Your Do i need sinkhole insurance in florida images are available. Do i need sinkhole insurance in florida are a topic that is being searched for and liked by netizens today. You can Get the Do i need sinkhole insurance in florida files here. Get all free photos.

If you’re looking for do i need sinkhole insurance in florida pictures information related to the do i need sinkhole insurance in florida keyword, you have come to the ideal blog. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

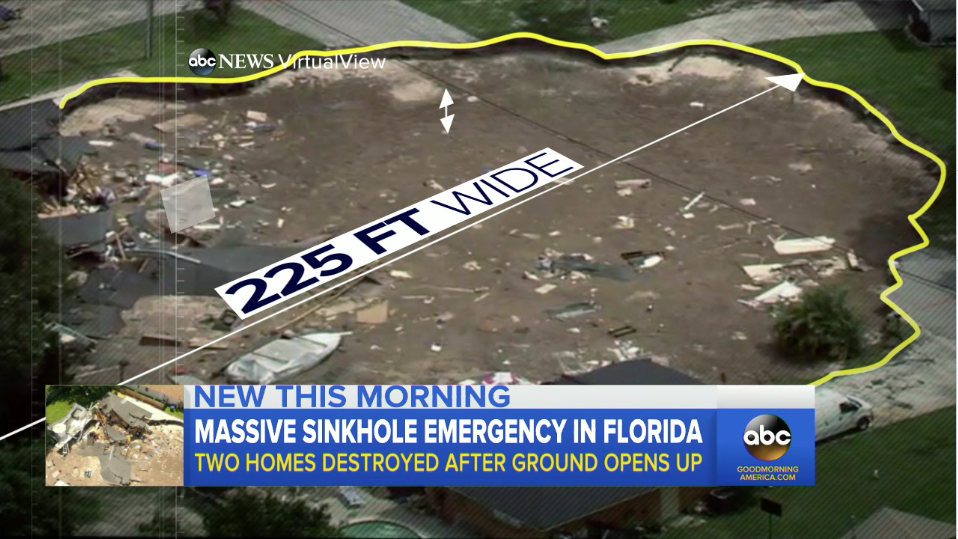

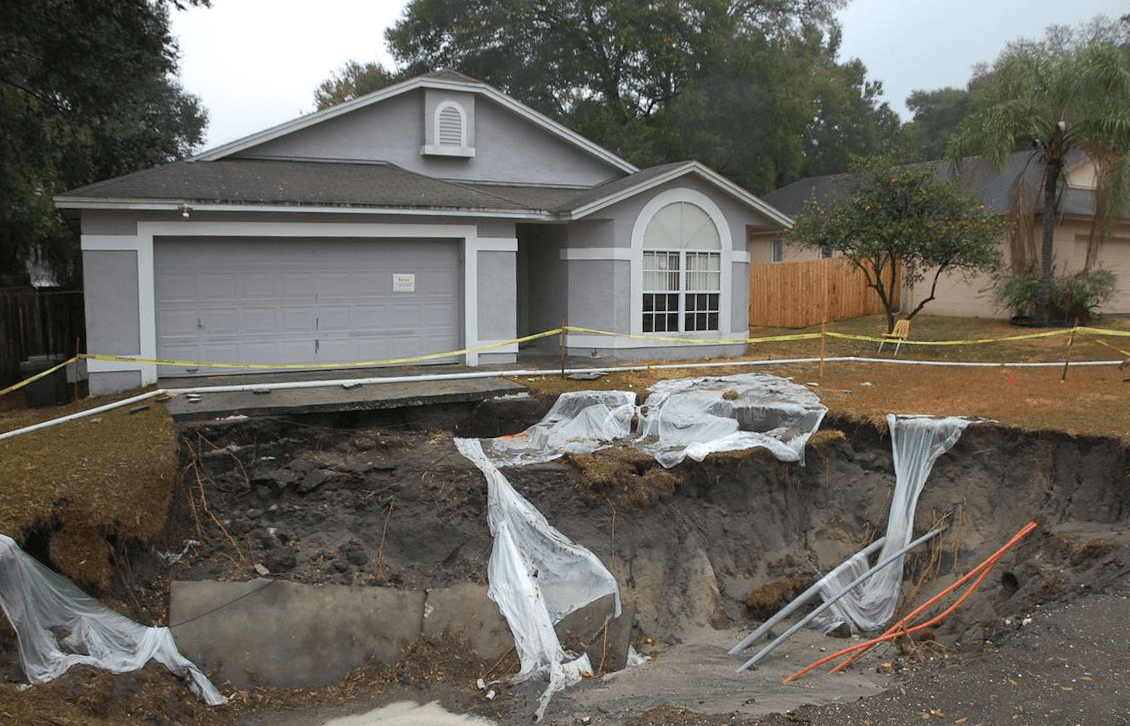

Do I Need Sinkhole Insurance In Florida. Sinkhole coverage is incredibly important in florida; If you get sinkhole insurance, make sure it’s enough coverage to completely rebuild your home if it’s destroyed. It is important to keep in mind that normal home insurance in florida does not include sinkhole insurance. Sinkhole insurance coverage in 2011, the florida legislature changes the statutes on how insurance companies handle sinkhole claims and issue sinkhole coverage.

Does homeowners insurance cover sinkholes? From clickorlando.com

Contents1 do i need […] If you live in an area prone to sinkholes or that has existing sinkhole activity, then your insurance company may decline coverage entirely. Given the common occurrences of sinkholes in florida, the state laws include statutes for sinkhole insurance. Its a beautiful place to live and work but definitely comes with its risks. Here in florida we are exposed to many natural disasters. Again, if you’re thinking, “do i need sinkhole coverage in florida?” the answer is that it depends on your unique circumstances and location.

Florida and tennessee insurers are required to offer optional sinkhole insurance, providing comprehensive protection against sinkhole damage.

You will also have to pay premiums over your normal home insurance if you decide to get sinkhole insurance. Again, if you’re thinking, “do i need sinkhole coverage in florida?” the answer is that it depends on your unique circumstances and location. If you live in an area prone to sinkholes or that has existing sinkhole activity, then your insurance company may decline coverage entirely. Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. The florida statute 627.706 says that every insurance company must provide coverage to homeowners for catastrophic ‘ground cover collapse’. Given the common occurrences of sinkholes in florida, the state laws include statutes for sinkhole insurance.

Source: arcwinsurance.com

Source: arcwinsurance.com

Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. The ground must abruptly collapse All insurance companies licensed in florida must “offer” sinkhole coverage, however an insurance company’s willingness to actually provide sinkhole coverage is contingent upon the characteristics of the ground structure beneath your home. The other unfortunate part is the deductible, many insurance companies require a 10% deductible for sinkhole losses. Florida and tennessee insurers are required to offer optional sinkhole insurance, providing comprehensive protection against sinkhole damage.

Source: thetamparealestateinsider.com

Source: thetamparealestateinsider.com

This rule arose from an unfortunate practice where some homeowners who suffered sinkhole damage and were paid by the insurance companies never fixed their sinkhole problems. Florida has more sinkholes than any other state in the nation. Before 2011, sinkhole coverage was automatically included into everyone’s homeowner insurance policy and the insurance companies were required to investigate every claim. Given the common occurrences of sinkholes in florida, the state laws include statutes for sinkhole insurance. The other unfortunate part is the deductible, many insurance companies require a 10% deductible for sinkhole losses.

Source: homeinsuranceking.com

Source: homeinsuranceking.com

There are certain parts of the world, such as texas and florida, where heavy floods and rainstorms are responsible for the formation of a sinkhole. If you get sinkhole insurance, make sure it’s enough coverage to completely rebuild your home if it’s destroyed. This list includes wild fires, sinkholes, hurricanes, tornados, and flooding. Before 2011, sinkhole coverage was automatically included into everyone’s homeowner insurance policy and the insurance companies were required to investigate every claim. If you live in florida or another area prone to sinkholes, then sinkhole insurance may be worthwhile — though expensive.some florida counties with a history of sinkholes have annual premiums of more than $2,100 for just sinkhole coverage.

Source: insuranceclaimlawyerblog.com

Source: insuranceclaimlawyerblog.com

That’s more than the average homeowners insurance policy in the state of $1,991. The florida statute 627.706 says that every insurance company must provide coverage to homeowners for catastrophic ‘ground cover collapse’. If you receive insurance money for a sinkhole insurance claim in florida, the state now requires you to use this money to fix the damage your home suffered as a result. Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. A lot of customers see a coverage added to their policy called “sinkhole endorsement” and wonder why the coverage is in addition to the main portion of the policy.naturally they ask us whether or not they truly need sinkhole coverage living in tennessee.

Source: revisi.net

Source: revisi.net

Sinkhole insurance policies in florida protect you against unforeseen natural disasters related to sinkholes. Sinkhole insurance what is it and do i need it? You will need to get it separately. Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. All insurance companies licensed in florida must “offer” sinkhole coverage, however an insurance company’s willingness to actually provide sinkhole coverage is contingent upon the characteristics of the ground structure beneath your home.

Source: realestate.aol.com

Source: realestate.aol.com

This list includes wild fires, sinkholes, hurricanes, tornados, and flooding. Sinkhole insurance according to florida law, a sinkhole is a “landform generated by subsidence of sediment, soil, or rock as underlying strata. This rule arose from an unfortunate practice where some homeowners who suffered sinkhole damage and were paid by the insurance companies never fixed their sinkhole problems. Homeowners, do your due diligence when you get insurance. Contents1 do i need […]

Source: leader-law.com

Source: leader-law.com

A loss that�s covered by catastrophic ground collapse must meet the following criteria: Sinkhole insurance what is it and do i need it? That’s more than the average homeowners insurance policy in the state of $1,991. Hire a property appraiser, engineer, or professional land surveyor to help decide if you need sinkhole insurance for your home. Sinkhole insurance according to florida law, a sinkhole is a “landform generated by subsidence of sediment, soil, or rock as underlying strata.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. A loss that�s covered by catastrophic ground collapse must meet the following criteria: Current florida law requires that insurance companies provide catastrophic ground collapse coverage that insures in the event a sinkhole abruptly forms as a visible hole at land surface under an insured structure and damages it based upon specific criteria defined by florida statute 627.706. Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. Sinkhole coverage is incredibly important in florida;

Source: youngalfred.com

Source: youngalfred.com

Since sinkholes are pretty common in florida and they can be extremely costly, every homeowner in florida should opt for sinkhole coverage. Homeowners, do your due diligence when you get insurance. If you get sinkhole insurance, make sure it’s enough coverage to completely rebuild your home if it’s destroyed. It is important to keep in mind that normal home insurance in florida does not include sinkhole insurance. Current florida law requires that insurance companies provide catastrophic ground collapse coverage that insures in the event a sinkhole abruptly forms as a visible hole at land surface under an insured structure and damages it based upon specific criteria defined by florida statute 627.706.

Source: leader-law.com

Source: leader-law.com

Buying sinkhole insurance is not necessary everywhere, and only some particular areas require this condition. Its a beautiful place to live and work but definitely comes with its risks. Given the common occurrences of sinkholes in florida, the state laws include statutes for sinkhole insurance. Again, if you’re thinking, “do i need sinkhole coverage in florida?” the answer is that it depends on your unique circumstances and location. The more appropriate question you should be asking is “why do i need sinkhole coverage in.

Source: realestate.aol.com

Source: realestate.aol.com

Florida has more sinkholes than any other state in the nation. · sinkhole insurance in florida is covered under statute. This rule arose from an unfortunate practice where some homeowners who suffered sinkhole damage and were paid by the insurance companies never fixed their sinkhole problems. There are certain parts of the world, such as texas and florida, where heavy floods and rainstorms are responsible for the formation of a sinkhole. You will also have to pay premiums over your normal home insurance if you decide to get sinkhole insurance.

Source: foxnews.com

Source: foxnews.com

Sinkhole policy premiums are based on where your house was built, its construction materials, and how vulnerable it may be to sinking or shifting soil due to nearby cavities that could cause damage over time. Sinkhole insurance according to florida law, a sinkhole is a “landform generated by subsidence of sediment, soil, or rock as underlying strata. Sinkhole coverage is incredibly important in florida; Florida’s soil has a soggy quality that has been scientifically proven to be the cause of its high sinkhole rates. Sinkhole insurance policies in florida protect you against unforeseen natural disasters related to sinkholes.

Source: leader-law.com

Source: leader-law.com

Its a beautiful place to live and work but definitely comes with its risks. Insurance coverage for sinkhole activity that does not form a visible hole at. Sinkhole insurance according to florida law, a sinkhole is a “landform generated by subsidence of sediment, soil, or rock as underlying strata. Sinkhole coverage is incredibly important in florida; If you live in an area prone to sinkholes or that has existing sinkhole activity, then your insurance company may decline coverage entirely.

Source: clickorlando.com

It is important to keep in mind that normal home insurance in florida does not include sinkhole insurance. Sinkhole insurance according to florida law, a sinkhole is a “landform generated by subsidence of sediment, soil, or rock as underlying strata. Before 2011, sinkhole coverage was automatically included into everyone’s homeowner insurance policy and the insurance companies were required to investigate every claim. While you may not like paying extra on your insurance premiums, a sinkhole can open up beneath your home at any minute, seemingly out of nowhere. Sinkhole policy premiums are based on where your house was built, its construction materials, and how vulnerable it may be to sinking or shifting soil due to nearby cavities that could cause damage over time.

Source: dimmittinsurance.com

Source: dimmittinsurance.com

This list includes wild fires, sinkholes, hurricanes, tornados, and flooding. There are certain parts of the world, such as texas and florida, where heavy floods and rainstorms are responsible for the formation of a sinkhole. If you have sinkhole insurance, your insurance company will cover the damages caused by sinkholes. The other unfortunate part is the deductible, many insurance companies require a 10% deductible for sinkhole losses. If you get sinkhole insurance, make sure it’s enough coverage to completely rebuild your home if it’s destroyed.

Source: myfoundationrepairs.com

Source: myfoundationrepairs.com

The other unfortunate part is the deductible, many insurance companies require a 10% deductible for sinkhole losses. A lot of customers see a coverage added to their policy called “sinkhole endorsement” and wonder why the coverage is in addition to the main portion of the policy.naturally they ask us whether or not they truly need sinkhole coverage living in tennessee. The other unfortunate part is the deductible, many insurance companies require a 10% deductible for sinkhole losses. According to florida highway patrol, it was 10 feet wide and about 12 to 15 feet deep. Before 2011, sinkhole coverage was automatically included into everyone’s homeowner insurance policy and the insurance companies were required to investigate every claim.

Source: geohazardsinc.com

Source: geohazardsinc.com

If you live in an area prone to sinkholes or that has existing sinkhole activity, then your insurance company may decline coverage entirely. The florida statute 627.706 says that every insurance company must provide coverage to homeowners for catastrophic ‘ground cover collapse’. · sinkhole insurance in florida is covered under statute. Sinkhole policy premiums are based on where your house was built, its construction materials, and how vulnerable it may be to sinking or shifting soil due to nearby cavities that could cause damage over time. Sinkhole coverage is incredibly important in florida;

Source: businessinsider.com

Source: businessinsider.com

A lot of customers see a coverage added to their policy called “sinkhole endorsement” and wonder why the coverage is in addition to the main portion of the policy.naturally they ask us whether or not they truly need sinkhole coverage living in tennessee. Before 2011, sinkhole coverage was automatically included into everyone’s homeowner insurance policy and the insurance companies were required to investigate every claim. Anything that does not meet the 4 criteria of the catastrophic ground cover collapse would then have to be covered on an insurance policy under the optional sinkhole loss coverage or could be rejected completely if it is not structural damage or caused by sinkhole activity. · sinkhole insurance in florida is covered under statute. Opting for sinkhole insurance coverage provides coverage for your home, personal belongings and, most importantly, your financial future.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do i need sinkhole insurance in florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.