Your Do you need homeowners insurance before closing images are ready. Do you need homeowners insurance before closing are a topic that is being searched for and liked by netizens today. You can Find and Download the Do you need homeowners insurance before closing files here. Find and Download all free vectors.

If you’re searching for do you need homeowners insurance before closing pictures information linked to the do you need homeowners insurance before closing topic, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

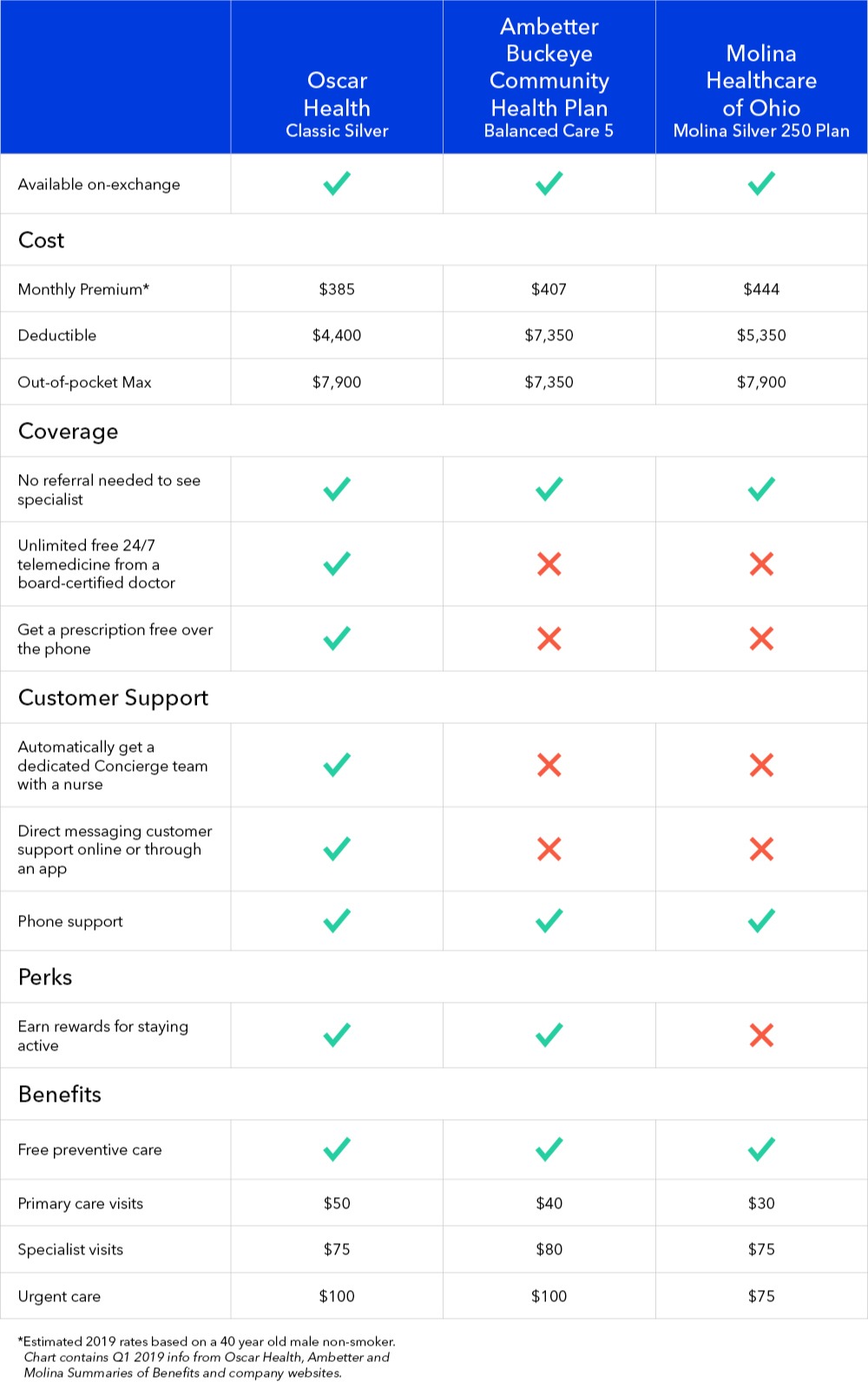

Do You Need Homeowners Insurance Before Closing. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Homeowners insurance premiums at closing requires you to stay alert and make sure everything is in place before you make your final decision and pay. You will be asked to provide a copy of a paid receipt and declarations page to satisfy your loan requirements. How long does it take to get homeowners insurance?

The (Mostly) Definitive Guide to Home Insurance From realtor.com

The (Mostly) Definitive Guide to Home Insurance From realtor.com

When you pay at closing you can negotiate and put a condition into your contract that the seller pays a portion of the cost, typically 3% to 6%. Insurance is a standard prerequisite for home loans. Do you need homeowners insurance before closing on a house? Homes are at a higher risk for damage when they are empty, and some insurance companies will only insure a house for so long before they cancel the policy. The post do you need homeowners insurance before closing on a house? Appeared first on at home in the future.

Buying homeowners insurance before closing enables your lender to establish an escrow for.

It is important to research various insurance policy options as they may offer different levels of coverage. Do you need homeowners insurance before closing on a house? Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. You may need an insurance binder to close on a home mortgage. Protecting your new home with homeowner’s insurance is important to you, and by law you are required to maintain homeowner’s insurance at all times, but do you need to purchase homeowner’s insurance before the closing on your new home? Appeared first on at home in the future.

Source: experthomereport.com

Source: experthomereport.com

If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. If you’re financing the purchase of your home through a mortgage, you are required to pay your homeowners insurance premium for the first year of homeownership by closing. Buying homeowners insurance before closing enables your lender to establish an escrow for. You may need an insurance binder to close on a home mortgage. The answer is a definitive yes as not only will homeowner’s insurance prior to closing be required by your lender, but also.

Source: experthomereport.com

Source: experthomereport.com

The answer is a definitive yes as not only will homeowner’s insurance prior to closing be required by your lender, but also. The answer is a definitive yes as not only will homeowner’s insurance prior to closing be required by your lender, but also. Otherwise, the loan won’t be. Although paid at the same time as closing, prepaid costs like your homeowners premium are not the same as closing costs. Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Protecting your new home with homeowner’s insurance is important to you, and by law you are required to maintain homeowner’s insurance at all times, but do you need to purchase homeowner’s insurance before the closing on your new home? Otherwise, the loan won’t be. Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing. Do i have to buy home insurance before closing? But that does not mean you have nothing to do before closing day.

Source: insurify.com

Source: insurify.com

One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Do i have to buy home insurance before closing? Although paid at the same time as closing, prepaid costs like your homeowners premium are not the same as closing costs. If you do not have homeowners insurance, it is very possible that no one will grant you a mortgage.

Source: realtor.com

Source: realtor.com

Attorneys banks credit unions financial advisors car insurance insurance agents mortgage providers real estate agents Appeared first on at home in the future. The binder will include information about your insurance such as policy coverage limits and covered perils. So, do you have to get insurance before closing? You may need an insurance binder to close on a home mortgage.

Source: gobankingrates.com

Source: gobankingrates.com

Before you can close on a mortgage, it is necessary to do a title search, gather cash for closing costs, then purchase a homeowners policy. Homeowners insurance is the kind of thing you hope you never have to use, but if you need it, it�s invaluable. By securing the coverage you need before you even move into your new home, you safeguard your purchase from disaster. Otherwise, the loan won’t be. You still have some things to take in consideration before closing.

Source: kelloninsurance.com

Source: kelloninsurance.com

Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at. Insurance is a standard prerequisite for home loans. You also need to let your insurance company know when you move out if you haven’t yet sold the house. It is important to research various insurance policy options as they may offer different levels of coverage. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Homeowners insurance is the kind of thing you hope you never have to use, but if you need it, it�s invaluable. If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. Yes, while homeowners insurance is not required by law, most mortgage lenders require it in exchange for extending you a home loan. Attorneys banks credit unions financial advisors car insurance insurance agents mortgage providers real estate agents Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at.

Source: compareclosing.com

Source: compareclosing.com

You may need an insurance binder to close on a home mortgage. You also need to let your insurance company know when you move out if you haven’t yet sold the house. Yes, you�ll typically need to prove at closing that you�ve paid the first full year of premiums on your homeowners insurance. Acquiring homeowners insurance is one condition that you’ll have to meet before closing. Do i have to buy home insurance before closing?

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

It is important to research various insurance policy options as they may offer different levels of coverage. Although paid at the same time as closing, prepaid costs like your homeowners premium are not the same as closing costs. Do i have to buy home insurance before closing? Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. When you pay at closing you can negotiate and put a condition into your contract that the seller pays a portion of the cost, typically 3% to 6%.

Source: memphislatest.blogspot.com

Source: memphislatest.blogspot.com

Before you can close on a mortgage, it is necessary to do a title search, gather cash for closing costs, then purchase a homeowners policy. An insurance binder is a temporary proof of homeowners insurance provided by your insurance company. Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing. If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Before you can close on a mortgage, it is necessary to do a title search, gather cash for closing costs, then purchase a homeowners policy. Insurance is a standard prerequisite for home loans. Before you can close on a mortgage, it is necessary to do a title search, gather cash for closing costs, then purchase a homeowners policy. If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. Buying homeowners insurance before closing enables your lender to establish an escrow for.

Source: edmontonlaw.ca

Source: edmontonlaw.ca

Homeowners insurance premiums at closing requires you to stay alert and make sure everything is in place before you make your final decision and pay. Attorneys banks credit unions financial advisors car insurance insurance agents mortgage providers real estate agents Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at. Yes, if you are purchasing a house with a mortgage, you must buy homeowners insurance before closing. Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing.

Source: gethomeownersinsurance.net

Source: gethomeownersinsurance.net

Yes, if you are purchasing a house with a mortgage, you must buy homeowners insurance before closing. The reason for this is that the lenders want to protect their investment. Before you close on a mortgage, your lender may require that you obtain homeowners insurance and keep your home covered until the loan is paid off. You will be asked to provide a copy of a paid receipt and declarations page to satisfy your loan requirements. Before you can close on a mortgage, it is necessary to do a title search, gather cash for closing costs, then purchase a homeowners policy.

Source: progressive.com

Source: progressive.com

Otherwise, the loan won’t be. Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing. Homeowners insurance premiums at closing requires you to stay alert and make sure everything is in place before you make your final decision and pay. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. But that does not mean you have nothing to do before closing day.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Yes, you�ll typically need to prove at closing that you�ve paid the first full year of premiums on your homeowners insurance. You also need to let your insurance company know when you move out if you haven’t yet sold the house. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at least a year in order to close on your home.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Insurance is a standard prerequisite for home loans. An insurance binder is a temporary proof of homeowners insurance provided by your insurance company. It is important to research various insurance policy options as they may offer different levels of coverage. Do i have to buy home insurance before closing? Acquiring homeowners insurance is one condition that you’ll have to meet before closing.

Source: mysecrets4life.blogspot.com

Source: mysecrets4life.blogspot.com

Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at. The reason for this is that the lenders want to protect their investment. Homeowners insurance is the kind of thing you hope you never have to use, but if you need it, it�s invaluable. You will be asked to provide a copy of a paid receipt and declarations page to satisfy your loan requirements.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you need homeowners insurance before closing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.