Your D o insurance cost public company images are available. D o insurance cost public company are a topic that is being searched for and liked by netizens today. You can Download the D o insurance cost public company files here. Get all free vectors.

If you’re searching for d o insurance cost public company images information connected with to the d o insurance cost public company interest, you have come to the right blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

D O Insurance Cost Public Company. However, there will certainly be some independent directors and officers who are uncomfortable with the idea of purchasing only $2.5 million of d&o insurance—an amount that any defense lawyer would be able to go through fairly quickly. In recent months, the market has become more dynamic, fueled by greater competition from existing insurers and new market entrants. The end goal is to find the best coverage for the best price. There are many factors, spanning a number of years, that led to the current market conditions, including deteriorating d&o insurer profitability (stemming from both increased losses and decreased investment returns), social inflation, the cyan decision, and.

Public Liability Insurance Cost Australia How much From smartbusinessinsurance.com.au

Public Liability Insurance Cost Australia How much From smartbusinessinsurance.com.au

Cost and liability limits premiums for private forms are generally cheaper, and they also tend to have lower retentions. Rates are still below 2008. As such, d&o insurance has become a regular part of companies risk management. Directors and officers (d&o) insurance cost are about $600 (for $1 million in coverage). D&o insurance is not a commodity, meaning there are material differences in the d&o policies you can buy, based on the cost of the d&o policy. And america isn’t alone in this trend.

Various industry sources, transre 0.80 0.90 1.00 1.10</p>

Policies can range from 1k per year for very small businesses or non profits to 15k for small public companies on up to 100k plus for larger organizations. Directors & officers insurance (d&o) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. Some insurance companies have identified the demand for thorough coverage, and responded by introducing specific endorsements and/or specialized policies particularly for investigations. The easiest way to figure out the best policy and limits for your company is to simply talk to a knowledgeable broker. For the q3 2021 edition of the report, average price per million 4.3 percent in the third quarter. But often companies may be able to eliminate duplicate coverage from other policies to help offset that cost a bit.

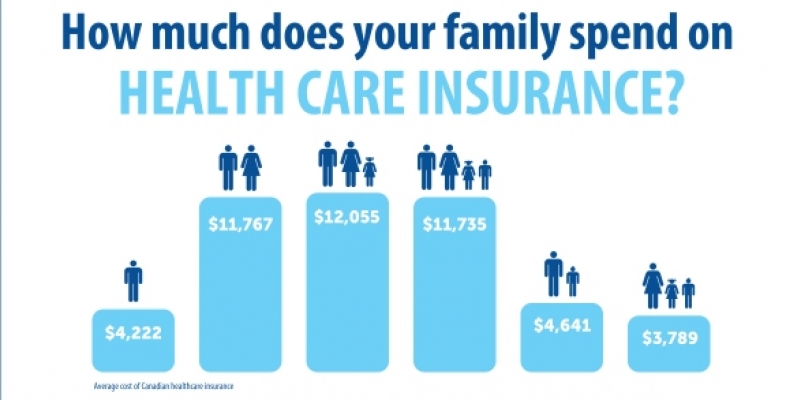

Source: fraserinstitute.org

Source: fraserinstitute.org

Quarterly d&o pricing index report each quarter, aon�s financial services group (fsg) publishes a pricing index of d&o insurance that tracks premium changes relative to the base year of 2001. It’s important to note that this is a. The end goal is to find the best coverage for the best price. The primary premium for a $10,000,000 limit is $100,000, and the first excess $10,000,000 limit excess $10,000,000 limit is $50,000. Companies purchase d&o cover because managers can make mistakes.

Source: sverigeja.com

Source: sverigeja.com

Find here detailed information about directors and officers (d&o) insurance cost. Some insurance companies have identified the demand for thorough coverage, and responded by introducing specific endorsements and/or specialized policies particularly for investigations. Premiums for public company d&o generally begin at an annual premium of 20k for a 1 mill limit. Many younger, smaller private companies will only buy $1 million to $3 million in d&o insurance—and in fact that may be all that is available to that company. D&o insurance claims are paid to directors and officers of a company or organization for losses or reimbursement of defense costs if legal action is brought against them.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

D&o pricing increases most public companies in the us experienced an increase in d&o costs. Cost and liability limits premiums for private forms are generally cheaper, and they also tend to have lower retentions. D&o pricing in the uk and australia is up, as well. The average directors and officers insurance cost a company pays mainly depends on the coverage offered. The report shows an upturn in d&o pricing in 2018, and it’s been climbing since.

Source: revisi.net

Source: revisi.net

The end goal is to find the best coverage for the best price. As 2020 draws to a close, the global commercial insurance market remains difficult, especially for us buyers of d&o insurance: The primary premium for a $10,000,000 limit is $100,000, and the first excess $10,000,000 limit excess $10,000,000 limit is $50,000. Public and private companies alike will continue to face narrow coverages and learn to live without specific coverage enhancements. It’s important to note that this is a.

Source: moneysupermarket.com

Source: moneysupermarket.com

And america isn’t alone in this trend. D&o pricing in the uk and australia is up, as well. The average directors and officers insurance cost a company pays mainly depends on the coverage offered. It’s no surprise that company size impacts the cost of d&o insurance. As 2020 draws to a close, the global commercial insurance market remains difficult, especially for us buyers of d&o insurance:

Source: jonesday.com

Source: jonesday.com

The end goal is to find the best coverage for the best price. Find here detailed information about directors and officers (d&o) insurance cost. In the above situation, the rol is 10%. Policies cost less than many might assume. It’s no surprise that company size impacts the cost of d&o insurance.

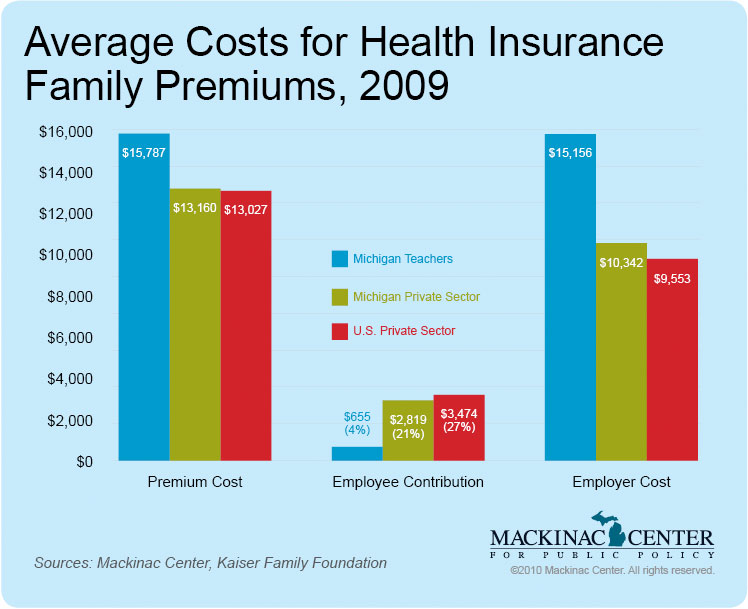

Source: mackinac.org

Source: mackinac.org

According to a price index report by transre, a property and casualty reinsurance company, rates are picking up across the board. D&o insurance is not a commodity, meaning there are material differences in the d&o policies you can buy, based on the cost of the d&o policy. Policies can range from 1k per year for very small businesses or non profits to 15k for small public companies on up to 100k plus for larger organizations. How much does d&o insurance cost? The end goal is to find the best coverage for the best price.

Source: alltradescover.com.au

Source: alltradescover.com.au

This type of insurance protects them from personal liability if a customer, investor, employee, competitor, or other stakeholder. Public and private companies alike will continue to face narrow coverages and learn to live without specific coverage enhancements. Some insurance companies have identified the demand for thorough coverage, and responded by introducing specific endorsements and/or specialized policies particularly for investigations. The report shows an upturn in d&o pricing in 2018, and it’s been climbing since. Rates are still below 2008.

Source: howmuch.net

Source: howmuch.net

The analysis shows that overall across all market capitalizations and across all attachment points, d&o pricing has declined 15% since 2013. The average directors and officers insurance cost a company pays mainly depends on the coverage offered. As 2020 draws to a close, the global commercial insurance market remains difficult, especially for us buyers of d&o insurance: A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss. D&o insurance policies offer liability cover for company managers to protect them from claims which may arise from the decisions and actions taken within the scope of their regular duties.

Source: sherpainsurance.com.au

Source: sherpainsurance.com.au

However, there will certainly be some independent directors and officers who are uncomfortable with the idea of purchasing only $2.5 million of d&o insurance—an amount that any defense lawyer would be able to go through fairly quickly. Directors and officers liability insurance rates have continued to harden in the first quarter of 2020 amid the coronavirus pandemic, according to a report from marsh. In the third quarter of 2020, d&o pricing for public companies rose more than 50%, with more than 90% of marsh clients renewing with rate increases. Many younger, smaller private companies will only buy $1 million to $3 million in d&o insurance—and in fact that may be all that is available to that company. Rates are still below 2008.

Source: foundershield.com

Source: foundershield.com

Directors and officers liability insurance rates have continued to harden in the first quarter of 2020 amid the coronavirus pandemic, according to a report from marsh. For the q3 2021 edition of the report, average price per million 4.3 percent in the third quarter. Cost and liability limits premiums for private forms are generally cheaper, and they also tend to have lower retentions. D&o insurance policies offer liability cover for company managers to protect them from claims which may arise from the decisions and actions taken within the scope of their regular duties. Policies can range from 1k per year for very small businesses or non profits to 15k for small public companies on up to 100k plus for larger organizations.

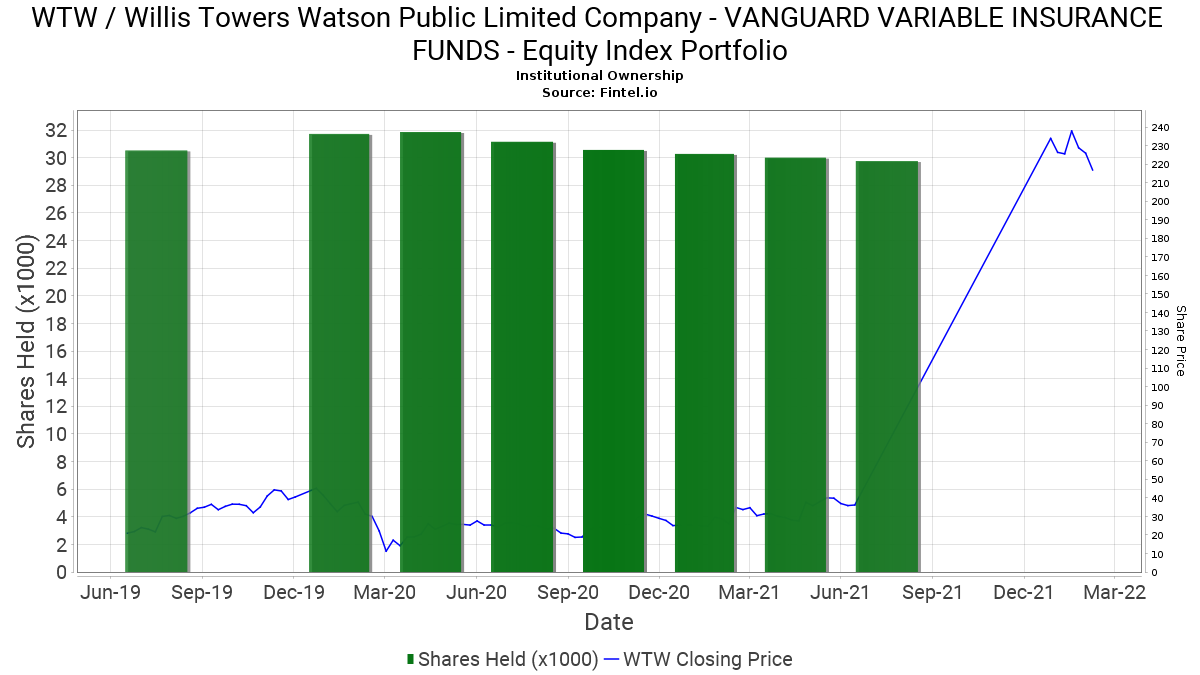

Source: fintel.io

Source: fintel.io

Public company coverage is more expensive because public companies generally face more liability exposure because they are public. It’s no surprise that company size impacts the cost of d&o insurance. The application process & pricing premiums: Public company coverage is more expensive because public companies generally face more liability exposure because they are public. The cost of d&o insurance is based on a variety of factors, including the type of business, your company�s revenues, whether you have had prior legal claims, and the amount of debt.

Increased limit factor (ilf) = the rpm of the excess/rpm of the layer below. Quarterly d&o pricing index report each quarter, aon�s financial services group (fsg) publishes a pricing index of d&o insurance that tracks premium changes relative to the base year of 2001. As companies mature, especially as they are on the path to becoming a public company, they may start to look at purchasing $5 million to $10 million in d&o insurance. In the above situation, the rol is 10%. According to a price index report by transre, a property and casualty reinsurance company, rates are picking up across the board.

Source: mybedsidemanner.blogspot.com

Source: mybedsidemanner.blogspot.com

The average directors and officers insurance cost a company pays mainly depends on the coverage offered. However, there will certainly be some independent directors and officers who are uncomfortable with the idea of purchasing only $2.5 million of d&o insurance—an amount that any defense lawyer would be able to go through fairly quickly. Quarterly d&o pricing index report each quarter, aon�s financial services group (fsg) publishes a pricing index of d&o insurance that tracks premium changes relative to the base year of 2001. Many younger, smaller private companies will only buy $1 million to $3 million in d&o insurance—and in fact that may be all that is available to that company. Some insurance companies have identified the demand for thorough coverage, and responded by introducing specific endorsements and/or specialized policies particularly for investigations.

Source: 5jcha.com

Source: 5jcha.com

The analysis shows that overall across all market capitalizations and across all attachment points, d&o pricing has declined 15% since 2013. However, there will certainly be some independent directors and officers who are uncomfortable with the idea of purchasing only $2.5 million of d&o insurance—an amount that any defense lawyer would be able to go through fairly quickly. The public d&o market continues to be a seller’s (hard) market. This type of insurance protects them from personal liability if a customer, investor, employee, competitor, or other stakeholder. How much does d&o insurance cost?

Source: moneysupermarket.com

Source: moneysupermarket.com

Directors and officers liability insurance rates have continued to harden in the first quarter of 2020 amid the coronavirus pandemic, according to a report from marsh. And america isn’t alone in this trend. A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss. The primary rpm is $10,000 and the first excess rpm is $5,000. According to a price index report by transre, a property and casualty reinsurance company, rates are picking up across the board.

Source: policyholderpulse.com

Source: policyholderpulse.com

Cost and liability limits premiums for private forms are generally cheaper, and they also tend to have lower retentions. A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss. Directors & officers insurance (d&o) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. D&o pricing increases most public companies in the us experienced an increase in d&o costs. As such, d&o insurance has become a regular part of companies risk management.

Source: pinterest.com

Source: pinterest.com

Directors & officers insurance (d&o) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. The easiest way to figure out the best policy and limits for your company is to simply talk to a knowledgeable broker. As companies mature, especially as they are on the path to becoming a public company, they may start to look at purchasing $5 million to $10 million in d&o insurance. As such, d&o insurance has become a regular part of companies risk management. D&o insurance claims are paid to directors and officers of a company or organization for losses or reimbursement of defense costs if legal action is brought against them.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title d o insurance cost public company by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.