Your Do you need third party insurance if you have comprehensive images are available. Do you need third party insurance if you have comprehensive are a topic that is being searched for and liked by netizens now. You can Find and Download the Do you need third party insurance if you have comprehensive files here. Get all free photos.

If you’re looking for do you need third party insurance if you have comprehensive images information connected with to the do you need third party insurance if you have comprehensive keyword, you have come to the right site. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Do You Need Third Party Insurance If You Have Comprehensive. One insurance plan that requires you to purchase additional third party liability coverage is employment practices liability insurance, which covers claims filed against the business by. Tpo should cover damage to other people and other cars if you’re involved in an accident. Third party fire and theft; So even if you�re fully covered for your own car, don�t assume you�re insured to drive other people�s cars otherwise you risk breaking the law.

What is the difference between comprehensive insurance and From quora.com

And understanding what you’re covered for can help you avoid unexpected costs. There are several types of car insurance, as well as the coverages that fall under them. Comprehensive and third party liability are different types of protection, but it is recommended to have both. Check things like your entitlement to a hire vehicle while your car’s in for repair or whether there’s an option to include roadside assistance on your comprehensive cover. One insurance plan that requires you to purchase additional third party liability coverage is employment practices liability insurance, which covers claims filed against the business by. So even if you�re fully covered for your own car, don�t assume you�re insured to drive other people�s cars otherwise you risk breaking the law.

Alternatively, a third party fire and theft policy, which includes some protection for your vehicle, might be sufficient for your needs.

While comprehensive car insurance offers the highest level of protection, you might only want to cover damage to other people’s vehicles and property through a basic third party property policy. Your motor insurance policy covers this instead. Compulsory third party insurance does not cover your vehicle during an accident. To secure both coverages for first party and third party property damage (tppd), a comprehensive motor insurance policy is generally acquired. Third party fire and theft; And understanding what you’re covered for can help you avoid unexpected costs.

Source: en.mozbox.net

Source: en.mozbox.net

You can add it along with third party liability. Ctp protects people injured by your car. Tpl provides compensation to the third party in case of an accident. And understanding what you’re covered for can help you avoid unexpected costs. • damage to your car or another person’s property in the event of an accident, which is why you need to purchase additional comprehensive or third party insurance on top of ctp.

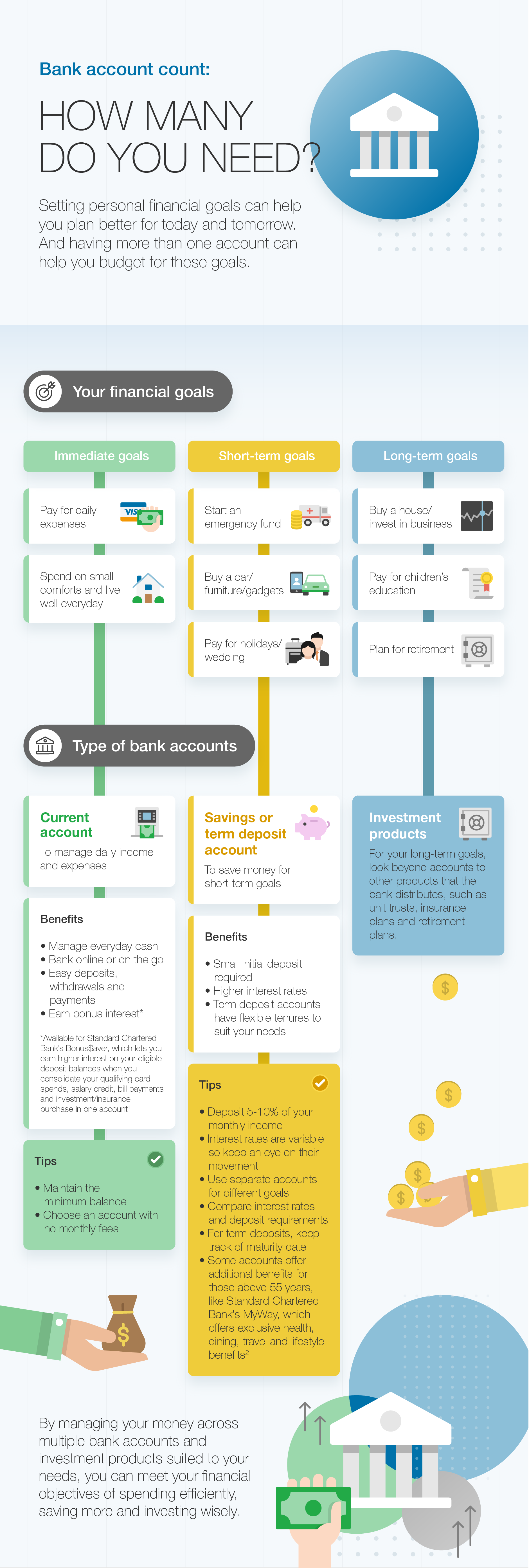

Source: sc.com

Source: sc.com

Comprehensive and third party liability are different types of protection, but it is recommended to have both. Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. One insurance plan that requires you to purchase additional third party liability coverage is employment practices liability insurance, which covers claims filed against the business by. Third party property damage insurance covers you for damage done to another person’s vehicle or property where you are at fault, but it doesn’t cover your own car. It covers any damage or injury caused by the insured, to another person or property.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Car insurance companies usually give you the option to add fire and theft cover to your third party insurance for a few extra bucks a month. • damage to your car or another person’s property in the event of an accident, which is why you need to purchase additional comprehensive or third party insurance on top of ctp. Not all insurance policies cover third party liability claims unless you actively select them when you buy your policy. Third party property car insurance.

Source: mypullipbygoodklaudia.blogspot.com

So even if you�re fully covered for your own car, don�t assume you�re insured to drive other people�s cars otherwise you risk breaking the law. Comprehensive insurance covers your car and the other persons car/s. Comprehensive car insurance is a much higher level of cover (and for this reason the most popular). And understanding what you’re covered for can help you avoid unexpected costs. In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property.

Source: banksathi.com

Source: banksathi.com

Third party coverage is mandatory. And understanding what you’re covered for can help you avoid unexpected costs. 3rd party property covers the other persons car/s so, yes you still have to pay ctp, hence why it is compulsary third party insurance Check things like your entitlement to a hire vehicle while your car’s in for repair or whether there’s an option to include roadside assistance on your comprehensive cover. Third party fire and theft;

Source: tisteam.com

Source: tisteam.com

• damage to your car or another person’s property in the event of an accident, which is why you need to purchase additional comprehensive or third party insurance on top of ctp. But you might have to pay for any damage to your own car. So even if you�re fully covered for your own car, don�t assume you�re insured to drive other people�s cars otherwise you risk breaking the law. Third party property damage insurance covers you for damage done to another person’s vehicle or property where you are at fault, but it doesn’t cover your own car. This article explains the difference between comprehensive and third party car insurance.

Source: selnews.com

Source: selnews.com

Car insurance companies usually give you the option to add fire and theft cover to your third party insurance for a few extra bucks a month. Not all insurance policies cover third party liability claims unless you actively select them when you buy your policy. It is also known as a comprehensive car insurance policy. Tpo should cover damage to other people and other cars if you’re involved in an accident. Comprehensive car insurance can also be purchased for extra protection, but isn’t required by law.

Source: revisi.net

Source: revisi.net

Comprehensive car insurance is a much higher level of cover (and for this reason the most popular). Third party coverage is mandatory. One insurance plan that requires you to purchase additional third party liability coverage is employment practices liability insurance, which covers claims filed against the business by. In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. Compulsory third party insurance does not cover your vehicle during an accident.

Source: etrustedadvisor.com

Source: etrustedadvisor.com

Comprehensive car insurance is a much higher level of cover (and for this reason the most popular). First though, what does compulsory third party (ctp) insurance cover? Third party property car insurance. Not all insurance policies cover third party liability claims unless you actively select them when you buy your policy. One insurance plan that requires you to purchase additional third party liability coverage is employment practices liability insurance, which covers claims filed against the business by.

Source: bankbazaar.com

Source: bankbazaar.com

Comprehensive insurance covers your car and the other persons car/s. And understanding what you’re covered for can help you avoid unexpected costs. Not only are comprehensive insurance policy holders covered against damage to other people’s vehicles or. To secure both coverages for first party and third party property damage (tppd), a comprehensive motor insurance policy is generally acquired. Tpl provides compensation to the third party in case of an accident.

Source: revisi.net

Source: revisi.net

You can add it along with third party liability. Third party property car insurance. This is because possessing at least third party cover is mandatory for all car owners in india. Alternatively, a third party fire and theft policy, which includes some protection for your vehicle, might be sufficient for your needs. Compulsory third party insurance does not cover your vehicle during an accident.

Source: aami.com.au

Source: aami.com.au

To secure both coverages for first party and third party property damage (tppd), a comprehensive motor insurance policy is generally acquired. • damage to your car or another person’s property in the event of an accident, which is why you need to purchase additional comprehensive or third party insurance on top of ctp. This means that issues with your own vehicle following a crash will need to be paid for by you. Driving other cars cover is usually only available on a comprehensive car insurance policy, so if you have third party (or third party, fire & theft) cover, you won’t be covered to. Third party property car insurance, sometimes called third party property damage, covers damage to other people’s vehicles and property.

Source: canstar.com.au

Source: canstar.com.au

Compulsory third party insurance does not cover your vehicle during an accident. It is also known as a comprehensive car insurance policy. This means that if you have an accident you can claim to have your car fixed, and your insurance provider may also compensate anyone else involved if eligible. If you’re travelling with a passenger in the. Third party only (sometimes referred to as tpo), covers any damage to other cars in the event of an accident but does not cover your own vehicle.

Source: pittmaninsurancegroupllc.com

Source: pittmaninsurancegroupllc.com

If i have fully comprehensive car insurance can i drive any car? Third party property car insurance. Comprehensive and third party liability are different types of protection, but it is recommended to have both. 3rd party property covers the other persons car/s so, yes you still have to pay ctp, hence why it is compulsary third party insurance It covers any damage or injury caused by the insured, to another person or property.

Source: fosterthepeoplelover.blogspot.com

Third party property damage insurance covers you for damage done to another person’s vehicle or property where you are at fault, but it doesn’t cover your own car. Comprehensive car insurance can also be purchased for extra protection, but isn’t required by law. It covers any damage or injury caused by the insured, to another person or property. This is because possessing at least third party cover is mandatory for all car owners in india. Check things like your entitlement to a hire vehicle while your car’s in for repair or whether there’s an option to include roadside assistance on your comprehensive cover.

Source: alkhalijimall.com

Source: alkhalijimall.com

3rd party property covers the other persons car/s so, yes you still have to pay ctp, hence why it is compulsary third party insurance Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else. Your motor insurance policy covers this instead. Third party property damage insurance covers you for damage done to another person’s vehicle or property where you are at fault, but it doesn’t cover your own car. Not all insurance policies cover third party liability claims unless you actively select them when you buy your policy.

Source: quora.com

This means that if you have an accident you can claim to have your car fixed, and your insurance provider may also compensate anyone else involved if eligible. Not only are comprehensive insurance policy holders covered against damage to other people’s vehicles or. This is because possessing at least third party cover is mandatory for all car owners in india. While comprehensive car insurance offers the highest level of protection, you might only want to cover damage to other people’s vehicles and property through a basic third party property policy. If you’re travelling with a passenger in the.

Source: fosterthepeoplelover.blogspot.com

Source: fosterthepeoplelover.blogspot.com

Third party insurance is the least amount of cover that you should legally have on your car. Comprehensive car insurance is a much higher level of cover (and for this reason the most popular). First though, what does compulsory third party (ctp) insurance cover? Alternatively, a third party fire and theft policy, which includes some protection for your vehicle, might be sufficient for your needs. This article explains the difference between comprehensive and third party car insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you need third party insurance if you have comprehensive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.