Your D o insurance cost images are available. D o insurance cost are a topic that is being searched for and liked by netizens now. You can Download the D o insurance cost files here. Find and Download all royalty-free images.

If you’re looking for d o insurance cost images information related to the d o insurance cost keyword, you have come to the ideal site. Our website always gives you hints for seeing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

D O Insurance Cost. D&o insurance buyers whose advisors recommend the lowest priced alternative need to consider whether (a) the advisor is recommending the lowest priced alternative because it really is the best option for the company based on full consideration of all relevant factors; The end goal is to find the best coverage for the best price. Defence costs are also covered and are payable in advance of final judgment. We are a leading business insurance broker, working with a wide range of insurance providers and underwriters, allowing us to offer a extensive range of products to suit your insurance requirements.

D&O Insurance Pricing Trends 2021 From foundershield.com

D&O Insurance Pricing Trends 2021 From foundershield.com

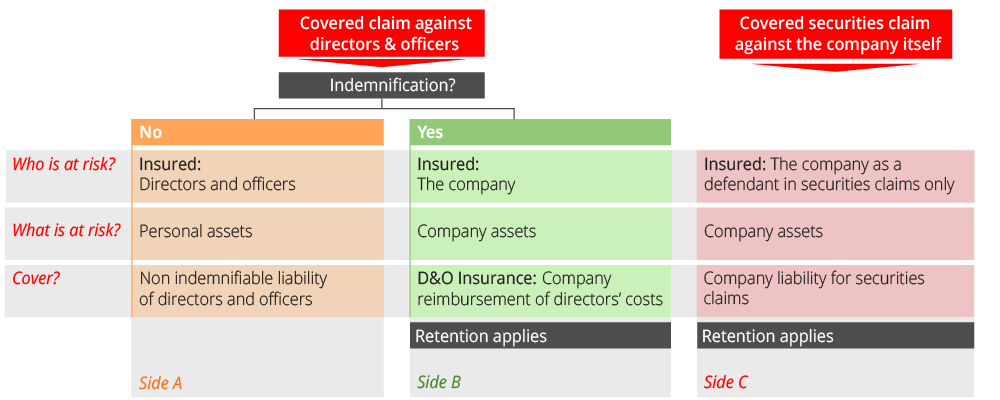

•what does a d&o program look like? This policy provides protection for claims brought against directors, officers and. The end goal is to find the best coverage for the best price. Although many carriers can provide d&o insurance quotes, here are some we recommend for your company or. The following table shows the average premium. How much will d&o insurance cost?

Policies cost less than many might assume.

Find here detailed information about directors and officers (d&o) insurance cost. (b) the advisor is recommending the lowest price alternative because he or she thinks that is what the. The best way to get an accurate figure for the costs of d&o insurance is by speaking to our expert team here at erskine murray. Directors and officers (d&o) insurance cost are about $600 (for $1 million in coverage). D&o insurance is a complex cover requiring attention to what is and isn’t covered. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year.

Source: horstinsurance.com

Source: horstinsurance.com

Directors & officers insurance (d&o) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. D&o insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. (b) the advisor is recommending the lowest price alternative because he or she thinks that is what the. 15 •does d&o insurance encourage managers to behave negligently? Common risk scenarios include failure to comply with regulation or laws, reporting errors or misrepresentation.

Source: woodruffsawyer.com

Source: woodruffsawyer.com

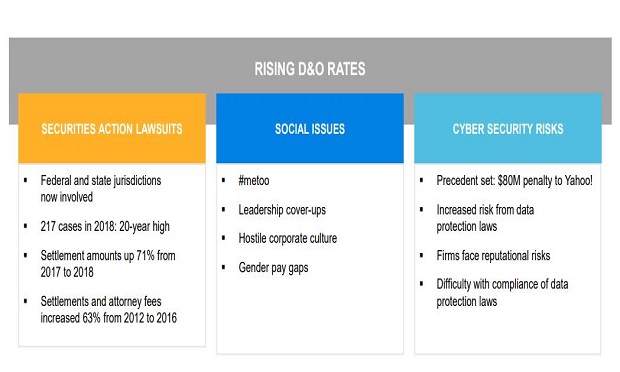

But often companies may be able to eliminate duplicate coverage from other policies to help offset that cost a bit. D&o insurance is not a commodity, meaning there are material differences in the d&o policies you can buy, based on the cost of the d&o policy. Public companies were targeted in more than 400 securities suits in each of the last three calendar years, and are on pace to see another 350 this year, according to data from nera. A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss. At landesblosch our goal is to partner you with an insurance carrier that understands what you are doing and knows how to protect your work and mission.

Source: quotelinedirectblog.co.uk

Source: quotelinedirectblog.co.uk

For the q3 2021 edition of the report, average price per million 4.3 percent in the third quarter. Although the cost of us directors and officers liability (d&o) insurance continues to rise for nearly all public company buyers, the pace of change slowed considerably in the third quarter of 2021. A typical deductible is $5,000. The highest reported loss clocked in at over $17,000,000. The following table shows the average premium.

Source: abbyjoher1983.blogspot.com

Source: abbyjoher1983.blogspot.com

Common exclusions include fraud, intentional non. The average directors and officers insurance cost a company pays mainly depends on the coverage offered. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year. For the q3 2021 edition of the report, average price per million 4.3 percent in the third quarter. 15 •does d&o insurance encourage managers to behave negligently?

Source: kbigroup.com.au

Source: kbigroup.com.au

15 •does d&o insurance encourage managers to behave negligently? •what does a d&o program look like? 16 •what about companies active in more than one country? The end goal is to find the best coverage for the best price. Common risk scenarios include failure to comply with regulation or laws, reporting errors or misrepresentation.

Source: foundershield.com

Source: foundershield.com

Common risk scenarios include failure to comply with regulation or laws, reporting errors or misrepresentation. D&o insurance covers claims resulting from managerial decisions that have adverse consequences. Spac d&o insurance costs are rising underwriters of directors and officers (d&o) liability for spacs have pulled back capacity and significantly increased rates as they evaluate the recent increase securities class action filings, the sec’s chairman’s comments and the overall pace of spac ipos. Find here detailed information about directors and officers (d&o) insurance cost. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year.

Source: propertycasualty360.com

Source: propertycasualty360.com

Unsurprisingly, d&o pricing has experienced a swift shift from a soft market to a hard market since 2019. Directors & officers insurance (d&o) is liability insurance that covers the directors and officers of the company against lawsuits alleging a breach of fiduciary duty. In recent months, the market has become more dynamic, fueled by greater competition from existing insurers and new market entrants. For insureon customers, the median cost of d&o insurance is $103 per month, or $1,240 annually. Although many carriers can provide d&o insurance quotes, here are some we recommend for your company or.

Source: minterellison.co.nz

Source: minterellison.co.nz

Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year. Given the significant costs exposure in the uk, one can see why d&o premiums are affected. D&o insurance covers claims resulting from managerial decisions that have adverse consequences. In recent months, the market has become more dynamic, fueled by greater competition from existing insurers and new market entrants. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year.

Source: securenow.in

Source: securenow.in

A company pays for this coverage so executives can serve confidently as leaders of their organization without fear of personal financial loss. Although the cost of us directors and officers liability (d&o) insurance continues to rise for nearly all public company buyers, the pace of change slowed considerably in the third quarter of 2021. We are a leading business insurance broker, working with a wide range of insurance providers and underwriters, allowing us to offer a extensive range of products to suit your insurance requirements. For insureon customers, the median cost of d&o insurance is $103 per month, or $1,240 annually. Rates for d&o insurance are affordably priced.

Source: foundershield.com

Source: foundershield.com

In recent months, the market has become more dynamic, fueled by greater competition from existing insurers and new market entrants. The average total cost for companies without d&o insurance is $394,000 following these types of losses. 15 •what if a company is going public? Each quarter, aon�s financial services group (fsg) publishes a pricing index of d&o insurance that tracks premium changes relative to the base year of 2001. Policies cost less than many might assume.

Source: propertycasualty360.com

Source: propertycasualty360.com

In recent months, the market has become more dynamic, fueled by greater competition from existing insurers and new market entrants. D&o insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. 15 •does d&o insurance encourage managers to behave negligently? Common allegations covered include breaches of fiduciary duty, failure to comply with. The end goal is to find the best coverage for the best price.

Source: coverwallet.com

Source: coverwallet.com

Click here to access the full q3 2021 d&o quarterly report and past reports. (b) the advisor is recommending the lowest price alternative because he or she thinks that is what the. Each quarter, aon�s financial services group (fsg) publishes a pricing index of d&o insurance that tracks premium changes relative to the base year of 2001. Many companies prefer a higher deductible, with a correspondingly lower premium, choosing only to invoke the policy when faced with a major lawsuit. The cost of d&o insurance primarily depends on the size of your business and the number of employees.

Source: stoneridgeinsurance.ca

Source: stoneridgeinsurance.ca

The cost of d&o insurance is based on a variety of factors, including the type of business, your company�s revenues, whether you have had prior legal claims, and the amount of debt. Policies cost less than many might assume. Although many carriers can provide d&o insurance quotes, here are some we recommend for your company or. The highest reported loss clocked in at over $17,000,000. The average directors and officers insurance cost a company pays mainly depends on the coverage offered.

Source: everquote.com

Source: everquote.com

Directors and officers (d&o) insurance cost are about $600 (for $1 million in coverage). How much will d&o insurance cost? D&o insurance is a complex cover requiring attention to what is and isn’t covered. The cost of d&o insurance is based on a variety of factors, including the type of business, your company�s revenues, whether you have had prior legal claims, and the amount of debt. D&o insurance buyers whose advisors recommend the lowest priced alternative need to consider whether (a) the advisor is recommending the lowest priced alternative because it really is the best option for the company based on full consideration of all relevant factors;

Source: insuranks.com

Public companies were targeted in more than 400 securities suits in each of the last three calendar years, and are on pace to see another 350 this year, according to data from nera. For insureon customers, the median cost of d&o insurance is $103 per month, or $1,240 annually. D&o insurance is a complex cover requiring attention to what is and isn’t covered. Defence costs are also covered and are payable in advance of final judgment. Unsurprisingly, d&o pricing has experienced a swift shift from a soft market to a hard market since 2019.

Source: buzzgoat.com

Source: buzzgoat.com

The average total cost for companies without d&o insurance is $394,000 following these types of losses. Depending on deductibles and other variables, d&o insurance can cost approximately $60 to $100 per employee per year. The following table shows the average premium. Common risk scenarios include failure to comply with regulation or laws, reporting errors or misrepresentation. 15 •what if a company is going public?

Source: pinterest.com

Source: pinterest.com

16 •what about companies active in more than one country? D&o insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. Common allegations covered include breaches of fiduciary duty, failure to comply with. D&o insurance for your board is unique and therefore requires a unique policy. The trend in average premiums has shown a consistent reduction from $5939 in 2003 to $3830 in 2009.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Common allegations covered include breaches of fiduciary duty, failure to comply with. D&o insurance covers claims resulting from managerial decisions that have adverse consequences. The average premium has reduced by a third over that seven year period. Over the past seven years the overall trend of average premiums per policy has been to fall. The highest reported loss clocked in at over $17,000,000.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title d o insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.