Your Do both roommates need renters insurance images are available in this site. Do both roommates need renters insurance are a topic that is being searched for and liked by netizens now. You can Get the Do both roommates need renters insurance files here. Get all free photos.

If you’re looking for do both roommates need renters insurance images information related to the do both roommates need renters insurance keyword, you have come to the right site. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Do Both Roommates Need Renters Insurance. If a pair of roommates want to go in on a renters policy together, that’s certainly an option. If this is the case, you’ll need to confirm whether your landlord accepts joint policies, or requires separate policies for each tenant. Cons of sharing renters insurance with roommates. Not only is a renter’s insurance policy cheaper than most people expect, but peace of mind that comes from having your own policy is well worth the couple dollars you could save if you split a policy.

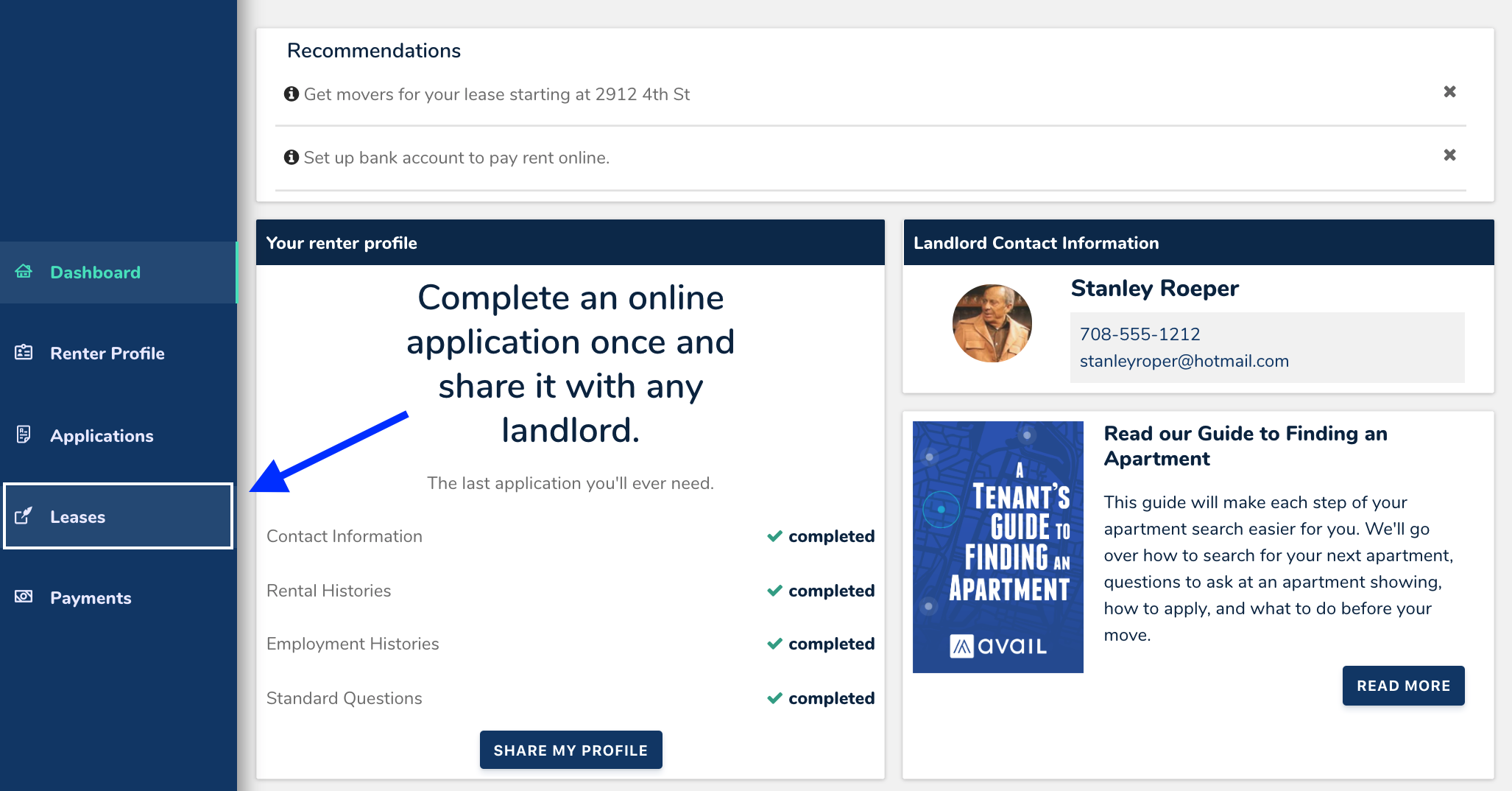

How do I upload renters insurance proof of coverage? Avail From rentalutions.zendesk.com

How do I upload renters insurance proof of coverage? Avail From rentalutions.zendesk.com

If you want renters insurance and your roommate doesn�t, you can still get a policy to protect your belongings. So if your roommate registers the insurance for the apartment in. How to share renters insurance with roommates. Additionally, state and insurance company regulations may prevent you from adding roommates to a renters insurance policy. So, if the roommate is the cause of damages that need to be paid out, the policyholder’s claim history will be hurt regardless of who was at fault. Also, that policyholder will be deemed a higher risk from thereon.

Please note, if one roommate owns the home, while the other rents, then both parties will likely have to buy separate coverage.

Renters insurance usually offers both possessions and liability coverage. Make sure both roommates are on the lease. Both tenants are not legally required to have renters insurance in most states. Here’s the lowdown on what you need to know about renters� insurance for roommates: Please note, if one roommate owns the home, while the other rents, then both parties will likely have to buy separate coverage. Cons of sharing renters insurance with roommates.

Source: best-insurance-colorado.com

Source: best-insurance-colorado.com

- there’s no extra charge to add a roommate, and it won’t. Roommates living in a dormitory owned by the university are probably covered by a parent or guardian�s homeowners policy and don�t need renters insurance. Here’s what you need to know about renters insurance, including what it covers and how to save money on a policy. 2) a maximum of two unrelated people can be on a single policy, so additional roommates will need to buy a separate policy. Yes, technically you can—as long as state law and your insurance company both allow it.

Source: onailhartman.com

Source: onailhartman.com

If this is the case, you’ll need to confirm whether your landlord accepts joint policies, or requires separate policies for each tenant. What that means is a rate hike, not only for renters insurance but perhaps also with home insurance and auto insurance! Renters insurance only need be issued to one person. Tips for renters insurance with roommates. 34 sanford fleming road, winnipeg, manitoba r2c 4g7 from sherazali.ca.

Source: mylittlerosebud.blogspot.com

Source: mylittlerosebud.blogspot.com

The owner will need homeowners insurance, while the tenant will need renters insurance. Your insurance will only cover your material possessions. Does each person in an apartment need renters insurance? Why rental occupancy limits exist. Roommates at a college or university might need renters insurance.

Source: mymodelmummy.com

Source: mymodelmummy.com

Renters insurance only need be issued to one person. This arrangement might not always be logical, however. Why rental occupancy limits exist. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. 34 sanford fleming road, winnipeg, manitoba r2c 4g7 from sherazali.ca.

Source: scottiinsurance.com

Renters insurance only covers the person listed on the policy. Renters insurance only need be issued to one person. What that means is a rate hike, not only for renters insurance but perhaps also with home insurance and auto insurance! If a renters insurance policy has a claim limit of $3000 for electronics, and someone breaks into an apartment and steals both roommates’ laptops and other electronics, will splitting that $3,000 replace all of it? Roommates at a college or university might need renters insurance.

Source: justyn-tebbs.com

Source: justyn-tebbs.com

Tips for renters insurance with roommates. Be sure to get the replacement value v. 2) a maximum of two unrelated people can be on a single policy, so additional roommates will need to buy a separate policy. If you do end up increasing the claim limit, you’ll need to pay more for an extra endorsement. Sharing renters insurance with a roommate can save you both a few bucks in the short run, but it�s not always a good idea.

Source: nerdwallet.com

Source: nerdwallet.com

It’s not a good idea to share renters insurance with roommates. Do all roommates need renters insurance? If you own all of it, then you there really is no reason for the roommate to have the insurance. If your policy insured you for $25,000, that money now has to cover both you and your roommates valuables. It’s not a good idea to share renters insurance with roommates.

Source: pinterest.com

Source: pinterest.com

Please note, if one roommate owns the home, while the other rents, then both parties will likely have to buy separate coverage. If this is the case, you’ll need to confirm whether your landlord accepts joint policies, or requires separate policies for each tenant. Roommates at a college or university might need renters insurance. Make sure both roommates are on the lease. The roommate with more belongings will need more coverage.

Source: thelexkentucky.com

Source: thelexkentucky.com

Therefore, your renters insurance might be best kept separate. The downside of roommates sharing renters insurance is that the coverage limits don’t change just because someone is endorsed onto the policy. It may be tempting to share a policy to save some money in the short run, but doing so could have some serious disadvantages: If an accident happens and you need to make a claim to replace your personal belongings, you will receive compensation, but your roommate won�t be covered. Rentswift team reviewed by robert jellison may 3, 2021 get a renters insurance quote.

Source: ocl.pitt.edu

Source: ocl.pitt.edu

It’s not a good idea to share renters insurance with roommates. Additionally, state and insurance company regulations may prevent you from adding roommates to a renters insurance policy. Rentswift team reviewed by robert jellison may 3, 2021 get a renters insurance quote. Therefore, your renters insurance might be best kept separate. There will need to be a primary policyholder, but they can list their roommate, and divide the premiums between the two of them.

Source: rentalutions.zendesk.com

Source: rentalutions.zendesk.com

Roommates at a college or university might need renters insurance. 3) there’s no extra charge to add a roommate, and it won’t. If you do end up increasing the claim limit, you’ll need to pay more for an extra endorsement. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. Renters insurance only need be issued to one person.

Source: rias.co.uk

Source: rias.co.uk

Renters insurance usually offers both possessions and liability coverage. If a pair of roommates want to go in on a renters policy together, that’s certainly an option. Most of the time when you add a roommate onto your policy, your claim limit does not increase. No, sharing renters insurance with roommates is not a good plan. 1) a roommate does not have to be on the lease to be added to the policy.

Source: insurance-insurance.org

Source: insurance-insurance.org

So if your roommate registers the insurance for the apartment in. Roommates at a college or university might need renters insurance. No, both roommates do not need renters insurance. If your policy insured you for $25,000, that money now has to cover both you and your roommates valuables. Does each person in an apartment need renters insurance?

Source: bearingstar.com

Source: bearingstar.com

Instead of both paying $15. Tips for renters insurance with roommates. How to get renters insurance with roommates. The bottom line is this: The roommate with more belongings will need more coverage.

Source: buzzgoat.com

Source: buzzgoat.com

Not only is a renter’s insurance policy cheaper than most people expect, but peace of mind that comes from having your own policy is well worth the couple dollars you could save if you split a policy. However, roommates renting a house or apartment off campus need to each have their own renters insurance policy. Tips for renters insurance with roommates. That said, you can list roommates on your policy. How to share renters insurance with roommates.

Source: bobbyireland.blogspot.com

Source: bobbyireland.blogspot.com

There will need to be a primary policyholder, but they can list their roommate, and divide the premiums between the two of them. Also, that policyholder will be deemed a higher risk from thereon. Here’s the lowdown on what you need to know about renters� insurance for roommates: The bottom line is this: Roommates with pets may need additional liability.

Source: scottiinsurance.com

Here are five reasons it’s really not wise. Tips for renters insurance with roommates. Yes, technically you can—as long as state law and your insurance company both allow it. That said, you can list roommates on your policy. The owner will need homeowners insurance, while the tenant will need renters insurance.

Source: blog.aisinsurance.com

Source: blog.aisinsurance.com

Renters insurance only covers the person listed on the policy. Roommates sharing a renters insurance policy can become a real headache in the event of a total loss. If an accident happens and you need to make a claim to replace your personal belongings, you will receive compensation, but your roommate won�t be covered. Therefore, your renters insurance might be best kept separate. So, if the roommate is the cause of damages that need to be paid out, the policyholder’s claim history will be hurt regardless of who was at fault.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do both roommates need renters insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.