Your Do you have to declare points to insurance straight away images are available. Do you have to declare points to insurance straight away are a topic that is being searched for and liked by netizens today. You can Get the Do you have to declare points to insurance straight away files here. Find and Download all royalty-free photos.

If you’re looking for do you have to declare points to insurance straight away images information related to the do you have to declare points to insurance straight away interest, you have visit the ideal blog. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

Do You Have To Declare Points To Insurance Straight Away. You�ll need to reply within 28 days, sending back the name and details of the person driving at the time. Most insurers only ask you to declare any points received while you’ve been covered by them at renewal time, but some state in their terms that you must tell them as soon as you. If it was a cash fixup, consider biting your tongue. You do need to inform them as soon as the points are on the license.

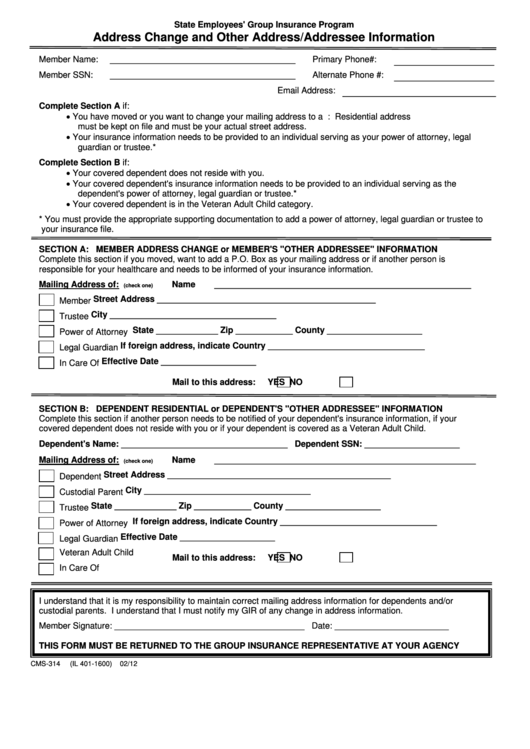

Fillable Address Change And Other Address/addressee From formsbank.com

Fillable Address Change And Other Address/addressee From formsbank.com

So even if the points have been removed after four years, you’ll need to keep declaring them to most insurers for a further year. Dp�s just written off my car (plus 2 others). If it was a cash fixup, consider biting your tongue. As with doc cover it�s totally down to the individual policy in question. But some providers require you to tell them straight away. You�ll need to reply within 28 days, sending back the name and details of the person driving at the time.

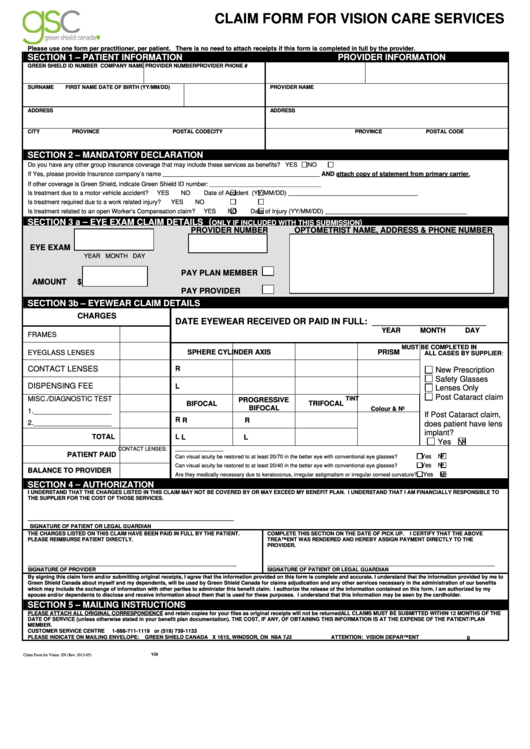

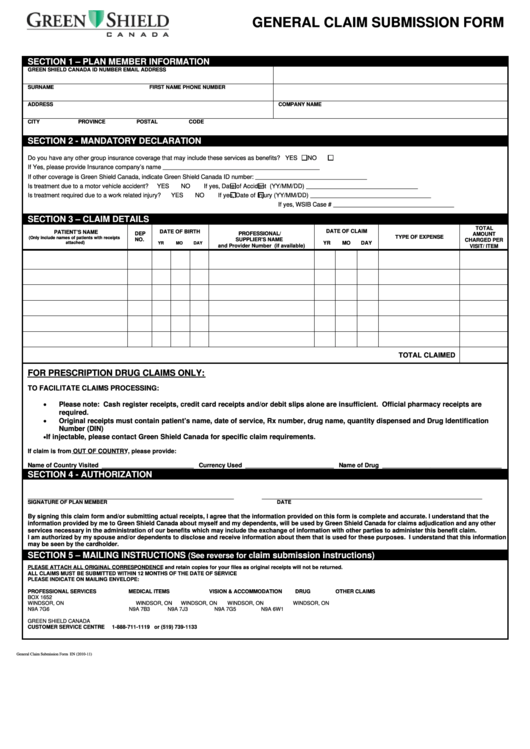

Specialist cover for drivers with spent and unspent penalty points

If you attend a speed awareness course instead of adding points to your licence, you don�t need to tell us about it. You could face also criminal charges for fraudulently withholding information from your insurer. So if you’re caught speeding, you could get 3 points on your licence and a fine of at least £100. If you get points on your licence, your car insurance is likely to go up. They’re to keep you, other road users, and pedestrians as safe as possible. If you get a motoring conviction, driving licence endorsement or fixed penalty notice during the policy year, you must tell us about it before your renewal.

Source: formsbank.com

Source: formsbank.com

You�ll need to reply within 28 days, sending back the name and details of the person driving at the time. Not telling your insurer about previous motoring or criminal convictions could invalidate your insurance. Penalty points if you or any named drivers receive a fixed penalty, motoring conviction or are disqualified during your policy term you must tell your insurer at renewal, using the dvla conviction code. Dp�s just written off my car (plus 2 others). Specialist cover for drivers with spent and unspent penalty points

Source: formsbank.com

Source: formsbank.com

It�s always worth asking your insurer too via phone/email even if the documentation mentions that you have to declare straight away, so i found out, as even though mine stated in the documentation they need to know about any changes including driving convictions straight away, it turns out they actually dont, which has saved me a lot of time, hassle and money. So if you’re caught speeding, you could get 3 points on your licence and a fine of at least £100. How long do you need to tell your insurer about conviction points on your driving licence? Speed limits are there for a reason: When it’s time to renew your car insurance you will find that the vast majority of insurance providers ask you about driving convictions within the last five years.

Source: formsbank.com

Source: formsbank.com

If you don�t, you�ll be required to produce your licence to the police within seven days to have the points added. If you don�t, you�ll be required to produce your licence to the police within seven days to have the points added. I didn�t declare 3 points on license to insurers, now got to make a claim. But the amount it will go up will depend on a few factors. This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive.

Source: liputan6.nanyamulu.com

Source: liputan6.nanyamulu.com

If you get points on your licence, your car insurance is likely to go up. They’re to keep you, other road users, and pedestrians as safe as possible. Dp�s just written off my car (plus 2 others). Penalty points if you or any named drivers receive a fixed penalty, motoring conviction or are disqualified during your policy term you must tell your insurer at renewal, using the dvla conviction code. Declaring penalty points to your car insurance.

Source: sr22insurancenews.com

Penalty points if you or any named drivers receive a fixed penalty, motoring conviction or are disqualified during your policy term you must tell your insurer at renewal, using the dvla conviction code. But the amount it will go up will depend on a few factors. If you don’t, your insurance policy will be invalidated, meaning any future claims could be turned down. When you begin accumulating penalty points on your driving record, your insurance premiums will probably increase. And if you have any convictions for motoring offences when taking out car insurance, you�ll need to let the insurer know.

Source: straighttalkla.com

Source: straighttalkla.com

The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. The same applies to any penalty points on your licence. Many state that you must declare any points as soon as you get them. Specialist cover for drivers with spent and unspent penalty points Under the road traffic act 1998, you are legally required to inform your insurer if you receive any points on your licence.

The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. If you�re caught speeding by a camera you�ll be sent a notice of intended prosecution (nip) which will explain the offence. This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive. If you don�t, you�ll be required to produce your licence to the police within seven days to have the points added. If you attend a speed awareness course instead of adding points to your licence, you don�t need to tell us about it.

So if you’re caught speeding, you could get 3 points on your licence and a fine of at least £100. I didn�t declare 3 points on license to insurers, now got to make a claim. Under the road traffic act 1998, it is an offence to withhold relevant information when applying for car insurance. So even if the points have been removed after four years, you’ll need to keep declaring them to most insurers for a further year. Price comparison site comparethemarket estimated that someone with six points on their licence could face a £328 hike on the cost of a new policy.

Source: express.co.uk

Source: express.co.uk

When to disclose driving convictions if you are applying for insurance, insurers will ask you for details on any endorsements. I didn�t declare 3 points on license to insurers, now got to make a claim. When to disclose driving convictions if you are applying for insurance, insurers will ask you for details on any endorsements. If you don�t, you�ll be required to produce your licence to the police within seven days to have the points added. Yes, it’s important to tell your insurance provider if you receive points for a motoring conviction or a fixed penalty notice.

Source: dc-acupuncture.com

Source: dc-acupuncture.com

Most insurers only ask you to declare any points received while you’ve been covered by them at renewal time, but some state in their terms that you must tell them as soon as you. And you must meet the minimum eyesight. Dp�s just written off my car (plus 2 others). Many state that you must declare any points as soon as you get them. If you get points on your licence, your car insurance is likely to go up.

Source: formsbank.com

Source: formsbank.com

B bora nelson registered joined sep 27, 2005 48 posts #7 · mar 8, 2006 just ring em and tell them. Policy providers will assess your risk factors, including any driving endorsements, when quoting cover for any length of time. I think you do need to tell them straightaway, you know that small print in the policy note that says �you must inform us if your circumstances have changed, health, penalty points, modifications to the car blah blah blah. The same applies to any penalty points on your licence. Specialist cover for drivers with spent and unspent penalty points

Source: rias.co.uk

Source: rias.co.uk

This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive. The car insurer you�re requesting a quote from (or the comparison website) will generally ask you for any motoring convictions over the past 5 years. So even if the points have been removed after four years, you’ll need to keep declaring them to most insurers for a further year. I didn�t declare 3 points on license to insurers, now got to make a claim. This means that you’re legally obliged to tell a prospective (or current) insurer of any penalty points you receive.

Source: seetignes.com

Source: seetignes.com

Under the road traffic act 1998, it is an offence to withhold relevant information when applying for car insurance. Specialist cover for drivers with spent and unspent penalty points While this may not happen immediately, (although you should inform your insurers right away) as you might have to renew your insurance before the new prices can take effect, you will probably end up paying more. When you begin accumulating penalty points on your driving record, your insurance premiums will probably increase. If you don’t, your insurance policy will be invalidated, meaning any future claims could be turned down.

Source: styrowing.com

Source: styrowing.com

There should be something in the policy t&c saying they have to be immediately notified of any changes. But the amount it will go up will depend on a few factors. As with doc cover it�s totally down to the individual policy in question. If you�re caught speeding by a camera you�ll be sent a notice of intended prosecution (nip) which will explain the offence. If it was a cash fixup, consider biting your tongue.

Source: noxrentals.com

Source: noxrentals.com

Do i have to tell my insurer company about a speed awareness course? Many state that you must declare any points as soon as you get them. When it’s time to renew your car insurance you will find that the vast majority of insurance providers ask you about driving convictions within the last five years. “the short answer is immediately. The same applies to any penalty points on your licence.

.png “Accidental Death and Dismemberment Lawsuits”) Source: forthepeople.com

Do i have to tell my insurer company about a speed awareness course? How long do you need to tell your insurer about conviction points on your driving licence? I think you do need to tell them straightaway, you know that small print in the policy note that says �you must inform us if your circumstances have changed, health, penalty points, modifications to the car blah blah blah. “the short answer is immediately. It�s always worth asking your insurer too via phone/email even if the documentation mentions that you have to declare straight away, so i found out, as even though mine stated in the documentation they need to know about any changes including driving convictions straight away, it turns out they actually dont, which has saved me a lot of time, hassle and money.

Source: horaprensa.com

Source: horaprensa.com

If you don’t, your insurance policy will be invalidated, meaning any future claims could be turned down. You don�t need to mention parking fines. Do i have to tell my insurer company about a speed awareness course? Yes, it’s important to tell your insurance provider if you receive points for a motoring conviction or a fixed penalty notice. While this may not happen immediately, (although you should inform your insurers right away) as you might have to renew your insurance before the new prices can take effect, you will probably end up paying more.

Source: insuranceopedia.com

Source: insuranceopedia.com

Under the road traffic act 1998, it is an offence to withhold relevant information when applying for car insurance. If you don�t, you�ll be required to produce your licence to the police within seven days to have the points added. It�s down to me to claim from my insurance. How long do you need to tell your insurer about conviction points on your driving licence? Not telling your insurer about previous motoring or criminal convictions could invalidate your insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you have to declare points to insurance straight away by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.