Your Do i need buildings insurance as a tenant images are ready in this website. Do i need buildings insurance as a tenant are a topic that is being searched for and liked by netizens now. You can Find and Download the Do i need buildings insurance as a tenant files here. Get all free photos and vectors.

If you’re looking for do i need buildings insurance as a tenant images information related to the do i need buildings insurance as a tenant interest, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

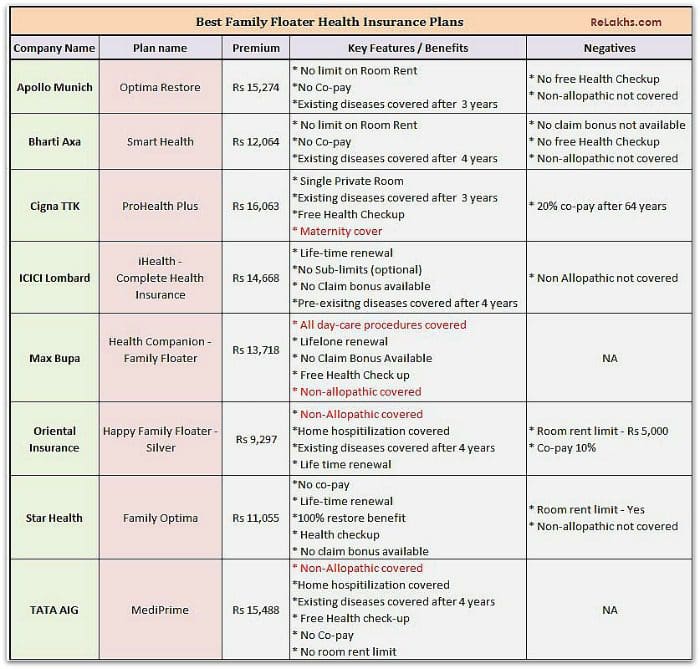

Do I Need Buildings Insurance As A Tenant. Your landlord might have buildings insurance as a condition of an outstanding mortgage. You�ll only need renters insurance if your landlord or your building requires it. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings.

Do you really need renters insurance for your Apartment From willowcreekcrossingapartments.com

Do you really need renters insurance for your Apartment From willowcreekcrossingapartments.com

It is important for renters to note that the property owner�s insurance policy does not cover them, and their items are lost in the event they are damaged or. This is because it will be your landlord’s responsibility to make sure the right cover is in place. I am not sure on our legal position for this. As a tenant, it is common that a commercial lease will require you to take out insurance for the premises. This will make sure your personal belongings. Your landlord might have buildings insurance as a condition of an outstanding mortgage.

This can range from things as small as a stain.

Public liability in relation to the building and the common areas. It is important for renters to note that the property owner�s insurance policy does not cover them, and their items are lost in the event they are damaged or. W hat does business buildings insurance cover? This will make sure your personal belongings. As a tenant, knowing what type of insurance you need is important so that you can be confident your belongings are protected should something happen. Accidentally damage any of your landlord’s furniture.

Source: washingtonpost.com

Source: washingtonpost.com

If you’re a tenant, you might want to take out a contents insurance policy to insure your belongings. Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings. The building (against loss and damage); Public liability in relation to the building and the common areas. If you’re a tenant in the sense you’re a landlord with a leasehold and someone else owns the freehold to your property, you may be responsible for buildings insurance.

Source: chnonline.org

Source: chnonline.org

However you might want to consider contents cover. There’s no legal requirement for you have to a landlord insurance policy in place when renting your property to tenants. As a tenant, you are responsible for paying your rent and utility bills, buildings insurance is your landlord’s responsibility. Almost half of renters don�t have contents insurance. I do not see how we have any insurable interest on the property, for example we would not benefit from any claim on the insurance, so why should we pay it?

Source: turbotenant.com

Source: turbotenant.com

The building (against loss and damage); This will make sure your personal belongings. You don’t need to take out buildings insurance if you’re renting a property. Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings. If your house or flat is robbed, or if there’s a fire or a flood, then your landlord’s insurance should take care of any repairs or renovations that the building might need.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The building (against loss and damage); Your landlord might have buildings insurance as a condition of an outstanding mortgage. If you’re a tenant in the sense you’re a landlord with a leasehold and someone else owns the freehold to your property, you may be responsible for buildings insurance. However you might want to consider contents cover. As a tenant, you don’t need building insurance.

Source: wintersins.com

Source: wintersins.com

Also, in our contract it mentions that we need to reimburse the landlord for his buildings insurance. You�ll only need renters insurance if your landlord or your building requires it. As a tenant, you are responsible for paying your rent and utility bills, buildings insurance is your landlord’s responsibility. There’s no legal requirement for you have to a landlord insurance policy in place when renting your property to tenants. Typically, a landlord will be required to maintain insurance in respect of:

Source: pinterest.com

Source: pinterest.com

This is because it will be your landlord’s responsibility to make sure the right cover is in place. Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings. How do i know if i need renters insurance? Accidentally damage your landlord’s fixtures or fittings. While it’s not a legal requirement to take out any form of insurance when renting a property, it’s often a wise idea.

Source: prweb.com

Source: prweb.com

But you’ll still need contents insurance to cover you for any loss or damage to your own property. This will make sure your personal belongings. I do not see how we have any insurable interest on the property, for example we would not benefit from any claim on the insurance, so why should we pay it? This can range from things as small as a stain. Also, in our contract it mentions that we need to reimburse the landlord for his buildings insurance.

Source: directlineforbusiness.co.uk

Source: directlineforbusiness.co.uk

Almost half of renters don�t have contents insurance. Almost half of renters don�t have contents insurance. How do i know if i need renters insurance? You�ll only need renters insurance if your landlord or your building requires it. You should ensure you have contents insurance though, as this will.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

This is because it will be your landlord’s responsibility to make sure the right cover is in place. Do i need landlord insurance? If your house or flat is robbed, or if there’s a fire or a flood, then your landlord’s insurance should take care of any repairs or renovations that the building might need. While it’s not a legal requirement to take out any form of insurance when renting a property, it’s often a wise idea. Landlords will have cover in place to protect their property (buildings insurance).

Source: mccoolinsurance.com

Source: mccoolinsurance.com

It is a common misunderstanding that if there is a flood or a fire. We have also never received an official. The building (against loss and damage); You are not legally obligated to get tenant insurance but a landlord may require that you get insurance before they rent an apartment to you. Accidentally damage your landlord’s fixtures or fittings.

Source: heathcrawford.co.uk

Source: heathcrawford.co.uk

Landlords will have cover in place to protect their property (buildings insurance). If you are renting a commercial building for business use, chances are that your landlord is going to require you to get an insurance policy before allowing you to sign the lease. The main objective of the builders risk policy is to cover property in care, custody or control of an owner or tenant during a construction project. Also, in our contract it mentions that we need to reimburse the landlord for his buildings insurance. Landlords will have cover in place to protect their property (buildings insurance).

Source: pangeare.com

Source: pangeare.com

Can tenants insure a landlord’s building? Also, in our contract it mentions that we need to reimburse the landlord for his buildings insurance. It is a common misunderstanding that if there is a flood or a fire. Renters insurance is for occupants who do not own the property but want to protect their personal belongings that are in the home or on the property. In this manner, do i need renters insurance if i own a home?

Source: willowcreekcrossingapartments.com

Source: willowcreekcrossingapartments.com

It�s important to make sure you insure yourself for the amount it would cost to completely rebuild your. As a tenant, it is common that a commercial lease will require you to take out insurance for the premises. There�s no legal requirement for buildings insurance, although it’s a good idea for landlords to have it in place to protect not only their tenants but also their investment. You don’t need to take out buildings insurance if you’re renting a property. Do i need landlord insurance?

Source: jmg.com

Source: jmg.com

There�s no legal requirement for buildings insurance, although it’s a good idea for landlords to have it in place to protect not only their tenants but also their investment. There�s no legal requirement for buildings insurance, although it’s a good idea for landlords to have it in place to protect not only their tenants but also their investment. Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings. I am not sure on our legal position for this. It is a common misunderstanding that if there is a flood or a fire.

Source: prophub.com

Source: prophub.com

But you’ll still need contents insurance to cover you for any loss or damage to your own property. In general, no, if you own the freehold of a property, the building itself is your asset to protect. Renters insurance is for occupants who do not own the property but want to protect their personal belongings that are in the home or on the property. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: But you’ll still need contents insurance to cover you for any loss or damage to your own property.

Source: ahainsurance.ca

Source: ahainsurance.ca

This is because it will be your landlord’s responsibility to make sure the right cover is in place. Can tenants insure a landlord’s building? While it’s not a legal requirement to take out any form of insurance when renting a property, it’s often a wise idea. Your household contents insurance may cover this. Landlords will have cover in place to protect their property (buildings insurance).

Source: savinjones.com

Accidentally damage any of your landlord’s furniture. The building (against loss and damage); Your landlord usually takes out the insurance, although you may be responsible for loss or damage to fixtures and fittings. If you’re a tenant in the sense you’re a landlord with a leasehold and someone else owns the freehold to your property, you may be responsible for buildings insurance. However you might want to consider contents cover.

Source: editionswithglam.blogspot.com

Source: editionswithglam.blogspot.com

In general, no, if you own the freehold of a property, the building itself is your asset to protect. Accidentally damage your landlord’s fixtures or fittings. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: You don’t need to take out buildings insurance if you’re renting a property. Accidentally damage any of your landlord’s furniture.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do i need buildings insurance as a tenant by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.