Your Do i have to tell new insurance about accident images are available. Do i have to tell new insurance about accident are a topic that is being searched for and liked by netizens today. You can Find and Download the Do i have to tell new insurance about accident files here. Find and Download all free vectors.

If you’re looking for do i have to tell new insurance about accident pictures information connected with to the do i have to tell new insurance about accident topic, you have visit the right blog. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

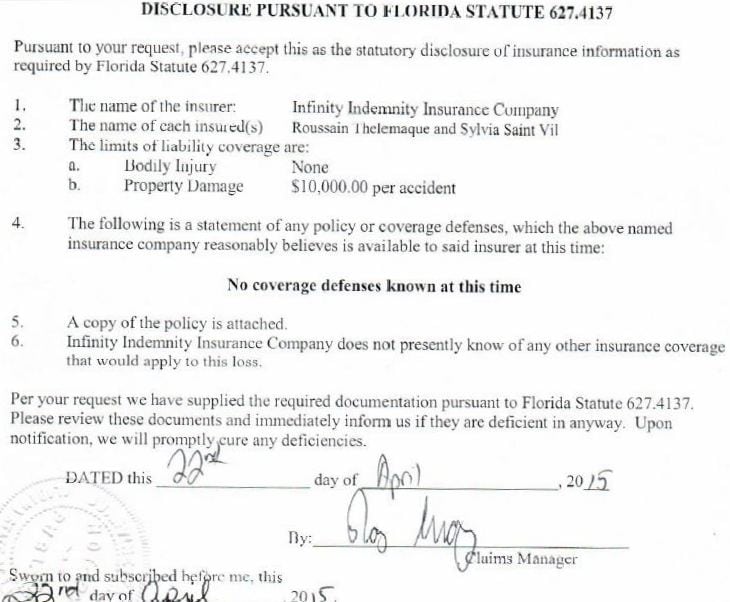

Do I Have To Tell New Insurance About Accident. If your vehicle is insured on a ‘fully comprehensive’ basis and you wish to claim the cost of vehicle damage from your own insurers then clearly the accident details will need to be reported and a claim made. Do i have to tell my car insurance company about an accident? Even if the claim wasn�t made through us or was in a car that isn�t insured with us, you�ll still need to let us know. They’re like a good neighbor, they’re there when you need them, they’re on your side.

State Of Louisiana Uninsured Underinsured Motorist Bodily From webmotor.org

State Of Louisiana Uninsured Underinsured Motorist Bodily From webmotor.org

Collision insurance is not required by any state law, but if your car is under lease or loan, your lender may require it. As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. Do i have to tell my car insurance company about an accident? I have looked for quotes on sites like comparethemarket and they ask for previous accidents and the outcomes of the claim, etc. Check the wording of your insurance policy to see if your insurer has specified how long you have to report an accident. We all know what their commercials say:

It will be a condition of your policy that you report the accident to your insurance company within a reasonable time,.

If the police made a report on the accident and your state places accidents on your driving record, your insurer will find out the accident the next time it. However, the car accident is still likely to show up on his driving record if a police officer wrote an accident report and his information was recorded. If your vehicle is insured on a ‘fully comprehensive’ basis and you wish to claim the cost of vehicle damage from your own insurers then clearly the accident details will need to be reported and a claim made. If you find out from the local repair shop that you have $400 in damages, it may not make sense to file a claim with a $500 deductible. You should send your insurer a letter telling them what�s happened. If you’ve been driving for any length of time, it’s quite likely you been involved in at least one accident.

Source: revisi.net

Source: revisi.net

Generally, you do not need to report accidents with minor damage and no physical injury to your insurance company. What insurance companies won’t tell you after a car accident. Obviously at this stage i do not know the outcome of anything, and there is a likelihood that the company insurance will sort it out. Accidents with uninsured motorists you should tell the police if. Collision insurance is not required by any state law, but if your car is under lease or loan, your lender may require it.

Source: webmotor.org

Source: webmotor.org

Do i have to tell my insurer? You must declare all accidents to your insurer, even if you didn�t make a claim. As long as no other person, car or property was affected by the accident, you don�t have much real need to contact your insurance company if you don�t file a claim. Usually car insurance policies state that you must tell your insurer about any accident, even if it was minor and you don’t want to claim on your insurance. If you’ve been driving for any length of time, it’s quite likely you been involved in at least one accident.

Source: justinziegler.net

Source: justinziegler.net

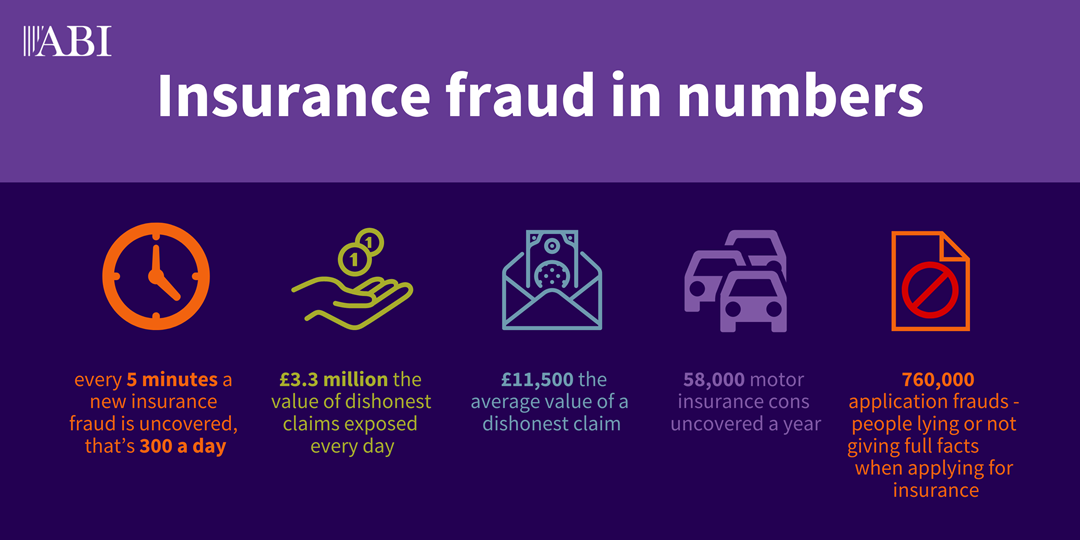

What insurance companies won’t tell you after a car accident. When taking out car insurance, you will usually be asked to disclose details of any accidents you’ve been involved in over the past five years. This type of insurance coverage is called uninsured and underinsured motorist (“um/uim”) coverage. This is designed to reduce litigation and make the claims process faster. There is a type of insurance coverage available to you through your own insurance carrier that does not require you to notify your insurance company of an accident within a reasonable amount of time.

Source: yourpreferredinsurance.com

Source: yourpreferredinsurance.com

Obtaining information on car accidents is perfectly legal for car insurance companies to use even if the company itself does not require you to report every accident if no one was injured and the damage was minor, you are not required to report an accident to your insurance company This is designed to reduce litigation and make the claims process faster. Collision insurance is not required by any state law, but if your car is under lease or loan, your lender may require it. Many insurance policies contain language that inhibits your ability to use coverage if the company is not reported within a specified timeframe. The other issue i have is my insurance is up for renewal in about 10 days.

Source: southernstatesinsurance.com

Source: southernstatesinsurance.com

This should ensure your insurer doesn’t settle with the other party�s insurer without your knowledge. However, you do have to inform your insurer if you’ve been in an accident. It will be a condition of your policy that you report the accident to your insurance company within a reasonable time,. Answer neil richardson aug 5, 2018 since the damage is being covered by the company�s commercial or business policy then he doesn�t have to notify his personal car insurance provider. As a matter of fact, there’s a lot they won’t tell you — things you need to know.

Source: marksalomone.com

Source: marksalomone.com

There is a type of insurance coverage available to you through your own insurance carrier that does not require you to notify your insurance company of an accident within a reasonable amount of time. However, you do have to inform your insurer if you’ve been in an accident. Yes it is ongoing at the moment. As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. Collision insurance is not required by any state law, but if your car is under lease or loan, your lender may require it.

Source: abi.org.uk

Source: abi.org.uk

This is designed to reduce litigation and make the claims process faster. This type of insurance coverage is called uninsured and underinsured motorist (“um/uim”) coverage. This is designed to reduce litigation and make the claims process faster. However, the car accident is still likely to show up on his driving record if a police officer wrote an accident report and his information was recorded. Do i have to tell my insurer?

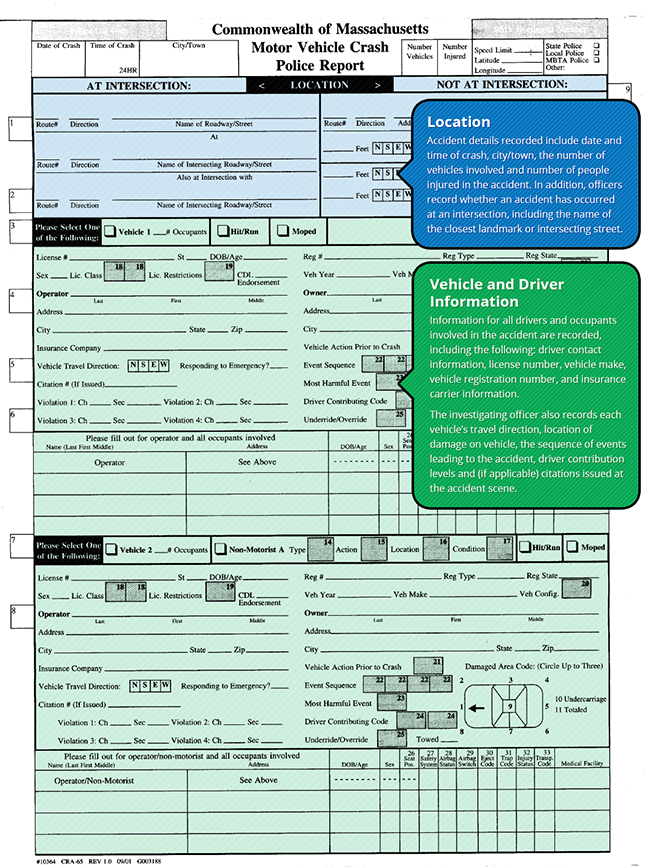

Source: formsbirds.com

Source: formsbirds.com

When filling out car insurance quote forms for you new car, you will indeed need to report the accident you had in your suv. If you’ve been driving for any length of time, it’s quite likely you been involved in at least one accident. If the police made a report on the accident and your state places accidents on your driving record, your insurer will find out the accident the next time it. Collision insurance is coverage that helps pay to repair or replace your car if it is damaged in an accident involving a collision with another car, tree, fence, or other objects. As long as no other person, car or property was affected by the accident, you don�t have much real need to contact your insurance company if you don�t file a claim.

Source: gogirl.co.uk

Source: gogirl.co.uk

What insurance companies won’t tell you after a car accident. They’re like a good neighbor, they’re there when you need them, they’re on your side. This type of insurance coverage is called uninsured and underinsured motorist (“um/uim”) coverage. You must also report the accident to your insurance company, even if you’re not planning to make a claim. Most insurers specify that you must inform them within 24 hours of the incident.

Source: blog.nycm.com

Source: blog.nycm.com

When taking out car insurance, you will usually be asked to disclose details of any accidents you’ve been involved in over the past five years. If the police made a report on the accident and your state places accidents on your driving record, your insurer will find out the accident the next time it. You should send your insurer a letter telling them what�s happened. When to notify your insurance company there is no need to call the insurance company immediately after the crash, but you should inform them promptly. If you’re involved in an accident, you must tell your insurance company as soon as possible.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

Yes it is ongoing at the moment. Generally, you do not need to report accidents with minor damage and no physical injury to your insurance company. This should ensure your insurer doesn’t settle with the other party�s insurer without your knowledge. However, the car accident is still likely to show up on his driving record if a police officer wrote an accident report and his information was recorded. If your vehicle is insured on a ‘fully comprehensive’ basis and you wish to claim the cost of vehicle damage from your own insurers then clearly the accident details will need to be reported and a claim made.

Source: readersdigest.ca

Source: readersdigest.ca

Obtaining information on car accidents is perfectly legal for car insurance companies to use even if the company itself does not require you to report every accident if no one was injured and the damage was minor, you are not required to report an accident to your insurance company As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. Do i have to tell my insurer? We all know what their commercials say: When taking out car insurance, you will usually be asked to disclose details of any accidents you’ve been involved in over the past five years.

Source: explosion.com

Source: explosion.com

However, the car accident is still likely to show up on his driving record if a police officer wrote an accident report and his information was recorded. As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. But make it crystal clear that this is for ‘information only’ and you don’t wish to make a claim. You must declare all accidents to your insurer, even if you didn�t make a claim. If the police made a report on the accident and your state places accidents on your driving record, your insurer will find out the accident the next time it.

Source: acclaimaward.co.uk

Source: acclaimaward.co.uk

As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. When to notify your insurance company there is no need to call the insurance company immediately after the crash, but you should inform them promptly. What insurance companies won’t tell you after a car accident. However, it doesn’t mean your insurer won’t find out about the accident another way.

Source: justicepays.com

Source: justicepays.com

Answer neil richardson aug 5, 2018 since the damage is being covered by the company�s commercial or business policy then he doesn�t have to notify his personal car insurance provider. If the police made a report on the accident and your state places accidents on your driving record, your insurer will find out the accident the next time it. Collision insurance is coverage that helps pay to repair or replace your car if it is damaged in an accident involving a collision with another car, tree, fence, or other objects. Yes, this means that your policy price could go up the following year, but the alternative could be much less favourable. If you are involved in a crash, there as some key steps you can take to protect yourself.

Source: carsguide.com.au

Source: carsguide.com.au

Do i have to tell my car insurance company about an accident? As you can imagine, if people could change cars to get free of a surcharge for having an accident, there would be a lot of people trading vehicles right after an accident. If you are involved in a crash, there as some key steps you can take to protect yourself. Collision insurance is not required by any state law, but if your car is under lease or loan, your lender may require it. Obviously at this stage i do not know the outcome of anything, and there is a likelihood that the company insurance will sort it out.

Source: oconnorpersonalinjury.com

Source: oconnorpersonalinjury.com

This should ensure your insurer doesn’t settle with the other party�s insurer without your knowledge. What insurance companies won’t tell you after a car accident. Generally, you do not need to report accidents with minor damage and no physical injury to your insurance company. It will be a condition of your policy that you report the accident to your insurance company within a reasonable time,. Many insurance policies contain language that inhibits your ability to use coverage if the company is not reported within a specified timeframe.

Source: sapling.com

Source: sapling.com

Collision insurance is coverage that helps pay to repair or replace your car if it is damaged in an accident involving a collision with another car, tree, fence, or other objects. If you’re involved in an accident, you must tell your insurance company as soon as possible. However, you do have to inform your insurer if you’ve been in an accident. Most insurers specify that you must inform them within 24 hours of the incident. But the truth is that insurance companies are not on your side.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title do i have to tell new insurance about accident by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.