Your Do you need insurance to lease a car images are ready. Do you need insurance to lease a car are a topic that is being searched for and liked by netizens now. You can Find and Download the Do you need insurance to lease a car files here. Find and Download all royalty-free vectors.

If you’re looking for do you need insurance to lease a car pictures information connected with to the do you need insurance to lease a car keyword, you have visit the right site. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

Do You Need Insurance To Lease A Car. You must have liability and collision coverage, which often is provided in your personal auto policy or through your credit card company. With either option, you�ll need to have the minimum required coverage to drive legally in your state, as well as coverage that meets the. Here are a few coverages to consider for a leased vehicle. Yes, you do have to insure a lease car and arrange this yourself.

Do You Need Insurance To Lease A Car at Insurance From revisi.net

Do You Need Insurance To Lease A Car at Insurance From revisi.net

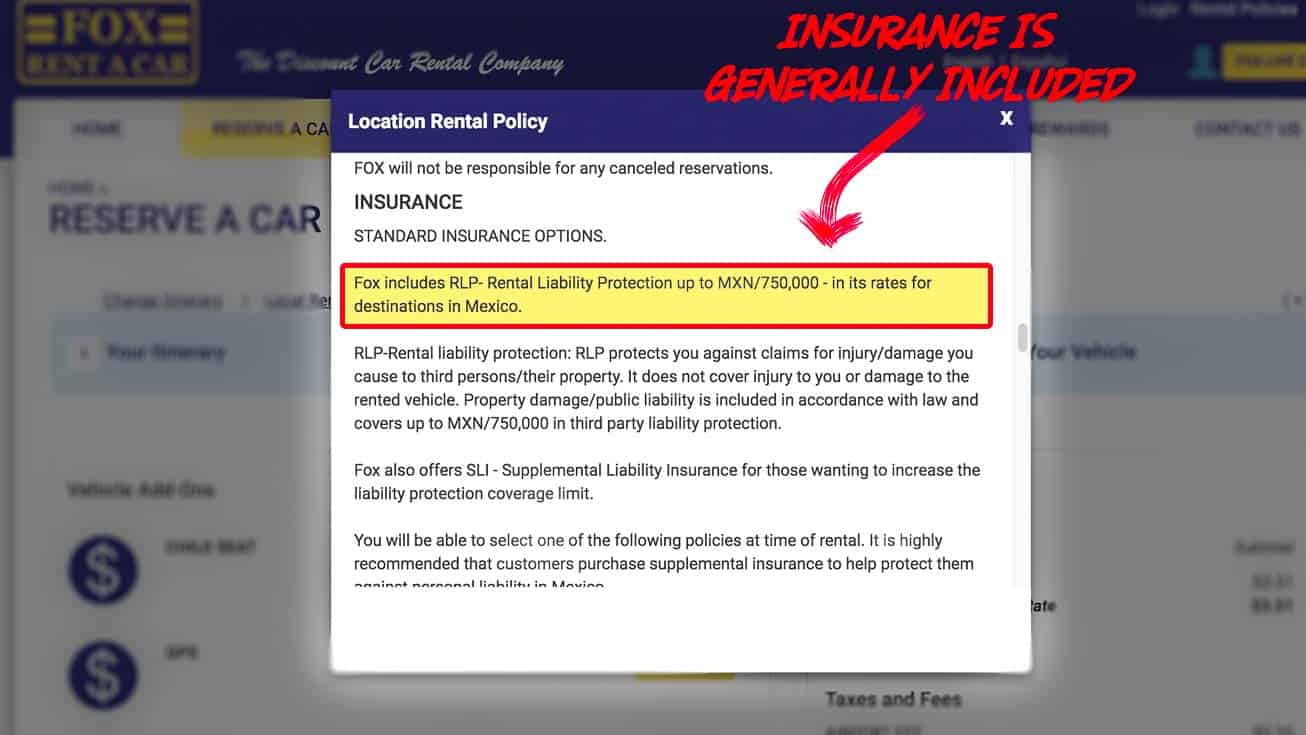

You will also need to ensure that it’s a fully comprehensive insurance policy, not just third party. And there are some considerations specific to car insurance for leased vehicles worth remembering. Our fuel & go package is a unique way you can bring together all aspects of leasing a car into one easy to manage payment. No, you do not need insurance to rent a car because rental companies have their own insurance. No, you don’t need to have insurance because rental cars are already insured. All with high limits and low deductibles.

Our fuel & go package is a unique way you can bring together all aspects of leasing a car into one easy to manage payment.

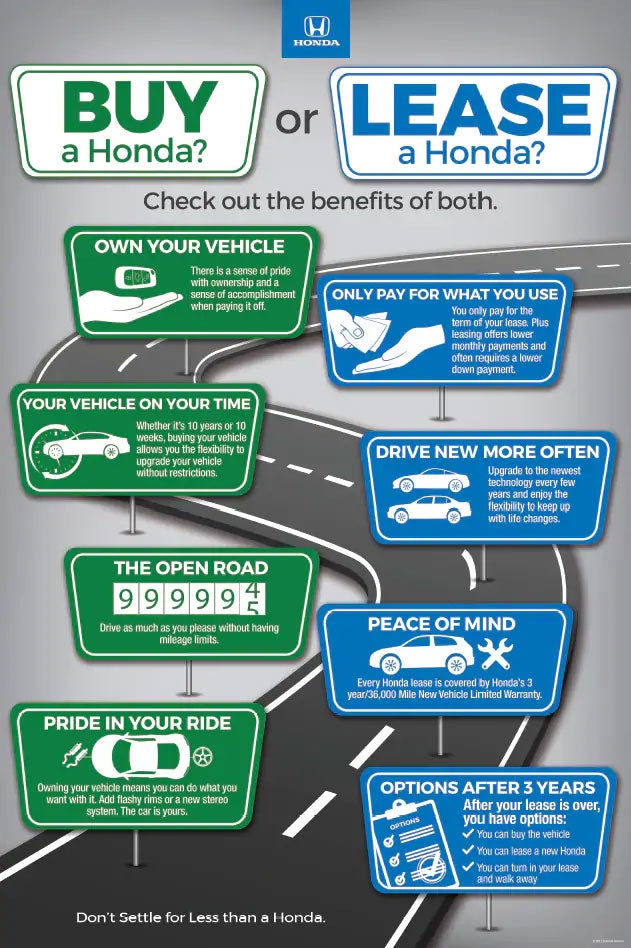

If you cannot provide proof of insurance, the car rental agency requires you to purchase the insurance from them. Fuel & go is a convenient way to get the vehicle you want already insured, maintenance & tax, all in one easy package. You must have liability and collision coverage, which often is provided in your personal auto policy or through your credit card company. When you lease a car, you have to buy auto insurance even though you don’t own the vehicle. And there are some considerations specific to car insurance for leased vehicles worth remembering. Car leases are popular among those who like driving new vehicles but don�t want the higher payments that typically come with financing a car.

Source: insurancepanda.com

Source: insurancepanda.com

Yet some rental firms typically have minimum coverage on their vehicles, so you could be hit with a hefty bill if you get in an accident. Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a. Also, what kind of insurance do i need to rent a car? Our fuel & go package is a unique way you can bring together all aspects of leasing a car into one easy to manage payment. For personal contract hire agreements, the person taking out the agreement must be the main policy holder or a named driver on the insurance certificate.

Source: cars2bike.com

Source: cars2bike.com

What type of car insurance do i need for my lease car? Do you need insurance to rent a car? (many insurers don�t allow this and require a credit card instead.) if you use a credit card, you won�t need proof of insurance, but you�ll still need to purchase some level of insurance to rent the vehicle. Also, what kind of insurance do i need to rent a car? Choosing to lease or finance a vehicle (rather than purchasing it outright) likely won’t have an impact on your premium, but the types of coverage you require may be different in each of these situations.

Source: revisi.net

Source: revisi.net

However, rental agencies typically have minimal coverage on their vehicles, so if. The dealership will inform you of the insurance you’ll be required to purchase to protect your leased car. Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a. Our fuel & go package is a unique way you can bring together all aspects of leasing a car into one easy to manage payment. Other options include buying extra insurance from the rental car company, using a credit card for coverage or getting a standalone policy.

Source: bellinghamautoacservice.com

Source: bellinghamautoacservice.com

The lease car will need to be insured from the very first day of the contract, to the very last day. That’s because you need to meet minimum auto insurance standards wherever you’re leasing as well as any additional requirements your lessor has, like comprehensive and collision coverage. That said, you won�t be able to drive off without some sort of coverage. Therefore, you’ll need to get insurance for a lease vehicle, whether you find a policy yourself or it’s sourced via your work through a business partnership. Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a.

Source: pinterest.com

Source: pinterest.com

But whether you buy or lease your vehicle, you need insurance on a leased car. Nearly all lessors will require comprehensive and collision coverage on a leased vehicle, and some will require liability limits above your state�s minimum. Even though you don�t own a leased car, you�re still required to carry your own insurance on the vehicle, according to the insurance information institute (iii). It covers the lease of the vehicle/s, road tax, maintenance and breakdown cover. Car insurance coverages required by law.

Source: darcarshonda.com

Source: darcarshonda.com

Choosing to lease or finance a vehicle (rather than purchasing it outright) likely won’t have an impact on your premium, but the types of coverage you require may be different in each of these situations. Setting up insurance for a lease car is the same as any other vehicle, except that you will need to tell the insurer that it’s a lease. With either option, you�ll need to have the minimum required coverage to drive legally in your state, as well as coverage that meets the. Even though you don�t own a leased car, you�re still required to carry your own insurance on the vehicle, according to the insurance information institute (iii). Choosing to lease or finance a vehicle (rather than purchasing it outright) likely won’t have an impact on your premium, but the types of coverage you require may be different in each of these situations.

Source: abiteofculture.com

Source: abiteofculture.com

Rental car companies usually provide minimum liability coverage only, so if you don’t have personal insurance, you’ll probably want to purchase extra rental car insurance through the rental company. Setting up insurance for a lease car is the same as any other vehicle, except that you will need to tell the insurer that it’s a lease. Yes, you do have to insure a lease car and arrange this yourself. If you cannot provide proof of insurance, the car rental agency requires you to purchase the insurance from them. Although leasing a vehicle allows you to make less per month than you would for a loan, you will be responsible for finding and purchasing your own car insurance after signing a lease while still making your lease payments.

Source: leasemorecarforlessmoney.com

Source: leasemorecarforlessmoney.com

All with high limits and low deductibles. Typically, dealers require $100,000 in bodily injury liability insurance, $50,000 in property damage liability, comprehensive and collision coverage, and a. When your lease is over, you have no stake in the vehicle and cannot sell it. What coverage do you need? But whether you buy or lease your vehicle, you need insurance on a leased car.

What coverage do you need? Gap (guaranteed asset protection) insurance is ideal if you lease a car because it covers any outstanding finance on your leasing agreement, should the car be stolen or written off. The dealership will inform you of the insurance you’ll be required to purchase to protect your leased car. If you cannot provide proof of insurance, the car rental agency requires you to purchase the insurance from them. It covers the lease of the vehicle/s, road tax, maintenance and breakdown cover.

Source: readersdigest.ca

Source: readersdigest.ca

Fuel & go is a convenient way to get the vehicle you want already insured, maintenance & tax, all in one easy package. You must take out a fully comprehensive insurance policy for your lease vehicle. But whether you buy or lease your vehicle, you need insurance on a leased car. Setting up insurance for a lease car is the same as any other vehicle, except that you will need to tell the insurer that it’s a lease. You don�t need to have your own auto insurance policy to rent a car.

Source: business2community.com

Source: business2community.com

You will also need to ensure that it’s a fully comprehensive insurance policy, not just third party. The lease car will need to be insured from the very first day of the contract, to the very last day. All with high limits and low deductibles. What coverage do you need? In general, rentals are automatically covered according to the state�s minimum for liability at no cost.

Source: bellinghamautoacservice.com

Source: bellinghamautoacservice.com

That said, you won�t be able to drive off without some sort of coverage. No, you don’t need to have insurance because rental cars are already insured. That’s because you need to meet minimum auto insurance standards wherever you’re leasing as well as any additional requirements your lessor has, like comprehensive and collision coverage. Fuel & go is a convenient way to get the vehicle you want already insured, maintenance & tax, all in one easy package. The dealership will inform you of the insurance you’ll be required to purchase to protect your leased car.

Source: revisi.net

Source: revisi.net

But whether you buy or lease your vehicle, you need insurance on a leased car. You don�t need your own car insurance to rent a car from enterprise or most other major car rental agencies. You don’t need to have your own auto insurance policy to rent a car. Does car leasing come with insurance? You must have liability and collision coverage, which often is provided in your personal auto policy or through your credit card company.

Source: ageco.co.uk

Source: ageco.co.uk

Gap (guaranteed asset protection) insurance is ideal if you lease a car because it covers any outstanding finance on your leasing agreement, should the car be stolen or written off. When you lease a car, you have to buy auto insurance even though you don’t own the vehicle. No, you do not need insurance to rent a car because rental companies have their own insurance. That said, some form of rental insurance is strongly advised because if you rent a car without insurance, you are responsible for any damages to the vehicle. Even though you don’t technically own a leased vehicle, you still need your own insurance for it.

Source: pinterest.com

Source: pinterest.com

Nearly all lessors will require comprehensive and collision coverage on a leased vehicle, and some will require liability limits above your state�s minimum. When you lease a car, you have to buy auto insurance even though you don’t own the vehicle. For personal contract hire agreements, the person taking out the agreement must be the main policy holder or a named driver on the insurance certificate. You typically don�t need to show proof of insurance when renting a car unless you use a debit card to pay for it. Here are a few coverages to consider for a leased vehicle.

Source: gettingstamped.com

Source: gettingstamped.com

Car insurance coverages required by law. That said, some form of rental insurance is strongly advised because if you rent a car without insurance, you are responsible for any damages to the vehicle. It covers the lease of the vehicle/s, road tax, maintenance and breakdown cover. But whether you buy or lease your vehicle, you need insurance on a leased car. Do you need insurance to rent a car?

Source: pinterest.com

Source: pinterest.com

That said, some form of rental insurance is strongly advised because if you rent a car without insurance, you are responsible for any damages to the vehicle. You may, however, need to purchase supplemental liability insurance to cover damages to another driver if you cause the accident (if your existing liability coverage doesn’t include rental cars). Gap (guaranteed asset protection) insurance is ideal if you lease a car because it covers any outstanding finance on your leasing agreement, should the car be stolen or written off. All with high limits and low deductibles. Does car leasing come with insurance?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you need insurance to lease a car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.