Your Do you pay insurance on a mobility car images are available. Do you pay insurance on a mobility car are a topic that is being searched for and liked by netizens today. You can Download the Do you pay insurance on a mobility car files here. Download all royalty-free photos and vectors.

If you’re searching for do you pay insurance on a mobility car images information related to the do you pay insurance on a mobility car keyword, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

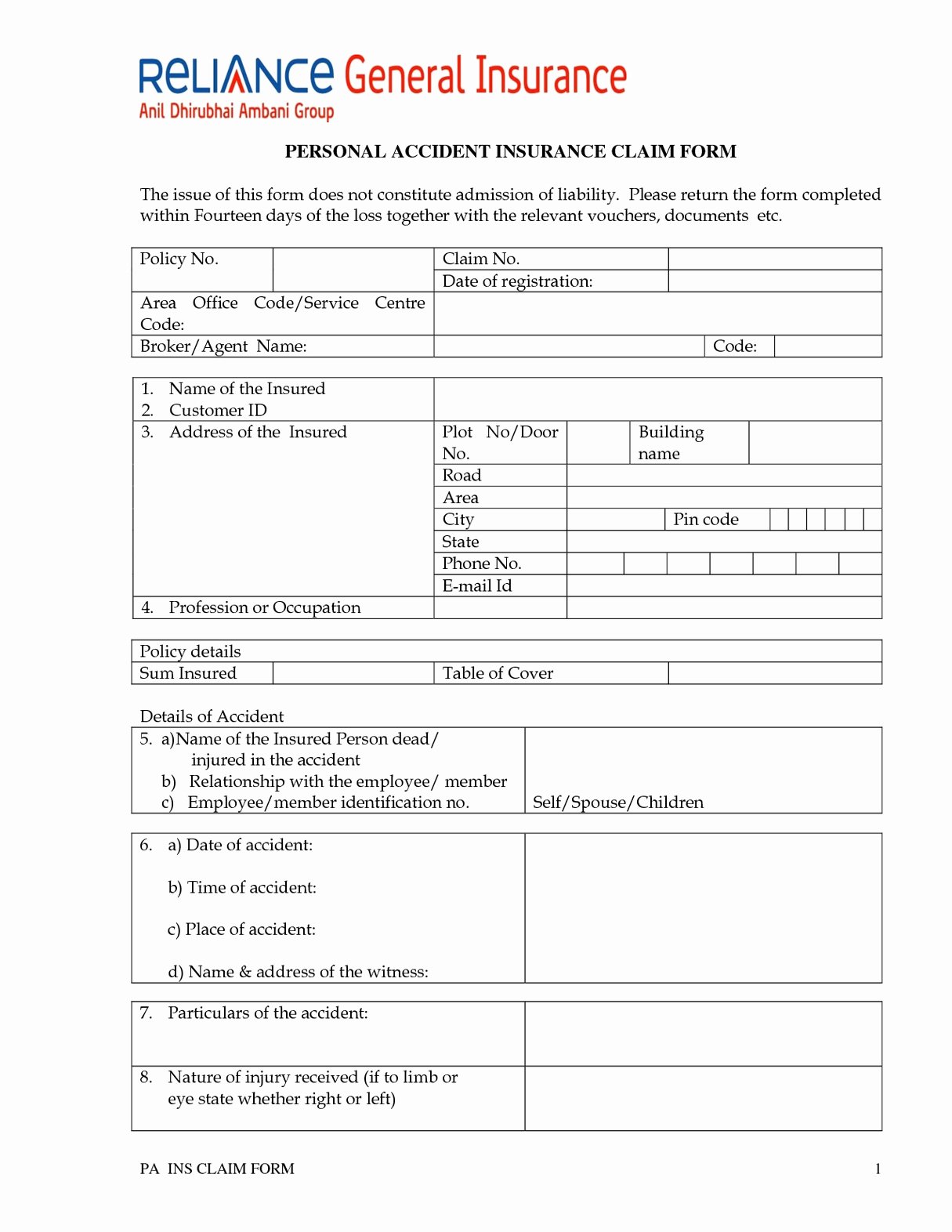

Do You Pay Insurance On A Mobility Car. You can get up to 3 other people to drive for you. If you need adaptations made to a vehicle, for example, hand controls, steering aids and pedal modifications, most are offered for free under the motability scheme. For confirmation of the amount or to discuss any queries, please contact rsa motability. With the motability scheme you exchange your higher rate mobility allowance to lease a brand new car for 3 years.

Making Payments For Your Car Insurance Premiums Auto From autovehicleinsurance.info

Making Payments For Your Car Insurance Premiums Auto From autovehicleinsurance.info

Details are given in your agreement and in your insurance policy document. The excess payable for insurance claims is quoted in your lease terms and conditions and your policy schedule. A £50 excess applies if your windscreen needs replacing. Motability will also consider requests to include drivers who live more than five miles away. This is because it will protect you not only against accidental damage and theft, but also negligence claims which may arise from use of your mobility vehicle. The motability scheme is really simple.

Motability will also consider requests to include drivers who live more than five miles away.

Motability will also consider requests to include drivers who live more than five miles away. If you need adaptations made to a vehicle, for example, hand controls, steering aids and pedal modifications, most are offered for free under the motability scheme. Details are given in your agreement and in your insurance policy document. If you receive a benefit because you have a disability or illness that makes it hard for you to get around, you can use it to pay for a vehicle from a charity called motability. If you receive a benefit because you have a disability or health condition that makes it hard for you to get around, you can use it to pay for a vehicle from a charity called motability. What excess do i have to pay if i have an accident?

Source: everplans.com

Source: everplans.com

Check you are eligible for the scheme; You just exchange all, or part of your mobility allowance to lease the vehicle of your choice. All you will have to pay for is the petrol. You can choose from lots of different vehicles, for example cars, mobility scooters or powered wheelchairs. This is because it will protect you not only against accidental damage and theft, but also negligence claims which may arise from use of your mobility vehicle.

Source: autovehicleinsurance.info

Source: autovehicleinsurance.info

Please do not attempt to repair the damage yourself. Motability will also consider requests to include drivers who live more than five miles away. In most cases you will be expected to pay the excess before your windscreen is replaced. Only drivers listed as permitted drivers on the certificate of motor insurance are insured to drive your motability car. All you will have to pay for is the petrol.

Source: wilkinsuranceagency.com

Source: wilkinsuranceagency.com

If your vehicle needs to be repaired you must pay the excess for each individual incident before the repair starts. It is difficult to see what more motability can do to help customers, considering: If you need adaptations made to a vehicle, for example, hand controls, steering aids and pedal modifications, most are offered for free under the motability scheme. Payments are deducted from your allowance every four weeks, then paid directly to us by the relevant benefits agency. If you choose to have minor damage repaired, you can make a claim through rsam.

Source: onlinefigure.com

Source: onlinefigure.com

You choose the vehicle you want at a price that works for you, and payments are deducted from your higher rate mobility allowance every four weeks, then paid directly to us by the department for work and pensions (dwp). You have to supply your own insurance for a hire purchase vehicle. Although insurance for mobility scooters or powerchairs is not a legal requirement, it is highly recommended. You choose the vehicle you want at a price that works for you, and payments are deducted from your higher rate mobility allowance every four weeks, then paid directly to us by the department for work and pensions (dwp). If you choose to have minor damage repaired, you can make a claim through rsam.

Source: machanic.net

Source: machanic.net

Choose the vehicle you want at a price that works for you. The excess varies depending on the age of the driver. The excess payable for insurance claims is quoted in your lease terms and conditions and your policy schedule. If you need adaptations made to a vehicle, for example, hand controls, steering aids and pedal modifications, most are offered for free under the motability scheme. The motability scheme is really simple.

Source: what-is-latest-news-on-tiger-woods32.blogspot.com

It is difficult to see what more motability can do to help customers, considering: We will pay for the cost of the item, less an amount for wear and tear and loss of value up to a total of £2,500. This is because it will protect you not only against accidental damage and theft, but also negligence claims which may arise from use of your mobility vehicle. Vehicle tax, registration and insurance you do not have to pay vehicle tax for any mobility scooter or powered wheelchair if it’s registered as a ‘class 3 invalid carriage’. Find a dealer or supplier, take a test drive and place your order;

Source: investopedia.com

Source: investopedia.com

If someone has the use of a motability car to drive for the benefit of someone else who is in receipt of dla higher rate mobility, is the insurance invalidated if he/she uses it when the person whose use it is intended for is not with him/her? You have to supply your own insurance for a hire purchase vehicle. All you will have to pay for is the petrol. You don’t have to be able to drive yourself. Drivers under 25 are restricted to motability cars with an insurance group of 16 or lower and with an engine that has a power output of 120 brake horse power (bhp) or less (this rule does not apply to young people driving a wheelchair accessible vehicles).

Source: motor1.com

Source: motor1.com

Motability will not refuse or obstruct you from purchasing a vehicle on motability, as that is your right as a disabled person whilst you are still in receipt of hrmc. The motability scheme is really simple. You must pay the cost of any replacement keys and in some circumstances replacement locks. Details are given in your agreement and in your insurance policy document. You choose the vehicle you want at a price that works for you, and payments are deducted from your higher rate mobility allowance every four weeks, then paid directly to us by the department for work and pensions (dwp).

Source: takemycounsel.com

Source: takemycounsel.com

If your car needs to be repaired you must pay the excess for each individual incident before the repair starts. The enhanced rate mobility component of personal independence payment (pip) for. The higher rate mobility component of disability living allowance (dla) for 12 months or more. Payments continue to be made directly from veterans uk and the dwp to motability without interruption. Please do not attempt to repair the damage yourself.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

In most cases you will be expected to pay the excess before your windscreen is replaced. You can still lease a motability car even if you don’t drive. If your car needs to be repaired you must pay the excess for each individual incident before the repair starts. Find a dealer or supplier, take a test drive and place your order; A £50 excess applies if your windscreen needs replacing.

Source: thefrisky.com

Source: thefrisky.com

There are hundreds of cars to choose from. You just exchange all, or part of your mobility allowance to lease the vehicle of your choice. You can easily view, add or change your named drivers during your lease in the �insurance cover� section of your motability scheme online account, saving you a call to rsa motability (rsam). You simply need to nominate a maximum of three drivers who will be insured by motability to drive the car on your behalf, as long as they live with (or within five miles of) you. Motability will also consider requests to include drivers who live more than five miles away.

Source: dmv.com

Source: dmv.com

Vehicle tax, registration and insurance you do not have to pay vehicle tax for any mobility scooter or powered wheelchair if it’s registered as a ‘class 3 invalid carriage’. There are hundreds of cars to choose from. You will need to pay an excess amount. Details are given in your agreement and in your insurance policy document. The higher rate mobility component of disability living allowance (dla) for 12 months or more.

Source: dewetdesign.blogspot.com

You will need to pay an excess amount. In most cases you will be expected to pay the excess before your windscreen is replaced. Details are given in your agreement and in your insurance policy document. Although insurance for mobility scooters or powerchairs is not a legal requirement, it is highly recommended. You have to supply your own insurance for a hire purchase vehicle.

Source: takemycounsel.com

Source: takemycounsel.com

Details are given in your agreement and in your insurance policy document. You can get a motability car or vehicle if you’ve been awarded: There are hundreds of cars to choose from. It is difficult to see what more motability can do to help customers, considering: You will need to pay an excess amount.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

There are hundreds of cars to choose from. Please do not attempt to repair the damage yourself. Details are given in your agreement and in your insurance policy document. Details are given in your agreement and in your insurance policy document. You choose the vehicle you want at a price that works for you, and payments are deducted from your mobility allowance every four weeks, then paid directly to us by your benefit payment agency.

Source: policygenius.com

Source: policygenius.com

You choose the vehicle you want at a price that works for you, and payments are deducted from your mobility allowance every four weeks, then paid directly to us by your benefit payment agency. Leasing a vehicle is easy. Details are given in your agreement and in your insurance policy document. The enhanced rate mobility component of personal independence payment (pip) for. You can still lease a motability car even if you don’t drive.

Source: autorentpa.com

Source: autorentpa.com

If you choose to have minor damage repaired, you can make a claim through rsam. You can join the motability scheme if you receive one Motability will not refuse or obstruct you from purchasing a vehicle on motability, as that is your right as a disabled person whilst you are still in receipt of hrmc. You simply need to nominate a maximum of three drivers who will be insured by motability to drive the car on your behalf, as long as they live with (or within five miles of) you. It is difficult to see what more motability can do to help customers, considering:

Source: hpminsurance.com

You will need to pay an excess amount. If someone has the use of a motability car to drive for the benefit of someone else who is in receipt of dla higher rate mobility, is the insurance invalidated if he/she uses it when the person whose use it is intended for is not with him/her? The enhanced rate mobility component of personal independence payment (pip) for. You don’t have to be able to drive yourself. You simply need to nominate a maximum of three drivers who will be insured by motability to drive the car on your behalf, as long as they live with (or within five miles of) you.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you pay insurance on a mobility car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.