Your Do i need water backup insurance as a renter images are ready in this website. Do i need water backup insurance as a renter are a topic that is being searched for and liked by netizens today. You can Download the Do i need water backup insurance as a renter files here. Find and Download all free photos.

If you’re looking for do i need water backup insurance as a renter images information connected with to the do i need water backup insurance as a renter topic, you have come to the right site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Do I Need Water Backup Insurance As A Renter. It covers the risks mentioned above. You can add water backup coverage to a renters insurance policy. If it is concern there are risk mitigation tactics like water sensors that i. Water backup caused by flooding wouldn’t be covered since every policyholder needs a separate flood insurance policy for those issues.

Do I really need to worry about flood coverage? Burgess From burgessinsurance.ca

Do I really need to worry about flood coverage? Burgess From burgessinsurance.ca

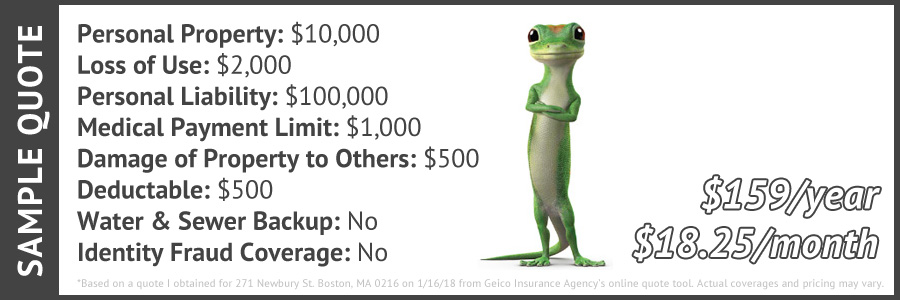

The cost to add water backup could range from $10 to $250 per year with traditional home insurance policies. As a business owner located in cherry hills village, co, you may want to consider flood insurance. You still need tenant insurance to cover the cost of replacing your belongings and, if necessary, relocating, though. Remember, it’s not covered by standard home or business insurance. If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. Water backup caused by flooding wouldn’t be covered since every policyholder needs a separate flood insurance policy for those issues.

It covers the risks mentioned above.

Do i need water backup insurance? Moving into an apartment that requires renters insurance. If you don�t own your company�s property, you should also think about renter�s insurance. A sump pump fails, causing water to flood a basement. Apart from being one of the more common claims for the average homeowner, it�s also one of. You can add water backup coverage to a renters insurance policy.

Source: daveramsey.com

Source: daveramsey.com

You can get $25,000 in water backup coverage for less than $200 a year. Remember, it’s not covered by standard home or business insurance. As a business owner located in cherry hills village, co, you may want to consider flood insurance. What is water backup insurance coverage? In maine, water backup is commonly caused by high groundwater level or a plumbing blockage or malfunction.

Source: pinterest.com

Source: pinterest.com

When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. As a business owner located in cherry hills village, co, you may want to consider flood insurance. It covers the risks mentioned above. It’s just a bad thing to happen. The tenant covers the contents.

Source: meidilight.com

Source: meidilight.com

If you don�t own your company�s property, you should also think about renter�s insurance. Moving into an apartment that requires renters insurance. And $10k in backup is only $150ish a year and if that happens, just be prepared for a rough road even when you do have insurance. Apart from being one of the more common claims for the average homeowner, it�s also one of. A sump pump fails, causing water to flood a basement.

Source: iii.org

Source: iii.org

If you don�t own your company�s property, you should also think about renter�s insurance. A water backup and sump pump overflow endorsement on your homeowners or renters insurance provides added protection from costly water damage resulting from backed up drains or failed sump pumps. I live well above seal level if that matters. If you don�t own your company�s property, you should also think about renter�s insurance. Water backup (coverage) is one of the most important optional coverages you can choose to have on your homeowners or renters policy,” says faschi.

Source: mentalfloss.com

Source: mentalfloss.com

It all depends on the type of water damage. You can add water backup coverage to a renters insurance policy. If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. This type of insurance isn’t required by the law or your mortgage lender. If you don�t own your company�s property, you should also think about renter�s insurance.

Source: npa1.org

Source: npa1.org

One of the policies i’ve found has sewer or drain backup coverage. There is one scenario in which you don’t need sewer backup insurance: Yes, it’s probably a good idea to get water backup insurance as a renter. As a business owner located in cherry hills village, co, you may want to consider flood insurance. Others will cover you right up to the coverage limit.

Source: rathbunagency.com

Source: rathbunagency.com

Yes, it’s probably a good idea to get water backup insurance as a renter. Sewer backup coverage can be added to your home, tenant or condo insurance policy and will pay for damages to your dwelling caused by the sewer system backing up. When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. Without the coverage, it is very difficult to get a claim paid if damage to your home is caused by water. I live well above seal level if that matters.

Source: npa1.org

Source: npa1.org

It covers the risks mentioned above. When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. What does water backup insurance cover? However, the installation of a backwater valve may be required by your provider. If you still have questions, it’s time to reach out to the insurance experts for renters.

Source: reviews.com

Source: reviews.com

Consider water backup insurance if you live on the first floor or near oceans or rivers prone to flooding. Without the coverage, it is very difficult to get a claim paid if damage to your home is caused by water. The tenant covers the contents. Coverage typically starts between $30 and $80 for $5,000 in coverage per year. I live well above seal level if that matters.

Source: bostonmove.com

Source: bostonmove.com

You can add water backup coverage to a renters insurance policy. Renters insurance water backup coverage can protect you from a variety of risks, including the risk of water backup from washing machines. Sewer backup coverage can be added to your home, tenant or condo insurance policy and will pay for damages to your dwelling caused by the sewer system backing up. As a business owner located in cherry hills village, co, you may want to consider flood insurance. If you don�t own your company�s property, you should also think about renter�s insurance.

Source: afsagent.com

Source: afsagent.com

What is water backup insurance coverage? You can add water backup coverage to a renters insurance policy. If it is concern there are risk mitigation tactics like water sensors that i. If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. Do i need water backup insurance?

This type of insurance isn’t required by the law or your mortgage lender. As a business owner located in cherry hills village, co, you may want to consider flood insurance. One of the policies i’ve found has sewer or drain backup coverage. If it is concern there are risk mitigation tactics like water sensors that i. When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event.

Source: purvesinsurance.com

Source: purvesinsurance.com

It’s important to understand the coverage you have, why you need it, and how it protects you. You still need tenant insurance to cover the cost of replacing your belongings and, if necessary, relocating, though. If it is concern there are risk mitigation tactics like water sensors that i. The apartment has a garage on the first floor with no plumbing, then 2nd and 3rd floor has plumbing. In this case, your landlord will be responsible for taking out a policy that protects their property.

Source: reneeisyouragent.com

Source: reneeisyouragent.com

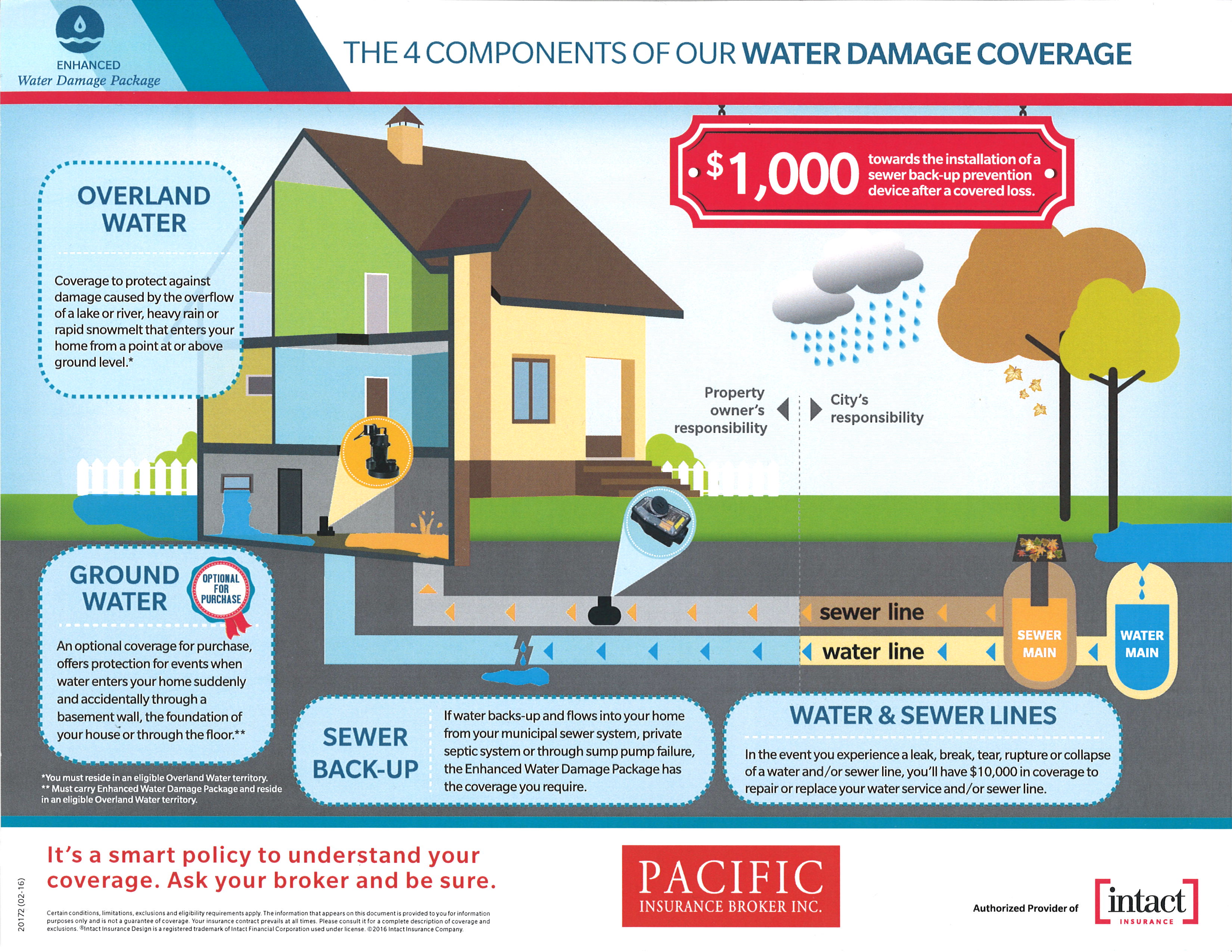

Sewer backup coverage can be added to your home, tenant or condo insurance policy and will pay for damages to your dwelling caused by the sewer system backing up. Water backup caused by flooding wouldn’t be covered since every policyholder needs a separate flood insurance policy for those issues. What does water backup insurance cover? A water backup and sump pump overflow endorsement on your homeowners or renters insurance provides added protection from costly water damage resulting from backed up drains or failed sump pumps. It’s just a bad thing to happen.

Source: stolly.com

Source: stolly.com

There is one scenario in which you don’t need sewer backup insurance: Consider water backup insurance if you live on the first floor or near oceans or rivers prone to flooding. When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. It’s important to understand the coverage you have, why you need it, and how it protects you. You still need tenant insurance to cover the cost of replacing your belongings and, if necessary, relocating, though.

Source: pacins.ca

Source: pacins.ca

If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. It’s important to understand the coverage you have, why you need it, and how it protects you. There is one scenario in which you don’t need sewer backup insurance: A water backup and sump pump overflow endorsement on your homeowners or renters insurance provides added protection from costly water damage resulting from backed up drains or failed sump pumps. Most of the time, yes water backup coverage is worth it.

Source: pacins.ca

Source: pacins.ca

If your apartment is damaged by water, your renters insurance may be able to help you cover the costs of replacing your belongings. There are several exceptions to this rule, but it is very hard to get a claim paid if it’s caused by water. When it comes to sewer backup, your renters insurance most likely won’t cover damage caused by this type of event. Do i need water backup insurance? A water backup and sump pump overflow endorsement on your homeowners or renters insurance provides added protection from costly water damage resulting from backed up drains or failed sump pumps.

Source: absoluteinsurance.ca

Source: absoluteinsurance.ca

Most of the time, yes water backup coverage is worth it. Remember, it’s not covered by standard home or business insurance. There is one scenario in which you don’t need sewer backup insurance: But because backups can happen to just about anyone, you’re always taking a risk by going without coverage. One of the policies i’ve found has sewer or drain backup coverage.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do i need water backup insurance as a renter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.