Your Do i need workers comp insurance for myself images are ready. Do i need workers comp insurance for myself are a topic that is being searched for and liked by netizens today. You can Get the Do i need workers comp insurance for myself files here. Download all royalty-free photos and vectors.

If you’re looking for do i need workers comp insurance for myself images information linked to the do i need workers comp insurance for myself topic, you have visit the right site. Our website always provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

Do I Need Workers Comp Insurance For Myself. Nearly every state requires employers to offer workers’ comp insurance to employees. If you’re hurt and you don’t have workers’ comp, that could mean $40,000 out of your pocket. If you are a sole proprietor or partner/partnership or are incorporated, you do not need to seek benefits. A few states, including texas, do not require workers� compensation insurance.

Do I Need Workers Comp Insurance For Myself California From consolidate-a-student-lo-1c8e.blogspot.com

Do I Need Workers Comp Insurance For Myself California From consolidate-a-student-lo-1c8e.blogspot.com

A few states, including texas, do not require workers� compensation insurance. You’re not a member of a group for premium purposes. Check out more of our content for insights and lessons that can positively impact your business. No, sole traders or partnerships cannot take out cover for themselves. In north carolina, officers may exclude themselves from coverage, but they count in the determination of the. Do i need workers’ compensation if i have no employees?

Workers’ comp can help with that.

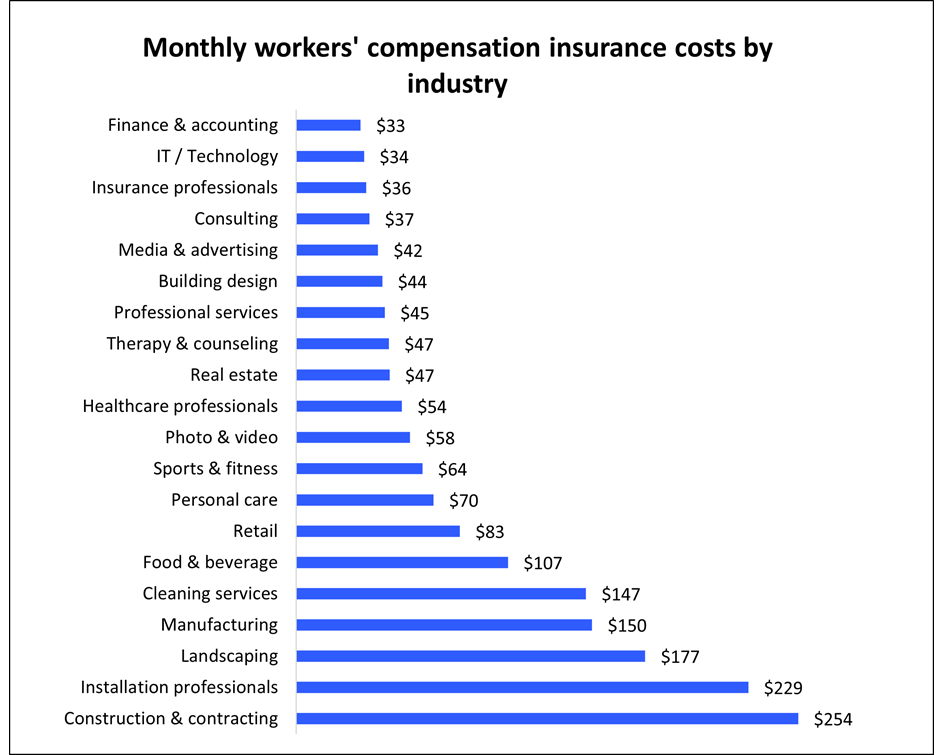

In north carolina, officers may exclude themselves from coverage, but they count in the determination of the. A small business owner with no employees is typically exempt from workers’ comp insurance in all states. The cost of workers’ comp insurance will depend on your state’s laws, the type of work you do, and your claims history. You pay $7,500 or less in annual wages. The short answer is no. Not in the eyes of the law at least.

![]() Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

In many states, small business owners and family members do not have to carry workers’ compensation coverage for themselves. Any worker who runs his own business can face injuries that might result to medical expenses and income loss. A workers’ comp exemption means you don’t need to provide workers’ comp to specific employees if they get injured or sick from their job. States require different types of employees to be covered by workers’ comp. Asking whether you are able to buy workers� compensation insurance for yourself is an important question, as the amount that an employer supplies rarely seems enough to cover any serious injuries.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

In many states, small business owners and family members do not have to carry workers’ compensation coverage for themselves. If you do business in north dakota, ohio, washington or wyoming, you�ll need to purchase insurance coverage from monopolistic funds administered by those state governments. If you are a sole proprietor or partner/partnership or are incorporated, you do not need to seek benefits. As an employer, you’re not required to get an insurance policy if: February 9, 2018 by ryan andrew.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

If you are injured while performing your work, you’ll be covered by your own workers’ comp policy. The cost of workers’ comp insurance will depend on your state’s laws, the type of work you do, and your claims history. In north carolina, officers may exclude themselves from coverage, but they count in the determination of the. Even if you are exempt, you still have the obligation to provide assistance with injury management and return to work. Nearly every state requires employers to offer workers’ comp insurance to employees.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

You pay $7,500 or less in annual wages. Even if you are exempt, you still have the obligation to provide assistance with injury management and return to work. You pay $7,500 or less in annual wages. Any worker who runs his own business can face injuries that might result to medical expenses and income loss. If you are a sole proprietor or partner/partnership or are incorporated, you do not need to seek benefits.

Source: chicagolawyers360.com

Source: chicagolawyers360.com

Asking whether you are able to buy workers� compensation insurance for yourself is an important question, as the amount that an employer supplies rarely seems enough to cover any serious injuries. None of the above mentions sole proprietors or independent contractors. No, sole traders or partnerships cannot take out cover for themselves. The worker’s compensation act can cover these expenses and save you a lot of hazards and time. You pay $7,500 or less in annual wages.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

No, sole traders or partnerships cannot take out cover for themselves. Workers comp insurance provides coverage for medical benefits and wage replacement when an employee is injured or killed on the job. People who work for themselves and don�t have employees are generally not required to purchase workers� compensation insurance. You’re not a member of a group for premium purposes. If you are a sole proprietor or partner/partnership or are incorporated, you do not need to seek benefits.

Source: blog.pricespin.net

Source: blog.pricespin.net

In many states small business owners and family members do not have to carry workers compensation coverage for themselves. There are also benefits to buying workers’ comp for yourself. People who work for themselves and don�t have employees are generally not required to purchase workers� compensation insurance. If you can afford the cost, this is an investment you can’t afford not to make because the average claim is $40,000. People who work for themselves and don�t have employees are generally not required to purchase workers�.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

People who work for themselves and don�t have employees are generally not required to purchase workers� compensation insurance. A few states, including texas, do not require workers� compensation insurance. If you are injured while performing your work, you’ll be covered by your own workers’ comp policy. Other types of insurance provisions will also help to offset the risk of injury which disallows you to work for a stipulated period of time, as well. The cost of workers’ comp insurance will depend on your state’s laws, the type of work you do, and your claims history.

Source: residencestyle.com

Source: residencestyle.com

You don�t employ an apprentice or trainee. A workers’ comp exemption means you don’t need to provide workers’ comp to specific employees if they get injured or sick from their job. Are you hungry for knowledge on business and leadership? Any worker who runs his own business can face injuries that might result to medical expenses and income loss. Other types of insurance provisions will also help to offset the risk of injury which disallows you to work for a stipulated period of time, as well.

Source: commercialtruckinsurancehq.com

Source: commercialtruckinsurancehq.com

People who work for themselves and don�t have employees are generally not required to purchase workers�. Check out more of our content for insights and lessons that can positively impact your business. Nearly every state requires employers to offer workers’ comp insurance to employees. People who work for themselves and don�t have employees are generally not required to purchase workers�. Not in the eyes of the law at least.

Source: berryinsurance.com

Do i need workers comp insurance for myself. Even if your medical insurance provides coverage for treatment expenses, it won’t cover any of your lost wages. As an employer, you’re not required to get an insurance policy if: When an injured employee accepts workers’ compensation payments, he or she legally gives up the right to sue the employer later for damages or negligence. The cost of workers’ comp insurance will depend on your state’s laws, the type of work you do, and your claims history.

Source: houstonlawyers360.com

Source: houstonlawyers360.com

A small business owner with no employees is typically exempt from workers’ comp insurance in all states. Asking whether you are able to buy workers� compensation insurance for yourself is an important question, as the amount that an employer supplies rarely seems enough to cover any serious injuries. Even if you are exempt, you still have the obligation to provide assistance with injury management and return to work. You pay $7,500 or less in annual wages. (see our quick guides for specifics on who can be legally excluded from coverage in minnesota, indiana, iowa,.

Source: jimglaserlaw.com

Source: jimglaserlaw.com

I am a sole trader/partnership, can i take out workers compensation insurance for myself? If you can afford the cost, this is an investment you can’t afford not to make because the average claim is $40,000. However, independent contractors might purchase a policy to: As an employer, you’re not required to get an insurance policy if: Even if you are exempt, you still have the obligation to provide assistance with injury management and return to work.

Source: blog.pricespin.net

Do i need workers’ compensation if i have no employees? The short answer is no. People who work for themselves and don�t have employees are generally not required to purchase workers� compensation insurance. In north carolina, officers may exclude themselves from coverage, but they count in the determination of the. If you are injured while performing your work, you’ll be covered by your own workers’ comp policy.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

There are also benefits to buying workers’ comp for yourself. Even if you are exempt, you still have the obligation to provide assistance with injury management and return to work. If you are injured while performing your work, you’ll be covered by your own workers’ comp policy. Are you hungry for knowledge on business and leadership? If you do business in north dakota, ohio, washington or wyoming, you�ll need to purchase insurance coverage from monopolistic funds administered by those state governments.

Source: consolidate-a-student-lo-1c8e.blogspot.com

Source: consolidate-a-student-lo-1c8e.blogspot.com

In many states small business owners and family members do not have to carry workers compensation coverage for themselves. Nearly every state requires employers to offer workers’ comp insurance to employees. So, if you fall into one of those camps, you’re likely thinking, “do i need workers’ comp insurance if i have. If you don t have employees you may not need to carry workers compensation insurance from a legal standpoint. Before buying any insurance, ask yourself, “do i need workers compensation insurance?” enlightened answers to this question will better enable you to protect your staff.

Source: houstonlawyers360.com

Source: houstonlawyers360.com

Other types of insurance provisions will also help to offset the risk of injury which disallows you to work for a stipulated period of time, as well. None of the above mentions sole proprietors or independent contractors. If you can afford the cost, this is an investment you can’t afford not to make because the average claim is $40,000. Not in the eyes of the law at least. If you get hurt at work and have workers’ comp, you won’t need to use your personal health insurance to cover medical costs.

Source: houstonlawyers360.com

Source: houstonlawyers360.com

None of the above mentions sole proprietors or independent contractors. When an injured employee accepts workers’ compensation payments, he or she legally gives up the right to sue the employer later for damages or negligence. Not in the eyes of the law at least. You’re not a member of a group for premium purposes. February 9, 2018 by ryan andrew.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do i need workers comp insurance for myself by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.