Your Do startups offer health insurance images are ready in this website. Do startups offer health insurance are a topic that is being searched for and liked by netizens now. You can Get the Do startups offer health insurance files here. Get all free vectors.

If you’re searching for do startups offer health insurance images information connected with to the do startups offer health insurance interest, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

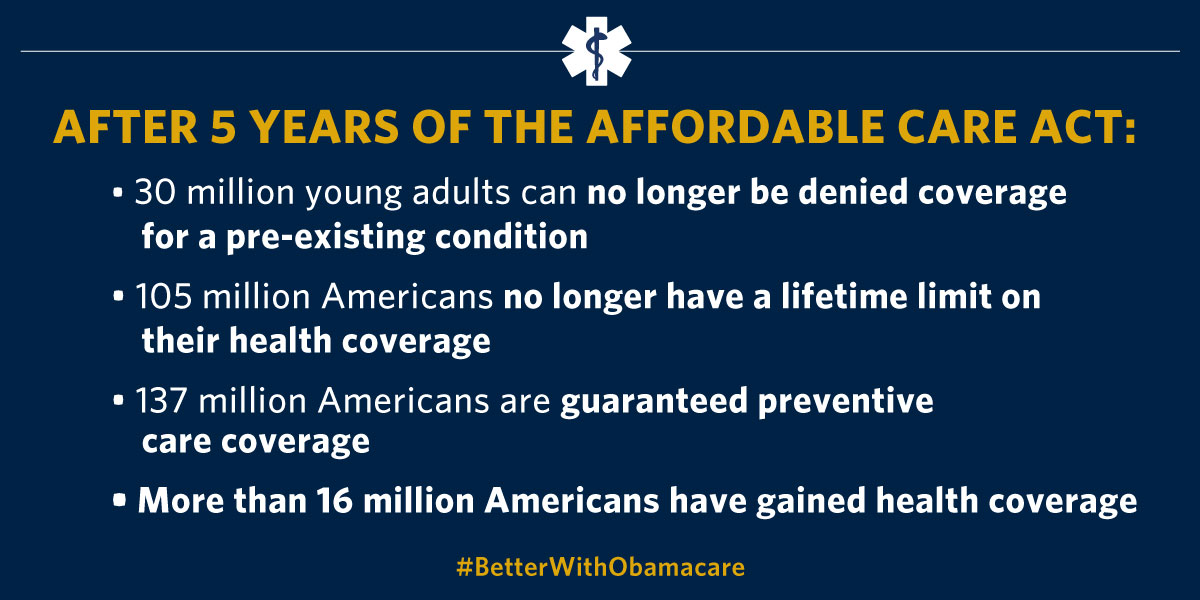

Do Startups Offer Health Insurance. Purchasing a private small group plan is another option for startups. ‘portable’ health insurance plans have become more popular. If you have a young workforce or just one that hasn’t had a lot of experience in choosing their benefits, send them our post on how to pick from your employer’s plans as they enter open enrollment. If a large company does not offer health insurance, the affordable care act says it can be fined.

See some of the best health insurance California has to From madailylife.com

See some of the best health insurance California has to From madailylife.com

Brokers are licensed insurance agents who can help connect entrepreneurs with insurance companies that offer health insurance plans for small businesses or startups. Small groups can find lots of options on the private market place. And you can offer benefits in a way that won’t break the bank or leave employees looking for new jobs. Purchasing a private small group plan is another option for startups. Why offer health insurance as a startup? Startups offers health insurance health insurance offers by startups according to the kaiser family foundation, annual premiums for single coverage for small businesses total $6,163, and annual premiums for family coverage total $16,625.

1) there’s often a broader choice of individual plans compared to small group plans and 2) individual employees might still qualify for individual health insurance subsidies, even if the.

Here’s what you need to know about providing health insurance as a startup business: There are two advantages to this approach: Surprisingly affordable, offering health insurance also sends the right message about your company culture — building a sustainable and healthy working. Startup health insurance is a great way to show employees that you’re invested in their futures. You can get health insurance for startups by selecting a group health plan through an insurance agent. Small groups can find lots of options on the private market place.

Source: moneysense.ph

Source: moneysense.ph

Today, however, most startups offer health insurance immediately, making it part of their business plan and including it in their compensation budget. Startups providing health insurance benefits succeed in retaining the best talent and qualify for exemptions from tax. But, there are several reasons for health insurance for startups to offer protection to employees. How to navigate small business health insurance options? It is not mandatory to provide group health insurance if you have fewer than 50 employees;

Source: ondeck.com

Source: ondeck.com

However, there are a number of important reasons to consider offering them healthcare coverage. Group health insurance › do most startups offer health insurance? There are two advantages to this approach: The startup founders are paving the way for finding new talents. There are various health insurance benefits for employers and employees that the startups will need to consider.

Source: business.inquirer.net

Source: business.inquirer.net

Purchasing a private small group plan is another option for startups. Startups offers health insurance health insurance offers by startups according to the kaiser family foundation, annual premiums for single coverage for small businesses total $6,163, and annual premiums for family coverage total $16,625. In the case of startup companies, they may not offer health insurance to their employee. Do you have to offer health insurance in 2020? Final thoughts on startup health insurance.

Source: exudeinc.com

Source: exudeinc.com

You don’t even need a broker these days if you don’t want to use one. Besides health insurance, many startups offer dental and vision insurance. This is a hefty fine — $3,860 for each employee annually (in 2020). How to navigate small business health insurance options? The startup founders are paving the way for finding new talents.

Source: benecaid.com

Source: benecaid.com

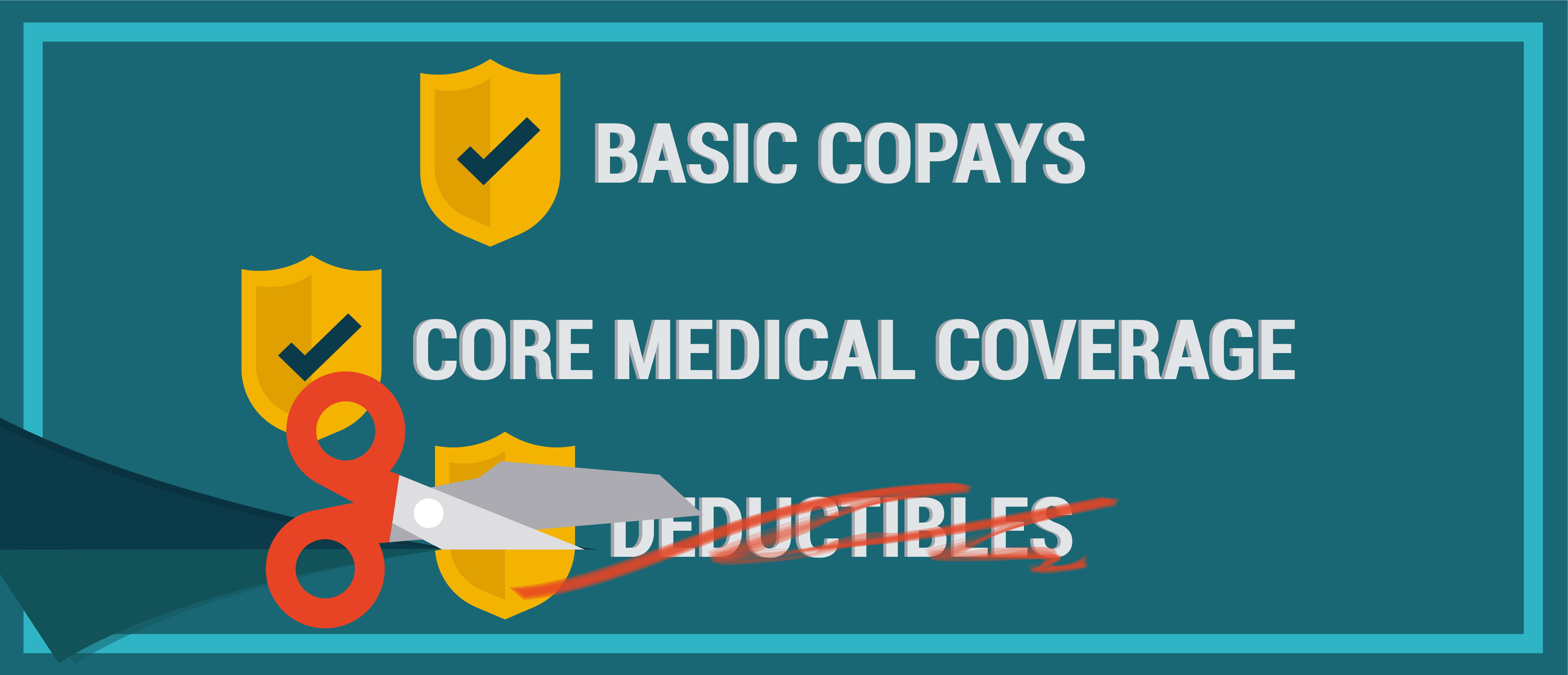

Today, however, most startups offer health insurance immediately, making it part of their business plan and including it in their compensation budget. Usually, a plan which has low monthly premiums and high annual deductibles is ideal for startups since employees are young and comparatively healthier. Most startups do not offer healthcare benefits because they cannot afford them. However, there are several compelling reasons to look into startup health insurance. Do you have to offer health insurance in 2020?

Source: peoplekeep.com

Having an idea of what the future holds can help you plan for the growth of your business. Startup health insurance is a great way to show employees that you’re invested in their futures. However, bigger companies with more employees are happy to offer the benefits as they have bigger budgets. There are various health insurance benefits for employers and employees that the startups will need to consider. If a large company does not offer health insurance, the affordable care act says it can be fined.

Source: lumenadvisory.com

Source: lumenadvisory.com

Usually, a plan which has low monthly premiums and high annual deductibles is ideal for startups since employees are young and comparatively healthier. Although offering group health insurance is optional if your startup has less than 50 employees, there are several compelling reasons that looking into health. In the case of startup companies, they may not offer health insurance to their employee. The coming in of so many startups in a short time is paving the way for better job opportunities. Group health insurance › do most startups offer health insurance?

Source: insurancenoon.com

Source: insurancenoon.com

Here’s what you need to know about providing health insurance as a startup business: Startups providing health insurance benefits succeed in retaining the best talent and qualify for exemptions from tax. Startups offers health insurance health insurance offers by startups according to the kaiser family foundation, annual premiums for single coverage for small businesses total $6,163, and annual premiums for family coverage total $16,625. There are various health insurance benefits for employers and employees that the startups will need to consider. This is a hefty fine — $3,860 for each employee annually (in 2020).

Source: eselectins.com

Source: eselectins.com

- there’s often a broader choice of individual plans compared to small group plans and 2) individual employees might still qualify for individual health insurance subsidies, even if the. In the case of startup companies, they may not offer health insurance to their employee. Why offer health insurance as a startup? Startups offering health insurance really doesn’t need to be as complicated as it seems. It is not mandatory to provide group health insurance if you have fewer than 50 employees;

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This is a hefty fine — $3,860 for each employee annually (in 2020). Do startups offer health benefits? If a large company does not offer health insurance, the affordable care act says it can be fined. Startups providing health insurance benefits succeed in retaining the best talent and qualify for exemptions from tax. How to navigate small business health insurance options?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

And you can offer benefits in a way that won’t break the bank or leave employees looking for new jobs. Most startups do not offer healthcare benefits because they cannot afford them. However, there are a number of important reasons to consider offering them healthcare coverage. If your company employs less than 50 employees, you may be eligible for a special group health insurance plan. If you would like to be more generous with benefits, you could also offer life insurance and other insurance that covers employees in the event of serious health complications, which is known as supplemental insurance.

Source: techstartups.com

Source: techstartups.com

And you can offer benefits in a way that won’t break the bank or leave employees looking for new jobs. How are startups responding to these trends? 1) there’s often a broader choice of individual plans compared to small group plans and 2) individual employees might still qualify for individual health insurance subsidies, even if the. ‘portable’ health insurance plans have become more popular. Usually, a plan which has low monthly premiums and high annual deductibles is ideal for startups since employees are young and comparatively healthier.

Source: medialogic.com

Source: medialogic.com

There are various health insurance benefits for employers and employees that the startups will need to consider. Having an idea of what the future holds can help you plan for the growth of your business. Startups providing health insurance benefits succeed in retaining the best talent and qualify for exemptions from tax. However, there are a number of important reasons to consider offering them healthcare coverage. But, there are several reasons for health insurance for startups to offer protection to employees.

Source: madailylife.com

Source: madailylife.com

If your company employs less than 50 employees, you may be eligible for a special group health insurance plan. Startups providing health insurance benefits succeed in retaining the best talent and qualify for exemptions from tax. Health insurance as a staff benefit is becoming more and more popular in the uk, and private health insurance is a great thing to offer as part of our startup employee benefits package. Why offer health insurance as a startup? So, a startup could have employees buy their own individual health insurance plan on their state marketplace and reimburse them for premiums.

Source: goodmoneying.com

Source: goodmoneying.com

Following are 3 key benefits enjoyed by small businesses by providing health insurance benefits to their employees under a single umbrella. Group health insurance › do most startups offer health insurance? But, there are several reasons for health insurance for startups to offer protection to employees. However, there are several compelling reasons to look into startup health insurance. Even if your firm has fewer than 50 employees, giving group health insurance is not mandatory.

Source: securenow.in

Source: securenow.in

This, therefore, means that startups should only offer. But, there are several reasons for health insurance for startups to offer protection to employees. This, therefore, means that startups should only offer. How do startups benefit 😀 by providing group health insurance plans? Do you have to offer health insurance in 2020?

Source: putuv.com

Source: putuv.com

Startup health insurance is a great way to show employees that you’re invested in their futures. Most startups do not offer healthcare benefits because they cannot afford them. Here’s what you need to know about providing health insurance as a startup business: How do startups benefit 😀 by providing group health insurance plans? Brokers are licensed insurance agents who can help connect entrepreneurs with insurance companies that offer health insurance plans for small businesses or startups.

Source: small-bizsense.com

Source: small-bizsense.com

How are startups responding to these trends? Following are 3 key benefits enjoyed by small businesses by providing health insurance benefits to their employees under a single umbrella. You can get health insurance for startups by selecting a group health plan through an insurance agent. However, bigger companies with more employees are happy to offer the benefits as they have bigger budgets. Usually, a plan which has low monthly premiums and high annual deductibles is ideal for startups since employees are young and comparatively healthier.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do startups offer health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.