Your Do you get homeowners insurance before closing images are ready in this website. Do you get homeowners insurance before closing are a topic that is being searched for and liked by netizens today. You can Get the Do you get homeowners insurance before closing files here. Download all royalty-free images.

If you’re searching for do you get homeowners insurance before closing images information related to the do you get homeowners insurance before closing keyword, you have visit the ideal blog. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

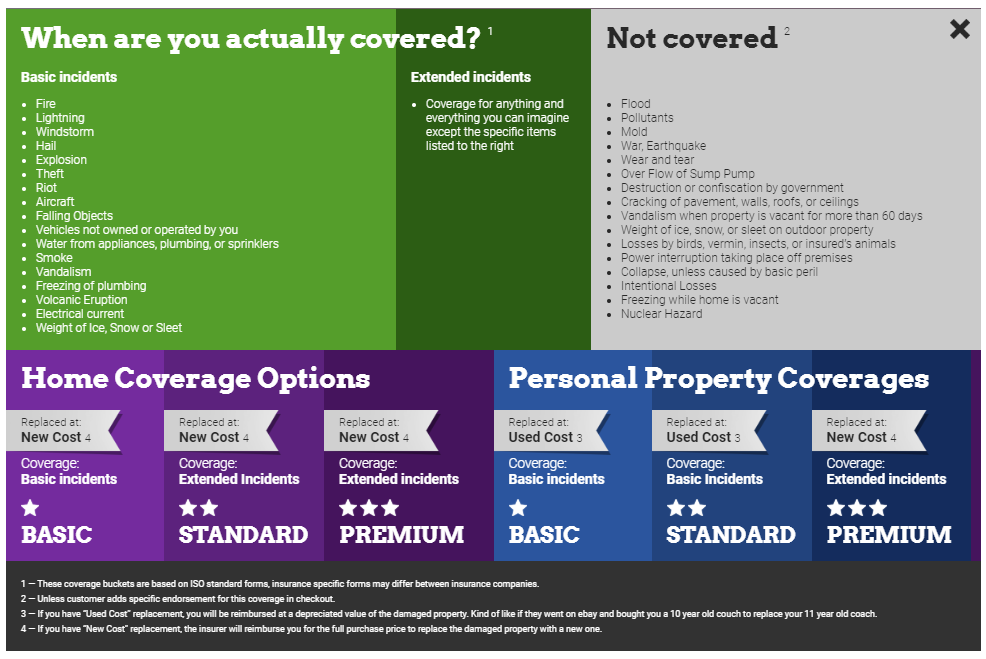

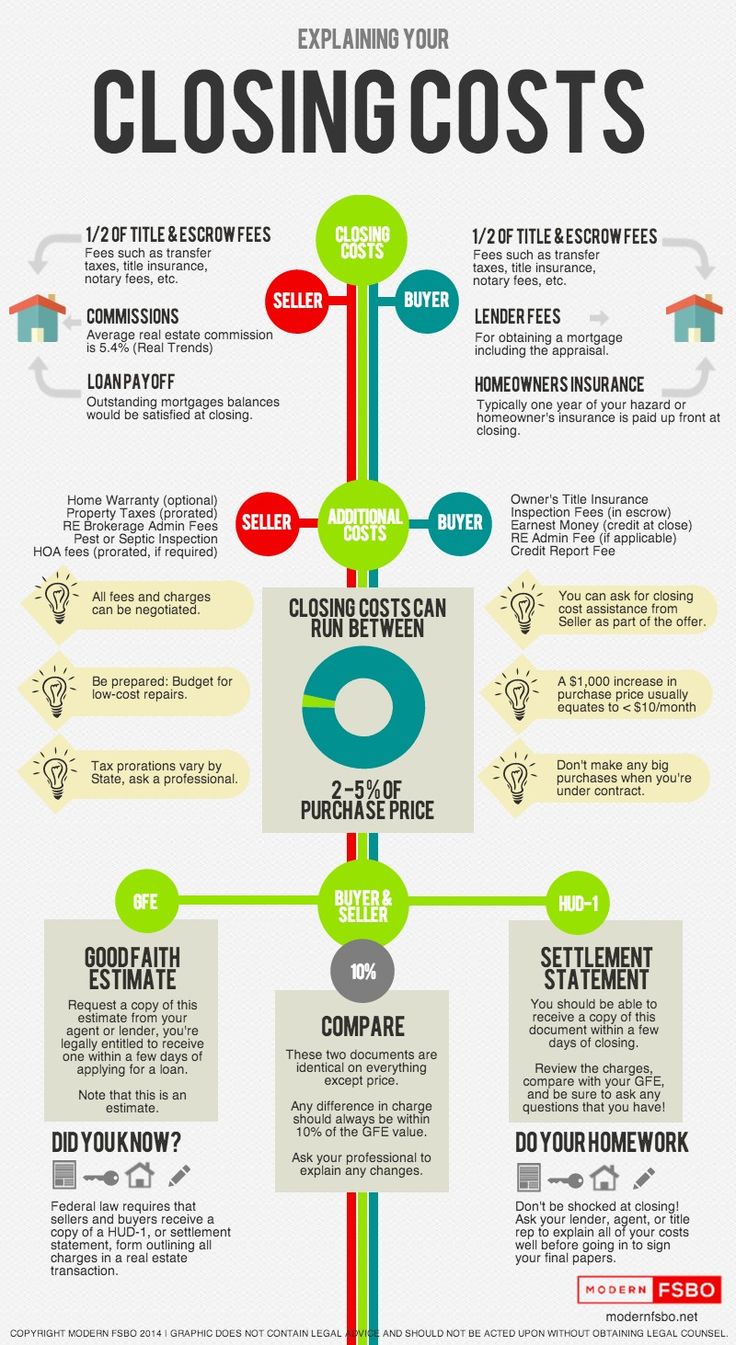

Do You Get Homeowners Insurance Before Closing. How long does it take to get homeowners insurance? A year from the closing enough money will have been collected through each monthly mortgage payment to pay for the second year’s premium, as well as every year thereafter. Experts say it’s best to start shopping for insurance up to a month before your closing date. When you buy a home with a mortgage, your lender will require you to get a homeowners insurance policy and provide proof of coverage before you can close on the loan.

Disability Insurance A Benefit for All From blog.disabilitycanhappen.org

Disability Insurance A Benefit for All From blog.disabilitycanhappen.org

Generally, mortgage lenders want you to have proof of homeowners insurance at least three business days before the closing date of your new home. So although you don’t need coverage to sell a house, you. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at least a year in order to close on your home. If your homeowners insurance is escrowed, the bank will issue a check for any prepayments on the insurance, usually within about 30 days, murtland said. You exclude the premium from your closing costs. In general, you purchase homeowners insurance before closing on the home.

Homeowners insurance premiums at closing requires you to stay alert and make sure everything is in place before you make your final decision and pay.

How long does it take to get homeowners insurance? One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance. You also have the option to pay the premium up front. You typically order homeowner�s insurance before closing on a home. When you buy a home with a mortgage, your lender will require you to get a homeowners insurance policy and provide proof of coverage before you can close on the loan. By securing the coverage you need before you even move into your new home, you safeguard your purchase from disaster.

Source: blog.disabilitycanhappen.org

Source: blog.disabilitycanhappen.org

One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance. Do i need homeowners insurance before closing? It is important to research various insurance policy options as they may offer different levels of coverage. You should get one at least two to three weeks before closing, just in case there’s a delay. Before closing on a new home, your lender will require you to purchase a home insurance policy.

Source: homeinsuranceking.com

Source: homeinsuranceking.com

When you buy a home with a mortgage, your lender will require you to get a homeowners insurance policy and provide proof of coverage before you can close on the loan. Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. So although you don’t need coverage to sell a house, you. You typically order homeowner�s insurance before closing on a home. How long does it take to get homeowners insurance?

Source: gobankingrates.com

Source: gobankingrates.com

Do i need homeowners insurance before closing? When you think about it from the lender’s perspective, it makes a lot of sense. For example, your lender could escrow. When you sell the house, your coverage is in effect until your title company sends in the payoff, or the funds to close the loan. This timing gives you ample wiggle room to compare coverages, rates, and the fine details of several insurers’ policies.

It is important to research various insurance policy options as they may offer different levels of coverage. But generally speaking, borrowers need to buy homeowners insurance before they can close on a home loan. Homeowners insurance premiums at closing requires you to stay alert and make sure everything is in place before you make your final decision and pay. If your homeowners insurance is escrowed, the bank will issue a check for any prepayments on the insurance, usually within about 30 days, murtland said. Do i have to buy home insurance before closing?

Sometimes insurers will take a home appraisal instead of an inspection, but this isn�t. In most cases, you’ll need to provide proof of insurance. When you think about it from the lender’s perspective, it makes a lot of sense. Therefore, at the closing there is not any money in the escrow account to pay the first year’s premium. Unless you’re paying in full with cash, you will have to pay for homeowners insurance either before or during the closing process.

Source: memphislatest.blogspot.com

Source: memphislatest.blogspot.com

Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing. One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance. When you buy a home with a mortgage, your lender will require you to get a homeowners insurance policy and provide proof of coverage before you can close on the loan. Do i need homeowners insurance before closing? When you sell the house, your coverage is in effect until your title company sends in the payoff, or the funds to close the loan.

Source: better.com

Source: better.com

You’ll already be dealing with your homeowners insurance prior to closing, because you’ll order the policy before closing time. If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. Do i need homeowners insurance before closing? Once you’ve purchased the policy, you’ll submit proof of insurance to your mortgage lender. Generally, mortgage lenders want you to have proof of homeowners insurance at least three business days before the closing date of your new home.

Source: houselogic.com

Source: houselogic.com

You typically order homeowner�s insurance before closing on a home. Home insurance protects you, as well as the lender. You typically order homeowner�s insurance before closing on a home. This timing gives you ample wiggle room to compare coverages, rates, and the fine details of several insurers’ policies. While many lenders provide insurance referrals, choosing a home insurance company is your decision.

Source: money.asda.com

Source: money.asda.com

How long does it take to get homeowners insurance? You typically order homeowner�s insurance before closing on a home. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at. Once you buy a policy , your insurance company will issue you an insurance binder , which is a document that can temporarily serve as proof of insurance while you wait to receive your. One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance.

Source: progressive.com

Source: progressive.com

Usually, if you’re not buying a home with cash, your lender will require you to pay the premium for one year’s worth of homeowners insurance prior to or at closing. Do you need to have homeowners insurance before closing? Sometimes insurers will take a home appraisal instead of an inspection, but this isn�t. Do i need homeowners insurance before closing? Do i have to buy home insurance before closing?

Source: daveramsey.com

Source: daveramsey.com

Therefore, at the closing there is not any money in the escrow account to pay the first year’s premium. If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered. Buying homeowners insurance before closing enables your lender to establish an escrow for your future premiums. Home insurance protects you, as well as the lender. When you sell the house, your coverage is in effect until your title company sends in the payoff, or the funds to close the loan.

Source: theconversation.com

Source: theconversation.com

If your homeowners insurance is escrowed, the bank will issue a check for any prepayments on the insurance, usually within about 30 days, murtland said. Do i need homeowners insurance before closing? Your mortgage lender will probably require you to purchase and prepay an insurance premium that covers the minimum coverage before they agree to loan to you. Do you need to have homeowners insurance before closing? If you are buying homeowners insurance for the first time, you probably wonder about the timeline for getting covered.

Source: alexbeauregard.com

Source: alexbeauregard.com

This applies to both purchase and refinance scenarios. Yes, you�ll typically need to prove at closing that you�ve paid the first full year of premiums on your homeowners insurance. In order to protect their investment (your new house), lenders will require you to cover your home against disasters. When you think about it from the lender’s perspective, it makes a lot of sense. Once you buy a policy , your insurance company will issue you an insurance binder , which is a document that can temporarily serve as proof of insurance while you wait to receive your.

Source: homewarrantycoloradospringsijitsugi.blogspot.com

Source: homewarrantycoloradospringsijitsugi.blogspot.com

But generally speaking, borrowers need to buy homeowners insurance before they can close on a home loan. Some insurers demand proof of coverage weeks before closing to allow the lender to review the policy. In order to protect their investment (your new house), lenders will require you to cover your home against disasters. Do i have to buy home insurance before closing? Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at least a year in order to close on your home.

Source: kelloninsurance.com

Source: kelloninsurance.com

A year from the closing enough money will have been collected through each monthly mortgage payment to pay for the second year’s premium, as well as every year thereafter. Do i need homeowners insurance before closing? Although paid at the same time as closing, prepaid costs like your homeowners premium are not the same as closing costs. One of the important things that you need to get done in the weeks before you complete the sale is the homeowners insurance. In most cases, you’ll need to provide proof of insurance.

Source: howiegetsitsold.com

Source: howiegetsitsold.com

You exclude the premium from your closing costs. When you buy a home with a mortgage, your lender will require you to get a homeowners insurance policy and provide proof of coverage before you can close on the loan. If your homeowners insurance is escrowed, the bank will issue a check for any prepayments on the insurance, usually within about 30 days, murtland said. By securing the coverage you need before you even move into your new home, you safeguard your purchase from disaster. For example, your lender could escrow.

For example, your lender could escrow. If your homeowners insurance is escrowed, the bank will issue a check for any prepayments on the insurance, usually within about 30 days, murtland said. This timing gives you ample wiggle room to compare coverages, rates, and the fine details of several insurers’ policies. You still have some things to take in consideration before closing. Therefore, at the closing there is not any money in the escrow account to pay the first year’s premium.

Source: realtor.com

Source: realtor.com

You still have some things to take in consideration before closing. Yes, while homeowners insurance is not required by law, most mortgage lenders require it in exchange for extending you a home loan. Before closing on a new home, your lender will require you to purchase a home insurance policy. Just in case you are still thinking you can get out of home insurance, yes, you do have to purchase it for at least a year in order to close on your home. Cons when paying at closing you have to use certified funds, which is money that comes directly from your bank accounts via wire or cashier’s check.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do you get homeowners insurance before closing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.