Your Divorce health insurance cobra images are ready. Divorce health insurance cobra are a topic that is being searched for and liked by netizens now. You can Download the Divorce health insurance cobra files here. Find and Download all free vectors.

If you’re searching for divorce health insurance cobra images information linked to the divorce health insurance cobra interest, you have pay a visit to the right blog. Our website always gives you hints for downloading the highest quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Divorce Health Insurance Cobra. Not having to worry about obtaining a separate policy during this difficult time in your life may be a welcome relief. Home » blog » cobra: Divorce can leave you without your spouse’s company health insurance plan. The same holds true when health insurance is continued under cobra following a divorce.

Divorce COBRA planning after being dropped from your From slideshare.net

Divorce COBRA planning after being dropped from your From slideshare.net

Cobra, or consolidated omnibus budget reconciliation act, is a federal program that requires your spouse’s employer to provide you with temporary health insurance after any significant life event, like divorce. The same holds true when health insurance is continued under cobra following a divorce. Additional cobra coverage is available for dependent children for up to 36 months. When a qualifying event changes the dependents in the family, you should notify your insurance plan administrator. If you are employed and your employer offers healthcare. However, cobra coverage is often very expensive.

The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce.

Cobra benefits continue for up to 36 months after a divorce. When a qualifying event changes the dependents in the family, you should notify your insurance plan administrator. If you don’t have health insurance after a divorce, here are some options for coverage cobra. You also have to pay administrative costs of up to two percent. Parents and children have different health care needs. The insurance can continue up to 36 months, depending on your situation and the premiums should not exceed 105% of the current group rate.

Source: slideshare.net

Source: slideshare.net

When the spouse takes the cobra option, they can remain on the former spouse’s health insurance plan, the one they were on before the divorce, for up to 18 months. Cobra (otherwise known as the consolidated omnibus budget reconciliation act), is a federal law. It is important to plan your health insurance in advance and know all your options to avoid this problem. Many divorced women are eligible for cobra health insurance coverage, but there are drawbacks. If there were the requisite number of employees at the company, the employer has 14 days after the divorce to provide you with materials that will allow you to continue insurance coverage through them.

Source: slideshare.net

Source: slideshare.net

This law makes it illegal for an employer to terminate your health insurance coverage just because you and your spouse got divorced. If you are employed and your employer offers healthcare. Cobra stands for consolidated omnibus budget reconciliation act of 1985. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. If your spouse dropped you from their plan, you can continue on that plan through divorce health insurance and cobra.

Source: slideshare.net

Source: slideshare.net

Health insurance coverage after divorce one of the potential adverse financial consequences of divorce is the loss of health insurance coverage. If john’s wife mary was previously covered under john’s plan and her premium cost john and his employer a total of $800 per month, mary will need to be prepared to pay the $800 premium herself in order to have the coverage continue. This law makes it illegal for an employer to terminate your health insurance coverage just because you and your spouse got divorced. Through cobra, individuals pay the entire monthly premium plus a two percent administrative fee, and may be able to remain insured with their health plan for up to 18, 29, or 36 months. However, you will be eligible for cobra health insurance coverage for up to 18 or 36 months (depending on the circumstances), just like any employee who loses coverage.

Source: slideshare.net

Source: slideshare.net

If john’s wife mary was previously covered under john’s plan and her premium cost john and his employer a total of $800 per month, mary will need to be prepared to pay the $800 premium herself in order to have the coverage continue. A tennessee divorce is generally included. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. If your spouse dropped you from their plan, you can continue on that plan through divorce health insurance and cobra. However, cobra coverage is often very expensive.

Source: slideshare.net

Source: slideshare.net

There is, however, a catch: This law makes it illegal for an employer to terminate your health insurance coverage just because you and your spouse got divorced. Not having to worry about obtaining a separate policy during this difficult time in your life may be a welcome relief. When a qualifying event changes the dependents in the family, you should notify your insurance plan administrator. You may elect this cobra benefit for up to 36 months.

Source: slideshare.net

Source: slideshare.net

A tennessee divorce is generally included. Cobra benefits continue for up to 36 months after a divorce. If there were the requisite number of employees at the company, the employer has 14 days after the divorce to provide you with materials that will allow you to continue insurance coverage through them. Divorced women often face multiple obstacles to obtaining health insurance coverage. Divorce or legal separation, or.

Source: slideshare.net

Source: slideshare.net

Parents and children have different health care needs. If you don’t have health insurance after a divorce, here are some options for coverage cobra. Cobra stands for consolidated omnibus budget reconciliation act of 1985. However, cobra coverage is often very expensive. This law makes it illegal for an employer to terminate your health insurance coverage just because you and your spouse got divorced.

Source: slideshare.net

Source: slideshare.net

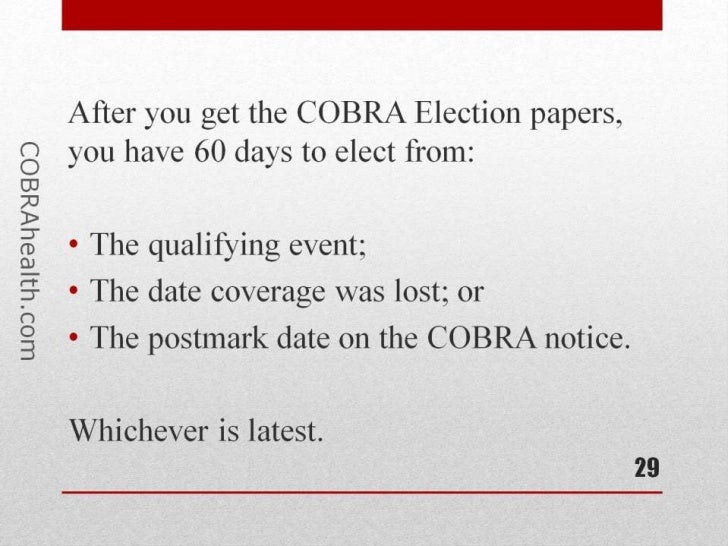

The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. They will provide a cobra election notice for those individuals. Home » blog » cobra: Your ex will need to work for a company with 20 or more employees to qualify for cobra.

Source: slideshare.net

Source: slideshare.net

When a qualifying event changes the dependents in the family, you should notify your insurance plan administrator. You may elect this cobra benefit for up to 36 months. It allows you to continue to get health insurance after your divorce from your spouse’s employer. Cobra is the consolidated omnibus budget reconciliation act, the law requiring health insurance providers to. It is important to plan your health insurance in advance and know all your options to avoid this problem.

Source: bwg-law.com

Source: bwg-law.com

The same holds true when health insurance is continued under cobra following a divorce. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the. It is important to plan your health insurance in advance and know all your options to avoid this problem. Through cobra, individuals pay the entire monthly premium plus a two percent administrative fee, and may be able to remain insured with their health plan for up to 18, 29, or 36 months.

Source: slideshare.net

Source: slideshare.net

The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. It allows you to continue to get health insurance after your divorce from your spouse’s employer. If your spouse dropped you from their plan, you can continue on that plan through divorce health insurance and cobra. A tennessee divorce is generally included. The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the.

Source: slideshare.net

Source: slideshare.net

If your spouse dropped you from their plan, you can continue on that plan through divorce health insurance and cobra. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. It allows you to continue to get health insurance after your divorce from your spouse’s employer. If you divorced your spouse but share health care coverage, you will receive coverage for 36 months with cobra. Cobra, or consolidated omnibus budget reconciliation act, is a federal program that requires your spouse’s employer to provide you with temporary health insurance after any significant life event, like divorce.

Source: jeannecolemanlaw.com

Source: jeannecolemanlaw.com

The same holds true when health insurance is continued under cobra following a divorce. When the spouse takes the cobra option, they can remain on the former spouse’s health insurance plan, the one they were on before the divorce, for up to 18 months. The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the. You also have to pay administrative costs of up to two percent. The insurance can continue up to 36 months, depending on your situation and the premiums should not exceed 105% of the current group rate.

Source: slideshare.net

Source: slideshare.net

The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. Additional cobra coverage is available for dependent children for up to 36 months. Home » blog » cobra: There is, however, a catch: If you have unfortunately found yourself in that category, and are covered under your former spouse’s group insurance plan, the consolidated omnibus budget reconciliation act (cobra) of 1985 gives you the right to continue your healthcare coverage.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

Many divorced women are eligible for cobra health insurance coverage, but there are drawbacks. This federal law helps patch up the health coverage holes that dependent spouses and children can lean on if a divorce or legal separation occurs or when a child ceases to be dependent under. Divorce or legal separation, or. It allows you to continue to get health insurance after your divorce from your spouse’s employer. Health insurance coverage after divorce one of the potential adverse financial consequences of divorce is the loss of health insurance coverage.

Source: slideshare.net

Source: slideshare.net

The cobra regulations provide that when spousal coverage is terminated in anticipation of a divorce, the spouse is entitled to cobra. The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the. The first thing to know is that cobra only applies if the insurance was a group plan through a company that had at least 20 employees the year before the divorce. Health insurance coverage after divorce one of the potential adverse financial consequences of divorce is the loss of health insurance coverage. When the spouse takes the cobra option, they can remain on the former spouse’s health insurance plan, the one they were on before the divorce, for up to 18 months.

Source: slideshare.net

Source: slideshare.net

Many divorced women are eligible for cobra health insurance coverage, but there are drawbacks. If you have unfortunately found yourself in that category, and are covered under your former spouse’s group insurance plan, the consolidated omnibus budget reconciliation act (cobra) of 1985 gives you the right to continue your healthcare coverage. Home » blog » cobra: Additional cobra coverage is available for dependent children for up to 36 months. This federal law helps patch up the health coverage holes that dependent spouses and children can lean on if a divorce or legal separation occurs or when a child ceases to be dependent under.

Source: slideshare.net

Source: slideshare.net

If a spouse works at a company with 20 or more people, then federal law mandates that a divorcing spouse is. Divorce can leave you without your spouse’s company health insurance plan. The employee must notify his or her employer of the divorce within 60 days of the date of the divorce, complete an insurance cancel request application and submit the cancel request application to the. The same holds true when health insurance is continued under cobra following a divorce. Through cobra, individuals pay the entire monthly premium plus a two percent administrative fee, and may be able to remain insured with their health plan for up to 18, 29, or 36 months.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title divorce health insurance cobra by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.