Your Do i need home insurance legal cover images are ready. Do i need home insurance legal cover are a topic that is being searched for and liked by netizens now. You can Download the Do i need home insurance legal cover files here. Download all free images.

If you’re searching for do i need home insurance legal cover pictures information related to the do i need home insurance legal cover topic, you have come to the ideal site. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Do I Need Home Insurance Legal Cover. Legal insurance plans typically offer coverage for the cost of consultations, advice, legal assistance and representation, and preparation of legal documents. Legal fees cover is useful for taking legal action to reclaim losses that you can’t recover through your standard home insurance policy, such as the excess you pay when making a claim. You may need to get a specific to cover your property if you only stay there occasionally. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home.

Why Do Landlords Need Legal Expenses Insurance? YouTube From youtube.com

Why Do Landlords Need Legal Expenses Insurance? YouTube From youtube.com

It is used to reclaim uninsured losses not covered by your standard car insurance policy. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. Legal cover provides financial protection against legal fees and losses following an accident that was not your fault. Although you don�t technically need homeowners insurance if your house is paid off and you don�t have a home equity loan or line of credit, most people choose to keep their coverage. Many holiday home insurance policies will also cover homes overseas. But these are only a few of the legal matters you might face.

You don�t have to have it by law, but it can be a good thing.

<< return to articles list. But just like buying sunscreen, it may help you avoid a helluva lot of trouble in the long term. Adding legal expenses to a home insurance policy could cover you for costs on cases related to: As a personal injury solicitor, i. Do i need home insurance legal cover? Employment disputes, such as unfair dismissal or discrimination ;

Source: lawadvocategroup.com

Source: lawadvocategroup.com

For car insurance, legal expenses insurance could cover you for the cost of making a claim for: Flood insurance while homeowners insurance covers certain types of water damage — like a burst pipe — it doesn’t cover flood damage. It can also cover cases where you�ve entered into a contract for the sale and supply of goods and services. The insurance information institute (iii) recommends you buy enough to cover your assets, or at least $300,000 to $500,000 worth of coverage for the average homeowner. Adding legal expenses to a home insurance policy could cover you for costs on cases related to:

Source: lhrtimes.com

Source: lhrtimes.com

Employment disputes, such as unfair dismissal or discrimination ; << return to articles list. Flood insurance while homeowners insurance covers certain types of water damage — like a burst pipe — it doesn’t cover flood damage. It’s a good idea to bump that up to at least $300,000—or more. Turns out, homeowners insurance isn’t required by law.

Legal fees cover is useful for taking legal action to reclaim losses that you can’t recover through your standard home insurance policy, such as the excess you pay when making a claim. But these are only a few of the legal matters you might face. You may also have elements of legal expenses insurance cover included with another product or as benefits. But just like buying sunscreen, it may help you avoid a helluva lot of trouble in the long term. Homeowners insurance doesn’t cover everything — you may need to add additional coverages to your policy or purchase separate standalone policies to ensure you’re fully protected.

Source: dicklawfirm.com

Source: dicklawfirm.com

Whether you’re thinking of buying a house, or you’re already in the process, homeowners insurance is definitely a term you’ll come across. If, for example, you lost your job and you felt it was unfair dismissal, family legal protection could help you pay for the cost of going to an employment tribunal or. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. As mentioned, legal cover with your home insurance could help you take legal action in cases concerning things like: Homeowners insurance doesn’t cover everything — you may need to add additional coverages to your policy or purchase separate standalone policies to ensure you’re fully protected.

Source: pinterest.com

Source: pinterest.com

It is often included with: You’ll be offered the cover automatically whenever you get a quotation, but if you decide against taking it out, you can add it at a later date. After spending so many years paying off your mortgage, it would be a shame to lose your biggest asset in just one event you can�t control. Many holiday home insurance policies will also cover homes overseas. It can also cover cases where you�ve entered into a contract for the sale and supply of goods and services.

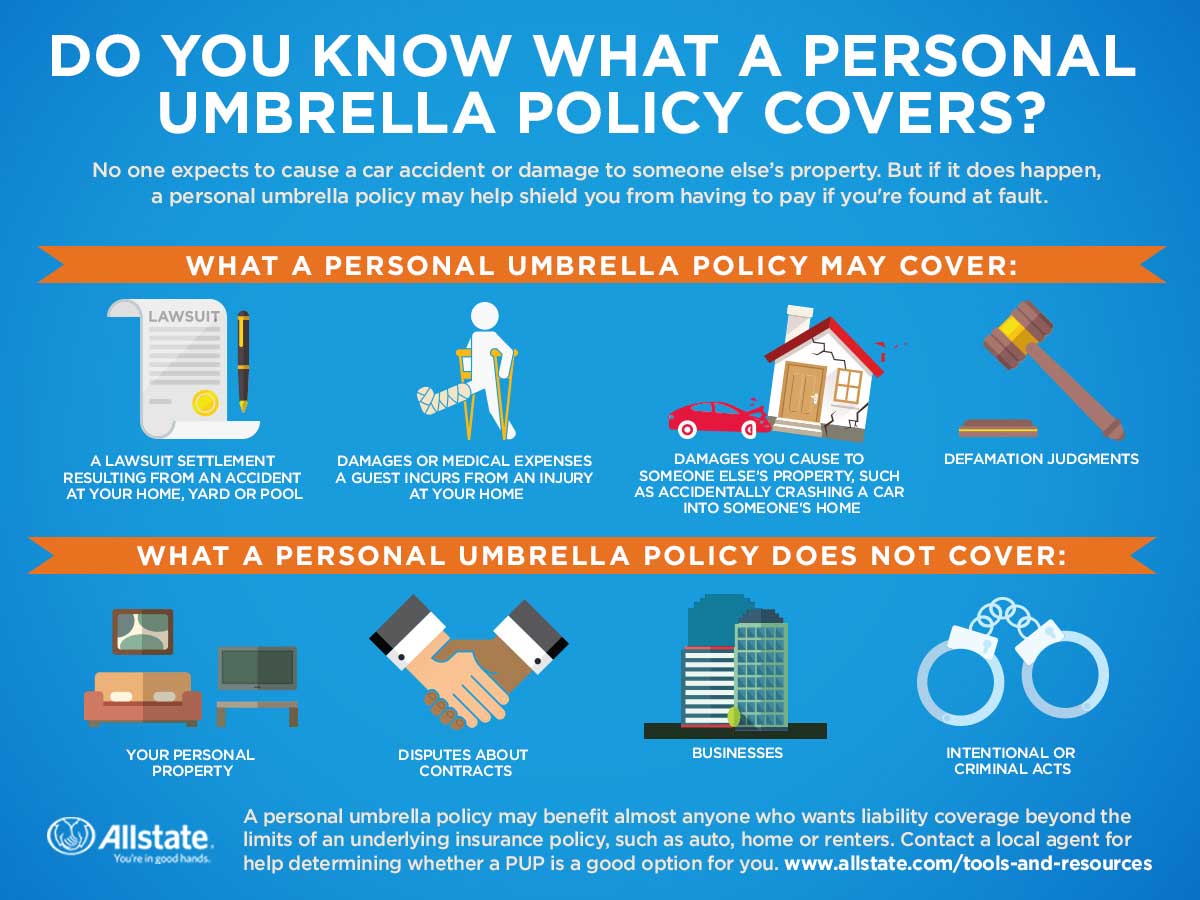

Source: allstate.com

Source: allstate.com

It’s a good idea to bump that up to at least $300,000—or more. What your legal insurance covers depends on the terms of your policy, so get familiar with it before buying in. It adds £35 a year to the average combined home insurance premium, which means legal cover won’t break the bank. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. You may also have elements of legal expenses insurance cover included with another product or as benefits.

Source: itsaboutjustice.law

Source: itsaboutjustice.law

This is because most insurers will not insure properties left empty for more than 30 consecutive days. Do i need home insurance legal cover? Legal fees cover is useful for taking legal action to reclaim losses that you can’t recover through your standard home insurance policy, such as the excess you pay when making a claim. Keep in mind that many insurance carriers offer discounts if you bundle multiple policies, install smart home technology or have a ‘green’ home. Whether you’re thinking of buying a house, or you’re already in the process, homeowners insurance is definitely a term you’ll come across.

Source: tisteam.com

Source: tisteam.com

What your legal insurance covers depends on the terms of your policy, so get familiar with it before buying in. Perhaps that tells you what it�s worth. If, for example, you lost your job and you felt it was unfair dismissal, family legal protection could help you pay for the cost of going to an employment tribunal or. It also might offer some coverage for identity theft or fraud. Disputes over faulty or damaged goods ;

Source: guideinsuranceservices.com

Source: guideinsuranceservices.com

The policies cover both legal costs and any payouts for which the policyholder would be responsible if found legally liable. If, for example, you lost your job and you felt it was unfair dismissal, family legal protection could help you pay for the cost of going to an employment tribunal or. << return to articles list. This is because most insurers will not insure properties left empty for more than 30 consecutive days. It’s a good idea to bump that up to at least $300,000—or more.

Source: youtube.com

Source: youtube.com

The policies cover both legal costs and any payouts for which the policyholder would be responsible if found legally liable. What’s included in home insurance legal expenses cover? Employment disputes, such as unfair dismissal or discrimination ; It can also cover cases where you�ve entered into a contract for the sale and supply of goods and services. Legal cover provides financial protection against legal fees and losses following an accident that was not your fault.

Source: realvaluehome.ca

Source: realvaluehome.ca

Legal cover provides financial protection against legal fees and losses following an accident that was not your fault. << return to articles list. As a personal injury solicitor, i. You may also have elements of legal expenses insurance cover included with another product or as benefits. It adds £35 a year to the average combined home insurance premium, which means legal cover won’t break the bank.

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

The insurance information institute (iii) recommends you buy enough to cover your assets, or at least $300,000 to $500,000 worth of coverage for the average homeowner. Home insurance isn’t a legal requirement, but it’s always a good idea to protect your home with both buildings insurance and contents insurance. Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. Does your home insurance cover your legal costs? Flood insurance while homeowners insurance covers certain types of water damage — like a burst pipe — it doesn’t cover flood damage.

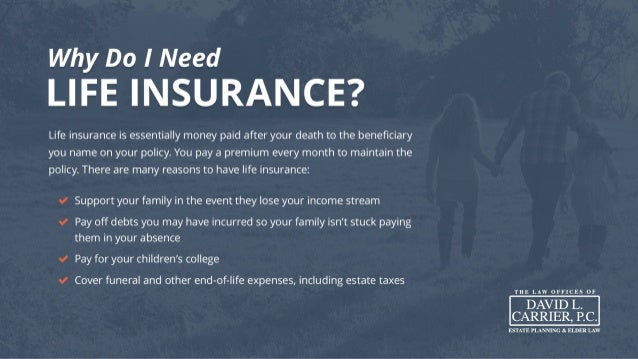

Source: slideshare.net

Source: slideshare.net

Adding legal expenses to a home insurance policy could cover you for costs on cases related to: Perhaps that tells you what it�s worth. The insurance information institute (iii) recommends you buy enough to cover your assets, or at least $300,000 to $500,000 worth of coverage for the average homeowner. But these are only a few of the legal matters you might face. Home insurance isn’t a legal requirement, but it’s always a good idea to protect your home with both buildings insurance and contents insurance.

Source: youtube.com

Source: youtube.com

Homeowners insurance doesn’t cover everything — you may need to add additional coverages to your policy or purchase separate standalone policies to ensure you’re fully protected. Whether you’re thinking of buying a house, or you’re already in the process, homeowners insurance is definitely a term you’ll come across. Perhaps that tells you what it�s worth. Legal cover provides financial protection against legal fees and losses following an accident that was not your fault. Issues with neighbours, such as noise and boundary disputes ;

Source: canadiancorrections.com

Source: canadiancorrections.com

Issues with neighbours, such as noise and boundary disputes ; Flood insurance while homeowners insurance covers certain types of water damage — like a burst pipe — it doesn’t cover flood damage. It is used to reclaim uninsured losses not covered by your standard car insurance policy. Many standard policies do not cover holiday homes. It can also cover cases where you�ve entered into a contract for the sale and supply of goods and services.

Source: usaa.com

Source: usaa.com

Legal insurance plans typically offer coverage for the cost of consultations, advice, legal assistance and representation, and preparation of legal documents. Turns out, homeowners insurance isn’t required by law. As mentioned, legal cover with your home insurance could help you take legal action in cases concerning things like: Your homeowners� insurance provides some legal cost coverage under its personal liability coverage. You don�t have to have it by law, but it can be a good thing.

Source: markweinsteinlaw.com

Source: markweinsteinlaw.com

What’s included in home insurance legal expenses cover? It also might offer some coverage for identity theft or fraud. Flood insurance while homeowners insurance covers certain types of water damage — like a burst pipe — it doesn’t cover flood damage. Legal insurance plans typically offer coverage for the cost of consultations, advice, legal assistance and representation, and preparation of legal documents. You may need to get a specific to cover your property if you only stay there occasionally.

Source: journal.firsttuesday.us

Source: journal.firsttuesday.us

If you’re liable for damages relating to your home, your standard home insurance policy will cover this. Legal liability insurance provides the policyholder with protection against claims resulting from injuries and damage to people and/or property. It adds £35 a year to the average combined home insurance premium, which means legal cover won’t break the bank. Homeowners insurance doesn’t cover everything — you may need to add additional coverages to your policy or purchase separate standalone policies to ensure you’re fully protected. You may also have elements of legal expenses insurance cover included with another product or as benefits.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do i need home insurance legal cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.