Your Do i need life insurance canada images are available in this site. Do i need life insurance canada are a topic that is being searched for and liked by netizens today. You can Download the Do i need life insurance canada files here. Find and Download all free photos and vectors.

If you’re searching for do i need life insurance canada pictures information related to the do i need life insurance canada keyword, you have visit the ideal site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Do I Need Life Insurance Canada. One of the draws of term coverage is that it’s very affordable and it fills a temporary need for income replacement. There are several factors that are used to determine how much life insurance you need in canada, and just as no two people are comparatively the same, no life insurance coverage should be the same. There are dozens of providers in canada that can sell you a life insurance policy. For a more precise figure, talk to a financial planner, insurance agent or insurance broker to determine how.

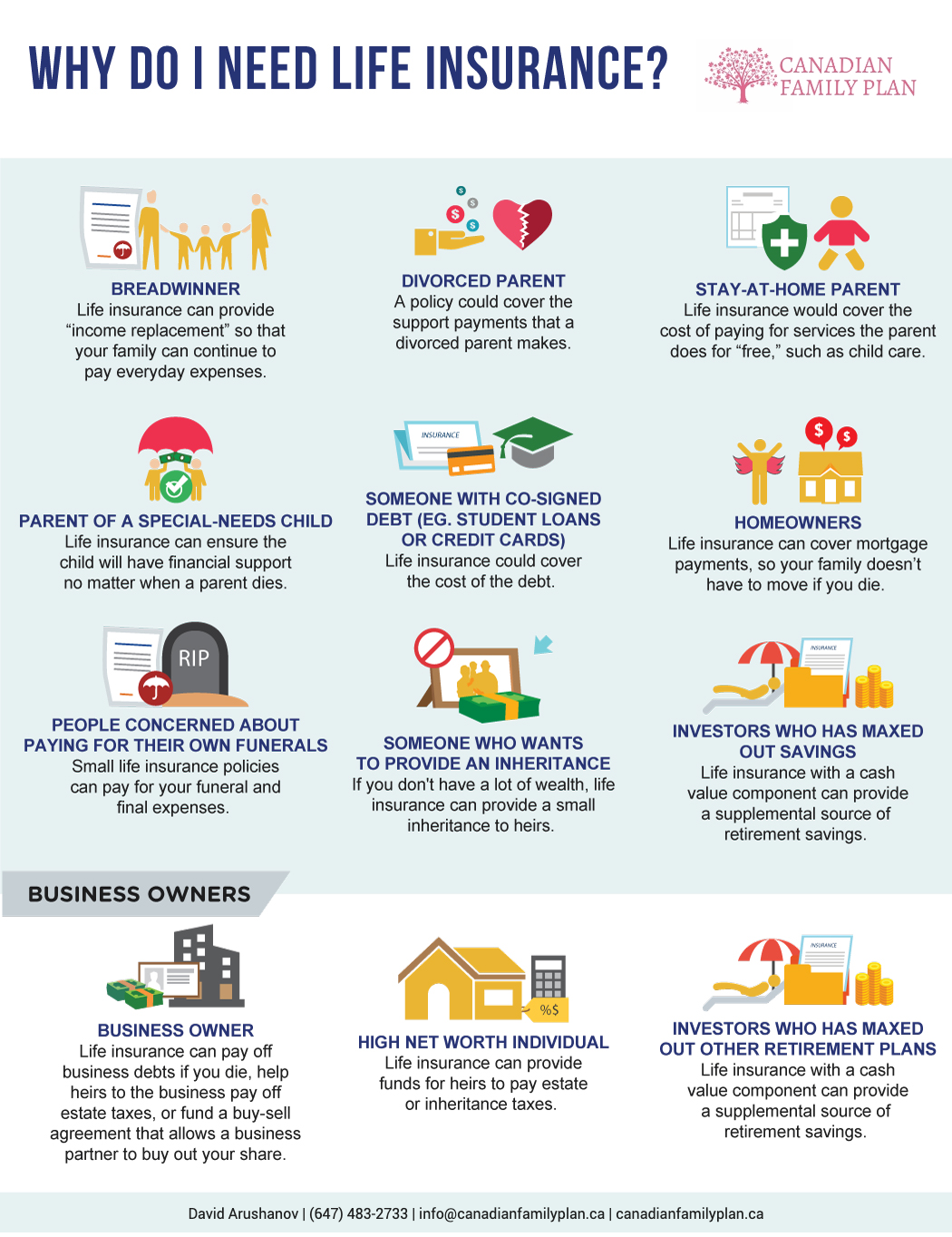

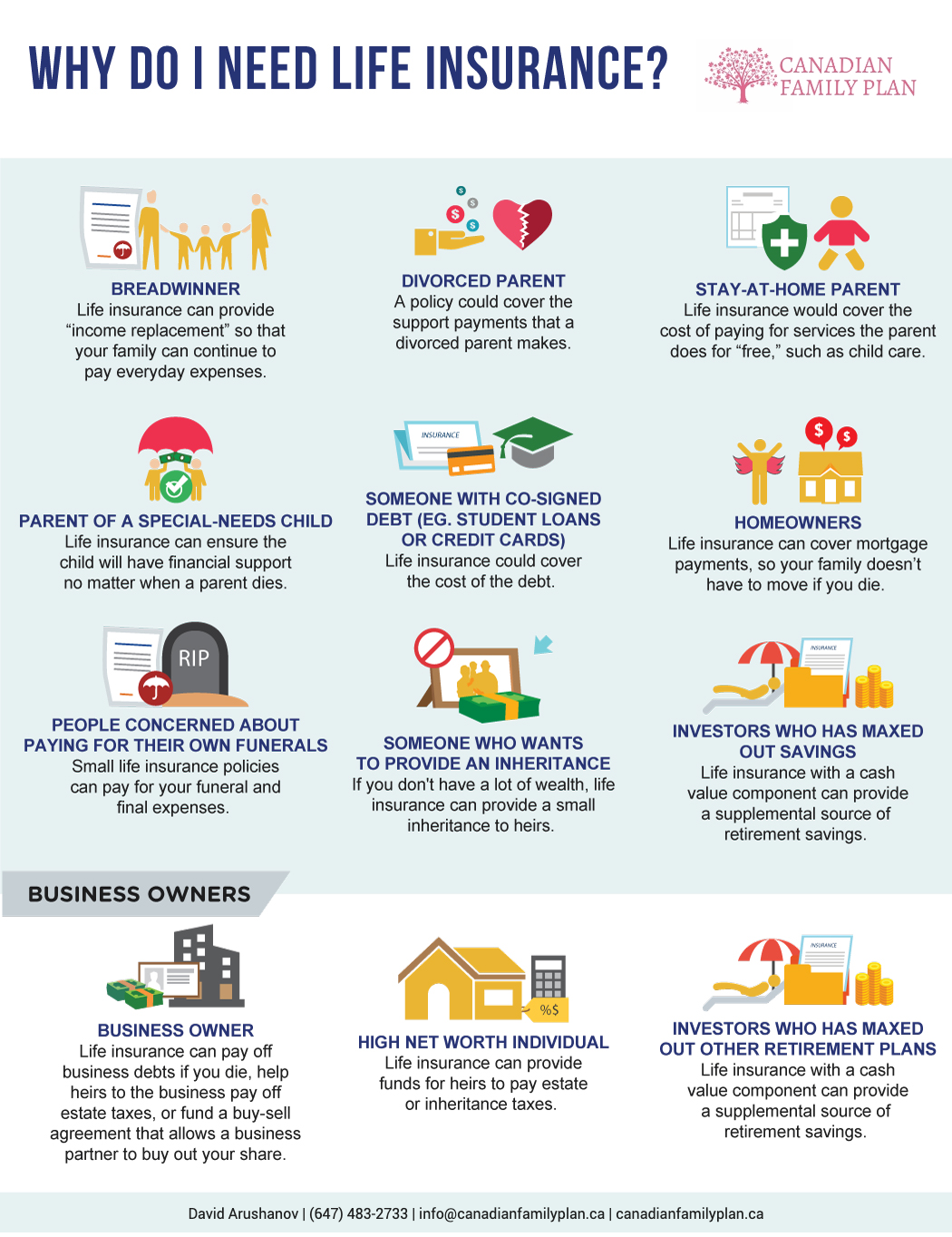

Do you REALLY need life insurance? Canadian Family Plan From canadianfamilyplan.ca

This involves taking courses as required by the province or territory in which the. It can also be part of your financial plan, so you may be able to access money. 6.2.11 identify your insurance needs. One of the draws of term coverage is that it’s very affordable and it fills a temporary need for income replacement. The combination of various factors enables insurers to evaluate the financial risk of a person’s premature death and place a ‘value’ on it. For the majority of canadians, life insurance is the only way to guarantee the financial security of their family or dependents after they pass on.

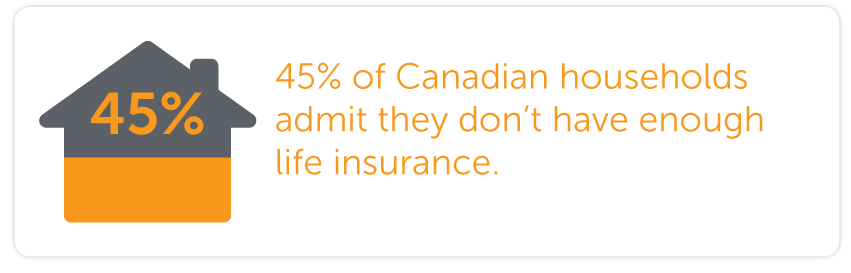

Many people believe that if they are single or don’t have any kids, then there is no need for them to purchase life insurance.

If you’re wondering whether or not you need life insurance, chances are you do. This involves taking courses as required by the province or territory in which the. Key factors that affect life insurance needs. Like everything else in life though, the answer is rarely cut. Life insurance can help your loved ones deal with the financial impact of your death. 6.2.10 credit or debt insurance.

Source: pinterest.co.uk

Source: pinterest.co.uk

Policyme offers life insurance for canadians in coverage amounts ranging from $100,000 to $5,000,000 per year, with term lengths ranging from 10, 15, 20, 25 and 30 years. So, we built an online service to offer canadians honest advice on their life insurance needs. For a more precise figure, talk to a financial planner, insurance agent or insurance broker to determine how. There are different types of life insurance, and different ways to make it work for you. Get started below or read more about how we calculate term life insurance needs in canada, as well as other types of life insurance coverage.

Source: carpinsurance.ca

Source: carpinsurance.ca

Key factors that affect life insurance needs. There are several factors that are used to determine how much life insurance you need in canada, and just as no two people are comparatively the same, no life insurance coverage should be the same. Key factors that affect life insurance needs. For the majority of canadians, life insurance is the only way to guarantee the financial security of their family or dependents after they pass on. But how much life insurance do you need?

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

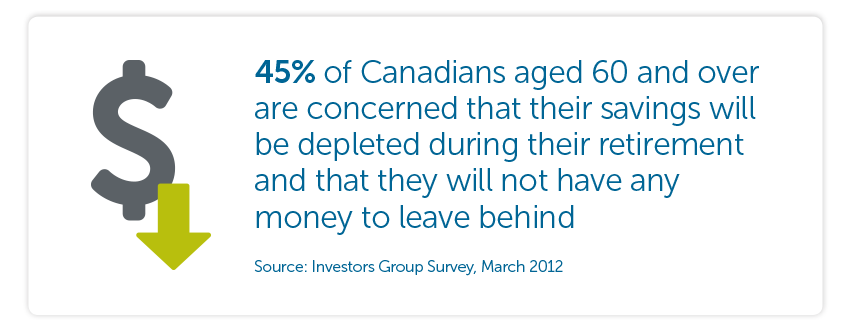

Permanent guaranteed life insurance for seniors in. Check out this dundas life blog post to find out more. Replace your income so your family can maintain their standard of living. In canada, life insurance for your child can be useful for several reasons. The amount represented more than five times the average household income.

Source: canadianfamilyplan.ca

Life insurance can help your loved ones deal with the financial impact of your death. The life insurance industry contributed to a whopping 48.9 percent of this figure. Permanent life insurance covers you for as long as you live (assuming you continue to pay your monthly premiums). Policyme offers life insurance for canadians in coverage amounts ranging from $100,000 to $5,000,000 per year, with term lengths ranging from 10, 15, 20, 25 and 30 years. A life insurance payout will cover those expenses and help the survivors try to live a normal life without you.

Source: emma.ca

Source: emma.ca

To make our number easier, the lifetime limit of an resp for any beneficiary in canada is $50,000. Life insurance is the most cost effective way to protect your families for future. Like everything else in life though, the answer is rarely cut. Life insurance can help your loved ones deal with the financial impact of your death. There are different types of life insurance, and different ways to make it work for you.

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

For instance, a person earning $200,000 a year needs $2,000,000 in life insurance. Wondering how much you should have? Like everything else in life though, the answer is rarely cut. 6.2.11 identify your insurance needs. Many of people don’t know about the life insurance no medical exam.

Source: cwfgroup.com

Source: cwfgroup.com

Provide for your children or dependents. There are several factors that are used to determine how much life insurance you need in canada, and just as no two people are comparatively the same, no life insurance coverage should be the same. Provide for your children or dependents. Policyme offers life insurance for canadians in coverage amounts ranging from $100,000 to $5,000,000 per year, with term lengths ranging from 10, 15, 20, 25 and 30 years. So, we built an online service to offer canadians honest advice on their life insurance needs.

Source: gfkirkpatrick.com

Source: gfkirkpatrick.com

Most don’t require a medical exam either! Great post jim, hmm everyone need life insurance coverage. Life insurance is the most cost effective way to protect your families for future. For the majority of canadians, life insurance is the only way to guarantee the financial security of their family or dependents after they pass on. The combination of various factors enables insurers to evaluate the financial risk of a person’s premature death and place a ‘value’ on it.

Source: gfkirkpatrick.com

Source: gfkirkpatrick.com

Life insurance is the most cost effective way to protect your families for future. Most canadians can be forgiven for not knowing exactly how much life insurance they need without a little help. Permanent life insurance covers you for as long as you live (assuming you continue to pay your monthly premiums). Replace your income so your family can maintain their standard of living. If you’re wondering whether or not you need life insurance, chances are you do.

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

This is a question where the answer really is dependent on your personal situation. But how much life insurance do you need? This is a question where the answer really is dependent on your personal situation. Experts generally recommend purchasing life insurance coverage worth 7 to 10 times your annual salary in order to protect your family. There are different types of life insurance, and different ways to make it work for you.

Source: wordsbywendy.com

Source: wordsbywendy.com

For a more precise figure, talk to a financial planner, insurance agent or insurance broker to determine how. The combination of various factors enables insurers to evaluate the financial risk of a person’s premature death and place a ‘value’ on it. Life insurance is the most cost effective way to protect your families for future. We are here to have a conversation with you about life insurance and help you determine how much and what kind works best for you and your family. Check out this dundas life blog post to find out more.

Source: cpp.ca

Source: cpp.ca

It’s not only to protect your family. You don’t purchase life insurance for yourself, you purchase it for the loved ones and dependents you leave behind. Remember, term life insurance is the type of coverage we recommend for most people most of the time, but this changes as clients age. One of the draws of term coverage is that it’s very affordable and it fills a temporary need for income replacement. For the majority of canadians, life insurance is the only way to guarantee the financial security of their family or dependents after they pass on.

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

If you think you don’t need life insurance, you’re right — technically, at least. Now, you just need to get some life insurance quotes. James duncan is a life insurance advisor at life insurance canada.com. So, we built an online service to offer canadians honest advice on their life insurance needs. A life insurance payout will cover those expenses and help the survivors try to live a normal life without you.

Source: canadianfamilyplan.ca

Source: canadianfamilyplan.ca

For a more precise figure, talk to a financial planner, insurance agent or insurance broker to determine how. For two kids, each with maxed out resp’s would be $100,000. Great post jim, hmm everyone need life insurance coverage. Check out this dundas life blog post to find out more. It’s not only to protect your family.

Source: lifeinsurancecanada.com

Source: lifeinsurancecanada.com

This is a question where the answer really is dependent on your personal situation. In canada, life insurance for your child can be useful for several reasons. So how much life insurance do you need? Great post jim, hmm everyone need life insurance coverage. So, we built an online service to offer canadians honest advice on their life insurance needs.

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

Life insurance is the most cost effective way to protect your families for future. In fact, it’s one of the most important investments an adult can make. Permanent life insurance becomes more viable when you’re in your 70’s. The amount represented more than five times the average household income. Many of people don’t know about the life insurance no medical exam.

Source: cpp.ca

Source: cpp.ca

6.2.12 summary of key messages. Get started below or read more about how we calculate term life insurance needs in canada, as well as other types of life insurance coverage. From what you’ve told us, we recommend that you talk to an advisor to make sure you are getting the coverage you need. 6.2.12 summary of key messages. Many of people don’t know about the life insurance no medical exam.

Source: pinterest.com

Source: pinterest.com

6.2.10 credit or debt insurance. Permanent life insurance becomes more viable when you’re in your 70’s. Remember, term life insurance is the type of coverage we recommend for most people most of the time, but this changes as clients age. Great post jim, hmm everyone need life insurance coverage. You don’t purchase life insurance for yourself, you purchase it for the loved ones and dependents you leave behind.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do i need life insurance canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.