticket can raise car insurance costs as much as 82%. In general, the iii explains, more experienced drivers are likely to pay less for auto insurance. How does a speeding ticket affect your car insurance? Less cost reduction over time. They could potentially even lead to your insurance company dropping your coverage altogether.

Source: valuepenguin.com

Source: valuepenguin.com

Here is the text of the law: If you are caught driving a car that is not registered, you will actually face a citation for operating an unregistered vehicle. Severity and number of convictions determine how much your insurance goes up. Failing to share the road; Nonmoving violations typically don�t affect a motorist�s insurance premiums.

Source: thelawdictionary.org

Source: thelawdictionary.org

Drivers charged with this crime can expect to pay on average 82% (or $1,200+) more per year for car insurance. Parking tickets do not typically affect your auto insurance rates directly. The latter having no points, but a. However, defective equipment is a non moving violation in virginia and it has no demerit points. Traffic violations not only take a financial toll in the form of fines, but they can also increase your car insurance premiums—up to a whopping 82% in some cases, according to a study by insurance comparison website the zebra.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does a defective vehicle ticket affect insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.