Your Do you have to inform insurance company of accident images are available in this site. Do you have to inform insurance company of accident are a topic that is being searched for and liked by netizens now. You can Get the Do you have to inform insurance company of accident files here. Get all free photos.

If you’re looking for do you have to inform insurance company of accident images information linked to the do you have to inform insurance company of accident topic, you have visit the ideal site. Our website always gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Do You Have To Inform Insurance Company Of Accident. You would be best served by cooperating with your insurance company. There is no need to call the insurance company immediately after the crash, but you should inform them promptly. You must also report the accident to your insurance company, even if you’re not planning to make a claim. Review your policy and it will tell you.

How to File a Claim for a Car Accident in the UAE From bankonus.com

How to File a Claim for a Car Accident in the UAE From bankonus.com

While that is a possibility, it is remote. First, inform the other person’s insurer that you have been involved in a crash with one of its policyholders. In fact, some people don�t call their agent even when they believe the other person is at fault. After a car accident, you may receive a call from the other driver�s insurance company, regardless of how clear it may be that the other driver was at fault for the crash.even in situations where you�re at fault, the other driver�s insurance company could still contact you. When providing notice to your insurance company, however, you do not have to make any statements on the details of what happened in your accident. If you do not, your insurance company is.

For example, you backed into the garage door or scraped your car on your driveway.

Many people think that the insurance company needs as many details as possible following an accident. Many people think that the insurance company needs as many details as possible following an accident. In fact, some people don�t call their agent even when they believe the other person is at fault. The only time that it might be reasonable to not report the accident to your insurance company is when a collision happened in your vehicle and on your property. It�s a good idea to get in touch with your insurance carrier within 72 hours of any incident that may prompt the filing of a claim. Here are reasons why it is important to do this:

Source: gogirl.co.uk

Source: gogirl.co.uk

Notify your insurance company to have the benefit of any of these coverages on your policy, you are required to report the accident to your insurance company. You entered into a legally binding contract with your insurance company that specifically spells out when and how you must notify your insurance company of certain events. You want to report your accident as soon as possible after it occurs. Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries. If you do not, your insurance company is.

Source: pinterest.com

Source: pinterest.com

If you do not, your insurance company is. Review your policy and it will tell you. You should send your insurer a letter telling them what�s happened. Of course, both you and the other driver in the accident have to agree to this course of action because, if one of you reports the accident and the other doesn’t, this could cause a problem when it comes time to collect on a. From the facts you present, it appears you are concerned united healthcare may “subrogate” against your opponent.

Source: pinterest.com

Source: pinterest.com

An alternative if you have this concern is to file a. Instead, giving them your full name, telephone number, and address should be enough. Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries. Regardless of fault, it is important to call your insurance company and report any accident that involved injuries or property damage. Do i have to inform my insurance company if i have an accident?

Source: goldmandaszkal.com

Source: goldmandaszkal.com

Before your next fender bender, though, be sure you understand when you should inform your insurance company and when you should resist the temptation to put in for a claim and pay out of pocket. Review your policy and it will tell you. After a car accident, you may receive a call from the other driver�s insurance company, regardless of how clear it may be that the other driver was at fault for the crash.even in situations where you�re at fault, the other driver�s insurance company could still contact you. No injuries appeared and the only property damaged is your own. First, inform the other person’s insurer that you have been involved in a crash with one of its policyholders.

Source: bankonus.com

Source: bankonus.com

An alternative if you have this concern is to file a. Notify your insurance company to have the benefit of any of these coverages on your policy, you are required to report the accident to your insurance company. You must do this within a reasonable amount of time. Instead, give the insurer the facts to show their driver is at fault and liable for your damages. You don’t have to report an accident to an insurance company if you don’t want to.

Source: vatrials.com

Source: vatrials.com

You should send your insurer a letter telling them what�s happened. Regardless of fault, it is important to call your insurance company and report any accident that involved injuries or property damage. If you do not, your insurance company is. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. Your lawyer can do that for you.

Source: osullivan-law-firm.com

Source: osullivan-law-firm.com

No injuries appeared and the only property damaged is your own. A common myth is that you do not need to contact. First, inform the other person’s insurer that you have been involved in a crash with one of its policyholders. I think mr cow�s point might be, putting moral and legal obligations aside, whether it is possible for an insurance company to tell whether you have been in an accident if you are not named in the insurance policy. Instead, giving them your full name, telephone number, and address should be enough.

Source: thelawadvisory.com

Source: thelawadvisory.com

Regardless of fault, it is important to call your insurance company and report any accident that involved injuries or property damage. Your lawyer can do that for you. Relay only the facts of the accident, even if you believe the other driver to be at fault, it’s not smart to just say that. An alternative if you have this concern is to file a. The only time that it might be reasonable to not report the accident to your insurance company is when a collision happened in your vehicle and on your property.

Source: weismaninsurance.net

Source: weismaninsurance.net

You entered into a legally binding contract with your insurance company that specifically spells out when and how you must notify your insurance company of certain events. This should ensure your insurer doesn’t settle with the other party�s insurer] without your knowledge. You want to report your accident as soon as possible after it occurs. You would be best served by cooperating with your insurance company. Do i have to tell my insurer?

Source: thelawadvisory.com

Source: thelawadvisory.com

You don’t have to report an accident to an insurance company if you don’t want to. An alternative if you have this concern is to file a. It�s a good idea to get in touch with your insurance carrier within 72 hours of any incident that may prompt the filing of a claim. In fact, some people don�t call their agent even when they believe the other person is at fault. For example, you backed into the garage door or scraped your car on your driveway.

Source: farofffromthe42ndparadoxbeyondpolaris.blogspot.com

Source: farofffromthe42ndparadoxbeyondpolaris.blogspot.com

To subrogate means they may pursue your opponent for reimbursement for the monies they paid out on your behalf. To subrogate means they may pursue your opponent for reimbursement for the monies they paid out on your behalf. But make it crystal clear that this is for ‘information only’ and that you don’t wish to make a claim. You want to report your accident as soon as possible after it occurs. Your lawyer can do that for you.

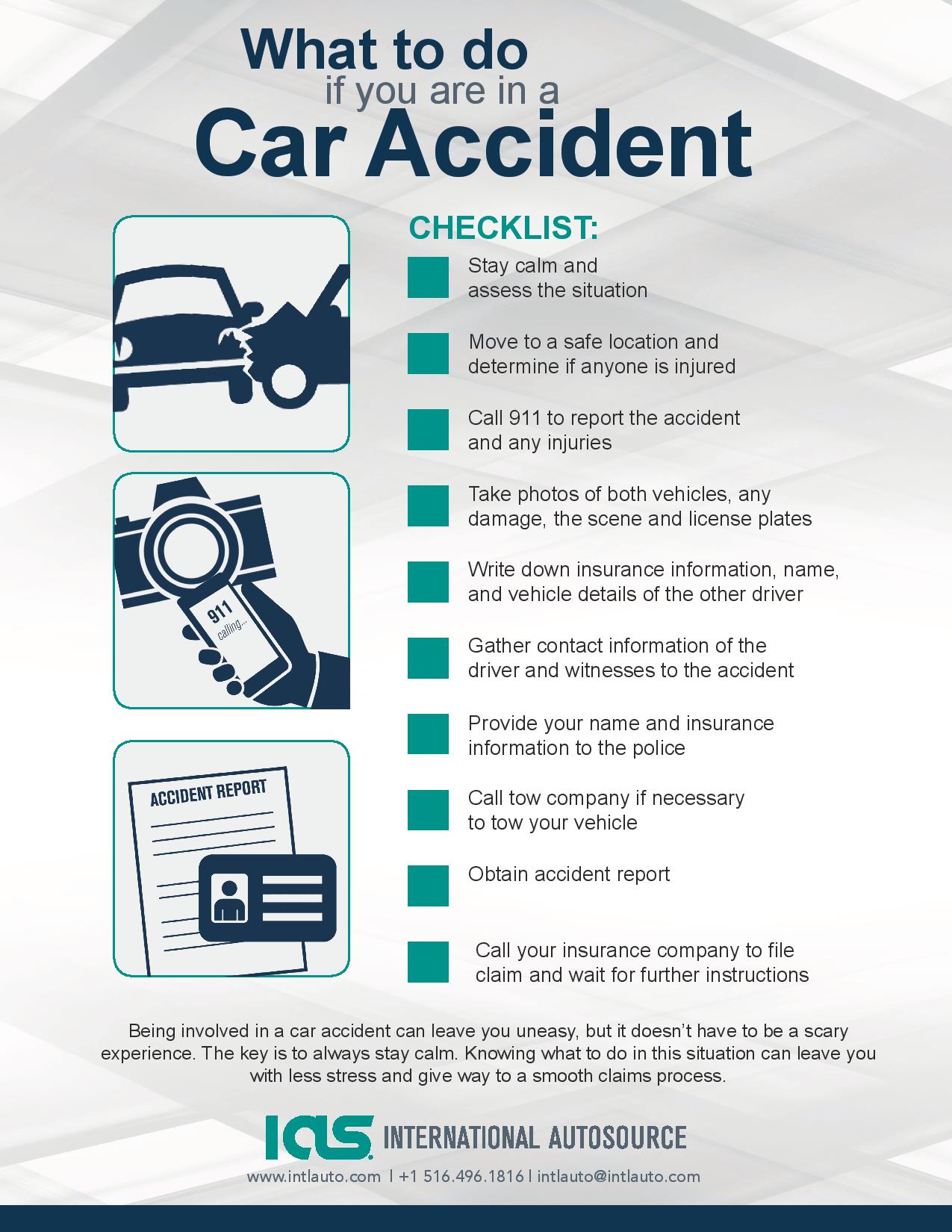

Source: blog.intlauto.com

Source: blog.intlauto.com

However, you do have to inform your insurer if you�ve been in an accident. Either way, you need to be careful with the information you provide to the other driver�s car insurance company. Do i have to inform my insurance company if i have an accident? Reporting your accident is simply notifying your insurance company that an accident occurred, not filing a claim to receive coverage for your property damages or injuries. You would be best served by cooperating with your insurance company.

Source: agentchris.com

Source: agentchris.com

I think mr cow�s point might be, putting moral and legal obligations aside, whether it is possible for an insurance company to tell whether you have been in an accident if you are not named in the insurance policy. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. Instead, giving them your full name, telephone number, and address should be enough. Before your next fender bender, though, be sure you understand when you should inform your insurance company and when you should resist the temptation to put in for a claim and pay out of pocket. You should send your insurer a letter telling them what�s happened.

Source: wkw.com

Source: wkw.com

While you must notify the insurance company of the accident, you should not explain the details of the accident, your injuries, or other potential damages at this time. Regardless of fault, it is important to call your insurance company and report any accident that involved injuries or property damage. Do i have to tell my insurer? In fact, some people don�t call their agent even when they believe the other person is at fault. You must also report the accident to your insurance company, even if you’re not planning to make a claim.

Source: 90snews.com

Source: 90snews.com

It�s a good idea to get in touch with your insurance carrier within 72 hours of any incident that may prompt the filing of a claim. Many times this is within 72 hours of the accident. Many people think that the insurance company needs as many details as possible following an accident. You want to report your accident as soon as possible after it occurs. While you must notify the insurance company of the accident, you should not explain the details of the accident, your injuries, or other potential damages at this time.

Source: rachelgallaher.blogspot.com

Source: rachelgallaher.blogspot.com

For example, you backed into the garage door or scraped your car on your driveway. Do i have to inform my insurance company if i have an accident? You would be best served by cooperating with your insurance company. You don’t have to report an accident to an insurance company if you don’t want to. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance.

Source: motor1.com

Source: motor1.com

I think mr cow�s point might be, putting moral and legal obligations aside, whether it is possible for an insurance company to tell whether you have been in an accident if you are not named in the insurance policy. In fact, some people don�t call their agent even when they believe the other person is at fault. If you fail to report it, your insurer could refuse to renew your policy or you could have your cover cancelled, so make it a priority. Either way, you need to be careful with the information you provide to the other driver�s car insurance company. You entered into a legally binding contract with your insurance company that specifically spells out when and how you must notify your insurance company of certain events.

Source: guidesglobal.com

Source: guidesglobal.com

Many people think that the insurance company needs as many details as possible following an accident. However, when speaking with them for the first time, you do not have to provide them with all of your personal information. Of course, both you and the other driver in the accident have to agree to this course of action because, if one of you reports the accident and the other doesn’t, this could cause a problem when it comes time to collect on a. In fact, some people don�t call their agent even when they believe the other person is at fault. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you have to inform insurance company of accident by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.