Your Do retirees need umbrella insurance policy images are ready. Do retirees need umbrella insurance policy are a topic that is being searched for and liked by netizens now. You can Find and Download the Do retirees need umbrella insurance policy files here. Get all free photos and vectors.

If you’re searching for do retirees need umbrella insurance policy images information linked to the do retirees need umbrella insurance policy keyword, you have come to the right blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Do Retirees Need Umbrella Insurance Policy. It would also provide coverage for any legal costs in a lawsuit. Until you do this, you likely do not need to worry about getting the extra insurance. But if you have $1 million in umbrella insurance, your umbrella policy will cover the portion of the judgment that your homeowner�s insurance. In other words, an umbrella policy can protect you when your automobile or homeowners liability insurance is not enough.

What Is An Umbrella Insurance Policy? Cometinsure From cometinsure.com

What Is An Umbrella Insurance Policy? Cometinsure From cometinsure.com

For instance, your auto insurance policy protects you in case of a car accident, while your homeowners policy covers your house, and the belongings in it, against theft or damage. Umbrella insurance is a form of personal liability coverage that protects you (plus your family and other household members) from large claims or lawsuits that go above your other insurance policies. Adviser steven podnos reviews the benefits of umbrella liability insurance coverage for retirees. Insurance, money, do you need an umbrella insurance policy? You don�t have to be wealthy to need an umbrella policy—even if you don�t have any assets, your wages can be garnished. If you have a net worth higher than $500,000, you need umbrella insurance.

An umbrella policy is an extra type of liability insurance that will provide coverage to you above and beyond the standard policy you have in place.

If you sustain a loss, you will need to pay for any costs beyond your plan limits unless you have an umbrella plan. You don�t need to be affluent to find these policies beneficial either. Do retirees need an umbrella policy? You don�t have to be wealthy to need an umbrella policy—even if you don�t have any assets, your wages can be garnished. If you have a fair amount of retirement assets saved up (like a lot of folks out there), the answer may well be. It sits on top of your existing home and auto coverage (hence the name “umbrella”) and pays the difference between what your primary insurance policies pay and what you still owe.

Source: arrudainsurance.com

Source: arrudainsurance.com

In other words, an umbrella policy can protect you when your automobile or homeowners liability insurance is not enough. If you have significant assets, purchasing umbrella insurance could be a wise move. Do retirees need an umbrella policy? This is because the more you have, the more you have to lose, and normal insurance policies won’t provide enough coverage. If you have a fair amount of retirement assets saved up (like a lot of folks out there), the answer may well be.

Source: graydontoole.com

Source: graydontoole.com

So, in assessing your needs for umbrella coverage, in general only nonqualified assets, along with assets in excess of. The same protection generally also applies to up to $1 million worth of assets held in individual retirement accounts (iras). Learn more about it here. It covers not just the policyholder, but also other members of their family or household. Your property insurance agent may have recommended you add an umbrella policy to your homeowners or auto insurance policy.

Source: insurancefortexans.com

So if you’re on the path to millionaire status (way to go!)—or you’re already there—umbrella insurance is for you. If you have a fair amount of retirement assets saved up (like a lot of folks out there), the answer may well be. An umbrella policy picks up where your auto and homeowners insurance policies. Find the income to insure against retirement risks keep in mind that an. If you have a net worth higher than $500,000, you need umbrella insurance.

Source: youtube.com

Source: youtube.com

But if you have $1 million in umbrella insurance, your umbrella policy will cover the portion of the judgment that your homeowner�s insurance. An umbrella policy is an extra type of liability insurance that will provide coverage to you above and beyond the standard policy you have in place. It would also provide coverage for any legal costs in a lawsuit. It protects you over the limits on your home or condo insurance. Do retirees need an umbrella policy?

Source: strausstroy.com

Source: strausstroy.com

Thus, if you have a $1 million umbrella policy coupled to $1 million of liability coverage in your auto policy, you would end up with $2 million of overall coverage. Until you do this, you likely do not need to worry about getting the extra insurance. Thus, if you have a $1 million umbrella policy coupled to $1 million of liability coverage in your auto policy, you would end up with $2 million of overall coverage. If you have a fair amount of retirement assets saved up (like a lot of folks out there), the answer may well be. Do you need umbrella liability insurance in retirement?

Source: wealthmanagement.com

Source: wealthmanagement.com

For instance, your auto insurance policy protects you in case of a car accident, while your homeowners policy covers your house, and the belongings in it, against theft or damage. You don�t need to be affluent to find these policies beneficial either. Your property insurance agent may have recommended you add an umbrella policy to your homeowners or auto insurance policy. Learn more about it here. If you have a net worth higher than $500,000, you need umbrella insurance.

Source: pinterest.com

Source: pinterest.com

It sits on top of your existing home and auto coverage (hence the name “umbrella”) and pays the difference between what your primary insurance policies pay and what you still owe. Retirees, cover yourself with umbrella insurance you may not realize you don’t have enough liability coverage until something catastrophic happens. Most types of insurance provide one specific kind of coverage. Your property insurance agent may have recommended you add an umbrella policy to your homeowners or auto insurance policy. “there’s less time to recover in the event of a big loss.

Source: pinterest.com

Source: pinterest.com

You don�t have to be wealthy to need an umbrella policy—even if you don�t have any assets, your wages can be garnished. However, you really need to keep some policies in place even after you quit working. It covers not just the policyholder, but also other members of their family or household. If you have significant assets, purchasing umbrella insurance could be a wise move. It would also provide coverage for any legal costs in a lawsuit.

Source: bbmich.com

Source: bbmich.com

Umbrella insurance becomes more important when you have built wealth and bought assets. However, you really need to keep some policies in place even after you quit working. An umbrella policy picks up where your auto and homeowners insurance policies. This is because the more you have, the more you have to lose, and normal insurance policies won’t provide enough coverage. The same protection generally also applies to up to $1 million worth of assets held in individual retirement accounts (iras).

Source: pinterest.com

Source: pinterest.com

This is because the more you have, the more you have to lose, and normal insurance policies won’t provide enough coverage. Think you might need umbrella insurance? Do retirees need an umbrella policy? Before we answer this question, let’s define umbrella insurance. If you have a fair amount of retirement assets saved up (like a lot of folks out there), the answer may well be.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Just like an umbrella for the rain that protects you from getting wet, umbrella insurance protects your money by filling the financial gap that your primary liability insurance. Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage. What is an umbrella policy, and how can it protect you? It covers not just the policyholder, but also other members of their family or household. This is because the more you have, the more you have to lose, and normal insurance policies won’t provide enough coverage.

Source: pinterest.com

Source: pinterest.com

Insurance, money, do you need an umbrella insurance policy? It would also provide coverage for any legal costs in a lawsuit. You don�t need to be affluent to find these policies beneficial either. If you work for an employer, are a renter, and have only a small nest egg, you probably do not need umbrella insurance yet. You don�t have to be wealthy to need an umbrella policy—even if you don�t have any assets, your wages can be garnished.

Source: pinterest.com

Source: pinterest.com

However, you really need to keep some policies in place even after you quit working. Insurance, money, do you need an umbrella insurance policy? An umbrella policy is an extra type of liability insurance that will provide coverage to you above and beyond the standard policy you have in place. You typically add umbrella liability coverage to existing liability coverage. Learn more about it here.

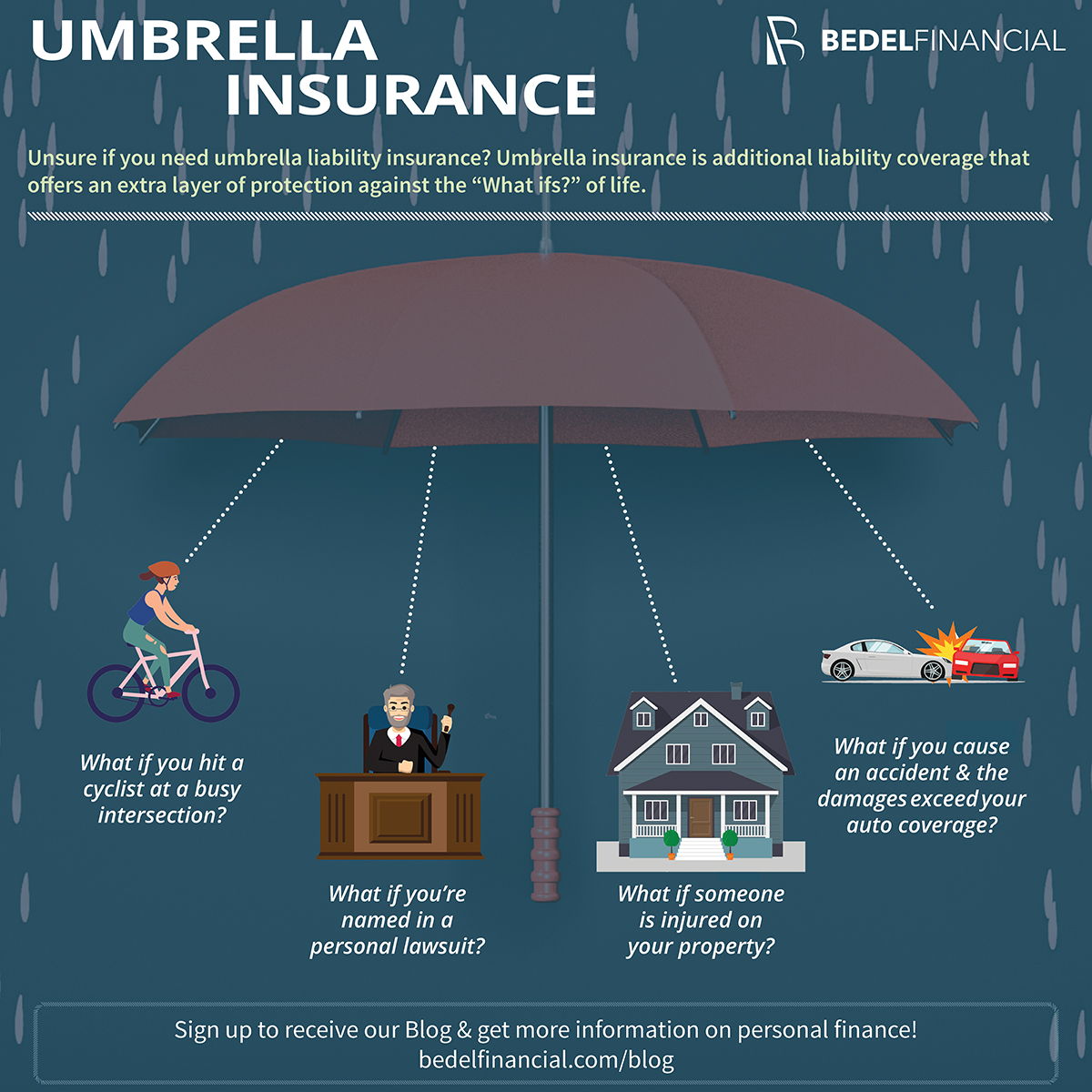

Source: bedelfinancial.com

Source: bedelfinancial.com

Retirement daily guest contributor feb 3,. It would also provide coverage for any legal costs in a lawsuit. Your property insurance agent may have recommended you add an umbrella policy to your homeowners or auto insurance policy. Think you might need umbrella insurance? If you have significant assets, purchasing umbrella insurance could be a wise move.

Source: scottagencyins.com

Source: scottagencyins.com

Just like an umbrella for the rain that protects you from getting wet, umbrella insurance protects your money by filling the financial gap that your primary liability insurance. So, in assessing your needs for umbrella coverage, in general only nonqualified assets, along with assets in excess of. Do you need umbrella liability insurance in retirement? And if you have a net worth of at least $500,000, you definitely need it. Thus, if you have a $1 million umbrella policy coupled to $1 million of liability coverage in your auto policy, you would end up with $2 million of overall coverage.

Source: cityscoop.us

Source: cityscoop.us

You typically add umbrella liability coverage to existing liability coverage. Do you need umbrella liability insurance in retirement? Learn more about it here. Find the income to insure against retirement risks keep in mind that an. If you sustain a loss, you will need to pay for any costs beyond your plan limits unless you have an umbrella plan.

Source: thestreet.com

Source: thestreet.com

It covers not just the policyholder, but also other members of their family or household. But if you have $1 million in umbrella insurance, your umbrella policy will cover the portion of the judgment that your homeowner�s insurance. Umbrella policies can offer purely excess protection, or, they can contain coverages. You don�t have to be wealthy to need an umbrella policy—even if you don�t have any assets, your wages can be garnished. Umbrella insurance is a form of personal liability coverage that protects you (plus your family and other household members) from large claims or lawsuits that go above your other insurance policies.

Source: beatingbroke.com

Source: beatingbroke.com

Insurance, money, do you need an umbrella insurance policy? Learn more about it here. If you work for an employer, are a renter, and have only a small nest egg, you probably do not need umbrella insurance yet. Think you might need umbrella insurance? So, in assessing your needs for umbrella coverage, in general only nonqualified assets, along with assets in excess of.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do retirees need umbrella insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.