Your Do you need public liability insurance for a wedding images are ready. Do you need public liability insurance for a wedding are a topic that is being searched for and liked by netizens now. You can Find and Download the Do you need public liability insurance for a wedding files here. Get all royalty-free photos and vectors.

If you’re searching for do you need public liability insurance for a wedding images information connected with to the do you need public liability insurance for a wedding keyword, you have visit the right site. Our website always gives you hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Do You Need Public Liability Insurance For A Wedding. Fortunately though, public liability cover can easily be purchased as part of a wedding insurance package. Couples today are opting for unconventional wedding venues such as parks, museums, historic mansions and private estates. Cancelation is a good idea in general, but especially relevant depending on your location. Some of our frequently asked questions are listed below.

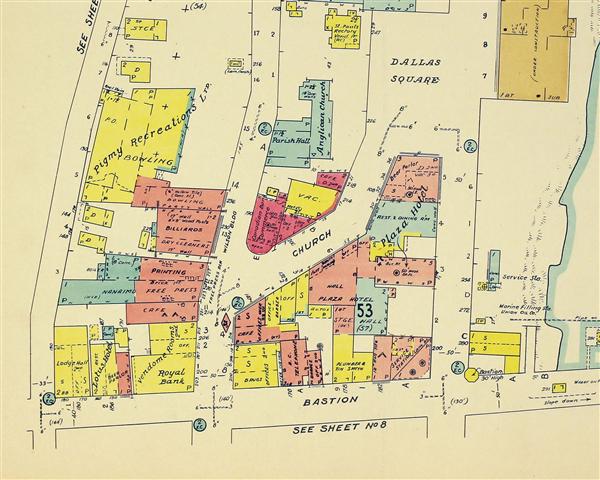

Does Your Small Business Need Public Liability Insurance From pscconnect.com.au

Does Your Small Business Need Public Liability Insurance From pscconnect.com.au

Bear in mind, though, that most companies will only cover celebrations in the country where you buy the insurance, although some companies, such as dream wedding insurance, will cover both australian and destination weddings. Organising a wedding can be stressful enough without worrying about what will happen if you or one of your guests accidentally damages the venue or causes a member of staff to suffer an injury. If your venue has asked you to get pal (party alcohol liabilty) insurance, venue insurance, or hall rental insurance, you’re in the right place. When hosting an event, most banquet halls and venues will require you to have event insurance in place. Yes, insurance can protect a wedding photographer financially against situations like injury to a member of the public or damage to their property (see public liability insurance); Cancelation is a good idea in general, but especially relevant depending on your location.

A bar, pub or restaurant would require primary liquor liability insurance, whereas a couple who only wanted to “cover their bases” during a wedding could get host liquor liability insurance.

Organising a wedding can be stressful enough without worrying about what will happen if you or one of your guests accidentally damages the venue or causes a member of staff to suffer an injury. Wedding liability insurance frequently asked questions. When hosting an event, most banquet halls and venues will require you to have event insurance in place. Street parties festivals fairs fundraisers gatherings If you need to insure your marquee separately or would like to include something like public liability, you will need to pay a premium. The one exception is for venues.

The one exception is for venues. What do the personal & public liability sections cover? Street parties festivals fairs fundraisers gatherings The cost of the claim was £15,000. A bar, pub or restaurant would require primary liquor liability insurance, whereas a couple who only wanted to “cover their bases” during a wedding could get host liquor liability insurance.

Source: benchmarkbroker.com

Source: benchmarkbroker.com

At dreamsaver wedding insurance we often receive questions from couples regarding what public liability cover they need for their wedding and what is the difference between the personal liability and public liability sections in the policy. This refers to when a customer is served too much alcohol, placing the liability on the bartender. A bar, pub or restaurant would require primary liquor liability insurance, whereas a couple who only wanted to “cover their bases” during a wedding could get host liquor liability insurance. Cost wise, wedding insurance policies can range from roughly $215 to $1300, depending on how much coverage you want. In addition, the venue will also need to be covered for public liability.

Source: moneysupermarket.com

Source: moneysupermarket.com

If an accident should happen and a claim is made and you are found to be liable, it is good to know you are covered. Cancelation is a good idea in general, but especially relevant depending on your location. Bear in mind, though, that most companies will only cover celebrations in the country where you buy the insurance, although some companies, such as dream wedding insurance, will cover both australian and destination weddings. Injury to an employee (see employers� liability insurance); Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor.

Source: startupnation.com

Source: startupnation.com

Cost wise, wedding insurance policies can range from roughly $215 to $1300, depending on how much coverage you want. If an accident should happen and a claim is made and you are found to be liable, it is good to know you are covered. Cancellation cover up to £32,000 (enough to cover the average wedding cost according to our survey ) would be around £90 to £100. At dreamsaver wedding insurance we often receive questions from couples regarding what public liability cover they need for their wedding and what is the difference between the personal liability and public liability sections in the policy. Dissatisfied clients (professional indemnity cover);

Source: pawson.com

Source: pawson.com

Many of these venues now require event hosts to purchase liability insurance. Public liability vs personal liability. Public liability insurance can help cover the costs of such incidents, paying out for the likes of repairs, medical bills and legal fees. If a venue doesn�t have its own insurance, liability insurance is a must and may even be required. Couples today are opting for unconventional wedding venues such as parks, museums, historic mansions and private estates.

Source: moneysupermarket.com

Source: moneysupermarket.com

Public liability vs personal liability. If an accident should happen and a claim is made and you are found to be liable, it is good to know you are covered. At dreamsaver wedding insurance we often receive questions from couples regarding what public liability cover they need for their wedding and what is the difference between the personal liability and public liability sections in the policy. Cancellation cover up to £32,000 (enough to cover the average wedding cost according to our survey ) would be around £90 to £100. You do not want to be held responsible for any accidents, especially if you have alcohol at your wedding.

Source: allstate.com

Source: allstate.com

1st january 2011 by adam. Many of these venues now require event hosts to purchase liability insurance. You do not want to be held responsible for any accidents, especially if you have alcohol at your wedding. If an accident should happen and a claim is made and you are found to be liable, it is good to know you are covered. Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor.

Source: public-liability-lnsurance.blogspot.com

Source: public-liability-lnsurance.blogspot.com

In addition, the venue will also need to be covered for public liability. Basically this section of the wedding insurance policy provides cover if you are sued for accidental injury to a 3rd party, such as a member of staff at the venue or accidental damage to 3rd party property. Public liability insurance is a type of insurance designed to protect you and your business against claims of personal injury or property damage sustained as a result of your business activities. The public liability aspect of wedding insurance has increased in popularity amongst couples getting married over the last few years. Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

You do not want to be held responsible for any accidents, especially if you have alcohol at your wedding. Often the venue will dictate the liability amount required, which may differ if your event is at a private venue or if you are dealing with a public event. Some of our frequently asked questions are listed below. Cancellation cover up to £32,000 (enough to cover the average wedding cost according to our survey ) would be around £90 to £100. Basically this section of the wedding insurance policy provides cover if you are sued for accidental injury to a 3rd party, such as a member of staff at the venue or accidental damage to 3rd party property.

Source: pscconnect.com.au

Source: pscconnect.com.au

Theft or damage to their cameras and other equipment; Theft or damage to their cameras and other equipment; If you are the fair organiser, you will also need to look into your insurance needs, most likely it will be a condition of the venue that you are covered. When hosting an event, most banquet halls and venues will require you to have event insurance in place. The cost of the claim was £15,000.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

The one exception is for venues. Yes, insurance can protect a wedding photographer financially against situations like injury to a member of the public or damage to their property (see public liability insurance); Often the venue will dictate the liability amount required, which may differ if your event is at a private venue or if you are dealing with a public event. The public liability aspect of wedding insurance has increased in popularity amongst couples getting married over the last few years. A bar, pub or restaurant would require primary liquor liability insurance, whereas a couple who only wanted to “cover their bases” during a wedding could get host liquor liability insurance.

Source: aiastl.com

Source: aiastl.com

If you need to insure your marquee separately or would like to include something like public liability, you will need to pay a premium. The cost of the claim was £15,000. Street parties festivals fairs fundraisers gatherings In addition, the venue will also need to be covered for public liability. 1st january 2011 by adam.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

The cost of the claim was £15,000. The cost of the claim was £15,000. Some wedding insurance providers include public liability cover as a standard feature of their policies, whereas other insurers will add cover for just a small additional premium, usually around the £20 mark. If you need to insure your marquee separately or would like to include something like public liability, you will need to pay a premium. Without this, they may have had to cover the cost of the damage themselves.

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

Bear in mind, though, that most companies will only cover celebrations in the country where you buy the insurance, although some companies, such as dream wedding insurance, will cover both australian and destination weddings. The one exception is for venues. Many of these venues now require event hosts to purchase liability insurance. The cost of the claim was £15,000. Couples today are opting for unconventional wedding venues such as parks, museums, historic mansions and private estates.

Source: ogilviefsltd.co.nz

Source: ogilviefsltd.co.nz

If an accident should happen and a claim is made and you are found to be liable, it is good to know you are covered. You will also need to get additional liquor liability insurance to cover for the alcohol you will be serving during the reception. Public liability insurance can help cover the costs of such incidents, paying out for the likes of repairs, medical bills and legal fees. A bar, pub or restaurant would require primary liquor liability insurance, whereas a couple who only wanted to “cover their bases” during a wedding could get host liquor liability insurance. The public liability aspect of wedding insurance has increased in popularity amongst couples getting married over the last few years.

Source: thongtinbenhdaday.com

Source: thongtinbenhdaday.com

Dissatisfied clients (professional indemnity cover); Public liability insurance is a type of insurance designed to protect you and your business against claims of personal injury or property damage sustained as a result of your business activities. If a venue doesn�t have its own insurance, liability insurance is a must and may even be required. At dreamsaver wedding insurance we often receive questions from couples regarding what public liability cover they need for their wedding and what is the difference between the personal liability and public liability sections in the policy. 1st january 2011 by adam.

Source: blog.constructaquote.com

Source: blog.constructaquote.com

Some wedding insurance providers include public liability cover as a standard feature of their policies, whereas other insurers will add cover for just a small additional premium, usually around the £20 mark. Temporary event liquor liability insurance is necessary if you are catering your wedding yourself or if the venue or catering company does not have liquor liability coverage. Public liability insurance can help cover the costs of such incidents, paying out for the likes of repairs, medical bills and legal fees. Basically this section of the wedding insurance policy provides cover if you are sued for accidental injury to a 3rd party, such as a member of staff at the venue or accidental damage to 3rd party property. Wedding liability insurance frequently asked questions.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor. Basically this section of the wedding insurance policy provides cover if you are sued for accidental injury to a 3rd party, such as a member of staff at the venue or accidental damage to 3rd party property. Wedding venues will have larger insurance policies, and they can also be added to a couple’s liability insurance plan for each individual wedding. If a venue doesn�t have its own insurance, liability insurance is a must and may even be required. Cancelation is a good idea in general, but especially relevant depending on your location.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do you need public liability insurance for a wedding by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.