Your Do you need legal cover on home insurance images are available. Do you need legal cover on home insurance are a topic that is being searched for and liked by netizens today. You can Get the Do you need legal cover on home insurance files here. Get all royalty-free photos.

If you’re searching for do you need legal cover on home insurance pictures information related to the do you need legal cover on home insurance interest, you have visit the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Do You Need Legal Cover On Home Insurance. But your home is arguably the. If you happen to be one of the lucky few out there who has paid off their mortgage, you don�t have to purchase homeowners insurance. Home contents insurance buildings insurance car or motorcycle insurance Many insurers offer legal cover of up to £100,000, but it is worth looking for at least £50,000 worth of cover to ensure you are not left out of pocket, as legal costs can mount up.

How Much Auto Coverage Do You Need? The Insurance Store From tisteam.com

How Much Auto Coverage Do You Need? The Insurance Store From tisteam.com

To make sure you get the cover you expect from accidental damage insurance, always read your policy carefully so you’re aware how your insurer defines accidental damage and what is included and excluded from the cover. It�ll protect you against the costs of being sued, or of making a claim against someone. Has more than six bedrooms. Home contents insurance buildings insurance car or motorcycle insurance Do i need home insurance legal cover? As a personal injury solicitor, i.

Legal expenses cover, also known as family legal protection, is a type of insurance you can buy alongside your home insurance.

To make sure you get the cover you expect from accidental damage insurance, always read your policy carefully so you’re aware how your insurer defines accidental damage and what is included and excluded from the cover. Home contents insurance buildings insurance car or motorcycle insurance If you decide to buy legal expenses cover, just make sure you don’t have it already. (but note that you will still need ‘all risks cover’ or ‘personal possessions cover’ to cover it whilst away from the home). Is worth more than £1 million. If you happen to be one of the lucky few out there who has paid off their mortgage, you don�t have to purchase homeowners insurance.

Source: usaa.com

Source: usaa.com

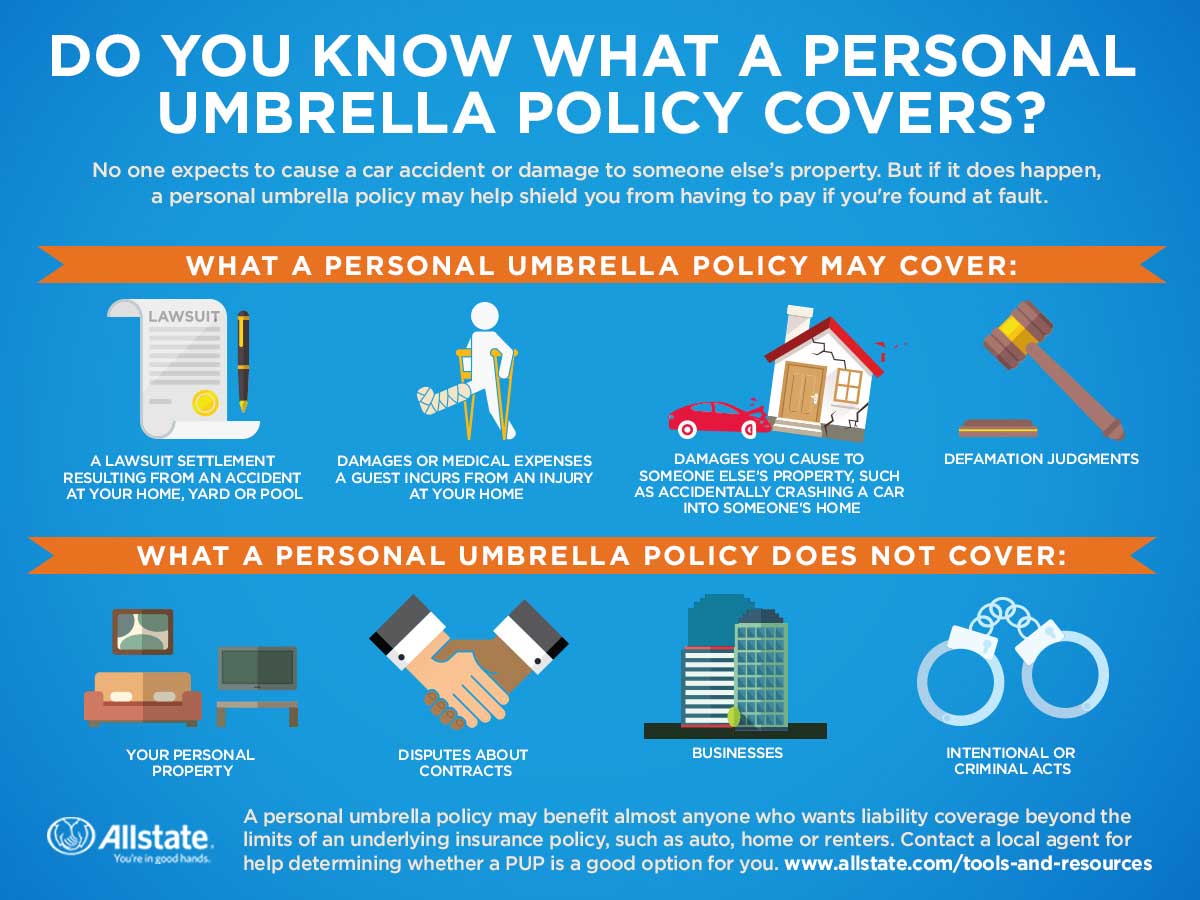

Is worth more than £1 million. You can’t typically get coverage for something that’s already happening — say, you’re in the. You might also have legal protection through your employer or your trade union. Legal expenses cover, also known as family legal protection, is a type of insurance you can buy alongside your home insurance. Solicitors� fees court fees the fees of any expert witnesses any legal costs awarded to the other party in the dispute the policyholder is usually required to accept any reasonable offer of settlement.

Source: youtube.com

Source: youtube.com

Is worth more than £1 million. It provides up to £100,000 to cover the cost of legal action brought by or against you, as long as the legal team believes you can win your case. It also might offer some coverage for identity theft or fraud. You’ll be offered the cover automatically whenever you get a quotation, but if you decide against taking it out, you can add it at a later date. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home.

Source: allstate.com

Source: allstate.com

Legal expenses cover, also known as family legal protection, is a type of insurance you can buy alongside your home insurance. But while it’s reassuring to know it’s there if you need it, it’s worth thinking. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. Legal cover does not pay out compensation to you but recovers the legal costs you incur when you pursue a third party for damages.

Source: lawadvocategroup.com

Source: lawadvocategroup.com

Home insurance legal cover home insurance legal expenses insurance typically covers legal proceedings relating to your home, employment, death or personal injury. Homeowners insurance is not legally required, but if you plan on taking out a mortgage on a home, your lender will most likely require you to purchase coverage when you go to close on the property. You can’t typically get coverage for something that’s already happening — say, you’re in the. It can also cover cases where you�ve entered into a contract for the sale and supply of goods and services. If you decide to buy legal expenses cover, just make sure you don’t have it already.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

Many insurers, if you refuse to pay for it, will just let you have legal expense cover free, anyway. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. It adds £35 a year to the average combined home insurance premium, which means legal cover won’t break the bank. Legal cover doesn’t add that much to the overall cost of home insurance and could provide up to £100,000 in legal costs. (but note that you will still need ‘all risks cover’ or ‘personal possessions cover’ to cover it whilst away from the home).

Source: pinterest.com

Source: pinterest.com

It is often included with: It also might offer some coverage for identity theft or fraud. If your home is worth a lot of money or has a large number of bedrooms, a standard home insurance policy may not cover you. It adds £35 a year to the average combined home insurance premium, which means legal cover won’t break the bank. It is often included with:

Source: itsaboutjustice.law

Source: itsaboutjustice.law

Do i need home insurance legal cover? If a customer is successful in their legal expenses insurance claim, they’ll be able to cover legal costs, which usually include: Legal cover doesn’t add that much to the overall cost of home insurance and could provide up to £100,000 in legal costs. If you decide to buy legal expenses cover, just make sure you don’t have it already. It also might offer some coverage for identity theft or fraud.

Source: etrustedadvisor.com

Source: etrustedadvisor.com

If you happen to be one of the lucky few out there who has paid off their mortgage, you don�t have to purchase homeowners insurance. Many insurers, if you refuse to pay for it, will just let you have legal expense cover free, anyway. If a customer is successful in their legal expenses insurance claim, they’ll be able to cover legal costs, which usually include: If, for example, you lost your job and you felt it was unfair dismissal, family legal protection could help you pay for the cost of going to an employment tribunal or equivalent to claim compensation. Legal cover does not pay out compensation to you but recovers the legal costs you incur when you pursue a third party for damages.

Source: insurancecredit.us

Source: insurancecredit.us

As a personal injury solicitor, i. It is often included with: It�ll protect you against the costs of being sued, or of making a claim against someone. If you decide to buy legal expenses cover, just make sure you don’t have it already. Legal expenses is an optional cover that can be added to your saga home insurance policy.

Source: realvaluehome.ca

Source: realvaluehome.ca

To make sure you get the cover you expect from accidental damage insurance, always read your policy carefully so you’re aware how your insurer defines accidental damage and what is included and excluded from the cover. Personal injury claims employment disputes, such as unfair dismissal or discrimination disputes over faulty or damaged goods issues with neighbours, such as noise and boundary disputes tax disputes medical. Is worth more than £1 million. Homeowners insurance is not legally required, but if you plan on taking out a mortgage on a home, your lender will most likely require you to purchase coverage when you go to close on the property. You can’t typically get coverage for something that’s already happening — say, you’re in the.

Source: dolmanlaw.com

Source: dolmanlaw.com

You’ll be offered the cover automatically whenever you get a quotation, but if you decide against taking it out, you can add it at a later date. If you happen to be one of the lucky few out there who has paid off their mortgage, you don�t have to purchase homeowners insurance. Many insurers, if you refuse to pay for it, will just let you have legal expense cover free, anyway. Do i need home insurance legal cover? The insurance information institute (iii) recommends you buy enough to cover your assets, or at least $300,000 to $500,000 worth of coverage for the average homeowner.

Source: slideshare.net

Source: slideshare.net

Home insurance policies often don’t allow for a homeowner to leave their house unattended for an extended period of time.now, there’s a difference between an unoccupied home and a vacant home, but the bottom line is that you may need to get special. Do i need legal cover on home insurance? Legal cover does not pay out compensation to you but recovers the legal costs you incur when you pursue a third party for damages. It provides up to £100,000 to cover the cost of legal action brought by or against you, as long as the legal team believes you can win your case. Personal injury claims employment disputes, such as unfair dismissal or discrimination disputes over faulty or damaged goods issues with neighbours, such as noise and boundary disputes tax disputes medical.

Source: canadiancorrections.com

Source: canadiancorrections.com

It�ll protect you against the costs of being sued, or of making a claim against someone. You might also have legal protection through your employer or your trade union. You don�t have to have it by law, but it can be a good thing. Legal cover doesn’t add that much to the overall cost of home insurance and could provide up to £100,000 in legal costs. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage.

Source: insurancenoon.com

Source: insurancenoon.com

(but note that you will still need ‘all risks cover’ or ‘personal possessions cover’ to cover it whilst away from the home). Many insurers offer legal cover of up to £100,000, but it is worth looking for at least £50,000 worth of cover to ensure you are not left out of pocket, as legal costs can mount up. Adding legal expenses to a home insurance policy could cover you for costs on cases related to: (but note that you will still need ‘all risks cover’ or ‘personal possessions cover’ to cover it whilst away from the home). If a customer is successful in their legal expenses insurance claim, they’ll be able to cover legal costs, which usually include:

Source: tisteam.com

Source: tisteam.com

If, for example, you lost your job and you felt it was unfair dismissal, family legal protection could help you pay for the cost of going to an employment tribunal or equivalent to claim compensation. Home insurance isn’t a legal requirement, but it’s always a good idea to protect your home with both buildings insurance and contents insurance. But your home is arguably the. But these are only a few of the legal matters you might face. Homeowners insurance is not legally required, but if you plan on taking out a mortgage on a home, your lender will most likely require you to purchase coverage when you go to close on the property.

Source: ramseysolutions.com

Source: ramseysolutions.com

Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. Solicitors� fees court fees the fees of any expert witnesses any legal costs awarded to the other party in the dispute the policyholder is usually required to accept any reasonable offer of settlement. Do i need legal cover on home insurance? 7 find out what your home insurance offers before you make a choice on your legal insurance plan options. Do i need legal cover on home insurance?

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

You can’t typically get coverage for something that’s already happening — say, you’re in the. The insurance information institute (iii) recommends you buy enough to cover your assets, or at least $300,000 to $500,000 worth of coverage for the average homeowner. You’ll be offered the cover automatically whenever you get a quotation, but if you decide against taking it out, you can add it at a later date. Home contents insurance buildings insurance car or motorcycle insurance It provides up to £100,000 to cover the cost of legal action brought by or against you, as long as the legal team believes you can win your case.

Source: bankrate.com

Source: bankrate.com

If a customer is successful in their legal expenses insurance claim, they’ll be able to cover legal costs, which usually include: But your home is arguably the. But while it’s reassuring to know it’s there if you need it, it’s worth thinking. You don�t have to have it by law, but it can be a good thing. (but note that you will still need ‘all risks cover’ or ‘personal possessions cover’ to cover it whilst away from the home).

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do you need legal cover on home insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.